Alaska Guaranty of Promissory Note by Individual - Corporate Borrower

Description

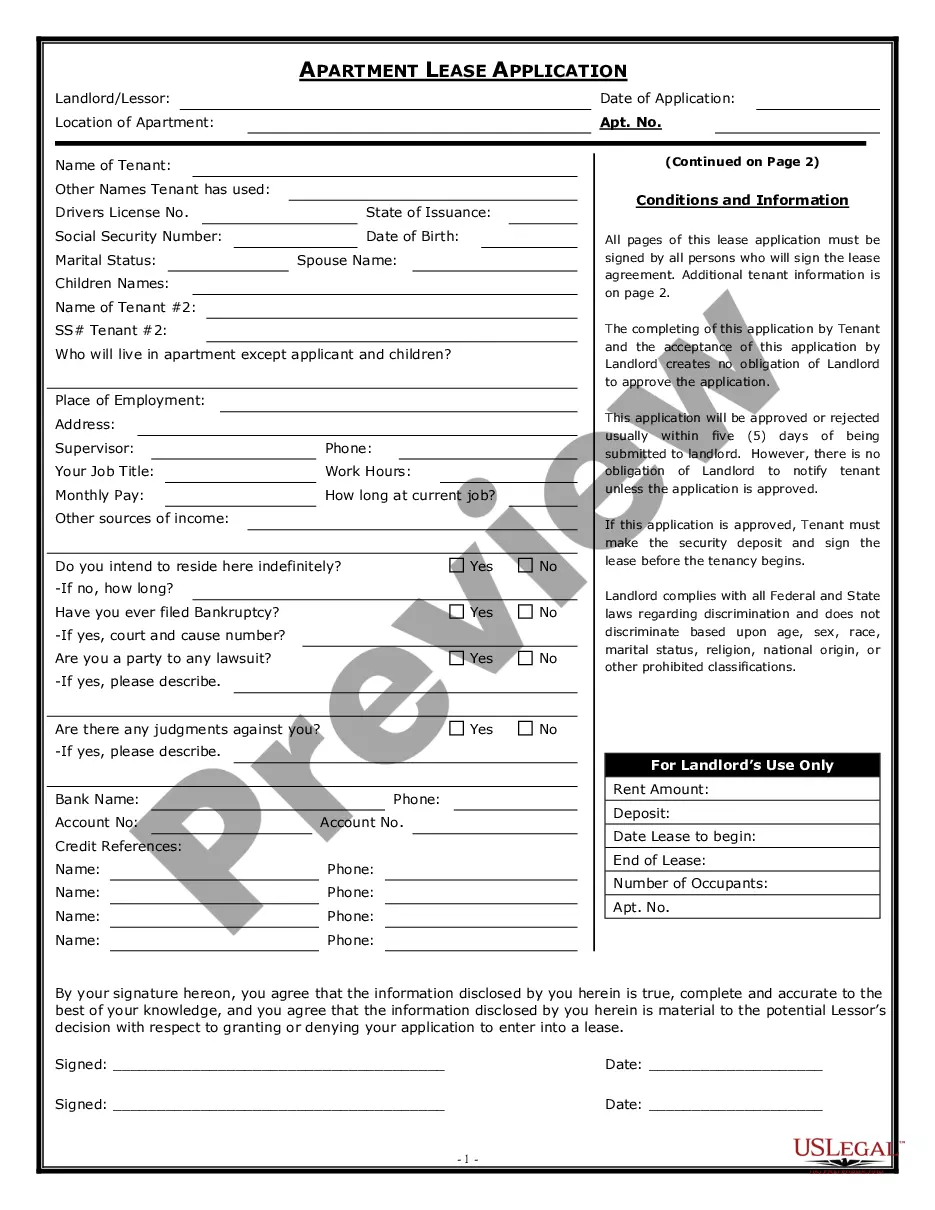

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

Have you ever been in a location where you need documents for either professional or personal reasons almost every day? There are many legal document templates accessible online, but finding forms you can trust isn't easy.

US Legal Forms provides thousands of template documents, such as the Alaska Guaranty of Promissory Note by Individual - Corporate Borrower, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Alaska Guaranty of Promissory Note by Individual - Corporate Borrower template.

Review all the document templates you have purchased in the My documents section. You can download another copy of the Alaska Guaranty of Promissory Note by Individual - Corporate Borrower at any time, if needed. Just select the necessary form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- Obtain the document you need and ensure it is suitable for your specific city/county.

- Use the Review button to check the form.

- Read the description to confirm you have selected the correct document.

- If the document isn’t what you’re looking for, utilize the Search field to find the form that fits your needs and specifications.

- Once you find the right document, click Purchase now.

- Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like or .

Parties to Promissory Notes 1) The maker: This is basically the person who makes or executes a promissory note and pays the amount therein. 2) The payee: The person to whom a note is payable is the payee.

A promissory note is a legal and a financial instrument that is written between three financing parties: the maker, the lender, and the payee/the borrower.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

As per section 32 of negotiable instrument act, in the absence of a contract to the contrary, the maker of a promissory note and the acceptor before the maturity of a bill of exchange are under the liability to pay the amount thereof at maturity.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

Promissory notes are debt instruments. They can be issued by financial institutions. The capital markets consist of two types of markets: primary and secondary.. However, they can also be issued by small companies or individuals.

As per the definition of a promissory note, they are used as a legal guarantee to repay lenders. They are now no longer used as widely as they once were but some examples and benefits of their uses include: Business loans businesses lending or borrowing money.