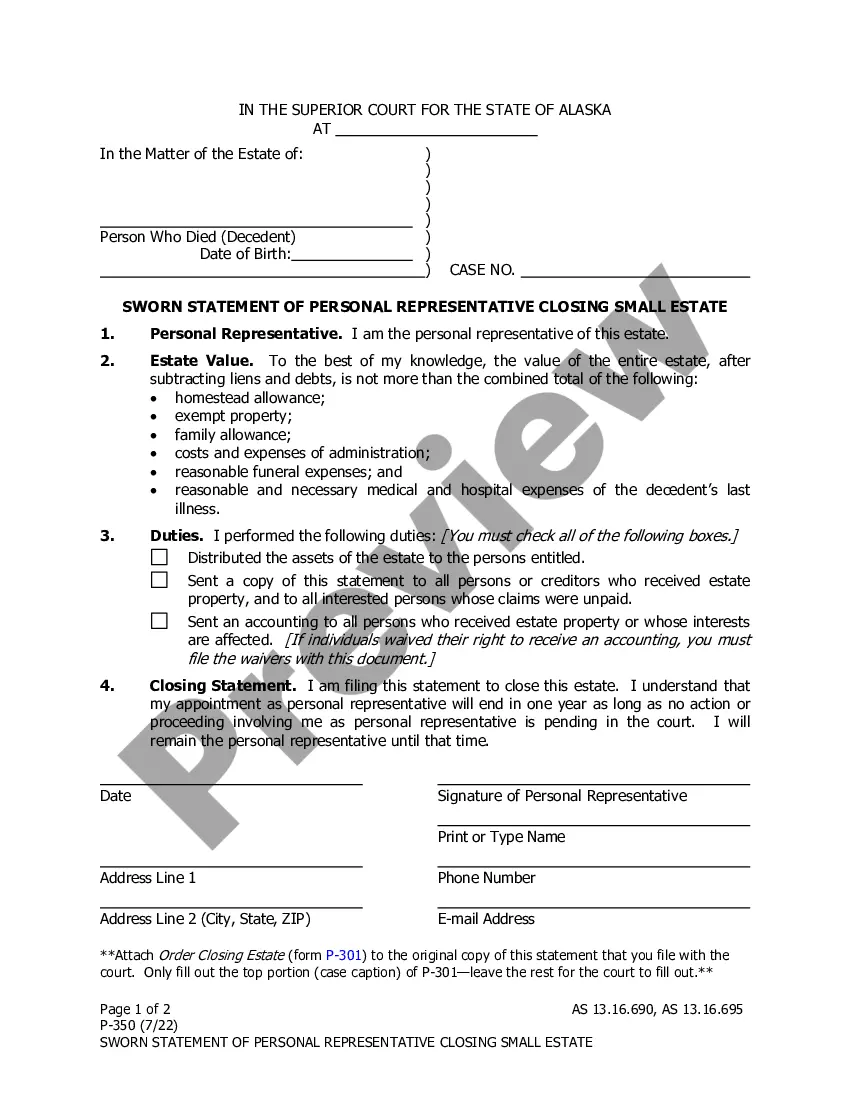

This sworn statement allows a personal representative to close the estate of a deceased who owned personal property valued at not more than $50,000, not including vehicles (which may be valued no higher than $100,000), at any time after disbursement and distribution of the estate in Alaska.

Sworn Statement of Personal Representative Closing Small Estate in Alaska

Description

How to fill out Sworn Statement Of Personal Representative Closing Small Estate In Alaska?

Employing Affidavit of Personal Representative Finalizing Minor Estate in Alaska examples crafted by experienced attorneys allows you to sidestep complications when preparing paperwork.

Simply download the form from our site, complete it, and request a legal expert to review it.

This approach can save you significantly more time and effort than asking a lawyer to draft a document from scratch to accommodate your needs.

Utilize the Preview option and read the details (if available) to determine if you require this particular sample, and if so, click Buy Now. Find an alternative sample using the Search bar if necessary. Choose a subscription that fits your needs. Begin using your credit card or PayPal. Select a file format and download your document. Once you have completed all the steps above, you will be able to fill out, create a hard copy, and sign the Affidavit of Personal Representative Finalizing Minor Estate in Alaska sample. Remember to verify all entered information for accuracy before submitting it or sending it out. Minimize the time spent on document creation with US Legal Forms!

- If you currently possess a US Legal Forms subscription, just Log In to your account and navigate back to the form webpage.

- Locate the Download button adjacent to the templates you are reviewing.

- Upon downloading a template, you will find all your stored samples in the My documents section.

- If you do not have a subscription, it’s not a significant issue.

- Simply follow the steps outlined below to register for your online account, obtain, and complete your Affidavit of Personal Representative Finalizing Minor Estate in Alaska template.

- Confirm that you are downloading the correct state-specific form.

Form popularity

FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.