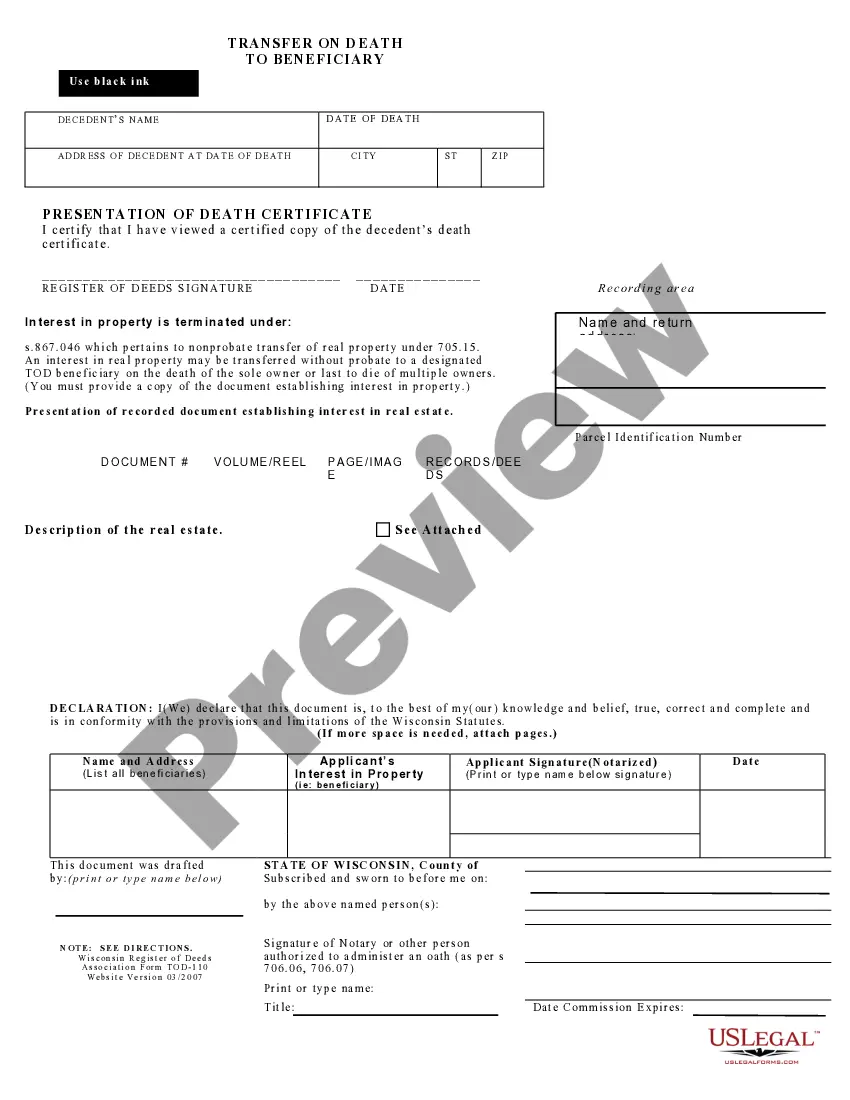

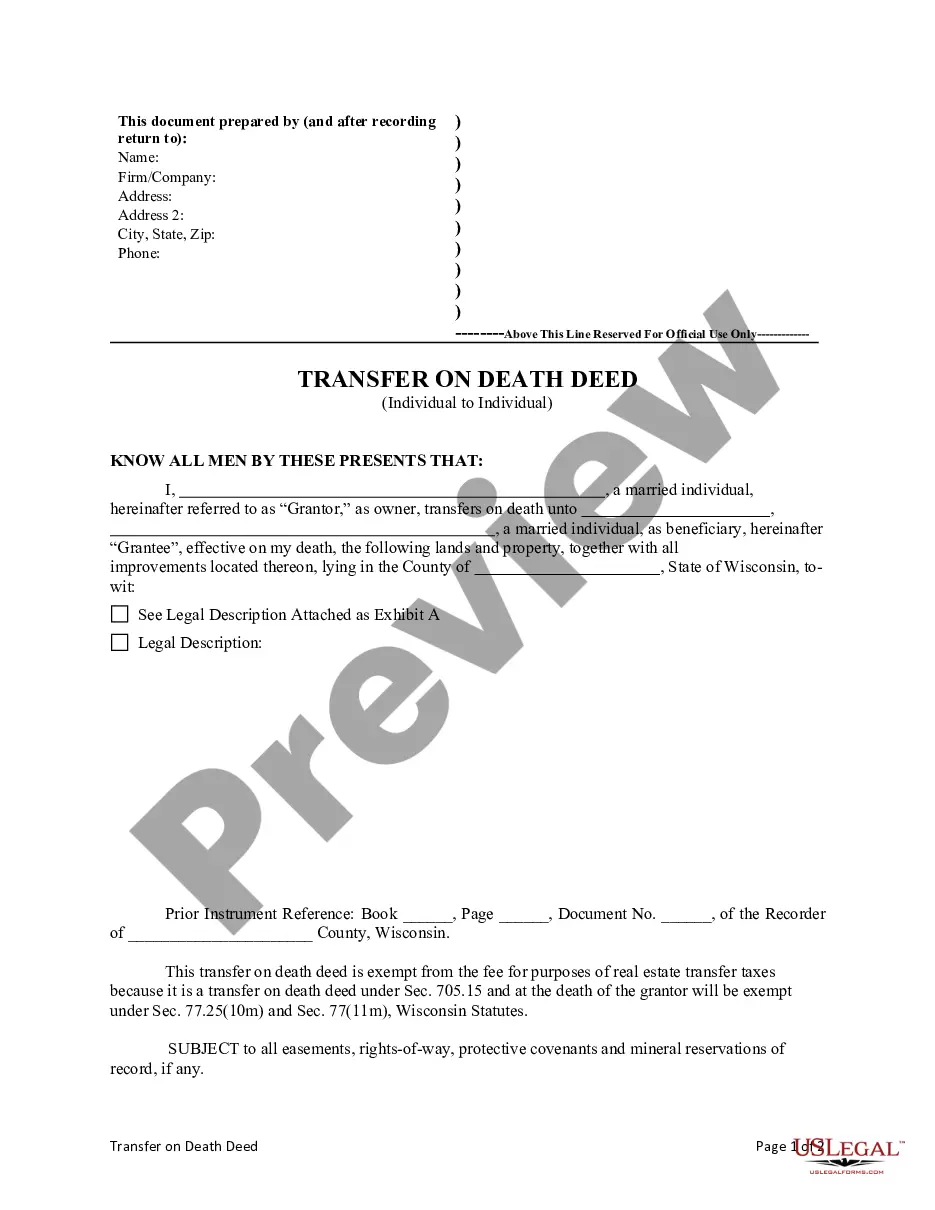

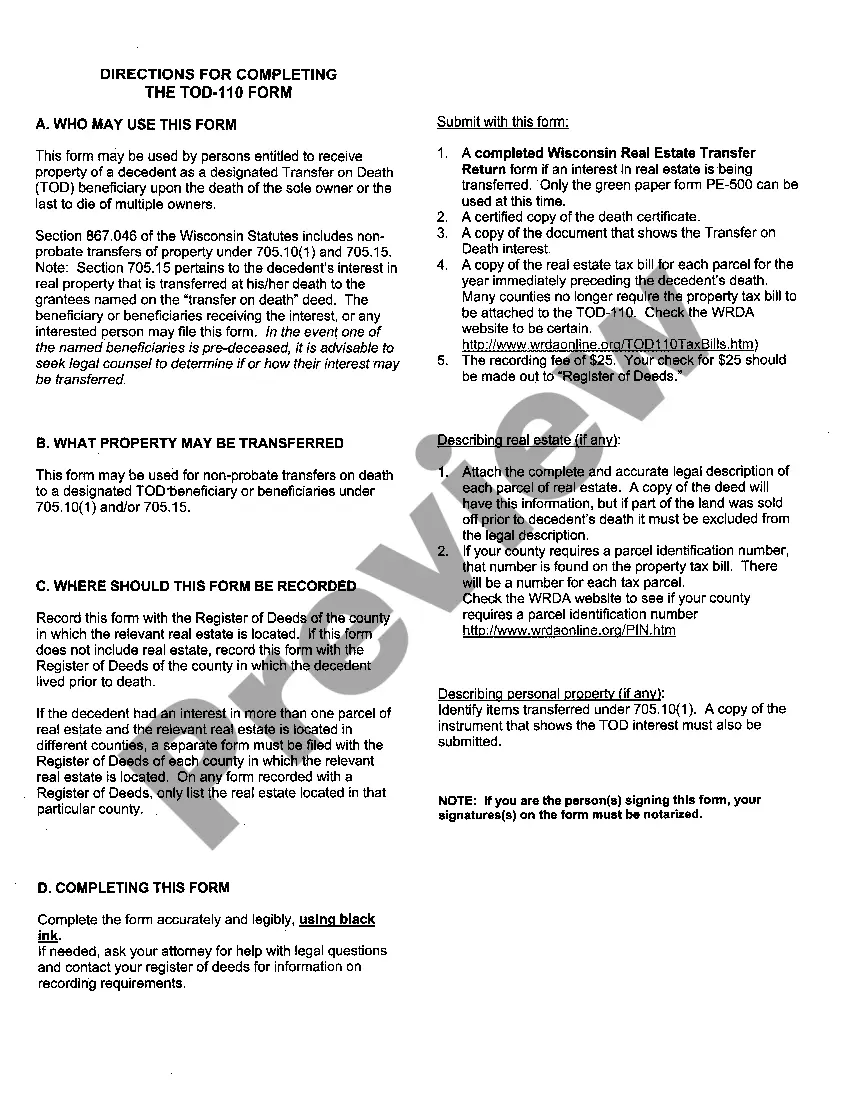

Wisconsin Transfer on Death or TOD to Beneficiary - Official Form Used to Record Beneficiary's Interest Following Death of Grantor

Form popularity

FAQ

If the property is to be transferred to a beneficiary the Executor or Administrator will need to submit a document called an 'Assent' to the Land Registry, with a copy of the Grant of Representation. The Land Registry will then transfer the property into the name of the new owner.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Wisconsin's Transfer on Death Deed. Wisconsin's Transfer on Death Deed (TOD Deed) allows for the non-probate transfer of real property upon death. This seemingly simple law, Wisconsin Statute 705.15, can be used as a powerful estate planning tool, in the right circumstances.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

If the deceased was sole owner, or co-owned the property without right of survivorship, title passes according to his will. Whoever the will names as the beneficiary to the house inherits it, which requires filing a new deed confirming her title. If the deceased died intestate -- without a will -- state law takes over.

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Once you obtain a transfer-on-death deed, complete the form to name a beneficiary. The transfer deed will ask you to name the person(s) you wish to inherit your property. You can name multiple people as the beneficiary, as well as an organization. List the beneficiary's complete name and avoid titles.