Washington Limited Liability Company LLC Operating Agreement

About this form

The Limited Liability Company (LLC) Operating Agreement is a crucial legal document that outlines the ownership and operational procedures of a Limited Liability Company. It serves to clarify the relationship among members, detailing their rights, responsibilities, management structure, and how profits and losses are shared. This form is distinct from other business agreements as it specifically addresses the unique aspects of an LLC, including flexibility in management options and the potential introduction of new members in the future.

Form components explained

- Formation clause outlining the establishment of the LLC and objectives.

- Member contributions, including initial capital and ownership percentages.

- Management structure specifying whether the LLC will be managed by members or appointed managers.

- Voting procedures detailing how decisions are made by members.

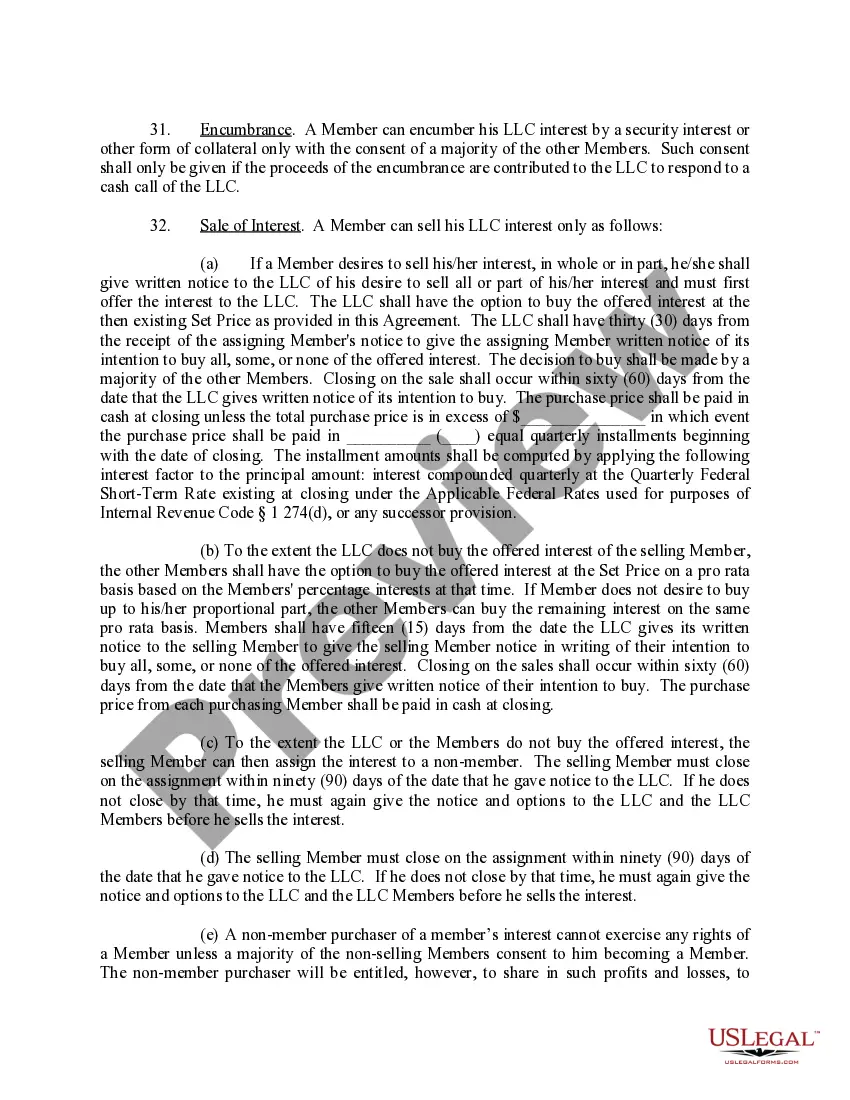

- Provisions for adding new members and handling membership transfers.

- Dissolution procedures explaining how to wind up LLC affairs upon termination.

Common use cases

This form should be used when establishing a new Limited Liability Company, ensuring that all members have a clear understanding of the operational framework and their roles. It is essential when starting a business that involves multiple owners, as it helps prevent future disputes by setting forth agreed-upon rules and expectations. Furthermore, this agreement is useful when making changes, such as adding new members or altering management structures, as it allows for amendments to be documented clearly.

Intended users of this form

This form is intended for:

- Individuals and groups forming a new Limited Liability Company.

- Existing LLC members who wish to formalize their operational agreements.

- Business owners looking to clarify roles, responsibilities, and profit-sharing structures.

- Legal professionals advising clients on LLC formation and agreements.

Steps to complete this form

- Identify the member(s) of the LLC and provide their names and addresses.

- Specify the name of the LLC and describe its business purpose.

- Detail each memberâs initial capital contributions and ownership percentages.

- Select the management structure, indicating whether members or managers will govern the LLC.

- Review the voting rights and procedures for decision-making among members.

- Ensure that all members sign the agreement to confirm their acceptance of the terms.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to clearly outline each member's contributions and ownership percentages.

- Not specifying the management structure, leading to confusion about responsibilities.

- Neglecting to obtain signatures from all members, which may render the agreement unenforceable.

- Overlooking state-specific regulations that may necessitate additional provisions.

Benefits of completing this form online

- Easy access to customizable templates that can be modified to fit your LLC's specific needs.

- Immediate downloads, allowing you to get started on your business without delays.

- In-built legal guidance helps ensure compliance with state laws.

- Efficient revisions can be made without the need for physical paperwork.

Main things to remember

- The Limited Liability Company Operating Agreement is essential for outlining the operational framework of your LLC.

- It provides clarity on ownership, management, and decision-making processes among members.

- This agreement can be adapted to meet specific business needs and state requirements.

- Utilizing an online format enhances convenience and efficiency in the formation process.

Looking for another form?

Form popularity

FAQ

Call, write or visit the secretary of state's office in the state in which the LLC does business. Call, email, write or visit the owner of the company for which you want to see the LLC bylaws or operating agreement.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

LLC operating agreements do not need to be filed with the state. Do not confuse the LLC operating agreement with the articles of organization. Articles of organization are public documents that are filed with the state to actually form the LLC.

If you share a business with your husband or wife, you should have a written agreement to protect your interests.The benefits of a husband/wife LLC are that you can file as a disregarded entity. No need to file a separate partnership return.

Washington does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.