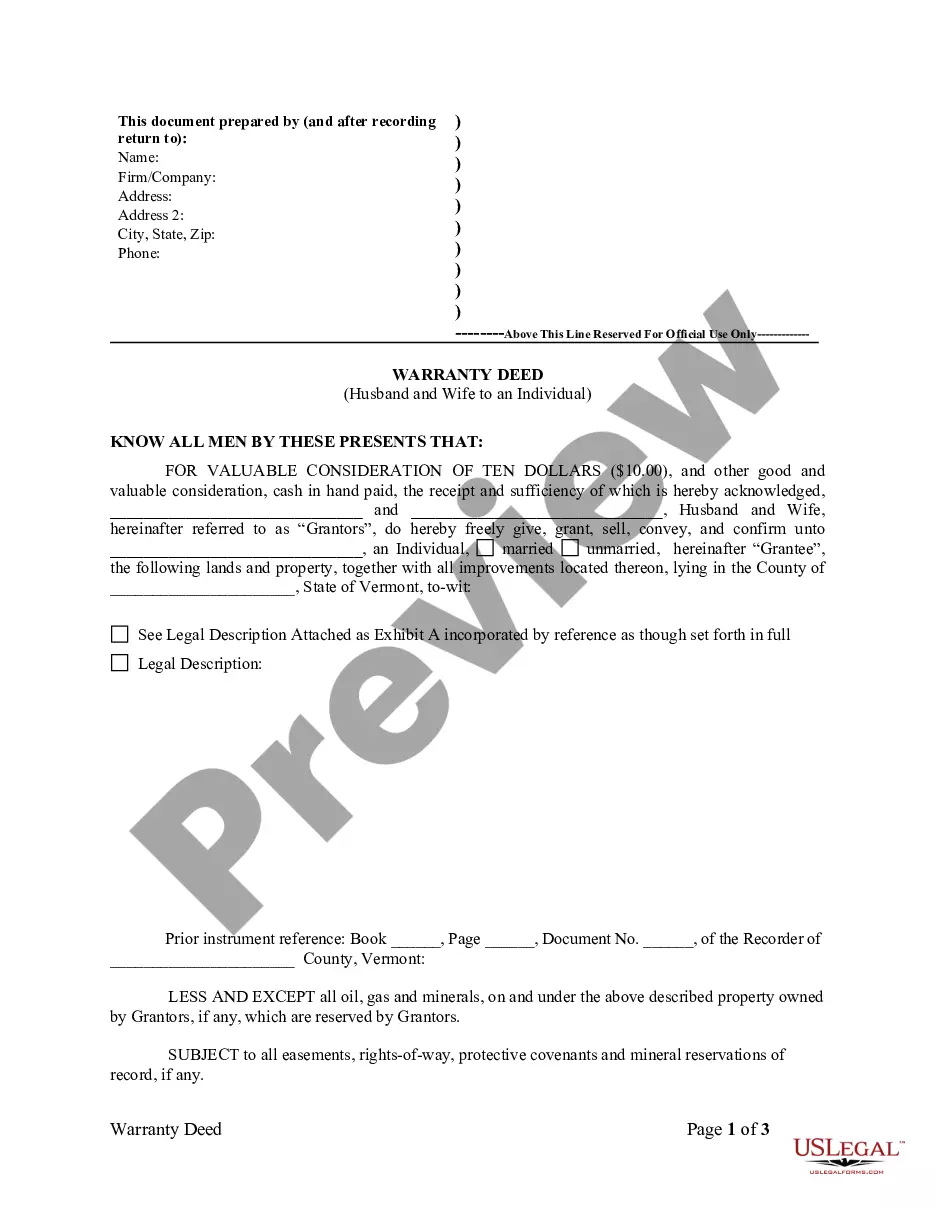

Vermont Warranty Deed from Husband and Wife to an Individual

Definition and meaning

A Vermont Warranty Deed from Husband and Wife to an Individual is a legal document used to transfer ownership of real property from a couple to an individual. This deed guarantees that the property is free from encumbrances and that the grantors have the legal right to make this transfer. It serves as evidence of the transaction and protects the grantee against future claims on the property.

How to complete a form

Completing a Vermont Warranty Deed requires careful attention to detail. Here are the steps to follow:

- Fill in the names of the grantors (husband and wife) in the designated fields.

- Provide the name of the grantee (individual receiving the property).

- Complete the legal description of the property, often attached as Exhibit A.

- Specify any reservations or exceptions regarding the property.

- Sign the deed in front of a notary public.

- Ensure the deed is recorded at the local county recorder's office.

Who should use this form

This form is suitable for married couples who want to transfer their property to an individual. It is often used when one spouse is selling or transferring their interest in a property to another person, or when the couple is gifting property. Users should have clear title to the property being transferred and understand any legal implications involved in the transaction.

Legal use and context

The Vermont Warranty Deed is a legally binding document that ensures both the grantors and grantee are protected during the transfer of property. The deed must be recorded in the county where the property is located to become valid against third-party claims. It is essential for ensuring transparency in property transactions and provides security to the buyer that the property is free from hidden claims.

What documents you may need alongside this one

When preparing to complete a Vermont Warranty Deed, consider having the following documents ready:

- Previous deed or title documents for the property.

- Identification for the grantors and grantee.

- Legal description of the property.

- Proof of payment or consideration for the transfer.

- Any relevant easements or agreements affecting the property.

What to expect during notarization or witnessing

Notarization is a crucial step in finalizing a Vermont Warranty Deed. During the process:

- The grantors must sign the deed in the presence of a notary public.

- The notary will verify the identities of the signers and witness the signatures.

- The notary will affix their seal and signature to the document to certify it.

It is important to ensure that all signers are present during this process to avoid delays.

Form popularity

FAQ

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

In estate law, joint tenancy is a special form of ownership by two or more persons of the same property. The individuals, who are called joint tenants, share equal ownership of the property and have the equal, undivided right to keep or dispose of the property. Joint tenancy creates a Right of Survivorship.

The names on the mortgage show who's responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.

California is a community property state, which is a policy that only applies to spouses and domestic partners.The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

Joint Tenancy Two or more people, including spouses, may hold title to their jointly owned real estate as joint tenants. There is a so-called right of survivorship, which means that when one dies, the property automatically transfers to the survivor without the necessity of probating the estate.

The most recognized form for a married couple is to own their home as Tenants by the Entirety. A tenancy by the entirety is ownership in real estate under the fictional assumption that a husband and wife are considered one person for legal purposes. This method of ownership conveys the property to them as one person.