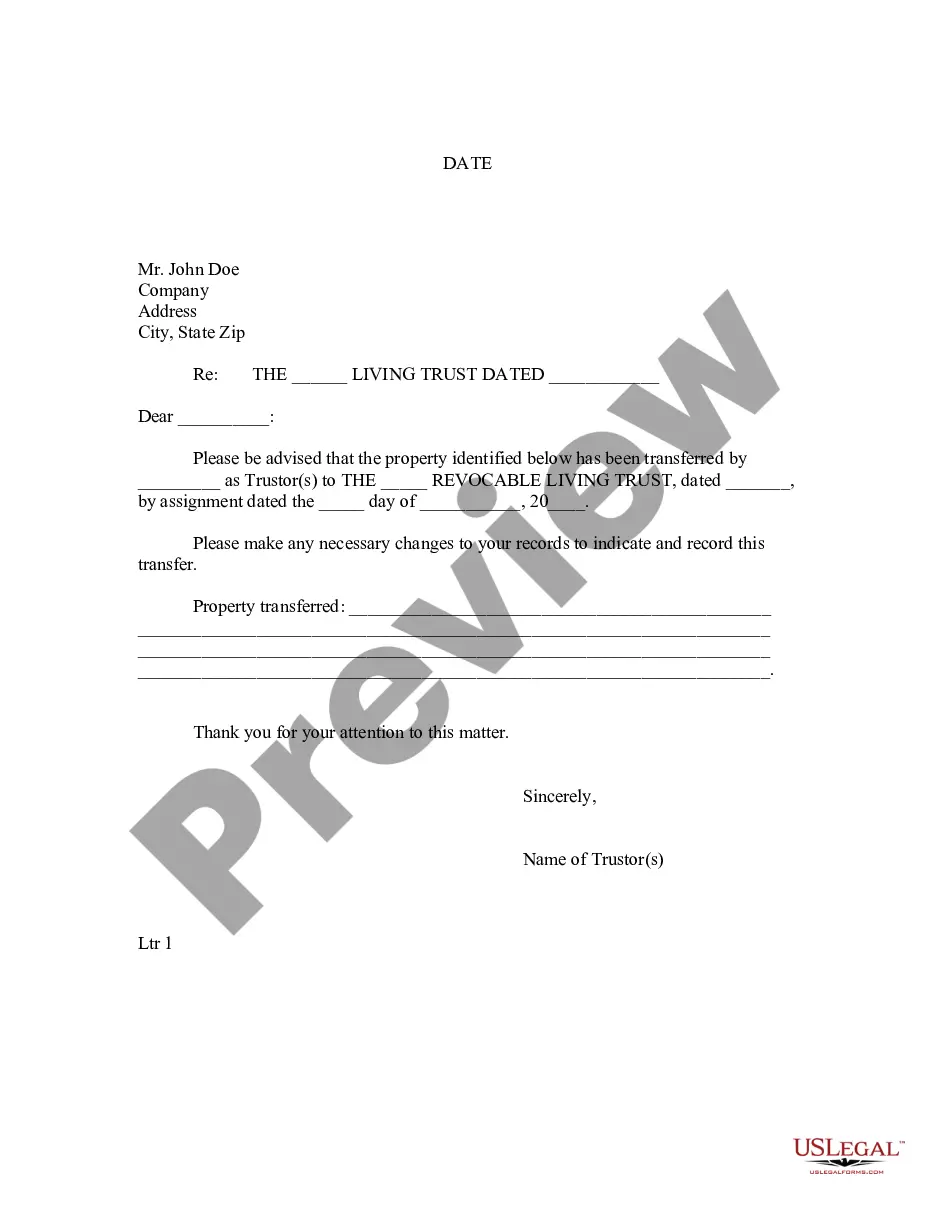

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Virginia Letter to Lienholder to Notify of Trust

Description

How to fill out Virginia Letter To Lienholder To Notify Of Trust?

Looking for a Virginia Letter to Lienholder to Notify of Trust online can be stressful. All too often, you find files which you believe are alright to use, but find out later they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Get any form you are searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will immediately be included in your My Forms section. In case you don’t have an account, you should sign up and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Virginia Letter to Lienholder to Notify of Trust from our website:

- See the form description and press Preview (if available) to check whether the template meets your expectations or not.

- If the form is not what you need, find others with the help of Search engine or the listed recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms library. Besides professionally drafted samples, customers can also be supported with step-by-step guidelines regarding how to find, download, and complete templates.

Form popularity

FAQ

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

Depending on state laws, paper titles are generally mailed and electronic titles and/or liens are released to the motor vehicle agency approximately 10 business days after the payoff is received. Allow 15-30 days for receipt of your title based on mail time and/or motor vehicle agency process.

A lienholder is a lender that legally has an interest in your property until you pay it off in full. The lender which can be a bank, financial institution or private party holds a lien, or legal claim, on the property because they lent you the money to purchase it.

The car (vehicle) lien release form is a document that is used by a lending institution or entity after a borrower has paid the loan in full and the borrower would like to retrieve the title to their vehicle.

A Lien Release (also considered a Lien Cancellation or Release of Lien) is a legally binding document that is sent by the current lien holder, the individual who has leased the property or provided payment to secure the property, that informs any debt in relation to that property has been fulfilled and they relinquish

When a vehicle is deemed a total loss, the lienholder needs to be notified and they will provide a Letter of Guarantee that states what the current payoff is for the loan.

The lender will also notify the Department of Motor Vehicles (DMV) that the loan has been paid in full. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied. This request can be made through the DMV or directly to the lender.