Nursing Agreement - Self-Employed Independent Contractor

Description

Definition and meaning

A Nursing Agreement - Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between a nurse and an employer who engages the services of the nurse as an independent contractor. This agreement clarifies the responsibilities, obligations, and rights of both parties involved in the nursing services provided.

Who should use this form

This form is intended for nurses who operate as independent contractors and seek clarity in their working relationship with employers. It is particularly beneficial for freelance nurses, travel nurses, and those providing private care services. Employers in healthcare settings who wish to engage self-employed nursing professionals should also utilize this document to ensure mutual understanding.

Key components of the form

The Nursing Agreement - Self-Employed Independent Contractor typically includes:

- Scope of Duties: Details the specific nursing services to be provided.

- Compensation: Explains payment terms and conditions.

- Termination Conditions: Outlines how and when either party can terminate the agreement.

- Independent Contractor Status: Clarifies the legal status of the nurse to maintain distinct roles.

- Representations and Warranties: Ensures the nurse holds the necessary professional qualifications.

Benefits of using this form online

Utilizing an online Nursing Agreement - Self-Employed Independent Contractor offers several advantages:

- Accessibility: Users can access and download the agreement at any time from anywhere.

- Time Efficiency: Online forms often come pre-filled with relevant information, speeding up the completion process.

- Guidance: Online platforms frequently provide step-by-step instructions to assist users in filling out the form correctly.

- Cost Reduction: Many online forms are free or offered at a low cost compared to hiring legal counsel for drafting the document.

Common mistakes to avoid when using this form

While completing the Nursing Agreement, it is vital to avoid several common pitfalls:

- Inadequate Detail: Failing to specify the scope of duties can lead to misunderstandings.

- Omitting Payment Terms: Not clearly defining compensation can result in disputes over payment.

- Ignoring Termination Clauses: Overlooking the conditions under which either party can terminate the agreement may create confusion.

- Not Reviewing State Regulations: Each state has unique regulations that may affect the agreement's validity.

What to expect during notarization or witnessing

When finalizing the Nursing Agreement, notarization or witnessing may be required to enhance its legal standing. Here’s what to expect:

- Identification: All parties will need to present valid forms of identification.

- Signing: The agreement should be signed in the presence of the notary or witness.

- Notary’s Role: The notary public will verify the identities of the signatories and may record the details of the transaction.

It is important to confirm whether your agreement necessitates notarization based on state laws.

How to fill out Nursing Agreement - Self-Employed Independent Contractor?

Among lots of paid and free templates that you find on the internet, you can't be certain about their accuracy and reliability. For example, who made them or if they’re skilled enough to deal with the thing you need those to. Keep relaxed and make use of US Legal Forms! Get Nursing Agreement - Self-Employed Independent Contractor templates made by skilled lawyers and avoid the high-priced and time-consuming procedure of looking for an lawyer and then paying them to draft a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the form you’re looking for. You'll also be able to access all your earlier downloaded documents in the My Forms menu.

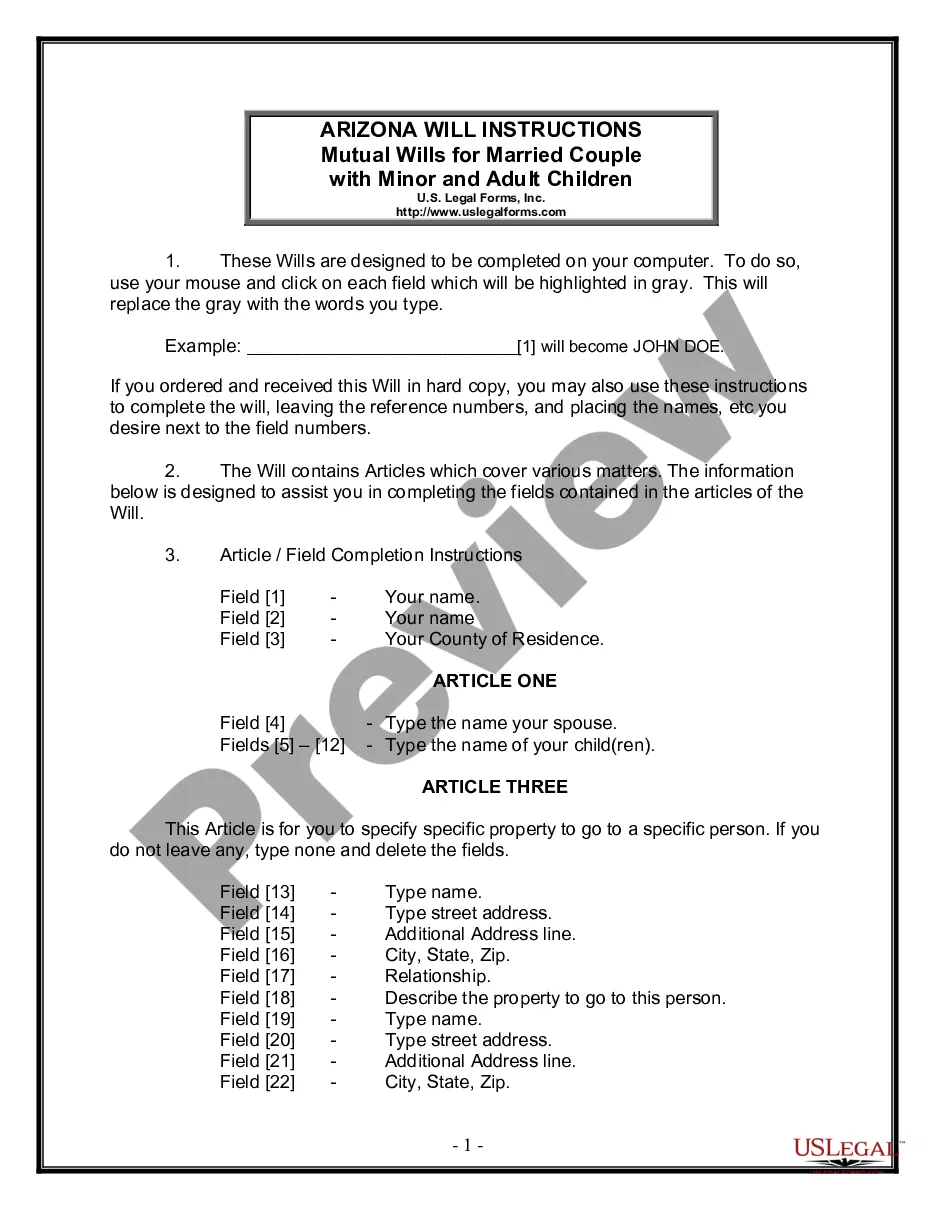

If you’re making use of our service the very first time, follow the guidelines listed below to get your Nursing Agreement - Self-Employed Independent Contractor with ease:

- Ensure that the file you see is valid where you live.

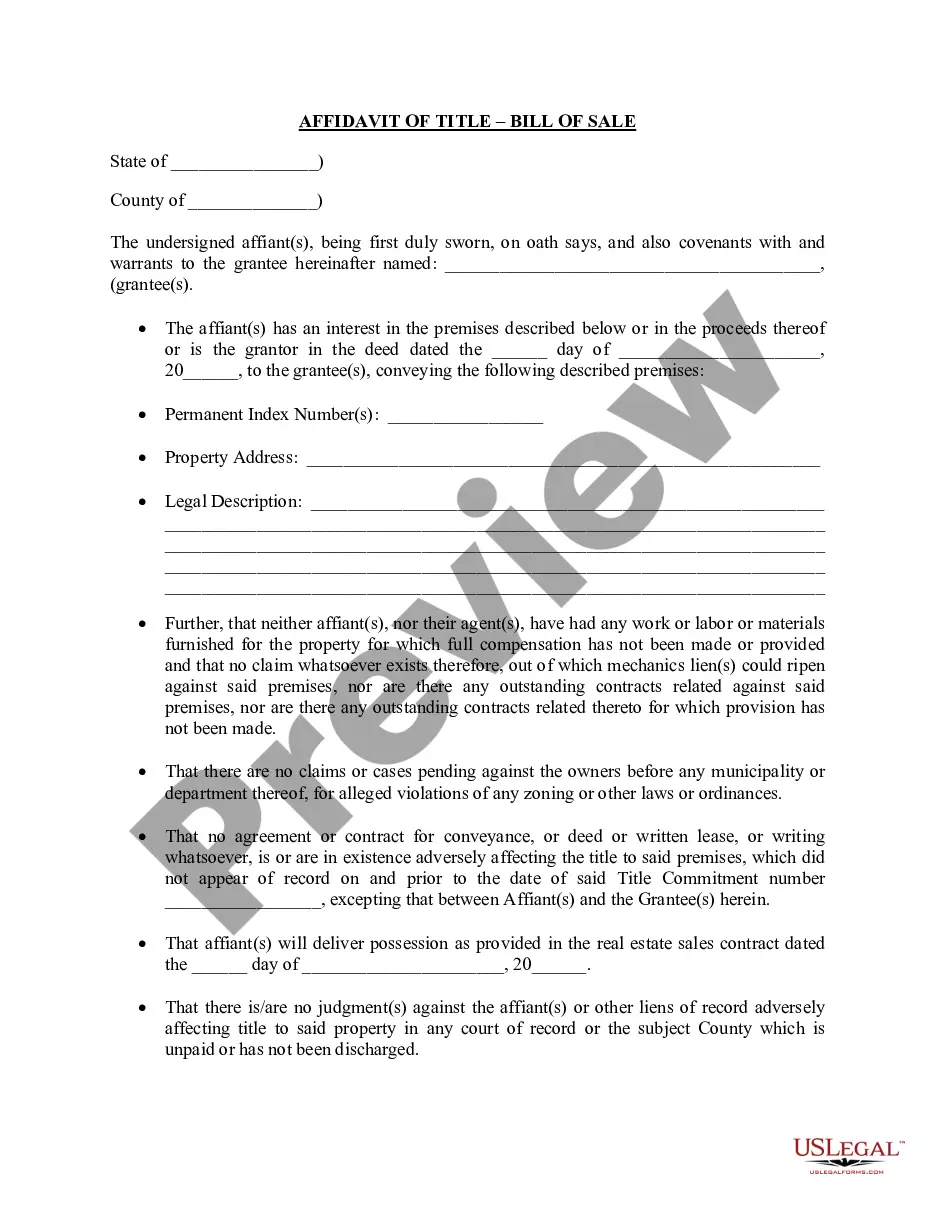

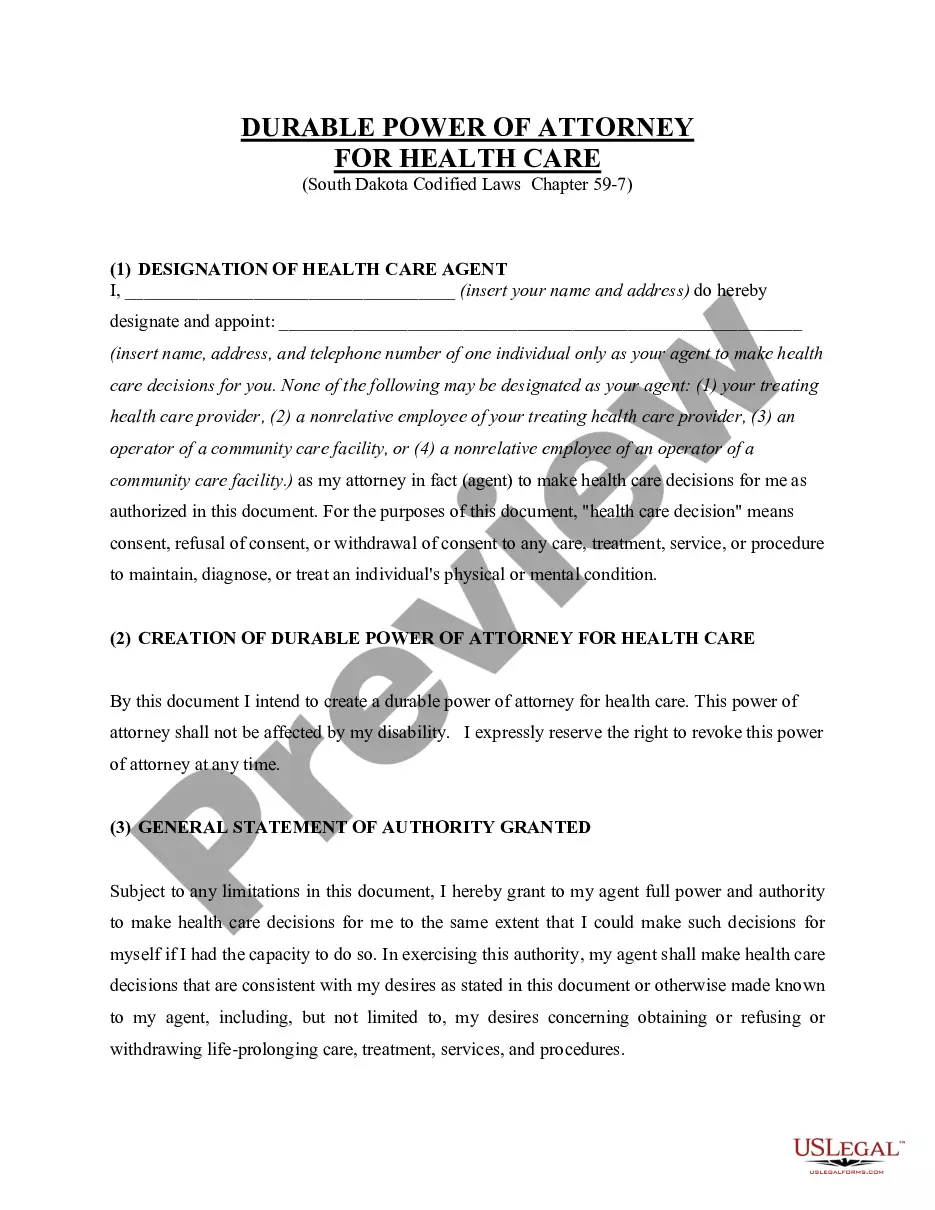

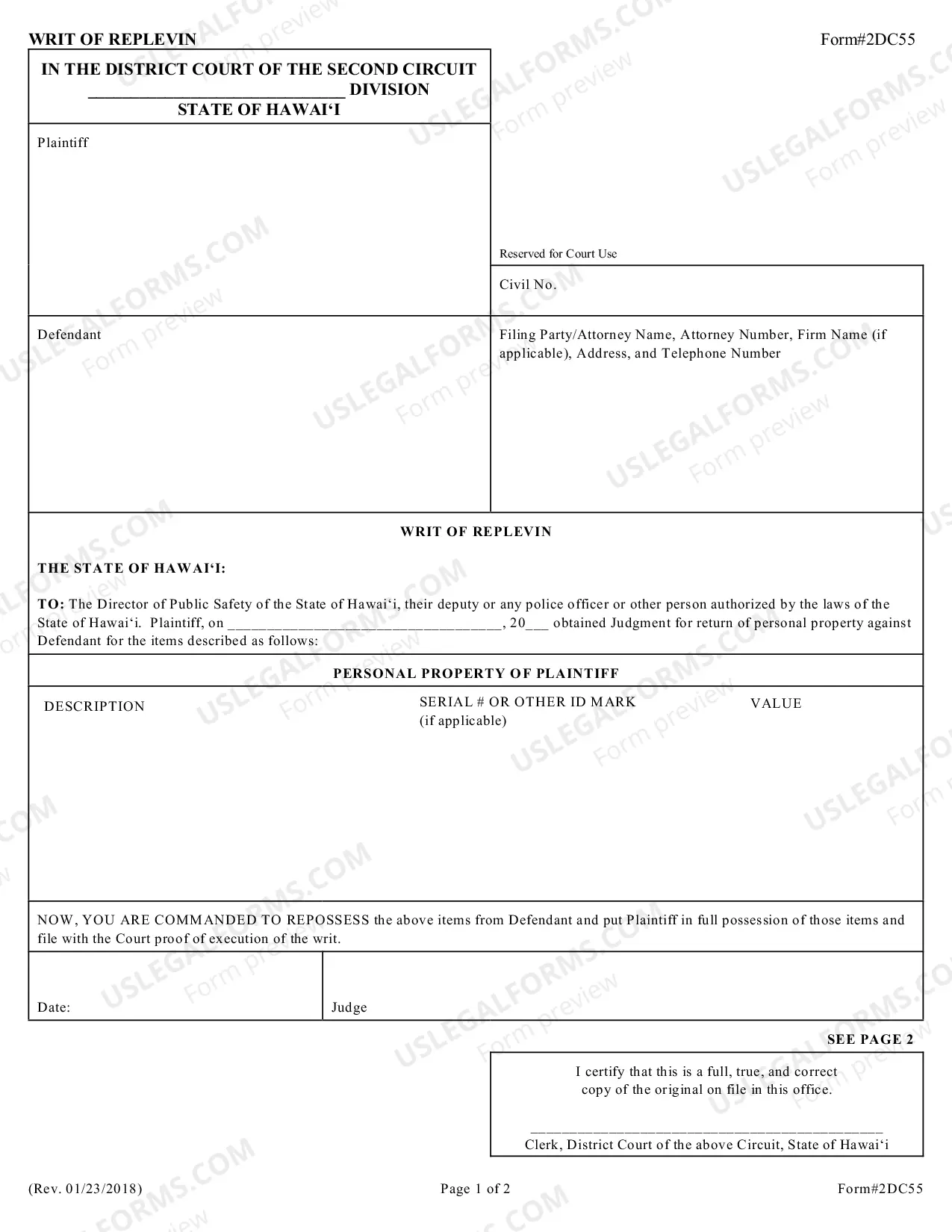

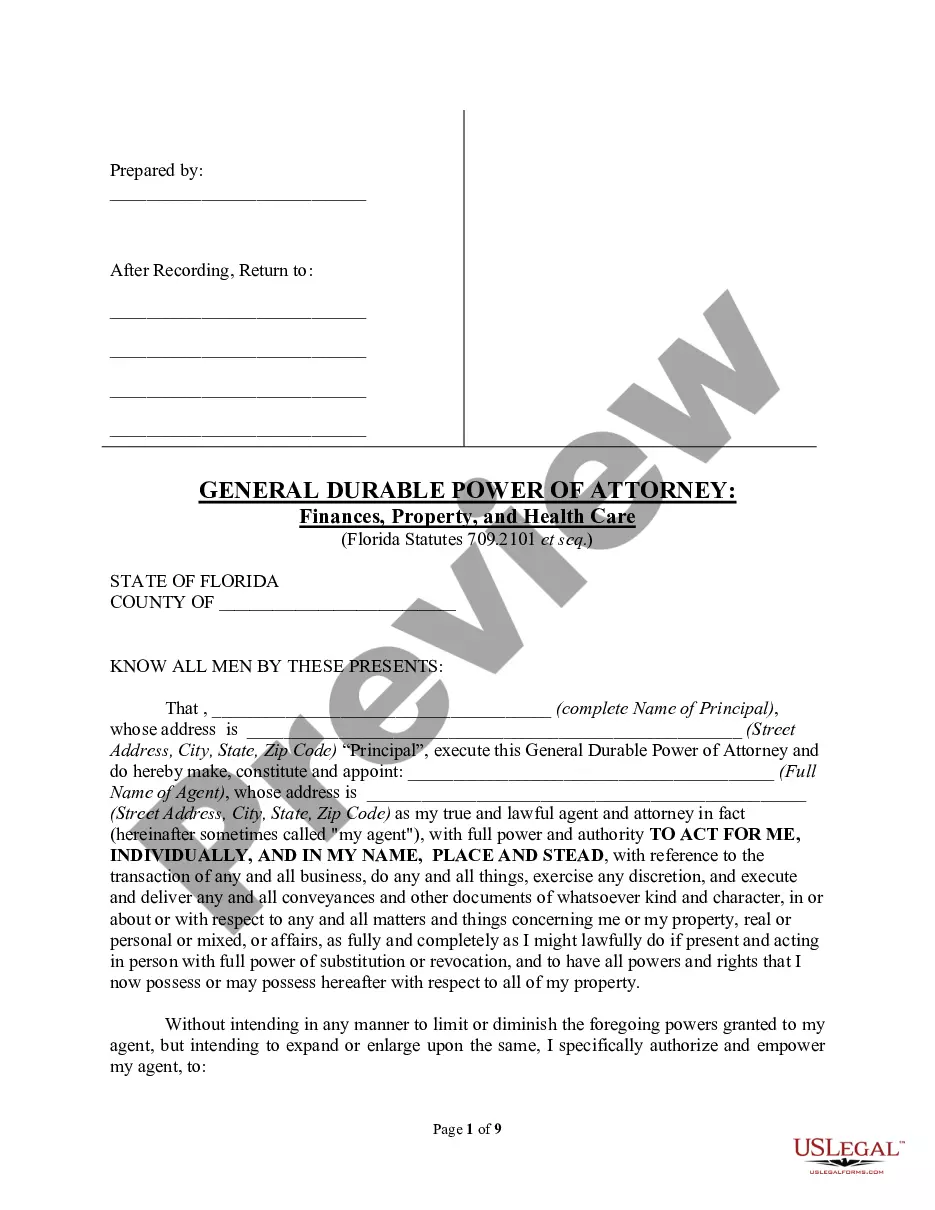

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another example using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and bought your subscription, you can utilize your Nursing Agreement - Self-Employed Independent Contractor as often as you need or for as long as it stays active where you live. Change it in your favored online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

A new law went into effect in California last month regulating gig labor. Here, nurses, CRNAs and NPs are not allowed to work as they wish but must conform to the hospital's policies and procedures while working in the same line of work as the company contracting their services.

In the simplest of terms, nurse practitioners that are 1099 employees are independent contractors. They receive a different tax form than that which accompanies more traditional W-2 employment status and are not technically employees of the company for which they work.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

If the NP is working for a facility or office that provides medical services, the NP cannot work as an independent contractor.Even if the NP works four hours, s/he must be an employee. If the NP is an employer, s/he cannot hire other providers as independent contractors. The providers must all be employees.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done).

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.