Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

Among lots of paid and free examples that you can get on the internet, you can't be certain about their reliability. For example, who made them or if they are skilled enough to deal with the thing you need them to. Always keep relaxed and use US Legal Forms! Get Employer Training Memo - Payroll Deductions templates made by professional lawyers and get away from the expensive and time-consuming process of looking for an lawyer or attorney and then having to pay them to draft a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access your earlier downloaded templates in the My Forms menu.

If you are making use of our website for the first time, follow the guidelines listed below to get your Employer Training Memo - Payroll Deductions with ease:

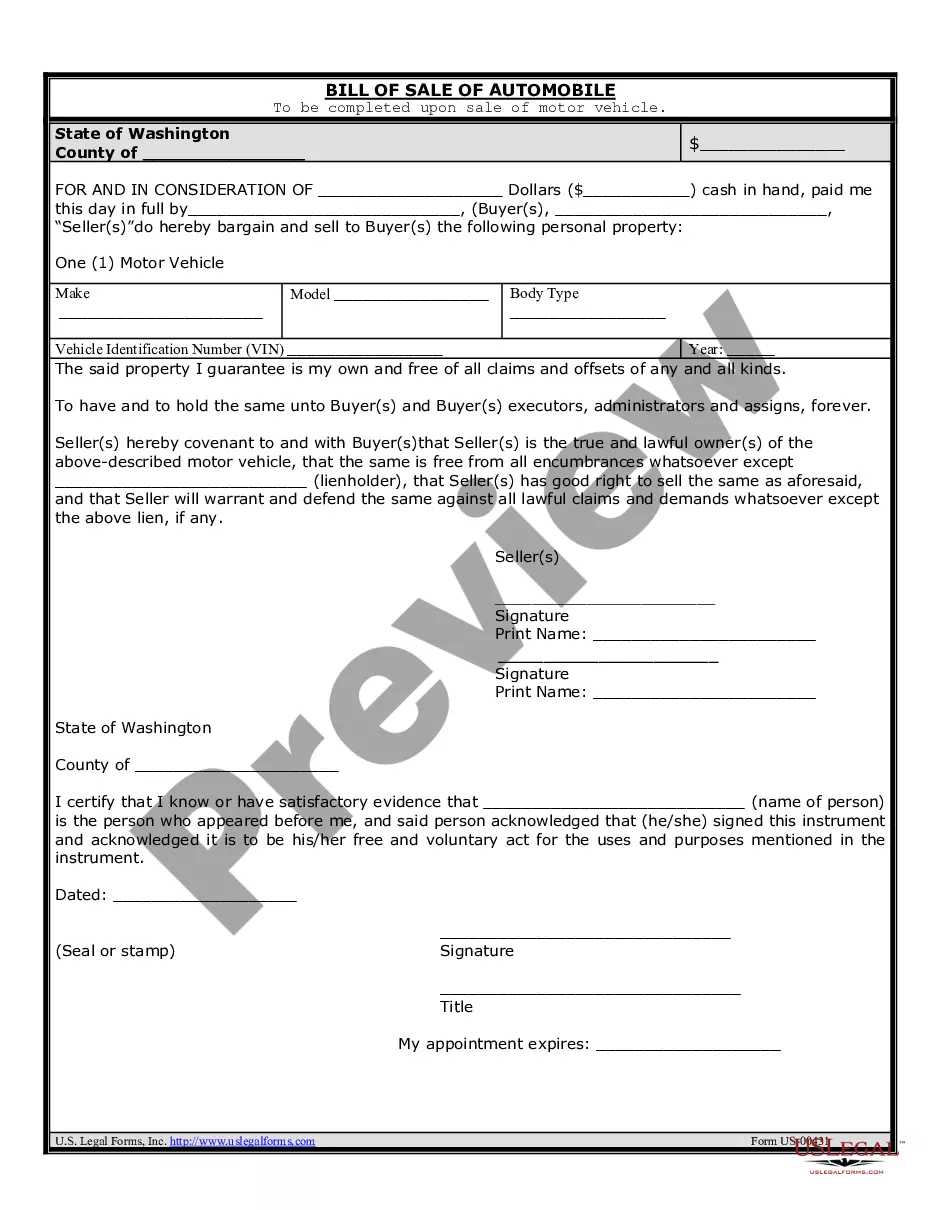

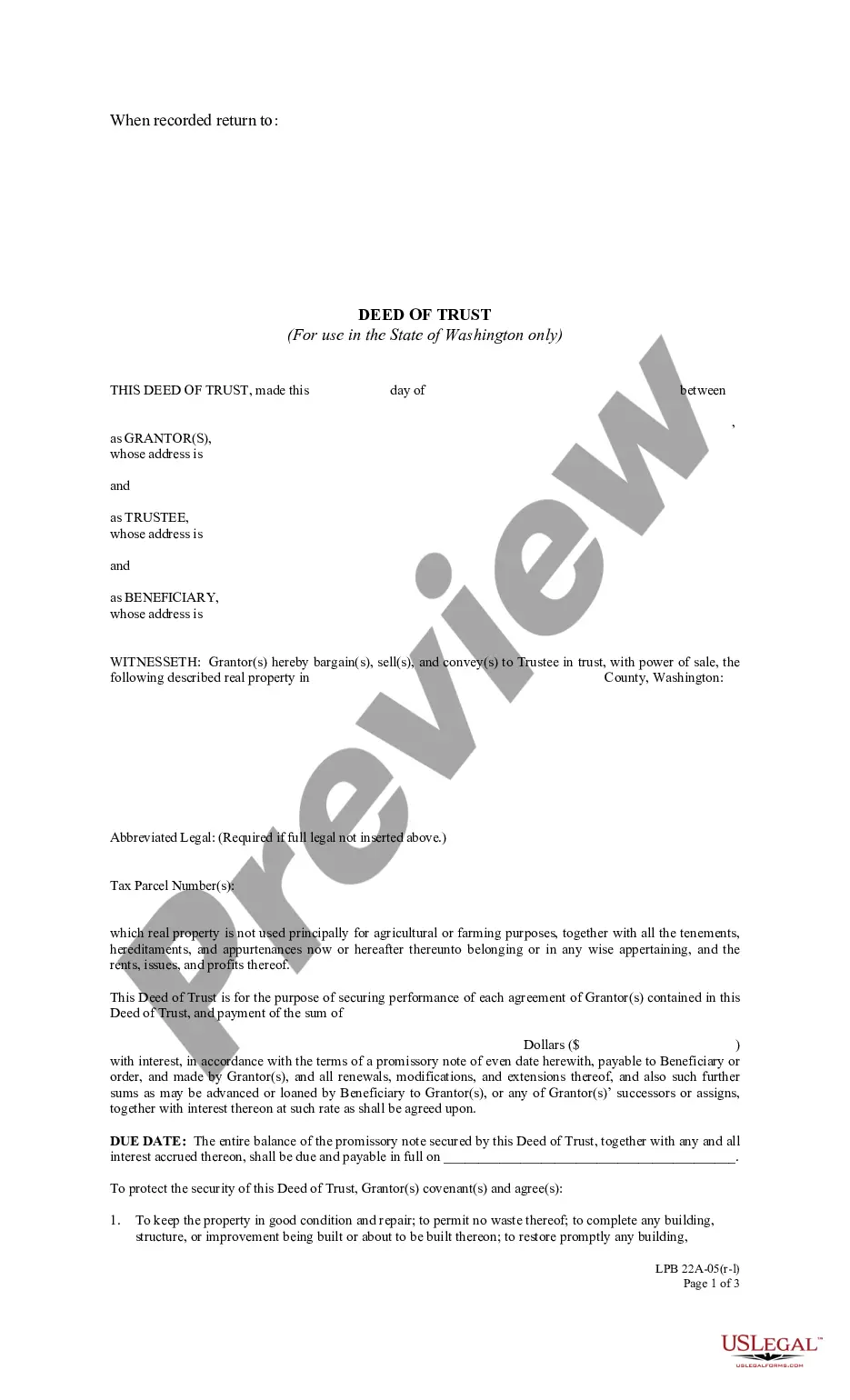

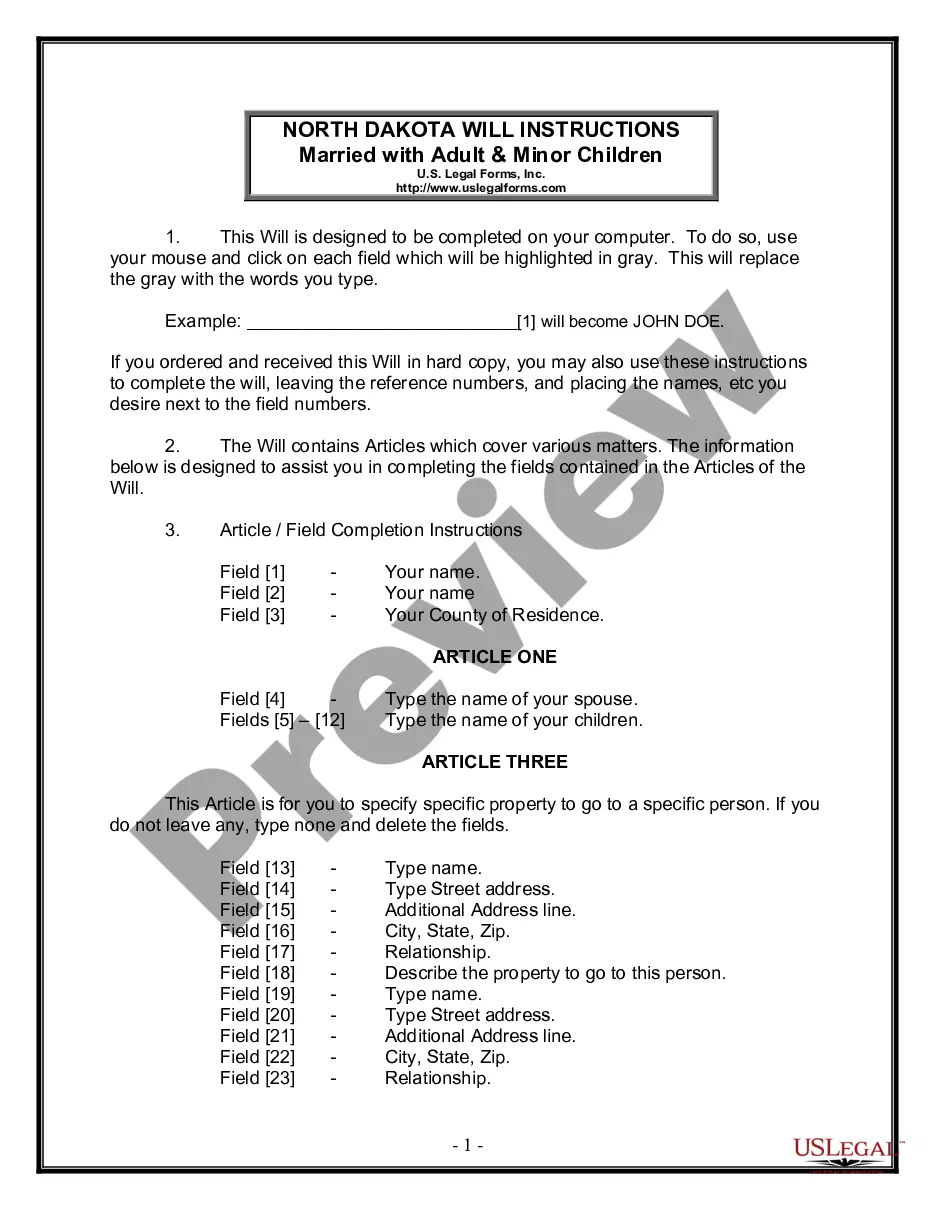

- Ensure that the document you discover applies in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you’ve signed up and paid for your subscription, you can utilize your Employer Training Memo - Payroll Deductions as often as you need or for as long as it remains active where you live. Edit it in your favored online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

The primary payroll journal entry is for the initial recordation of a payroll. This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed to the government by the company.

Debit "Wages Expense" for the full amount the company must pay for the pay period. Credit "Net Payroll Payable" and any deductions required. Add the total number of debits and then add the total number of credits.

Box A: Employee's Social Security number. Box B: Employer Identification Number (EIN) Box C: Employer's name, address, and ZIP code. Box D: Boxes E and F: Employee's name, address, and ZIP code. Box 1: Wages, tips, other compensation. Box 2: Federal income tax withheld. Box 3: Social Security wages.

Taxes that are withheld from an employee paycheck are entered as a debit to your salary expense account and a credit to your payable account. Debit the payable account and credit your cash account when you file your quarterly payroll taxes and issue the payment to the IRS.

Debit "Wages Expense" for the full amount the company must pay for the pay period. Credit "Net Payroll Payable" and any deductions required. Add the total number of debits and then add the total number of credits.

Can employers deduct your pay for training? If the employer is relying on a contract provision or written consent from the employee, the answer is Yes. If the deduction for training occurred without such authority, then the deduction would be illegal and the employee may have a potential employment claim.

Create a journal entry to record the total payroll: Debit the salary expense account for the total amount of the payroll. Credit the tax payable accounts for the total amount withheld from employee paychecks. Credit the cash account for the amount issued to the employees as net pay.

Payroll Withholdings are Liabilities (The taxes withheld from employees are not an expense of the company that withheld them.) The payroll taxes that are not withheld from employees are expenses of the employer and are liabilities until the amounts are remitted.

Box A: Employee's Social Security number. Box B: Employer Identification Number (EIN) Box C: Employer's name, address, and ZIP code. Box D: Boxes E and F: Employee's name, address, and ZIP code. Box 1: Wages, tips, other compensation. Box 2: Federal income tax withheld. Box 3: Social Security wages.