Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice

Description

How to fill out Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

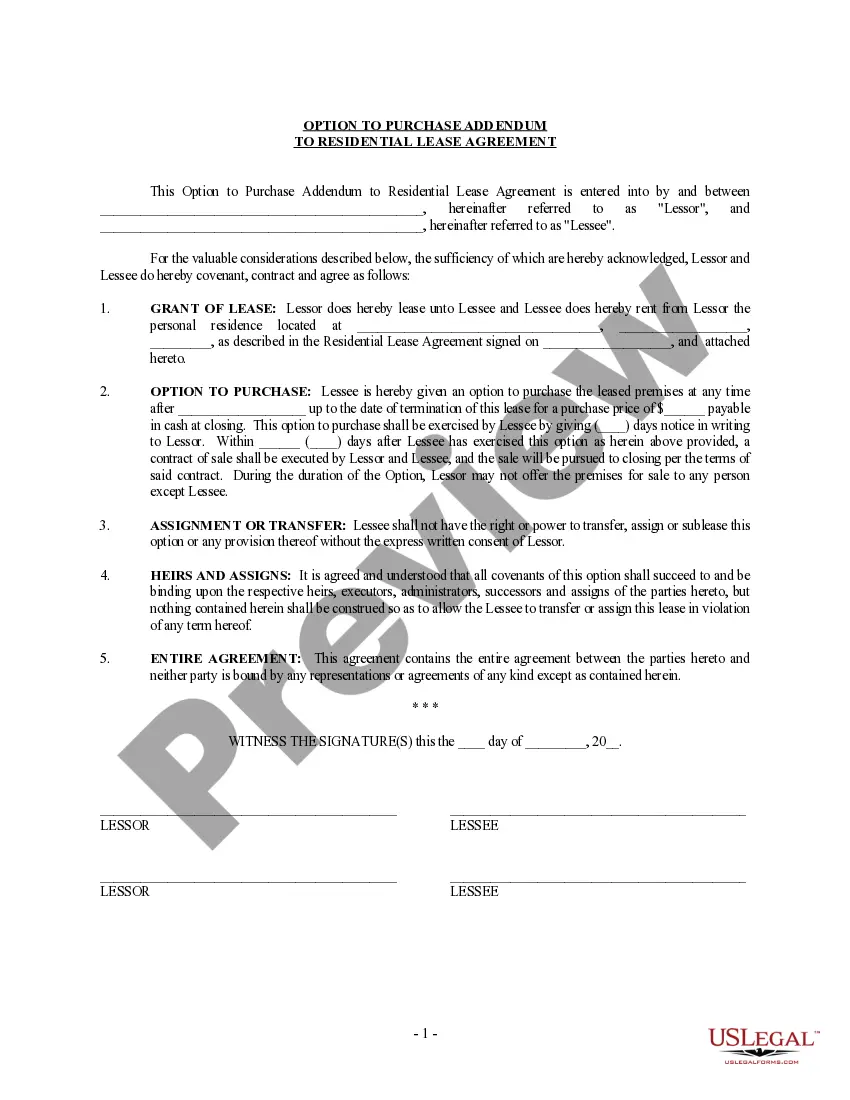

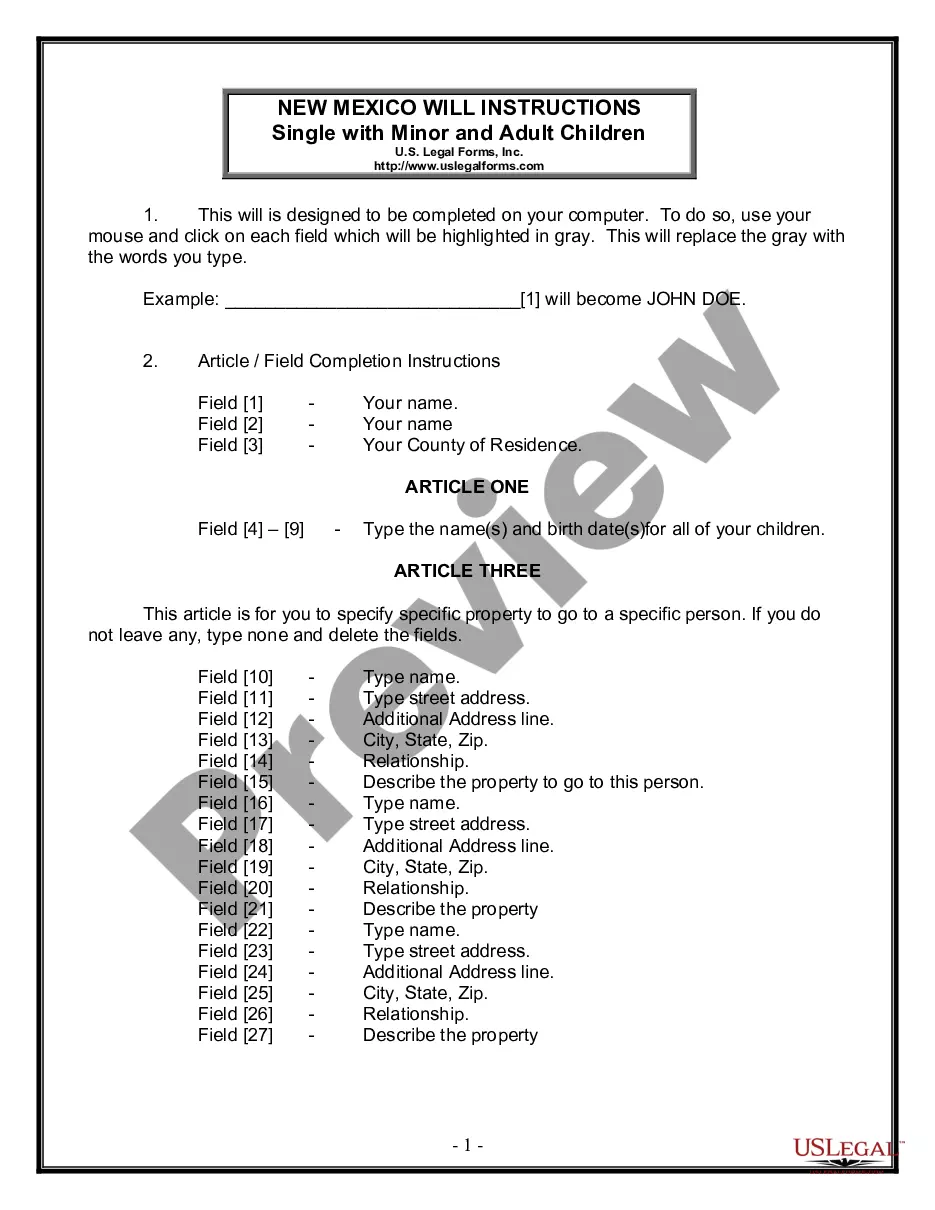

Use US Legal Forms to obtain a printable Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms catalogue online and provides cost-effective and accurate samples for customers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice:

- Check to make sure you have the correct template with regards to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Hit Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Use the Search engine if you want to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice. Over three million users already have utilized our platform successfully. Select your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.

In most states, lenders are required to provide a homeowner with sufficient notice of default. The lender must also provide notice of the property owner's right to cure the default before the lender can initiate a foreclosure proceeding. Written proof of money owed under the mortgage.

Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure. Applying for a foreclosure avoidance option, called loss mitigation, might delay the start date even further.

The Notice of Default starts the official foreclosure process. This notice is issued 30 days after the fourth missed monthly payment. From this point onwards, the borrower will have 2 to 3 months, depending on state law, to reinstate the loan and stop the foreclosure process.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

Proving Wrongful Foreclosure If you wish to sue the bank for wrongful foreclosure, you must prove the following: The lender owed you, the borrower, a legal duty. The lender breached that duty. The breach of duty caused your injury or loss (damages)

Lenders will seize the home, which is typically used as collateral for the loan and will put the property up for sale to try and recoup losses. The foreclosure process from beginning to end typically takes a lender about 18 months to foreclose on a property during normal times.

"Commencement of Foreclosure" for HUD's purposes is the first public action required by law such as filing a complaint or petition, recording a notice of default, or publication of a notice of sale.

Borrowers may not avoid foreclosure on their property, for example, simply on the basis of a lost promissory note. The lender has a right to "re-establish" the note legally as long as it has not sold or transferred the note to another party.