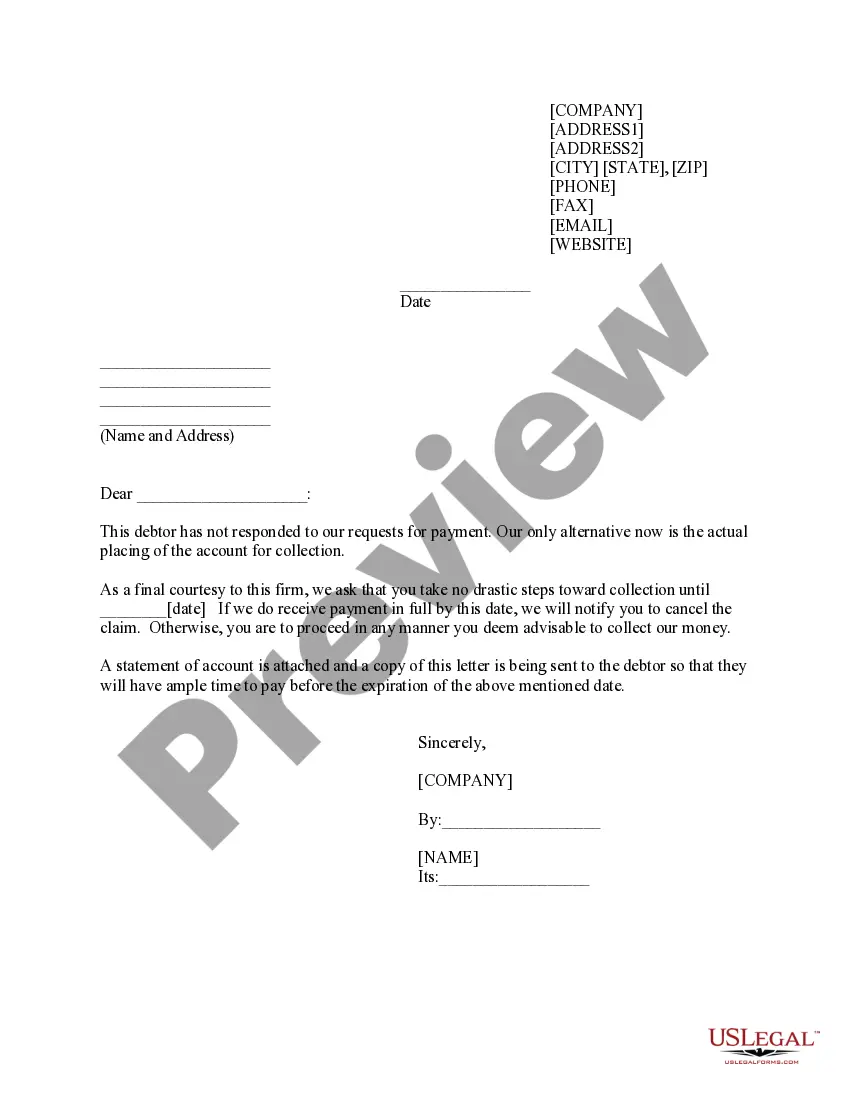

Referral of Account to Collection Agency

Description

How to fill out Referral Of Account To Collection Agency?

If you’re looking for a way to properly complete the Referral of Account to Collection Agency without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business scenario. Every piece of paperwork you find on our web service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these simple guidelines on how to obtain the ready-to-use Referral of Account to Collection Agency:

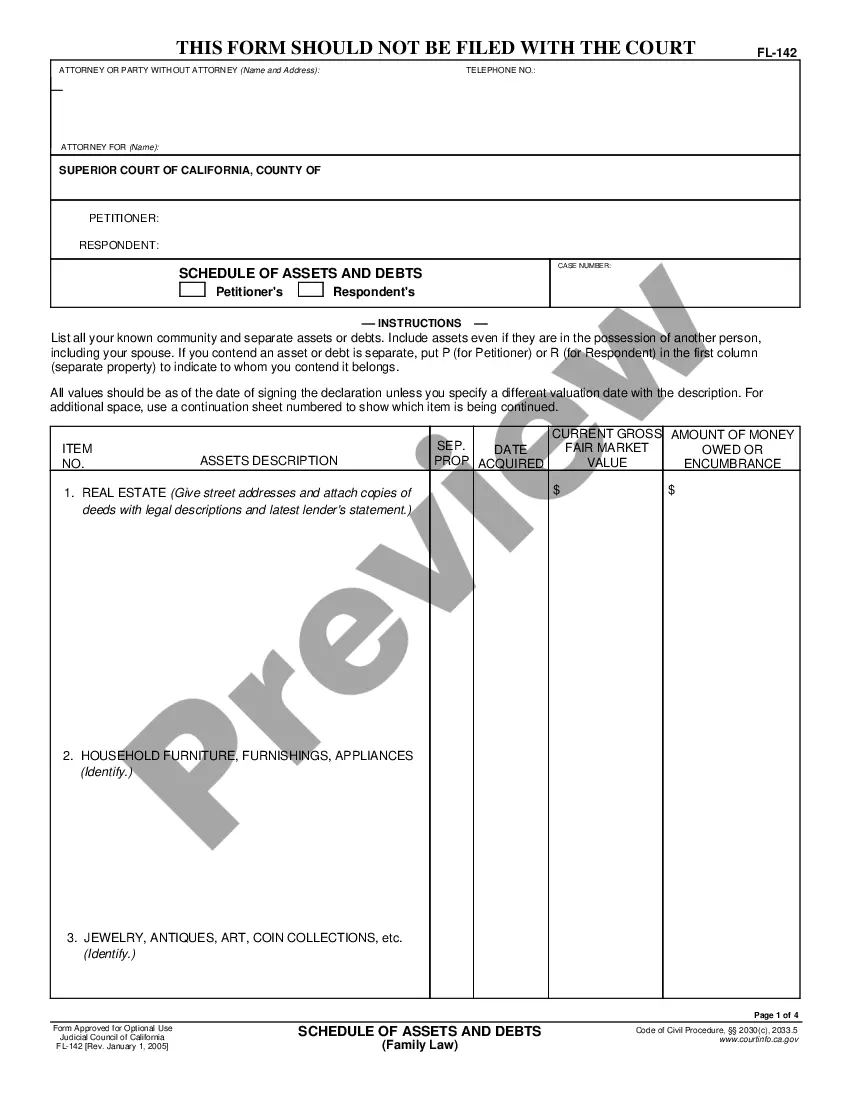

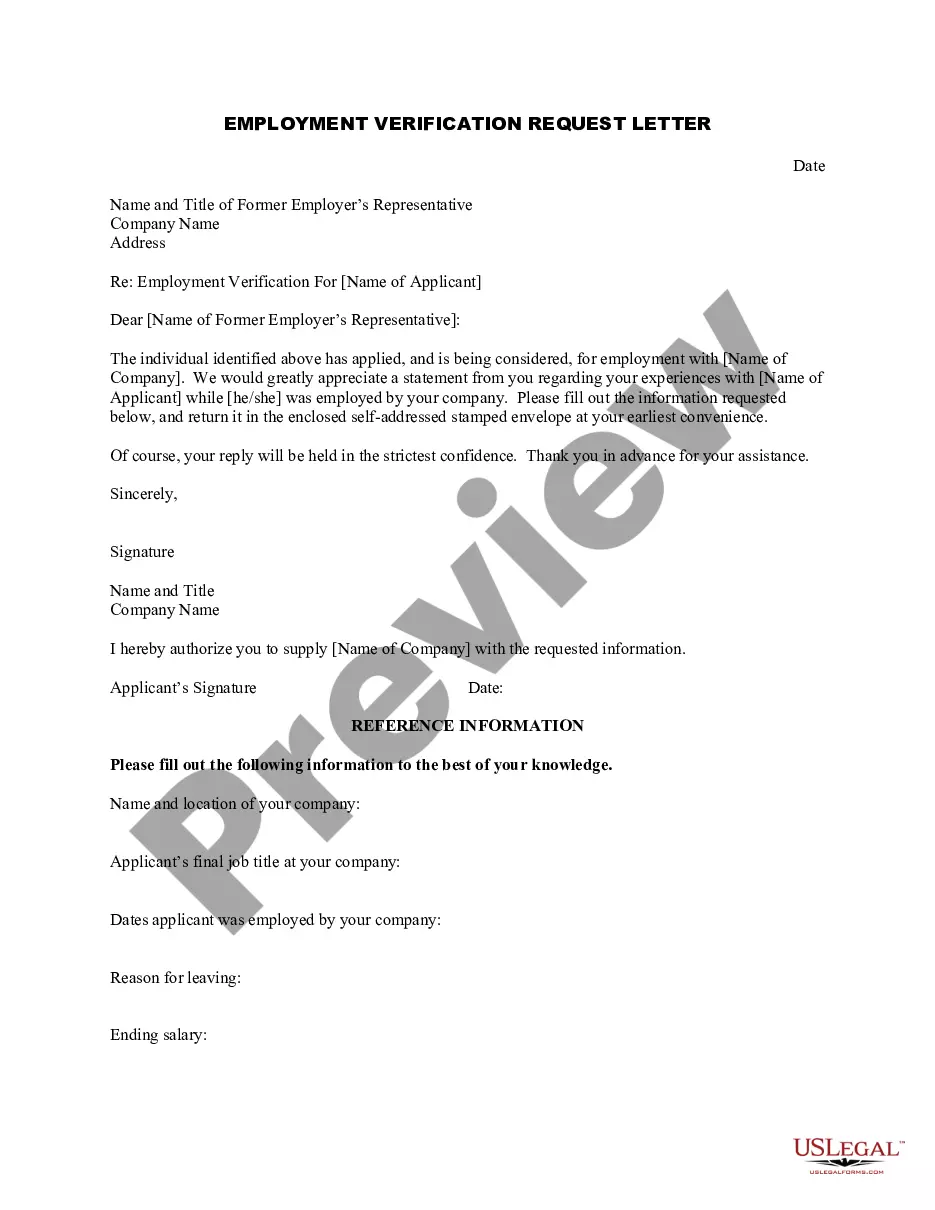

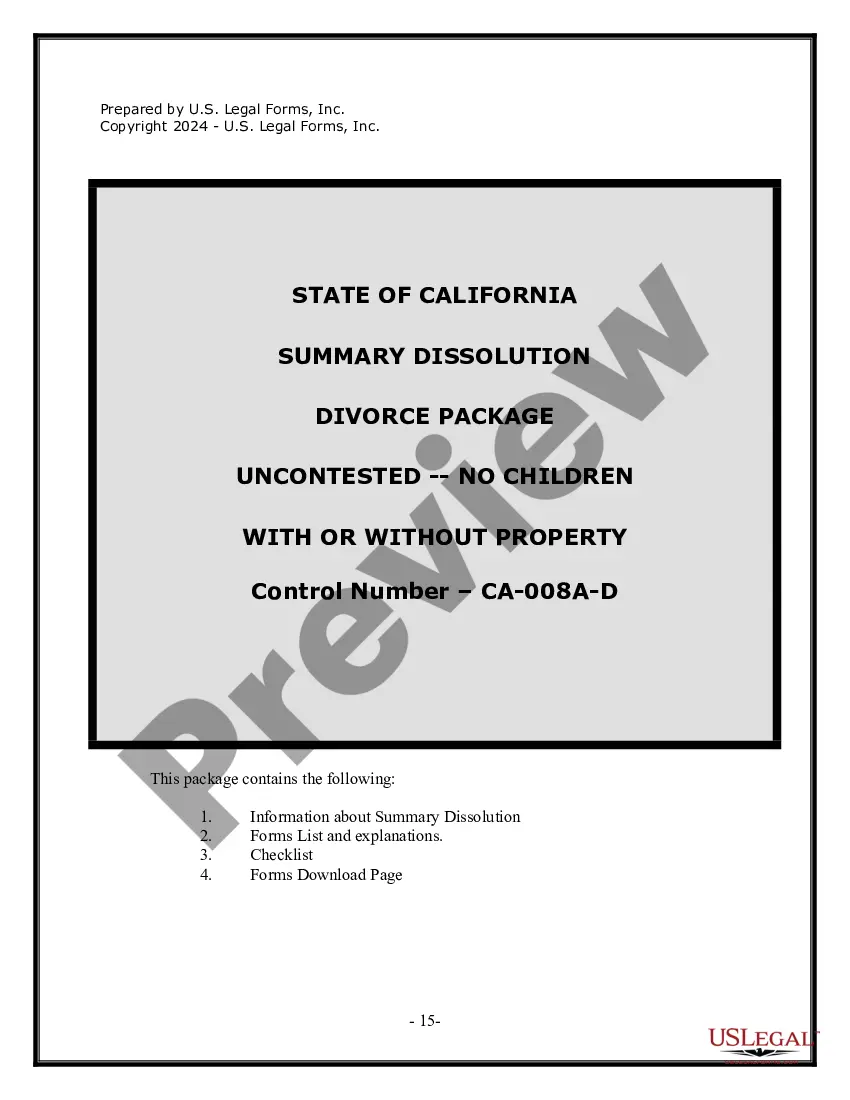

- Make sure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Referral of Account to Collection Agency and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Collection accounts have a significant negative impact on your credit scores. Collections can appear from unsecured accounts, such as credit cards and personal loans. In contrast, secured loans such as mortgages or auto loans that default would involve foreclosure and repossession, respectively.

A collection agency referral history record is linked to an account. It contains the amount of debt referred to the collection agency. It is the creation of this record that, in turn, triggers the interface of information to the collection agency.

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

What does it mean to have a debt in collections? When you have a debt in collections, it usually means the original creditor has sent the debt to a third-party person or agency to collect it.

When should you send someone to collections? Many experts recommend waiting 90 days after your invoice's due date to send someone to collections. You can ask the nonpaying client to pay their debt once the due date arrives ? you can't refer them to collections at that point.

While there may not be an immediate boost to your credit score, paying off collections accounts is overall beneficial for your personal finances. Some benefits of taking care of unpaid collections include: Avoiding a lawsuit from the debt collection agency or the original creditor.

Collections agencies are third-party companies charged with collecting overdue debts. They'll call you, send letters and attempt to get you to pay back the debt you owe. If they're successful, they'll take a cut of the recovered amount.

What Is a Collection Agency? A collection agency is a company used by lenders or creditors to recover funds that are past due, or from accounts that are in default. Often, a creditor will hire a collection agency after it has made multiple failed attempts to collect its receivables.