Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of

Description

How to fill out Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice Of?

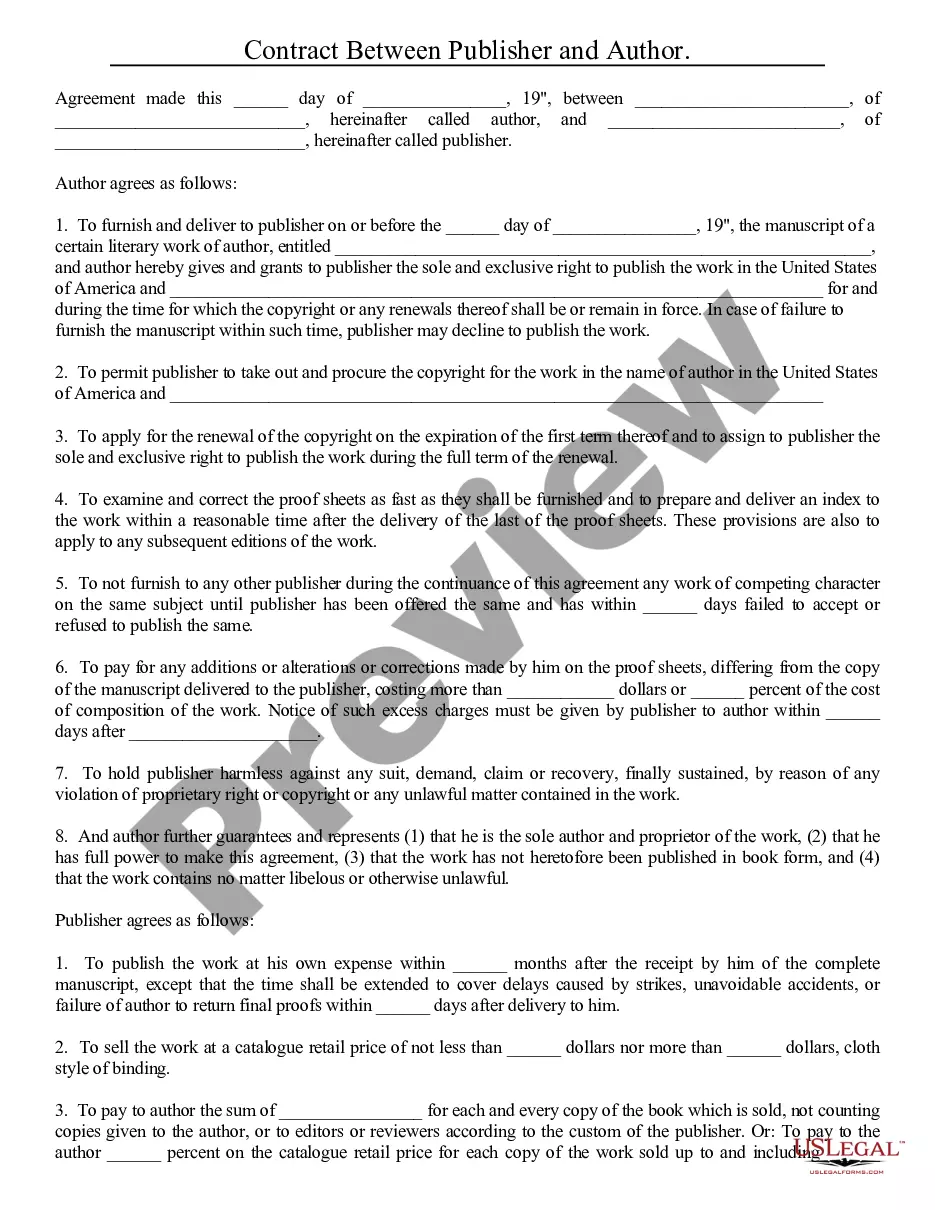

Aren't you sick and tired of choosing from hundreds of templates each time you need to create a Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of? US Legal Forms eliminates the wasted time countless American people spend exploring the internet for perfect tax and legal forms. Our expert crew of lawyers is constantly updating the state-specific Samples catalogue, so that it always has the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription need to complete a few simple actions before having the ability to download their Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of:

- Utilize the Preview function and read the form description (if available) to make certain that it’s the best document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate example for your state and situation.

- Utilize the Search field at the top of the page if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your file in a needed format to finish, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always be able to log in and download whatever document you require for whatever state you require it in. With US Legal Forms, finishing Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of samples or any other legal files is not hard. Get started now, and don't forget to examine your samples with certified attorneys!

Form popularity

FAQ

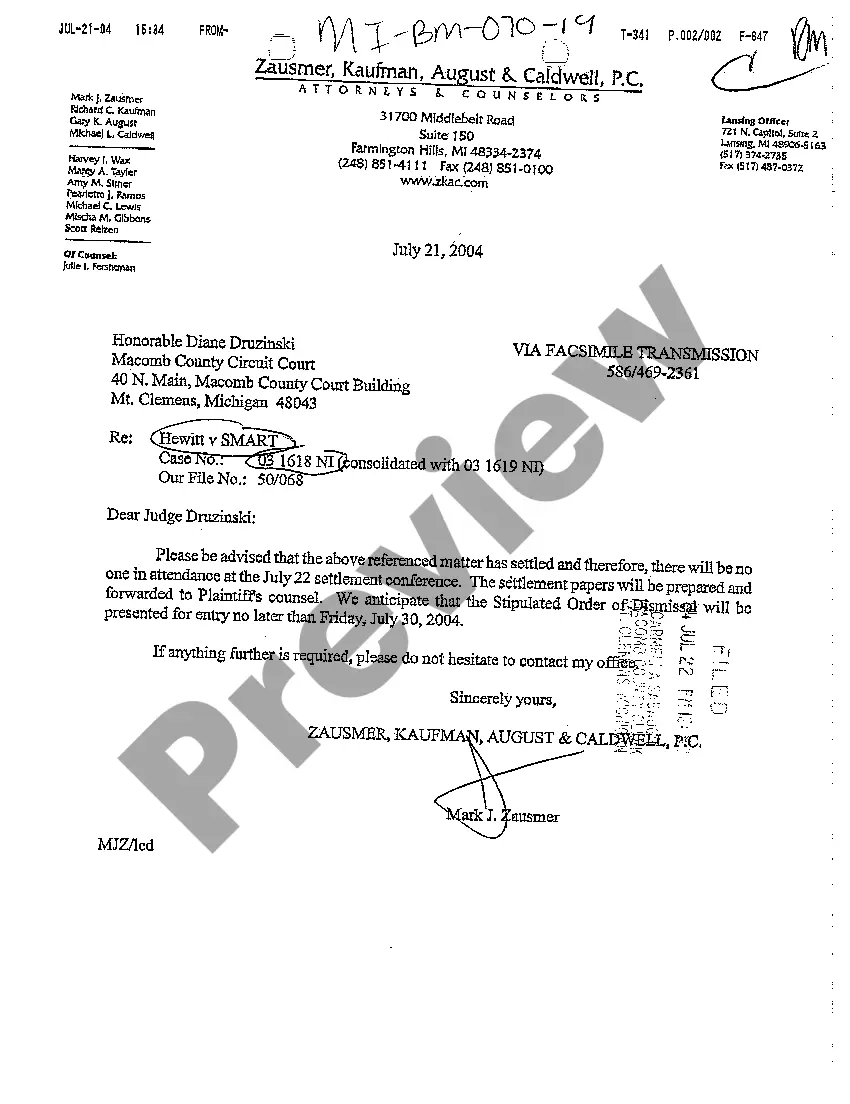

It takes a minimum of 120 days to complete a foreclosure in California; in other states, twelve or more months may pass before you're required to leave your home.

Lenders will seize the home, which is typically used as collateral for the loan and will put the property up for sale to try and recoup losses. The foreclosure process from beginning to end typically takes a lender about 18 months to foreclose on a property during normal times.

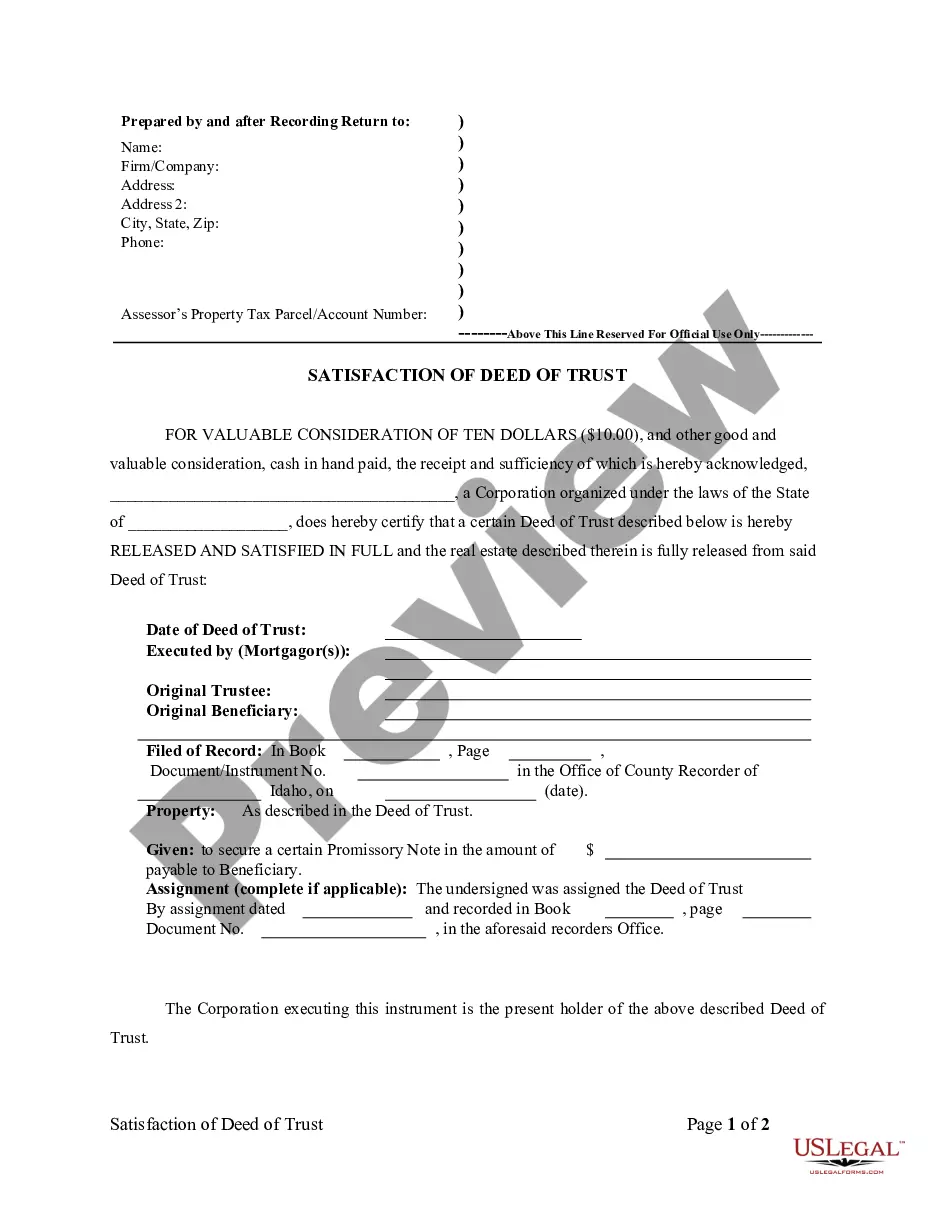

The Notice of Default starts the official foreclosure process. This notice is issued 30 days after the fourth missed monthly payment. From this point onwards, the borrower will have 2 to 3 months, depending on state law, to reinstate the loan and stop the foreclosure process.

In most states, lenders are required to provide a homeowner with sufficient notice of default. The lender must also provide notice of the property owner's right to cure the default before the lender can initiate a foreclosure proceeding.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

Most states allow lenders to sue borrowers for deficiencies after foreclosure or, in some cases, in the foreclosure action itself. Some states allow deficiency lawsuits in judicial foreclosures, but not in nonjudicial foreclosures.Your lender most likely won't sue you if they think they won't recover anything.

Proving Wrongful Foreclosure If you wish to sue the bank for wrongful foreclosure, you must prove the following: The lender owed you, the borrower, a legal duty. The lender breached that duty. The breach of duty caused your injury or loss (damages)

Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure. Applying for a foreclosure avoidance option, called loss mitigation, might delay the start date even further.

Foreclosures can take a long time because lenders and servicers must comply with the requirements under these laws. Mediation laws. Some states, cities, and municipalities have passed foreclosure mediation laws that can delay the foreclosure process. Mortgage servicing laws changed in 2014.