Rental Application for Married Couple

Description

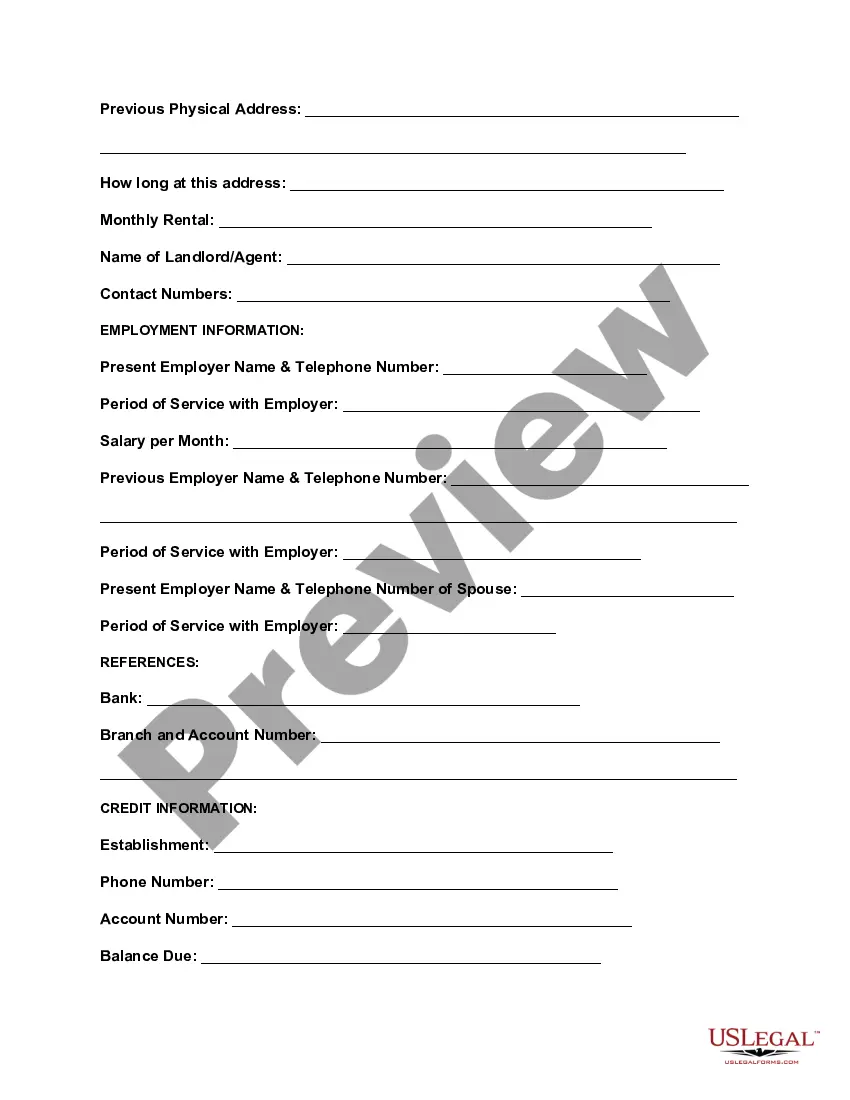

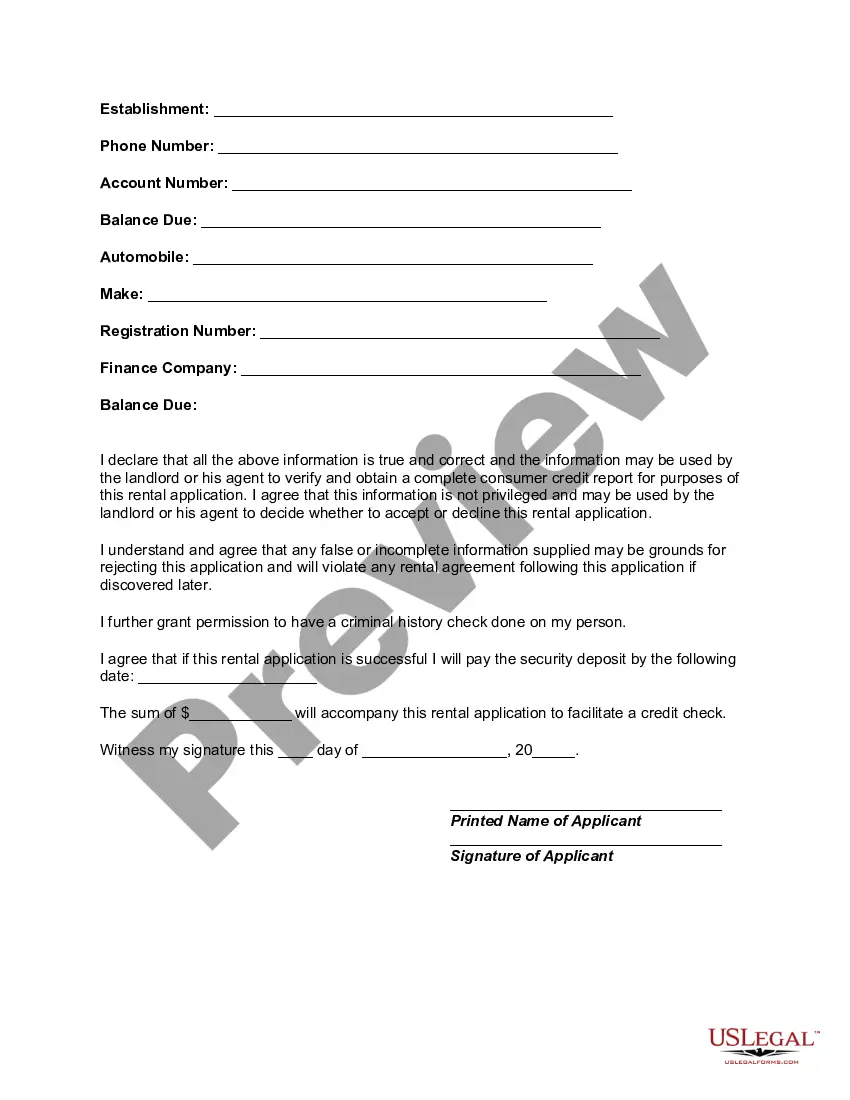

How to fill out Rental Application For Married Couple?

Use US Legal Forms to obtain a printable Rental Application for Married Couple. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms library online and offers reasonably priced and accurate templates for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and some of them might be previewed before being downloaded.

To download samples, users must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to easily find and download Rental Application for Married Couple:

- Check out to ensure that you have the right form with regards to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Click Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Rental Application for Married Couple. More than three million users already have used our platform successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

A co-applicant is a person who joins in the application of a loan or other service. Having a co-applicant can make an application more attractive since it involves additional sources of income, credit, or assets. A co-applicant has more rights and responsibilities than a co-signer or guarantor.

There is no law that says you and your spouse must sign a lease when you rent a home together. There's also no law that demands her name goes on the lease if she moves into a house you're already renting.

There is no law that says you and your spouse must sign a lease when you rent a home together.The law does, however, give your landlord some rights too -- and the landlord is within his rights to insist you both sign.

Most landlords require a credit check on every adult tenant unless someone is living with you who is unemployed or retired and you alone are going to be responsible for the rent. But the landlord may require information about the other tenant.

Apartment tenants often have lower credit scores than those seeking a mortgage, but landlords still have to assess risk. If your credit score is too low, then more than likely you'll be facing denial. According to Rentprep.com, the closer a tenant is to a score of 500, the more likely for denial.

Can you private rent with bad credit? Yes. It is ultimately the decision of the private landlord whether or not they will accept applicants as a tenant. There is no rule about the minimum rating you need for renting properties.

In order for a lease agreement to be valid, both parties must sign the contract. Depending on your state's laws, if a property manager is representing an owner, the owner may or may not be listed on the lease agreement.

Most landlords will want you to fill out a rental application with information on your employment, income, credit and financial information, rental housing history, and any criminal convictions. It's legal to ask for all this information and use it to make rental decisions.

It can be difficult to ask a friend or family member to cosign your lease, but it can help you to get into an apartment. If you have someone who is willing to cosign, make sure they have good credit and a history of timely mortgage or rental payments.