Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Sample Letter To Include Article Relating To Tax Sales?

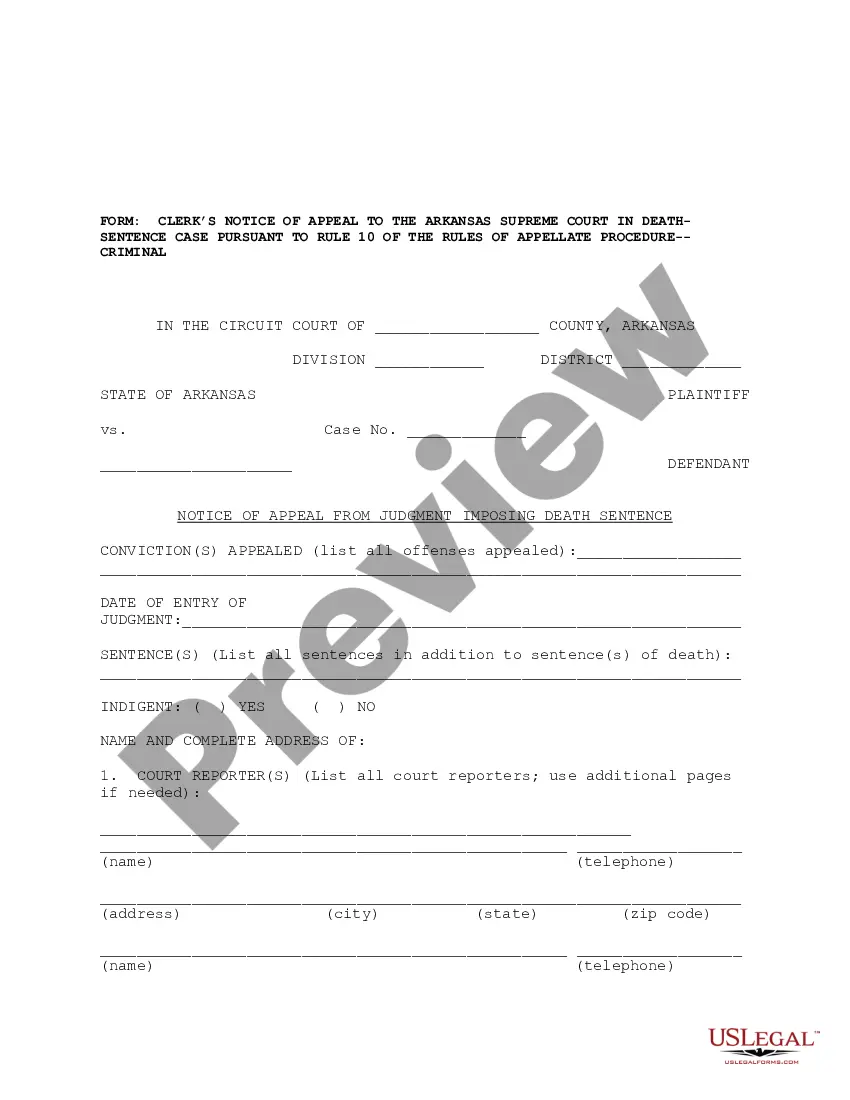

Use US Legal Forms to get a printable Sample Letter to Include Article Relating to Tax Sales. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms catalogue online and provides reasonably priced and accurate templates for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them might be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to easily find and download Sample Letter to Include Article Relating to Tax Sales:

- Check to ensure that you have the correct form in relation to the state it’s needed in.

- Review the document by reading the description and using the Preview feature.

- Hit Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Sample Letter to Include Article Relating to Tax Sales. Above three million users have already used our platform successfully. Select your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

Contrary to popular belief, the IRS does not have to record an NFTL before it can levy bank accounts or receivables. Once the Final Notice has been issued and 30 days have passed, the IRS can levy bank accounts and/or accounts receivable. The IRS does not perform a lien search prior to issuing a levy.

What Is a Tax Lien Foreclosure? Tax lien foreclosure is the sale of a property resulting from the property owner's failure to pay their tax liabilities. A tax lien foreclosure occurs when the property owner has not paid the required taxes, including property taxes and federal and state income taxes.

County and municipal governments create a tax lien certificate that states how much is owed in property taxes, along with any interest or penalties due. These certificates can then go to auction for investors, allowing the governments to collect payment on the past-due taxes, interest, and penalties.

Worthless Property. Sometimes owners stop paying their property taxes because the property is worthless. Foreclosure Risks. When you purchase a tax lien, state statutes limit the amount of time you have to foreclose on the property before the lien expires worthless. Municipal Fines and Costs. Bankruptcy.

After a tax sale happens, the homeowner might be able to redeem the property. "Redemption" is the right of the property owner to reclaim the property by paying the entire sale price, plus certain additional costs and interest, after the sale so long as it is within the time period allowed by statute.

Paying someone else's delinquent taxes can get you a property, but not always. Paying someone's taxes does not give you claim or ownership interest in a property, unless it's through a tax deed sale. This means that paying taxes on a property you're interested in buying won't do you any good.

A tax sale is the sale of a real estate property that results when a taxpayer reaches a certain point of delinquency in their owed property tax payments.

A tax lien sale is a method many states use to force an owner to pay unpaid taxes.The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.

What is sold is a tax sale certificate, a lien on the property. Tax sale certificates can earn interest of up to 18 per cent, depending on the winning percentage bid at the auction. At the auction, bidders bid down the interest rate that will be paid by the owner for continuing interest on the certificate amount.