Triple Net Lease for Commercial Real Estate

Description

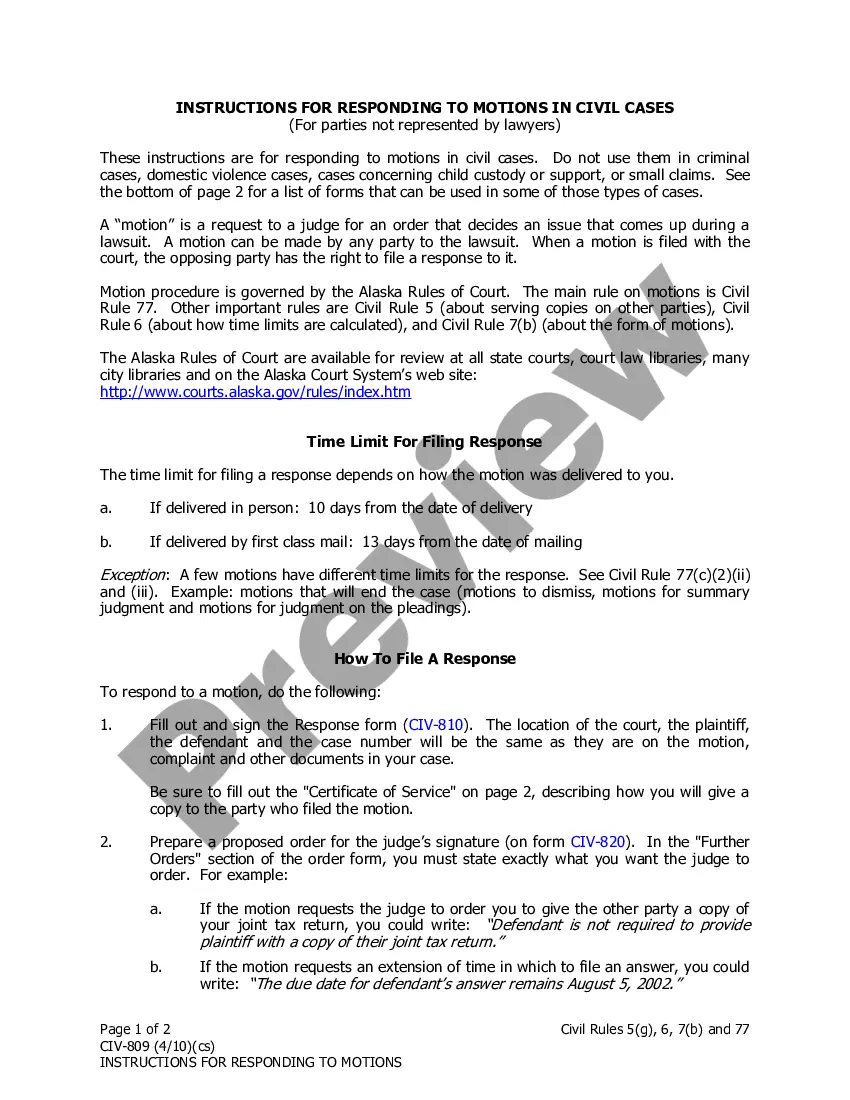

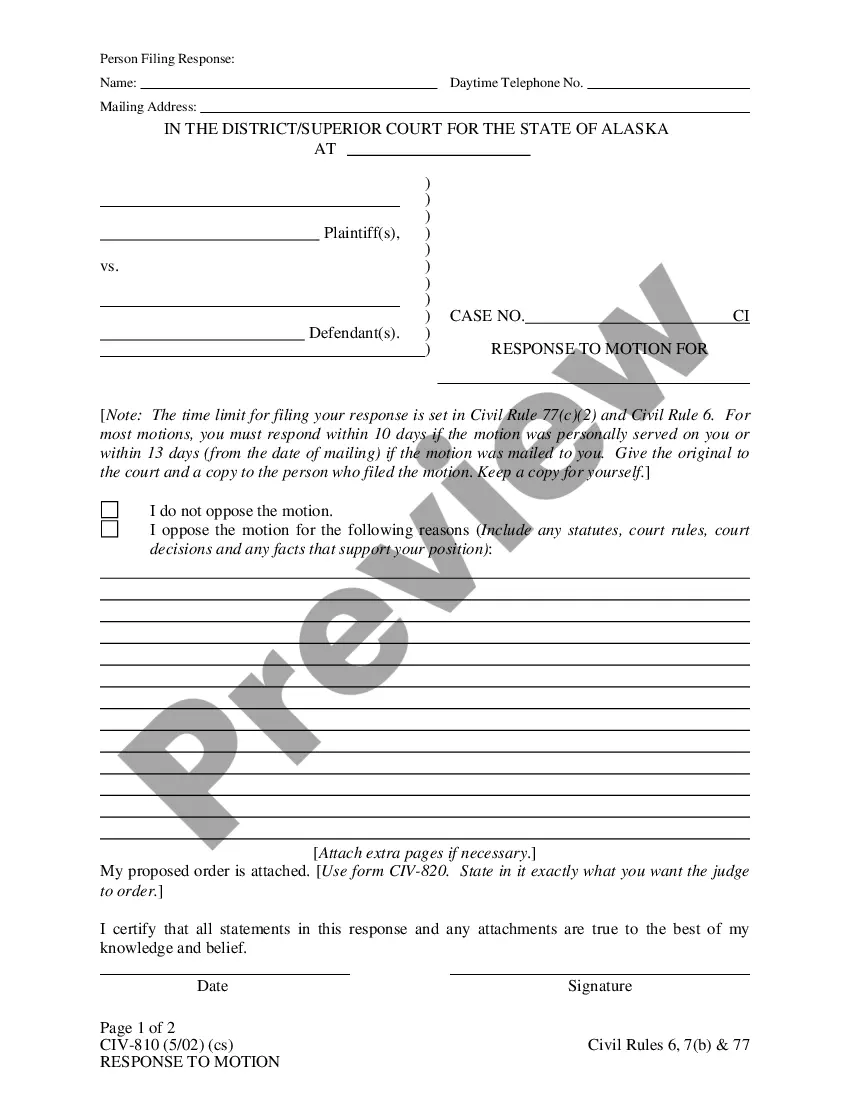

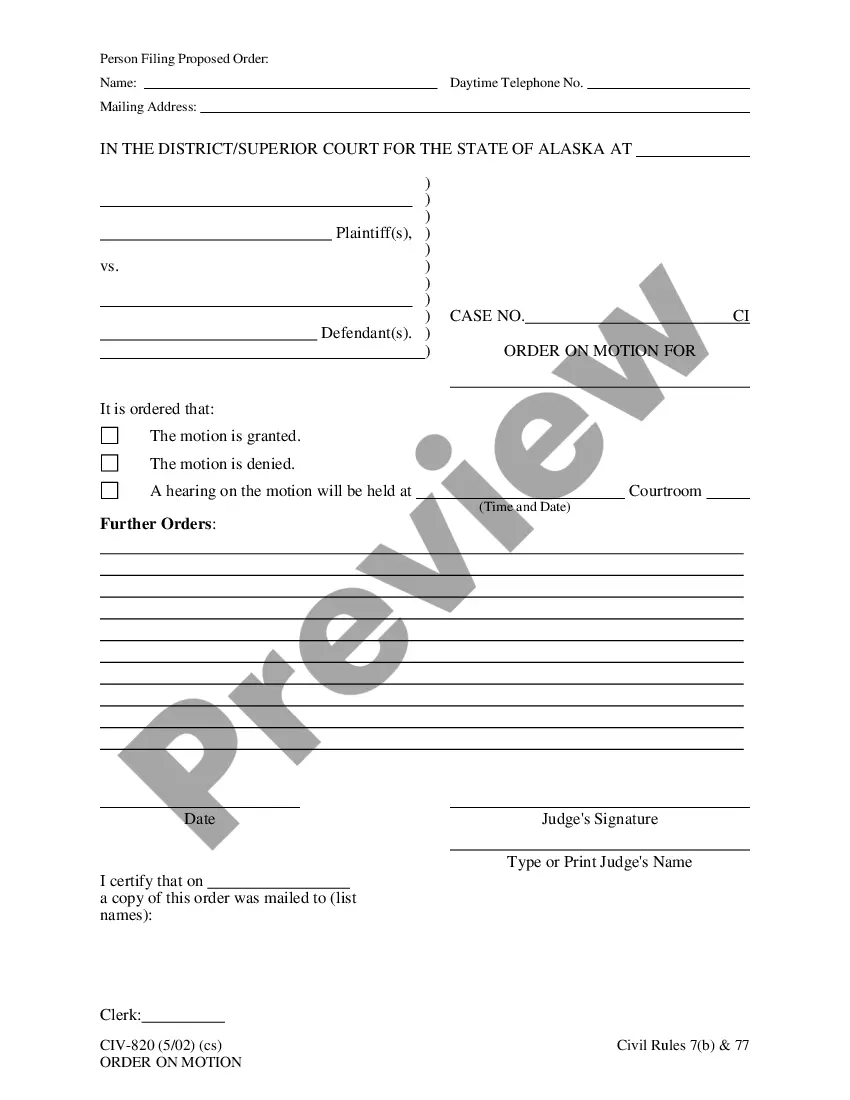

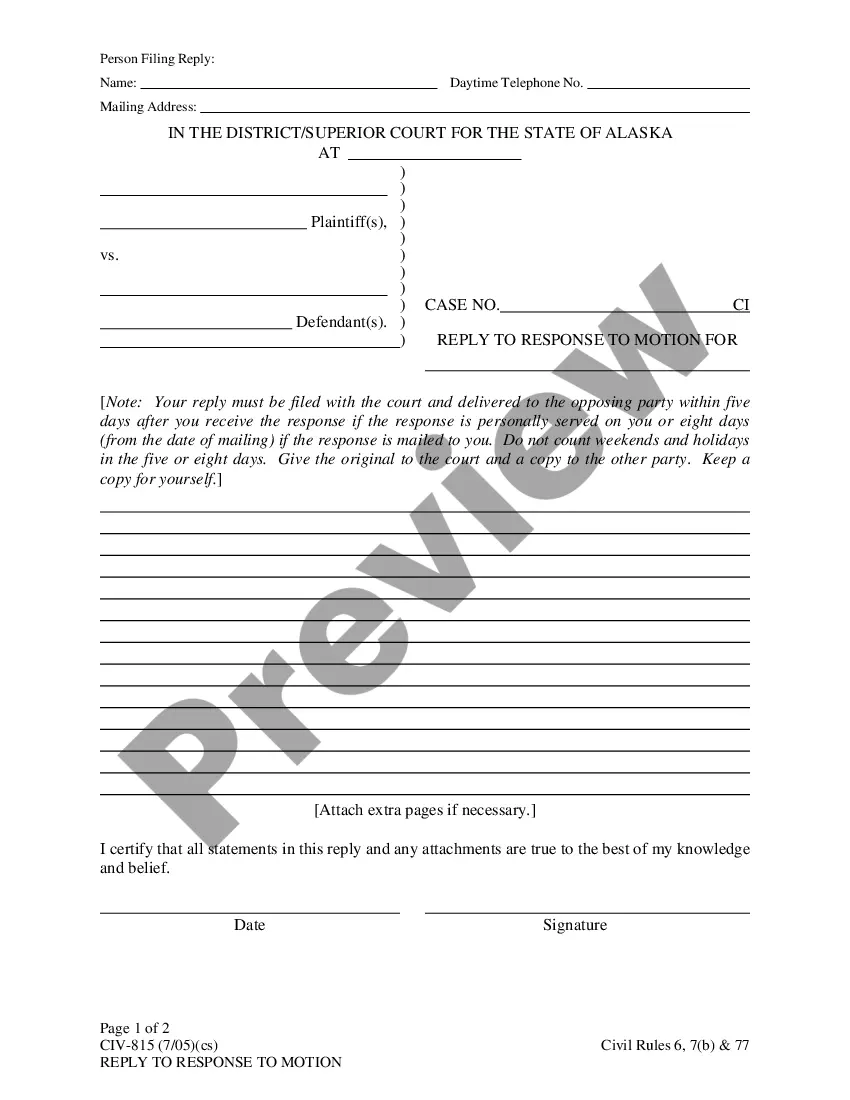

How to fill out Triple Net Lease For Commercial Real Estate?

Use US Legal Forms to get a printable Triple Net Lease for Commercial Real Estate. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the internet and provides cost-effective and accurate templates for consumers and attorneys, and SMBs. The documents are categorized into state-based categories and many of them can be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Triple Net Lease for Commercial Real Estate:

- Check out to ensure that you have the right template with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it’s the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search field if you want to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Triple Net Lease for Commercial Real Estate. Above three million users have utilized our platform successfully. Select your subscription plan and obtain high-quality forms within a few clicks.

Form popularity

FAQ

In a triple net lease (also referred to as a NNN lease), the tenant pays all expenses associated with the property. This includes real estate taxes, building insurance, maintenance (including structural repairs), rent, and utilities.

A triple net lease (triple-Net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property including real estate taxes, building insurance, and maintenance.

As the triple net property owner (unless otherwise specified in the NNN lease), you'll generally be responsible for maintaining and repairing these 3 main aspects of your building: Roof (repairs, maintenance, upgrades) Exterior Walls. Utility Repairs and Upkeep (for major things such as plumbing and electricity)

As the triple net property owner (unless otherwise specified in the NNN lease), you'll generally be responsible for maintaining and repairing these 3 main aspects of your building: Roof (repairs, maintenance, upgrades) Exterior Walls. Utility Repairs and Upkeep (for major things such as plumbing and electricity)

Why are triple net leases a good investment? Because single-tenant triple net (NNN) properties can provide some of the most reliable income streams in the commercial real estate investment industry.

NNN leases are considered to be one of the most secure investment opportunities. This is because, similar to bonds, single-tenant net-leased properties provide steady and predictable returns over time.

The most obvious benefit of using a triple net lease for a tenant is a lower price point for the base lease. Since the tenant is absorbing at least some of the taxes, insurance, and maintenance expenses, a triple net lease features a lower monthly rent than a gross lease agreement.

The most obvious benefit of using a triple net lease for a tenant is a lower price point for the base lease. Since the tenant is absorbing at least some of the taxes, insurance, and maintenance expenses, a triple net lease features a lower monthly rent than a gross lease agreement.