Agreement with Health Care Worker as an Independent Contractor

Description

Definition and meaning

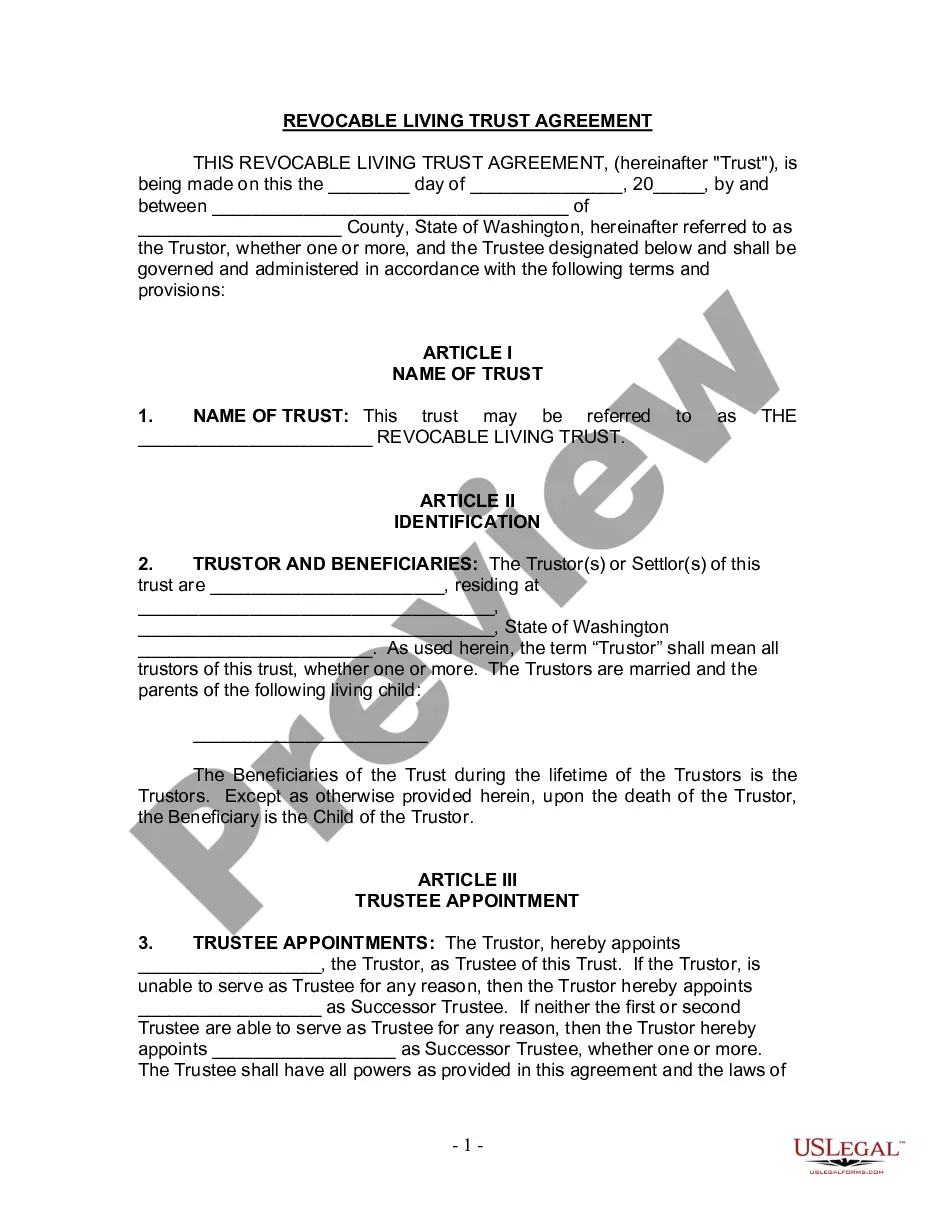

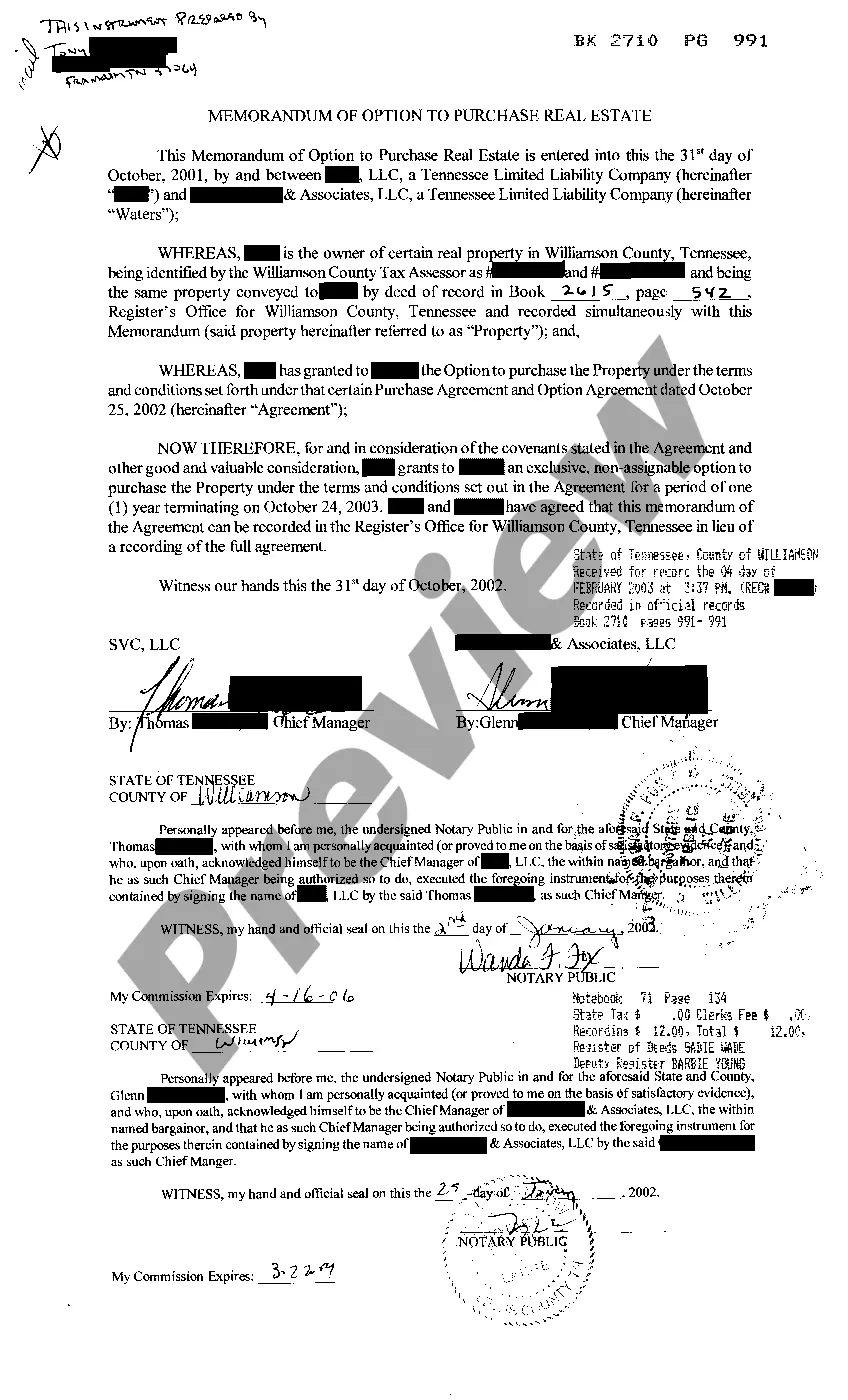

An Agreement with Health Care Worker as an Independent Contractor is a legal document that outlines the relationship between a health care provider and an independent contractor who offers healthcare services. This form ensures that both parties understand their rights, responsibilities, and the nature of their professional engagement. In this context, the Contractor operates autonomously, providing services without becoming an employee of the Provider. This type of agreement is critical in the healthcare sector, as it delineates the tasks and expectations involved in delivering patient care.

How to complete a form

Completing the Agreement with Health Care Worker as an Independent Contractor requires careful attention to detail. Follow these steps:

- Fill in Basic Information: Begin with the date of the agreement and the names of both parties—Provider and Contractor—along with their addresses.

- Define Services: Clearly state the health care services that the Contractor will provide.

- Engagement Terms: Specify the duration of the agreement, typically including the start date and renewal terms.

- Scope of Responsibilities: List the responsibilities of the Contractor in detail, ensuring clarity on roles.

- Fees: Outline payment terms, including the fee structure for services rendered.

- Signatures: Have both parties sign the agreement to make it legally binding.

Key components of the form

The Agreement with Health Care Worker as an Independent Contractor comprises several essential components:

- Engagement: Defines the professional engagement between the parties.

- Term of Engagement: Specifies the period during which the agreement is valid.

- Scope of Engagement: Describes specific duties and responsibilities of the Contractor.

- Fees and Expenses: Details of the compensation arrangement.

- Insurance and Indemnification: Outlines required insurance coverage and liability protections.

- Termination Clause: Conditions under which the agreement can be ended by either party.

Common mistakes to avoid when using this form

Users should be aware of several common pitfalls while drafting the Agreement with Health Care Worker as an Independent Contractor:

- Inadequate Details: Failing to fully define the services and roles can lead to misunderstandings.

- Missing Signatures: Not obtaining signatures from both parties renders the agreement unenforceable.

- Overlooking Regulatory Compliance: Ensure that all health regulations applicable to the services are addressed.

- Ignoring Insurance Requirements: Not specifying required insurance can lead to liability issues for both parties.

What documents you may need alongside this one

When preparing the Agreement with Health Care Worker as an Independent Contractor, you may need the following documents:

- Licenses and Certifications: Proof of any required professional qualifications held by the Contractor.

- Insurance Certificates: Documentation demonstrating required liability insurance coverage.

- Provider Policies: Copies of the Provider’s operational guidelines and procedures relevant to the Contractor’s duties.

How to fill out Agreement With Health Care Worker As An Independent Contractor?

Aren't you sick and tired of choosing from countless samples every time you want to create a Agreement with Health Care Worker as an Independent Contractor? US Legal Forms eliminates the lost time countless Americans spend surfing around the internet for appropriate tax and legal forms. Our expert crew of lawyers is constantly modernizing the state-specific Forms catalogue, so it always provides the appropriate files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription need to complete easy steps before having the capability to download their Agreement with Health Care Worker as an Independent Contractor:

- Make use of the Preview function and look at the form description (if available) to make certain that it’s the correct document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample to your state and situation.

- Use the Search field on top of the webpage if you have to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your template in a needed format to finish, create a hard copy, and sign the document.

After you have followed the step-by-step instructions above, you'll always have the ability to sign in and download whatever document you will need for whatever state you need it in. With US Legal Forms, finishing Agreement with Health Care Worker as an Independent Contractor samples or any other official files is easy. Get going now, and don't forget to recheck your examples with accredited attorneys!

Form popularity

FAQ

An independent contractor agreement is a document that an employer uses to hire a freelancer for a specific job. By extension, it distinguishes the independent contractor from an employee of the business for legal and tax purposes.

An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including: A description of the services provided. Terms and length of the project or service. Payment details (including deposits, retainers, and other billing details)

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Do employers need to complete employment verification checks for independent contractors? No.However, it is important to note that businesses and individuals may not hire independent contractors if they are aware that the independent contractor is not authorized to work in the United States.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

The term independent caregiver is commonly used to describe a home care professional who does not work for an agency. According to the IRS, if a privately hired / independent caregiver is paid more than $2,100 per year (in 2019), they are considered a household employee, not an independent contractor.