Triple Net Commercial Lease Agreement - Real Estate Rental

Description

Definition and meaning

A Triple Net Commercial Lease Agreement is a rental agreement in which the tenant agrees to pay all operating expenses associated with the property in addition to the rent. This typically includes property taxes, insurance, and maintenance costs. The term 'triple net' refers to the three categories of expenses incurred by the tenant.

Key components of the form

The Triple Net Commercial Lease Agreement includes several essential components:

- Property Description: Details about the leased premises.

- Term: Length of the lease agreement and any renewal terms.

- Rent: The amount of monthly rent and payment terms.

- Expenses: Specifics on taxes, insurance, and maintenance responsibilities.

- Default Conditions: Terms governing tenant’s default on lease obligations.

- Governing Law: Legal jurisdiction under which the lease will be interpreted.

Who should use this form

This form is ideal for landlords and commercial property owners who wish to protect themselves financially while providing tenants with a clear understanding of their financial obligations. This agreement is commonly used in retail, office, and industrial leases where the tenant can manage property expenses effectively.

Common mistakes to avoid when using this form

When completing a Triple Net Commercial Lease Agreement, it is crucial to avoid several common mistakes:

- Failing to clearly define the property being leased, leading to disputes about boundaries.

- Neglecting to specify which expenses the tenant is responsible for can result in financial misunderstandings.

- Not including a detailed description of default conditions may hinder the landlord's ability to enforce lease terms.

- Overlooking the need for both parties to review and agree upon all lease terms before signing.

What to expect during notarization or witnessing

During the notarization of the Triple Net Commercial Lease Agreement, parties must present valid identification to the notary. The notary will confirm identities and witness each party’s signature on the document. It is important for all signers to be present, as notarization validates the signatures and builds legal credibility for the lease.

How to fill out Triple Net Commercial Lease Agreement - Real Estate Rental?

Aren't you tired of choosing from hundreds of templates each time you need to create a Triple Net Commercial Lease Agreement - Real Estate Rental? US Legal Forms eliminates the wasted time numerous American citizens spend searching the internet for suitable tax and legal forms. Our professional team of attorneys is constantly updating the state-specific Samples catalogue, so that it always provides the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription should complete simple actions before being able to get access to their Triple Net Commercial Lease Agreement - Real Estate Rental:

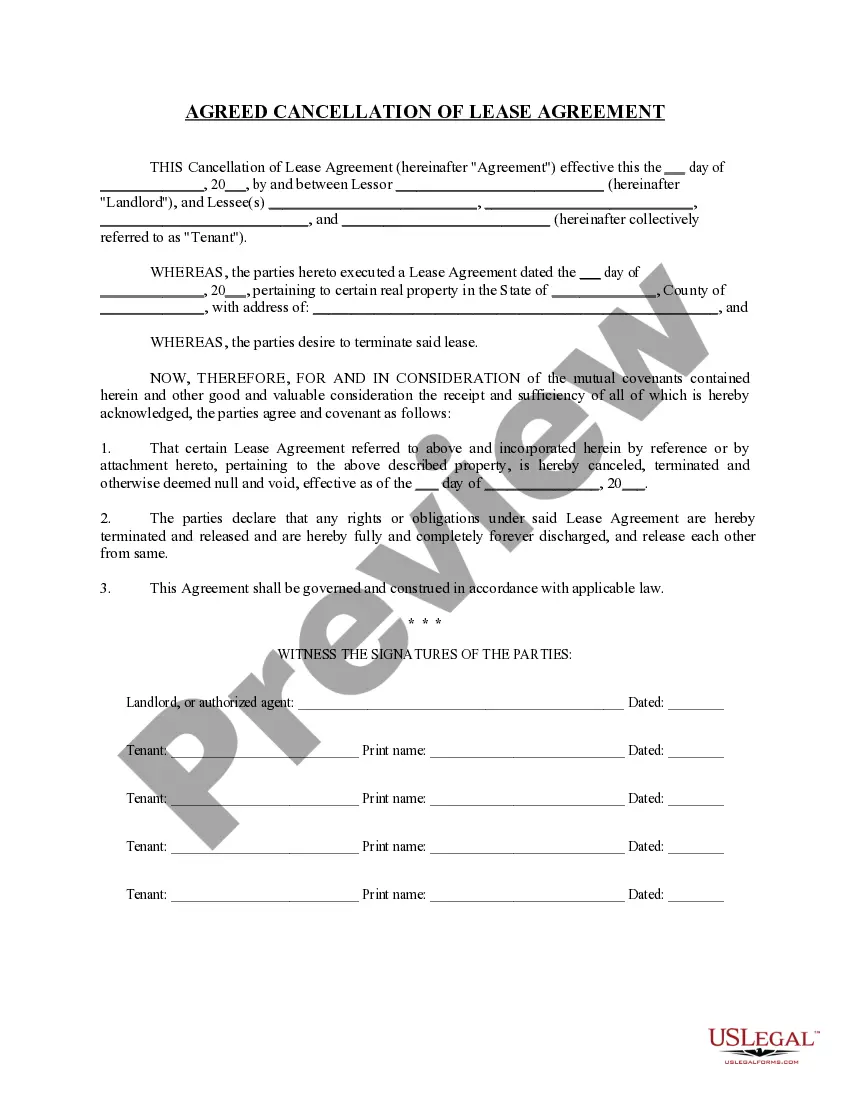

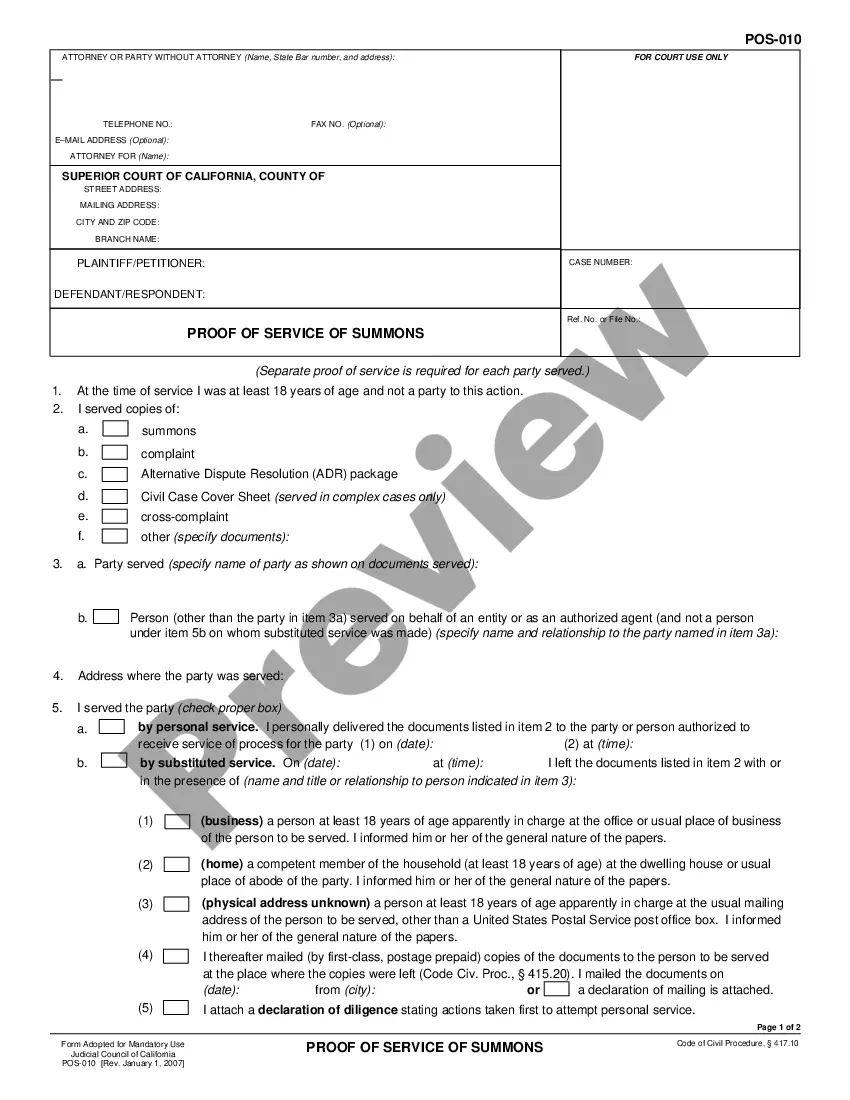

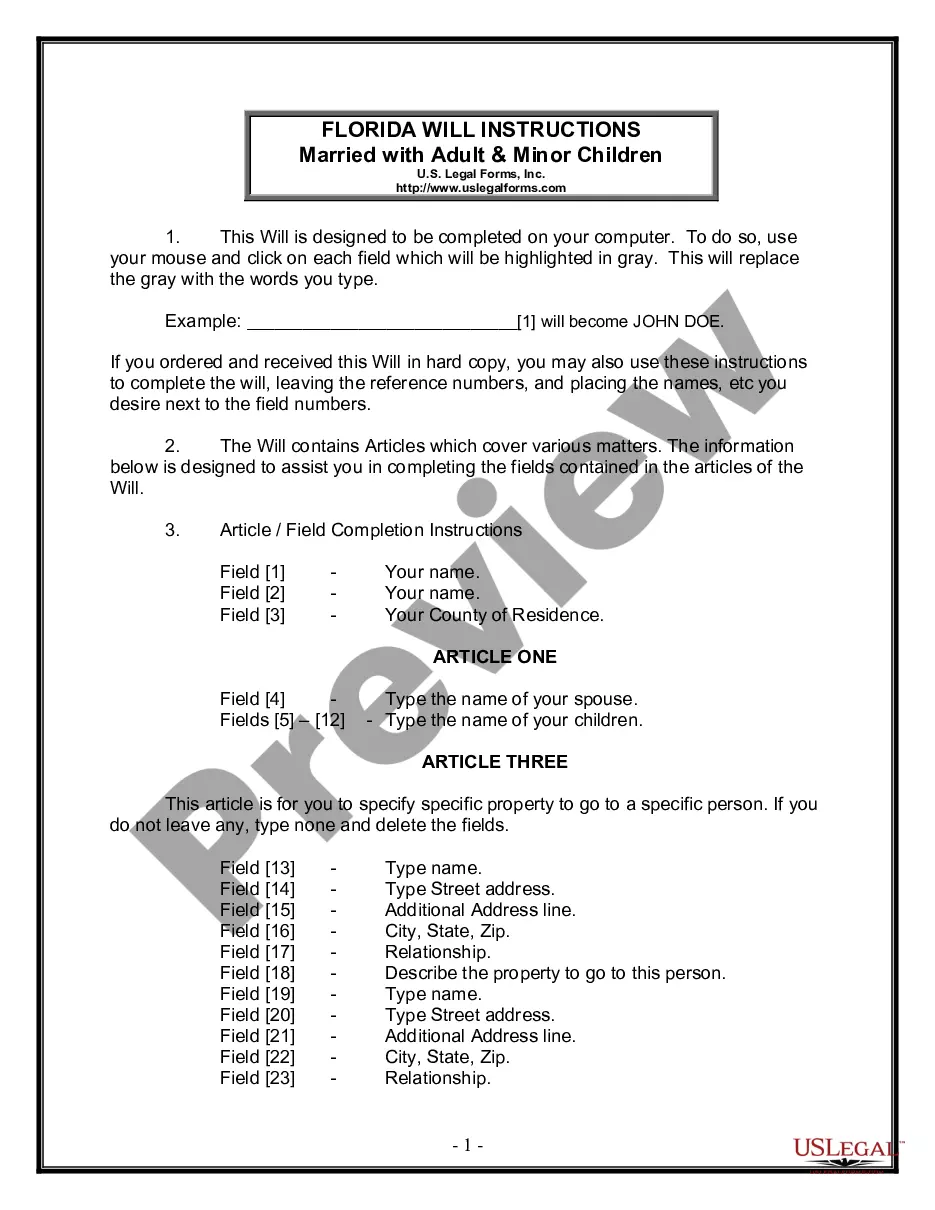

- Utilize the Preview function and look at the form description (if available) to make certain that it is the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct example for your state and situation.

- Use the Search field at the top of the site if you need to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your sample in a required format to finish, print, and sign the document.

When you have followed the step-by-step recommendations above, you'll always be capable of log in and download whatever document you need for whatever state you want it in. With US Legal Forms, finishing Triple Net Commercial Lease Agreement - Real Estate Rental samples or other legal paperwork is not hard. Begin now, and don't forget to double-check your samples with certified attorneys!

Form popularity

FAQ

Name the parties. A simple rental agreement form needs to name the parties signing the lease and where they live. Describe the premises. Define the term of the lease. Set how much rent is owed. Assign a security deposit amount. Finalize the lease.

A triple net lease is one of three types of net leases, a type of real estate lease where a tenant pays one or more additional expenses. Net leases generally include property taxes, property insurance premiums, or maintenance costs, and are often used in commercial real estate.

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.

As long as the contract spells out specific details and both parties have signed that they agree to the contract's terms, a handwritten contract is legally binding and enforceable in court.

With a triple net lease, the tenant agrees to pay the property expenses such as real estate taxes, building insurance, and maintenance in addition to rent and utilities.A single net lease on a commercial property includes property taxes in addition to rent.

Under California law, a lease does have to be in writing to be enforceable, but only when the lease is for a period of more than a year.There is, however, an additional legal doctrine called partial performance which does make oral contracts enforceable even if they are covered by the Statute of Frauds.

A net lease is a real estate lease in which a tenant pays one or more additional expenses.Double net leases include property taxes and insurance premiums, in addition to the base rent. A triple net lease includes property taxes, insurance, and maintenance costs, in addition to the base rent.

Triple net leases are calculated by adding the yearly taxes on the property and the insurance for the space together and dividing that amount by the building total rental square footage. The process of calculating a triple net lease is simplified when an entire building is leased to one tenant.

Net lease expenses payable by the tenant are typically divided into three categories: property taxes, insurance, and common area maintenance.