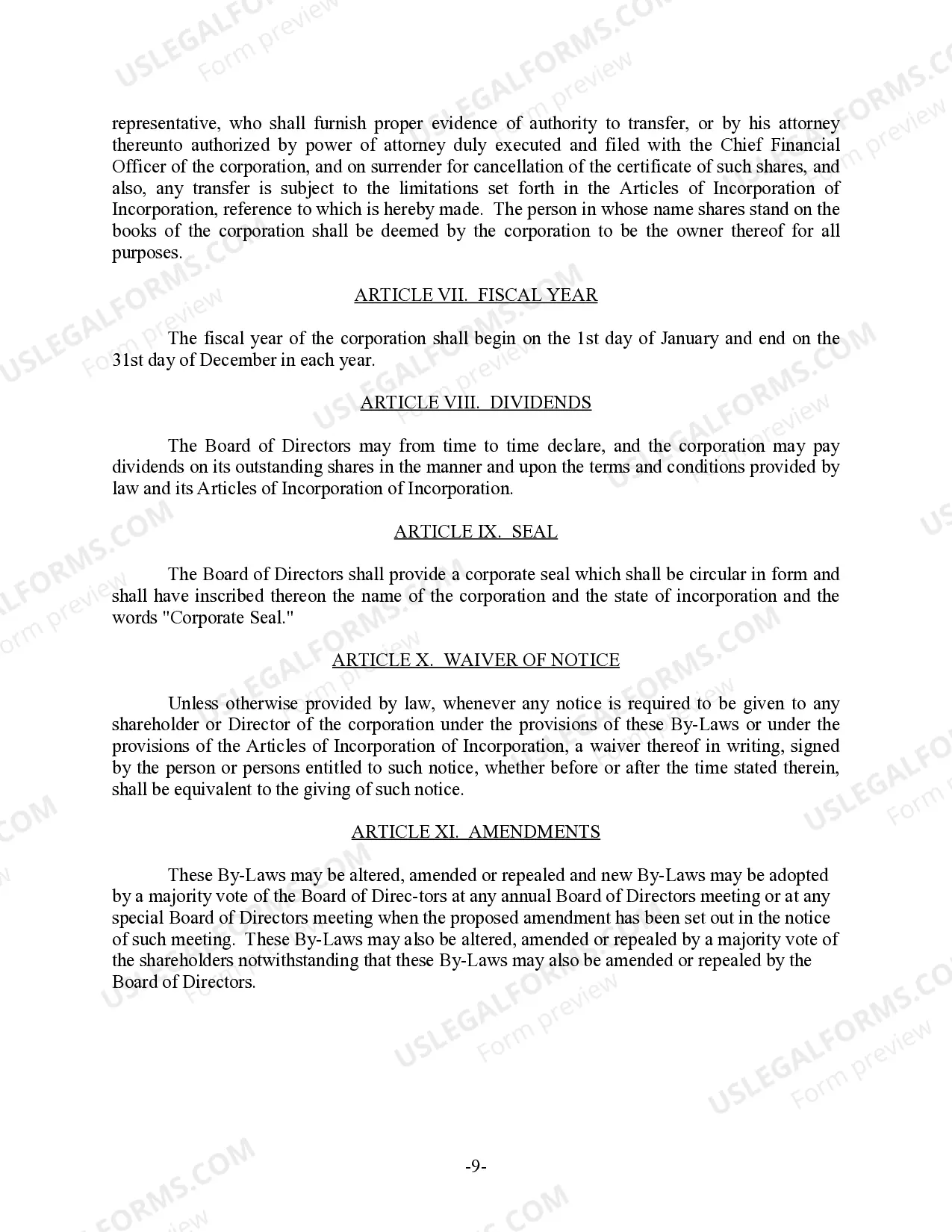

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Tennessee Bylaws for Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

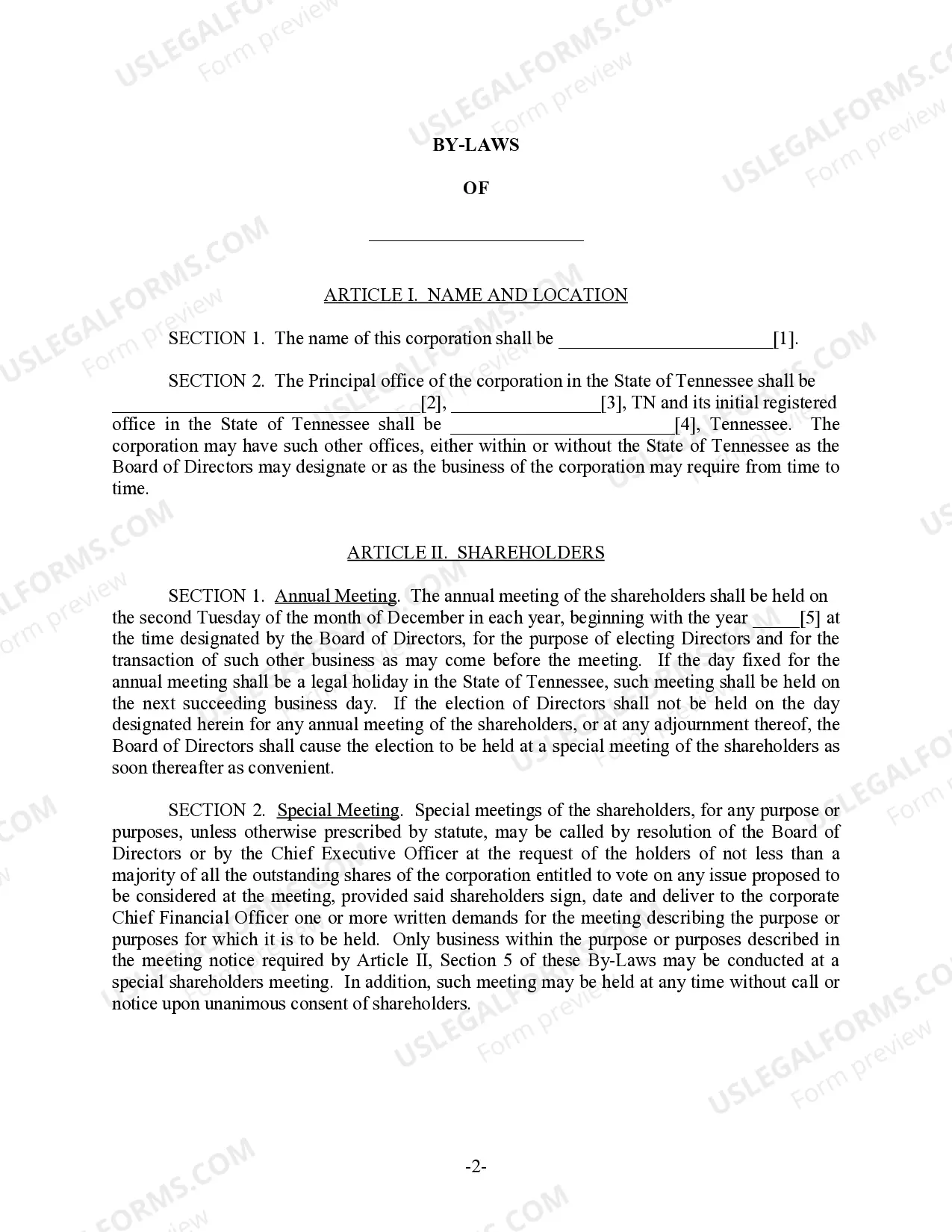

Tennessee Bylaws for Corporation: These are the rules and guidelines established by a corporation in Tennessee that dictate its governance and operations. Bylaws are mandatory for every corporation and cover aspects such as the structure of the company, the duties of executives, and the procedures for holding meetings and handling corporate affairs.

Step-by-Step Guide

- Determine the Needs of Your Corporation: Identify what specific bylaws are necessary for the nature and scale of your business.

- Consult Legal Counsel: Engage a lawyer with experience in Tennessee corporate law to help draft or review your bylaws.

- Incorporate Best Practices: Include provisions that reflect the best practices in corporate governance and compliance.

- Approval by the Board: The drafted bylaws should be presented for approval during a board meeting.

- Implementation: Once approved, the bylaws must be implemented and adhered to by everyone in the corporation.

- Regular Updates: Review and update the bylaws as necessary to adapt to new laws or changes in corporate structure.

Risk Analysis

- Legal Risks: Non-compliance with Tennessee state laws could lead to legal disputes or sanctions against the corporation.

- Operational Risks: Inadequate bylaws may lead to inefficient governance and decision-making processes.

- Reputational Risks: Poorly structured bylaws can damage the public's perception of the corporation's reliability and professionalism.

Key Takeaways

Understanding and adhering to the Tennessee bylaws for corporation is essential for legal compliance and effective management. Regular consultation with legal professionals and updates to the bylaws can mitigate potential risks associated with corporate governance.

Common Mistakes & How to Avoid Them

- Lack of Clarity: Avoid vague language that can lead to misinterpretations. Use clear and concise language in drafting the bylaws.

- Non-Compliance with State Laws: Regularly review the Tennessee corporate laws to ensure that your bylaws comply with current regulations.

- Ignoring Regular Updates: Keep the bylaws up-to-date with changes in corporate structure and laws to avoid legal issues.

FAQ

Q: Are bylaws required for all Tennessee corporations?

A: Yes, all corporations in Tennessee are legally required to have bylaws.

Q: Who approves the bylaws of a corporation?

A: The corporation's board of directors is responsible for approving the bylaws.

Q: Can bylaws be changed?

A: Yes, bylaws can be amended through a formal process outlined within the bylaws themselves, often involving a vote by the board of directors or the shareholders.

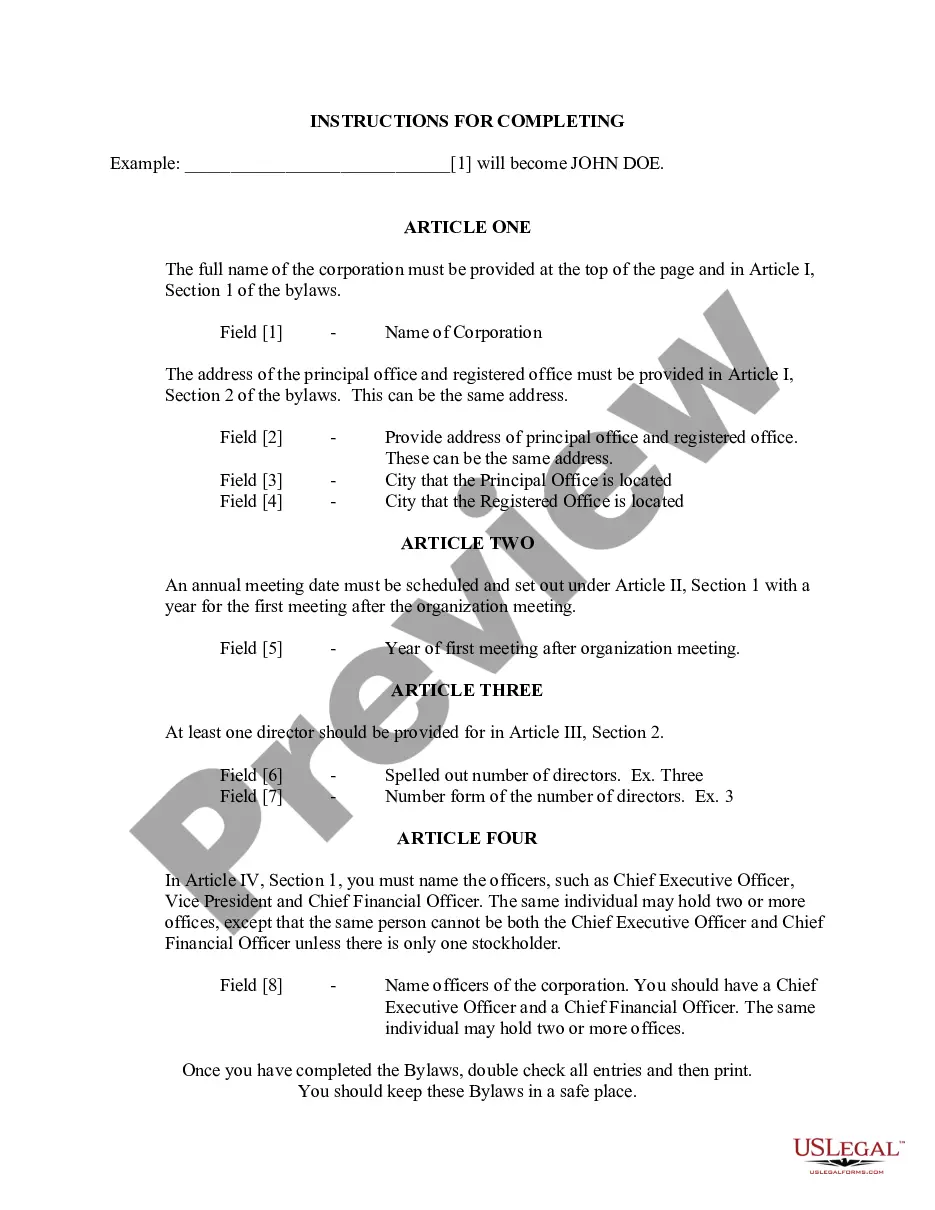

How to fill out Tennessee Bylaws For Corporation?

Get access to top quality Tennessee Bylaws for Corporation samples online with US Legal Forms. Steer clear of days of lost time seeking the internet and lost money on documents that aren’t updated. US Legal Forms offers you a solution to exactly that. Find above 85,000 state-specific authorized and tax samples you can download and submit in clicks within the Forms library.

To receive the sample, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Verify that the Tennessee Bylaws for Corporation you’re considering is appropriate for your state.

- Look at the sample utilizing the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Choose a preferred file format to download the document (.pdf or .docx).

You can now open the Tennessee Bylaws for Corporation template and fill it out online or print it and do it yourself. Think about giving the papers to your legal counsel to make sure everything is filled out correctly. If you make a mistake, print and fill sample again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and get much more forms.

Form popularity

FAQ

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation.Aside from number of directors, all the matters typically covered in the bylaws are otherwise covered by California statute, which would apply in the absence of any contrary lawful bylaw provision.

Choose a Corporate Structure. Incorporating means starting a corporation. Check Name Availability. Appoint a Registered Agent. File Tennessee Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.

Basic Corporate Information. The bylaws should include your corporation's formal name and the address of its main place of business. Board of Directors. Officers. Shareholders. Committees. Meetings. Conflicts of Interest. Amendment.

Tennessee charges a low $20 for corporations, and hits LLCs with a $300 filing fee for businesses with 1-6 members, and then tacks on an extra $50 per member. So if you have an 8 member LLC, you'll pay $400 per year to file your annual report, whereas a giant corporation pays $20.

Although the California General Corporation Law requires that the original or a copy of the bylaws be available to shareholders (Section 213), it does not require that corporate bylaws be signed.

The bylaws are the corporation's operating manual; they describe how the corporation is organized and runs its affairs. You do not file the bylaws with the state, but you need to explain the roles of the corporation's participants, and technology can play a role in carrying out the bylaws.

The bylaws of a corporation are the governing rules by which the corporation operates. Bylaws are created by the board of directors when the corporation is formed.

Bylaws are not public documents, but making them readily available increases your accountability and transparency and encourages your board to pay closer attention to them. Your board should review them regularly and amend them accordingly as your organization evolves.