Tennessee Buyer's Home Inspection Checklist

Overview of this form

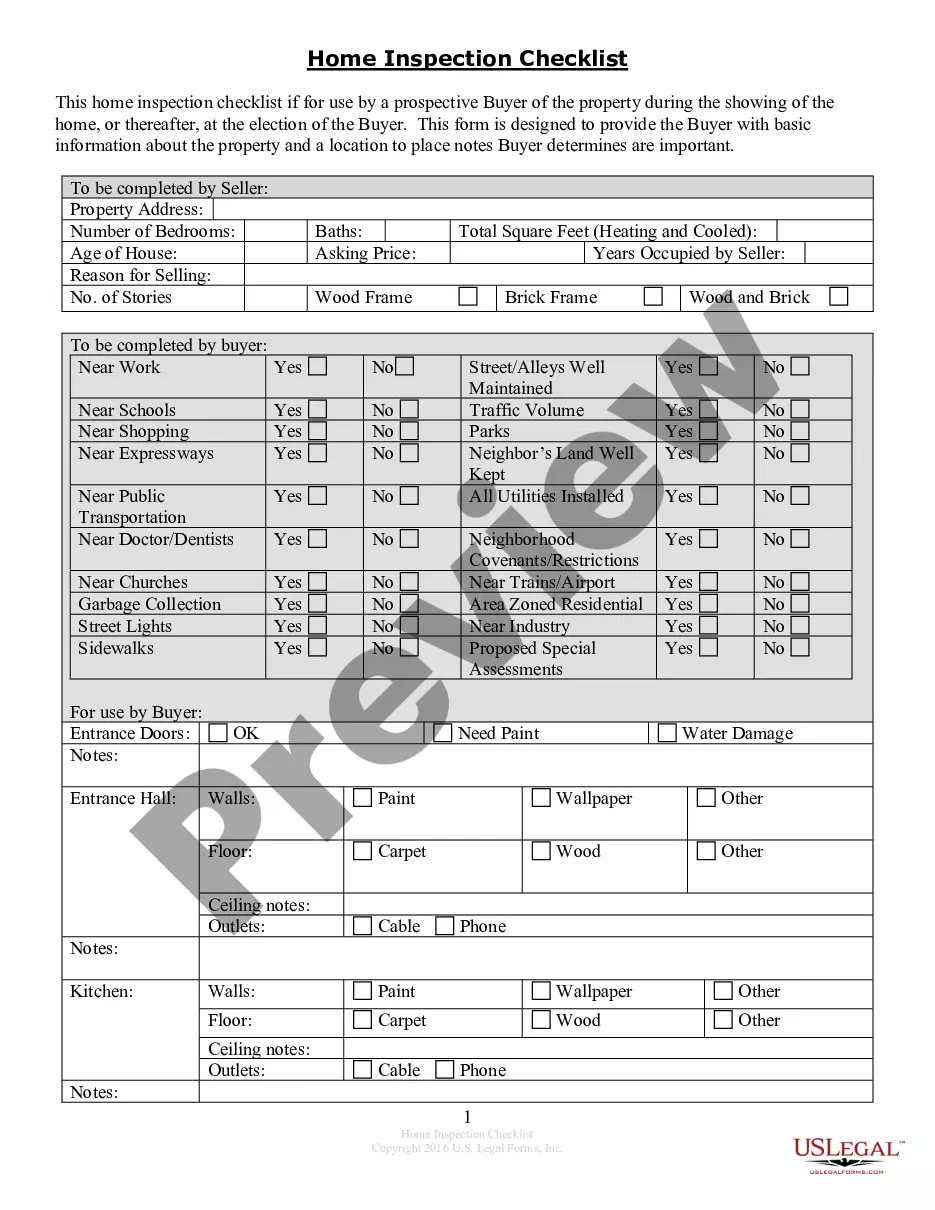

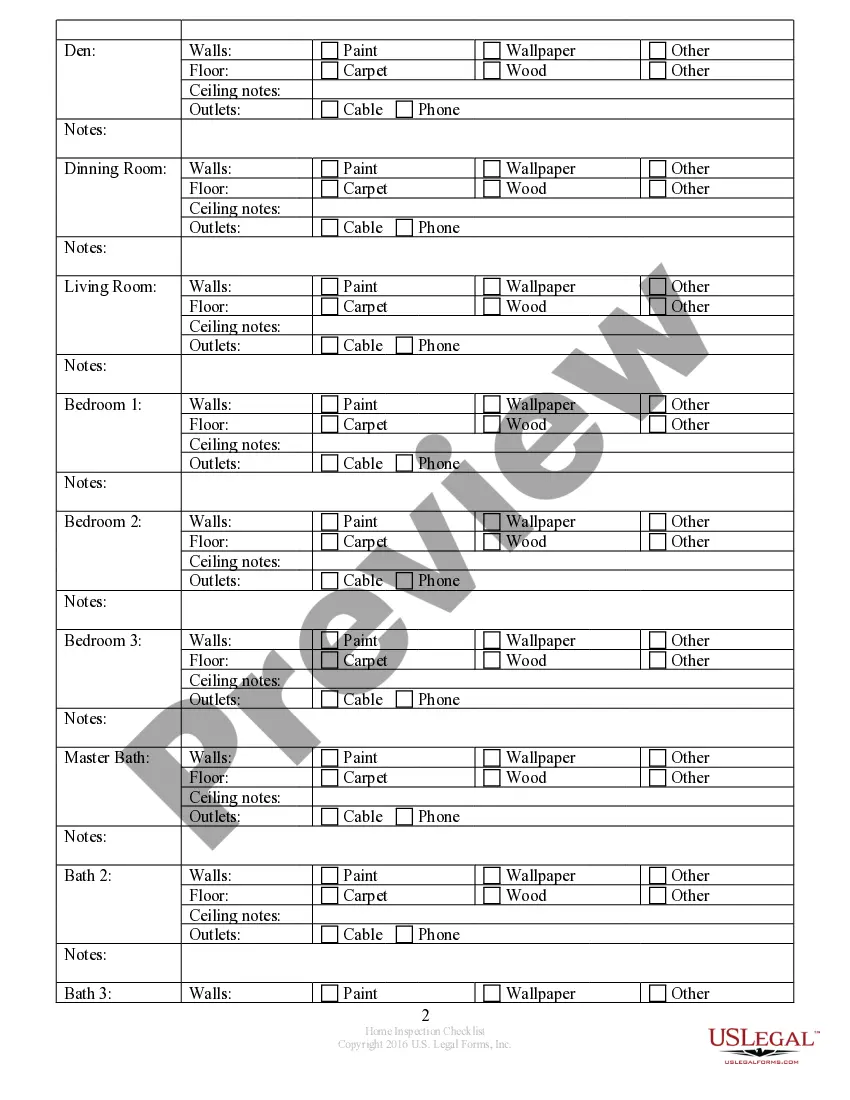

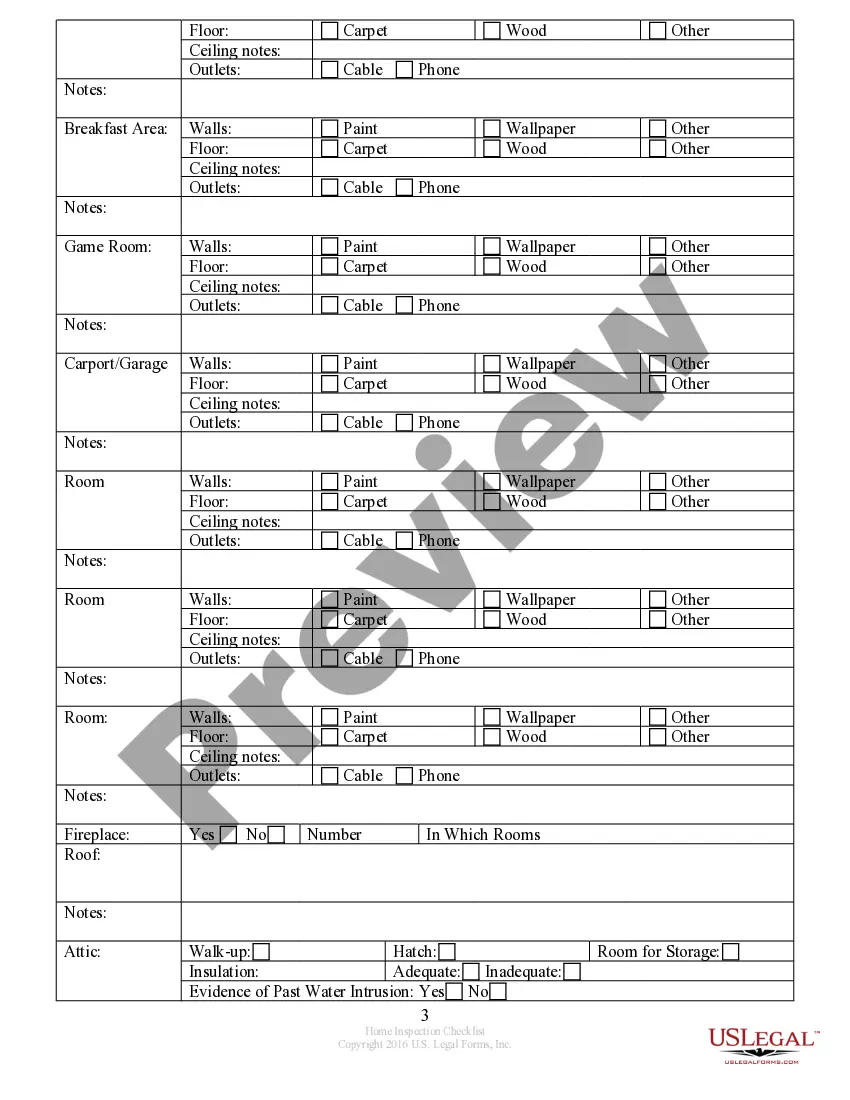

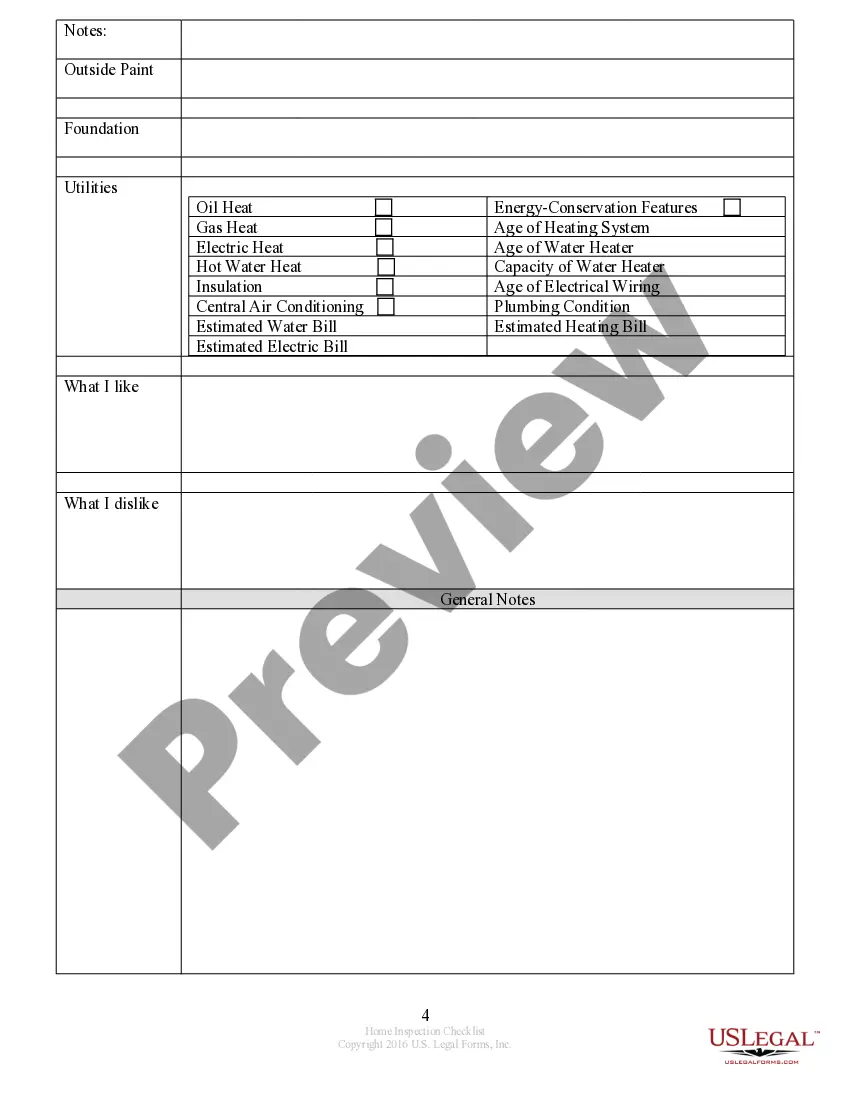

The Buyer's Home Inspection Checklist is a vital tool for individuals looking to purchase a home in Tennessee. This comprehensive checklist aids prospective buyers in assessing the condition of a property during their initial viewing. Unlike other forms that may focus solely on financial matters or contractual agreements, this checklist emphasizes the physical inspection of the home and surrounding environment, providing buyers with essential notes to consider before making an offer.

What’s included in this form

- Assessment of street and neighborhood conditions

- Evaluation of nearby amenities, such as schools and shopping

- Notes on traffic volume and noise levels

- Consideration of property upkeep by neighbors

- Utility and zoning information

When to use this form

This form should be used during the initial viewing of a home or afterward when the buyer needs to remember specific details about the property. It is particularly useful in situations where a buyer wants to ensure they ask the right questions and thoroughly evaluate the home's condition before making a purchase offer.

Who this form is for

- Prospective home buyers in Tennessee

- Real estate professionals assisting buyers

- Individuals unfamiliar with home buying who need a structured guideline

Steps to complete this form

- Start by entering the address of the property being assessed.

- Review each section of the checklist, marking "Yes" or "No" for each item based on your observations.

- Take note of important observations or questions next to the relevant checklist items.

- Consult with the seller or real estate agent for clarifications on any concerning areas.

- Keep the checklist for reference when making an offer or during negotiations.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Overlooking important details on the checklist due to lack of focus during the viewing.

- Failing to ask the seller clarifying questions about the property.

- Not using the checklist until after making an offer, missing key insights.

Why complete this form online

- Easy accessibility for downloads anytime, allowing for last-minute preparations.

- Editable format to personalize the checklist based on individual needs.

- Reliable and legally vetted templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Top reasons home inspections fail Electrical problems: The most common electrical issues include wiring that's not up to code, frayed wiring, or improperly wired electrical panels. Plumbing issues: Leaky pipes (and resulting water damage), failing water heaters, and sewer system problems are some of the most expensive.

Potential red flags that can arise during a property home inspection include evidence of water damage, structural defects, problems with the plumbing or electrical systems, as well as mold and pest infestations. The presence of one or more of these issues could be a dealbreaker for some buyers.

It's a good idea for the buyer to attend the home inspection because it'll be the perfect chance to ask the inspector how the home's various systems work and hear about maintenance. I always encourage the buyer at the beginning of the inspection to share anything that they have questions about, Pretty says.

Problem #1: Rundown roofing. Problem #2: Drainage issues. Problem #3: Faulty foundation. Problem #4: Plumbing problems. Problem #5: Pest infestations. Problem #6: Hidden mold. Problem #7: Failing heating systems. Problem#8: Electrical wiring.

Chimney Inspections. Electrical Inspections. Lead-Based Paint. Heating and Air Conditioning. Wood Damage. Foundation Inspections. Pool and Spa Inspections. Roof Inspections.

A home inspector will look at things like a home's foundation, structural components, roof, HVAC, plumbing, and electrical systems, then provide a written home inspection report with results.Buyers should attend the inspection so they can explore their new home in detail and ask questions during the process.

A buyer and seller's real estate agents will be able to fill them in on the laws in their particular state, but in general a seller is responsible for paying to fix severe water damage or mold issues, to replace missing or broken smoke detectors, and to remedy building code violations, among other things.

Ask the seller to make the repairs themselves. Ask for credits toward your closing costs. Ask the seller to reduce the sales price to make up for the repairs. Back out of the transaction (if you have an inspection contingency in place) Move forward with the deal.