Sample Bylaws for a New Mexico Professional Corporation

About this form

The Sample Bylaws for a New Mexico Professional Corporation is a legal document outlining the operating rules for a professional corporation in New Mexico. These bylaws establish the framework for governance, including the roles and responsibilities of directors and officers, meeting protocols, and shareholder rights. This form is essential for ensuring compliance with New Mexico laws that mandate licensed professionals run these corporations, differentiating it from general corporate bylaws suited for other types of businesses.

Key parts of this document

- Provisions for the naming of the corporation and its offices.

- Protocols for shareholder and board meetings, including notice requirements and quorum stipulations.

- Rules governing the election and roles of corporate officers, specifically requiring professional licensing in New Mexico.

- Guidelines for amending the bylaws and handling special corporate actions.

- Requirements for record-keeping and shareholder lists.

When to use this form

This form should be used when establishing a new professional corporation in New Mexico. It is necessary for outlining how the corporation will be governed, which is vital for avoiding disputes among directors and officers. This form is particularly relevant for licensed professionals, such as doctors, lawyers, or accountants, who are forming a corporation to offer their services legally and effectively.

Who needs this form

This form is intended for:

- Newly established professional corporations in New Mexico.

- Licensed professionals starting a business requiring formal organization under state law.

- Corporate attorneys and business consultants drafting bylaws for clients.

How to complete this form

- Enter the name of the corporation and its principal and registered office addresses.

- Specify the date for the annual meeting of shareholders and the year of the first meeting.

- Name at least one director and outline their responsibilities, ensuring they are licensed to practice in New Mexico.

- List the corporate officers, including at least a President and a Secretary, who must also be licensed professionals.

- Detail the procedures for calling special meetings and providing notice to shareholders.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

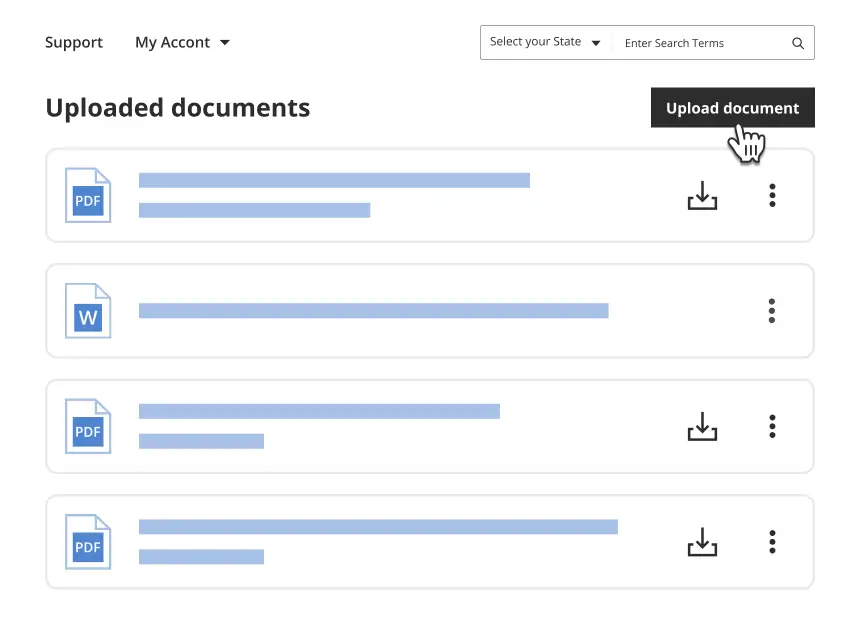

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to ensure all directors and officers are appropriately licensed.

- Neglecting specific provisions related to meeting notices and shareholder voting procedures.

- Not including the correct guidelines for amending the bylaws.

- Omitting key information such as meeting dates or quorum requirements.

Why complete this form online

- Convenient access to up-to-date legal templates drafted by licensed attorneys.

- Editability allows for customization to fit specific business needs.

- Secure downloads provide reliable storage of important legal documents.

- Instant access ensures timely completion of corporate governance requirements without delays.

Legal use & context

- Bylaws for professional corporations ensure legal compliance with state laws in New Mexico.

- Establishing clear governance rules minimizes the risk of future disputes.

- These bylaws are legally enforceable as a governing document of the corporation.

Quick recap

- This form is essential for establishing a professional corporation in New Mexico.

- The bylaws must reflect specific state regulations, particularly around licensing.

- Properly completed bylaws protect corporate governance and clarify director and officer roles.

Looking for another form?

Form popularity

FAQ

An S Corporation is required by state law to adopt bylaws that govern the corporation's internal management and the rights of the shareholders.

The California professional corporation bylaws were created to provide services in professions that require a state license in order to practice.The bylaws may be for either a C corporation or an S corporation.

Corporate bylaws commonly include information that specifies, for example, the number of directors the corporation has, how they will be elected, their qualification, and the length of their terms. It can also specify when, where, and how your board of directors can call and conduct meetings, and voting requirements.

Basic Corporate Information. The bylaws should include your corporation's formal name and the address of its main place of business. Board of Directors. Officers. Shareholders. Committees. Meetings. Conflicts of Interest. Amendment.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.