New Mexico Subcontractor's Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Mexico Subcontractor's Agreement?

US Legal Forms is really a unique platform to find any legal or tax template for submitting, such as New Mexico Subcontractor's Agreement. If you’re fed up with wasting time seeking appropriate examples and paying money on record preparation/lawyer fees, then US Legal Forms is exactly what you’re looking for.

To enjoy all the service’s benefits, you don't need to download any application but just choose a subscription plan and register your account. If you have one, just log in and get an appropriate sample, save it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need New Mexico Subcontractor's Agreement, take a look at the instructions below:

- Double-check that the form you’re taking a look at is valid in the state you want it in.

- Preview the form its description.

- Click on Buy Now button to get to the sign up page.

- Pick a pricing plan and carry on registering by entering some info.

- Choose a payment method to finish the sign up.

- Download the document by selecting your preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel uncertain regarding your New Mexico Subcontractor's Agreement form, speak to a lawyer to check it before you decide to send out or file it. Get started hassle-free!

Form popularity

FAQ

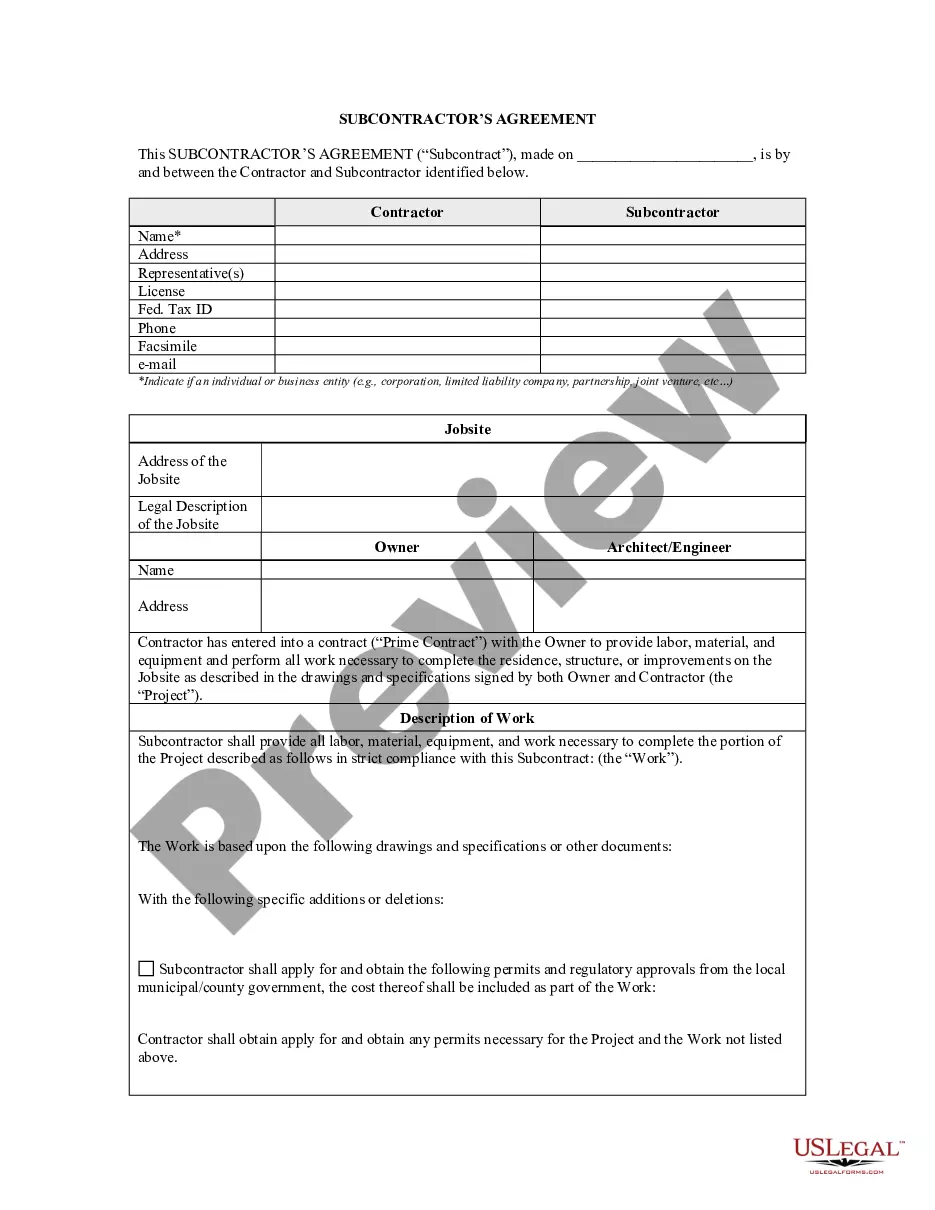

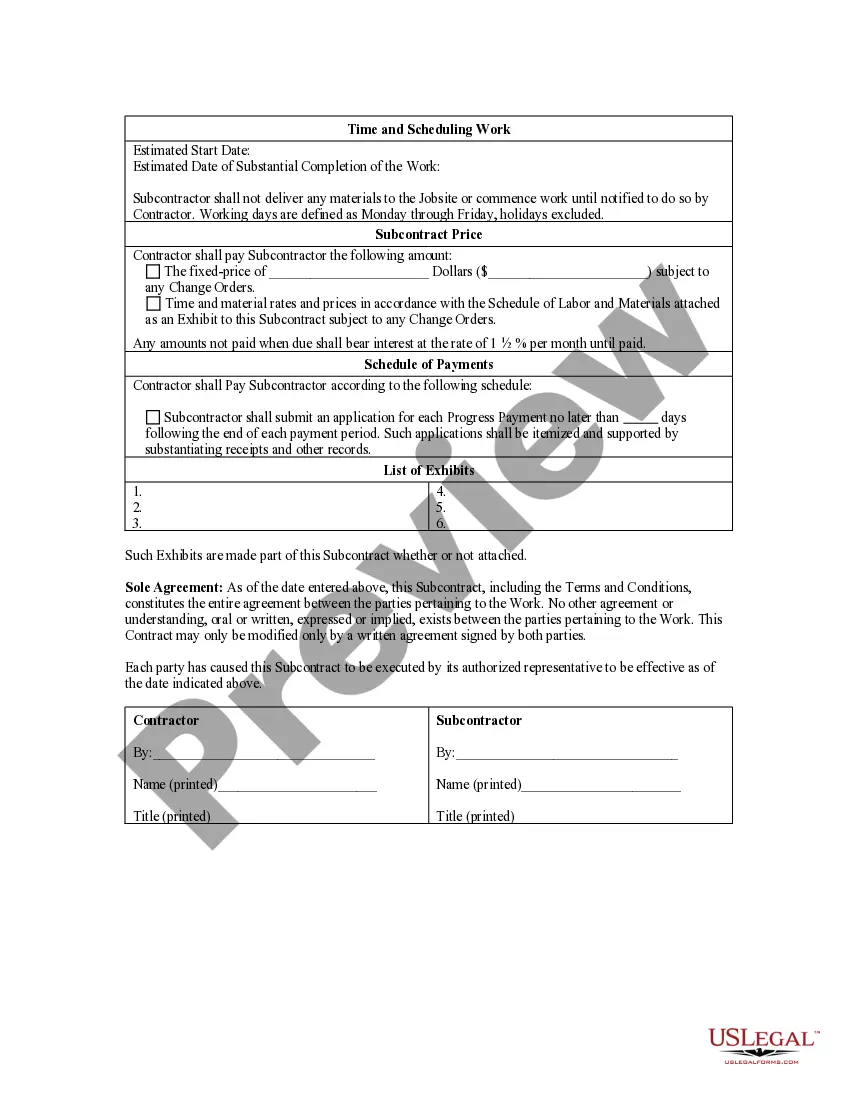

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.

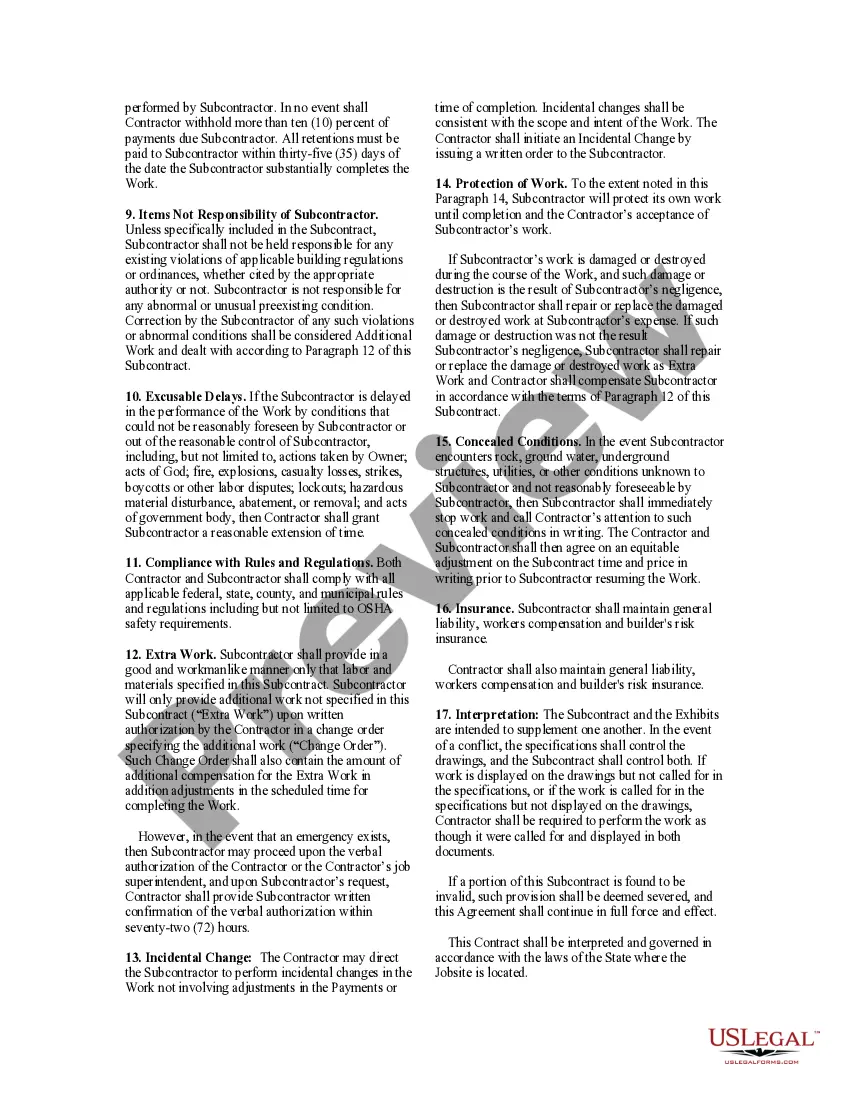

Depending on state law and the type of contract, a subcontractor can place a mechanic's lien on the property and get payment from the owner. If you are unable to get satisfaction, you can foreclose on the property and obtain payment from the sale.

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

In short, someone who sets their wage, hours, and chooses the jobs they take on is a subcontractor, while someone whose employer specifies their wage, hours, and work tasks is an employee.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

To avoid this additional tax, contractors must therefore ensure that all of their subcontractors are indeed subcontractors for tax purposes and not potentially an employee. Employees also have more rights such as minimum wage, pensions, holiday pay, sick pay.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

N. a person or business which has a contract (as an "independent contractor" and not an employee) with a contractor to provide some portion of the work or services on a project which the contractor has agreed to perform.