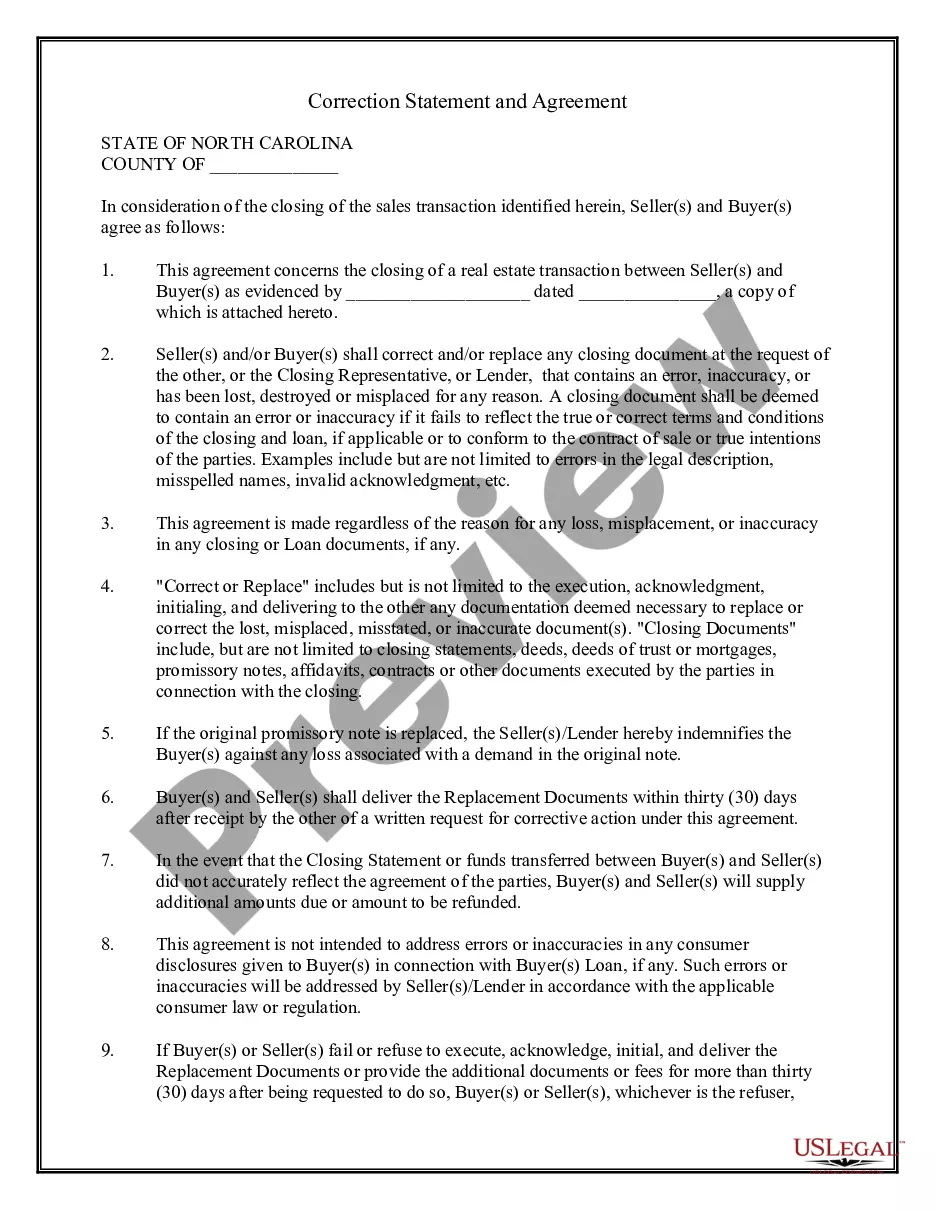

North Carolina Correction Statement and Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Correction Statement And Agreement?

Steer clear of costly attorneys and discover the North Carolina Correction Statement and Agreement you seek at a reasonable cost on the US Legal Forms website.

Utilize our straightforward groups feature to locate and retrieve legal and tax documents. Review their descriptions and preview them prior to downloading.

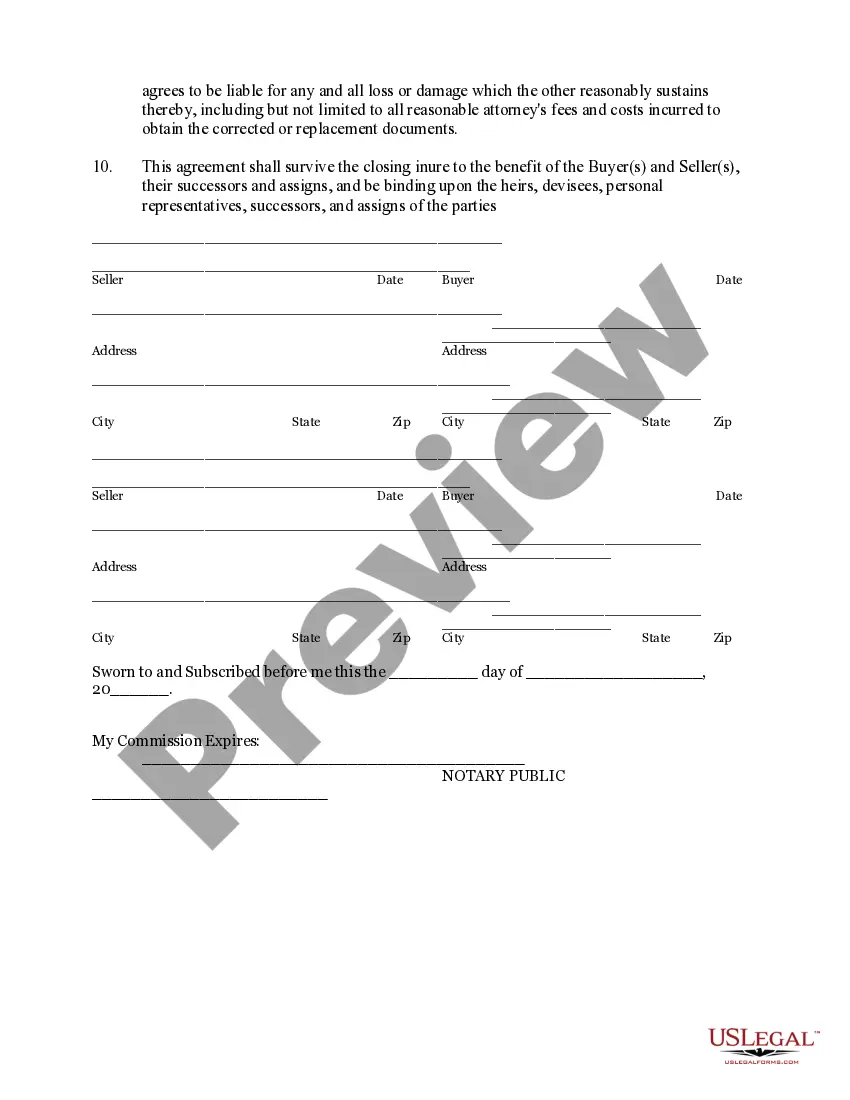

Opt to receive the form in PDF or DOCX format. Click on Download and locate your template in the My documents section. You are welcome to save the template to your device or print it. After downloading, you can fill out the North Carolina Correction Statement and Agreement manually or using editing software. Print it out and reuse the form multiple times. Achieve more for less with US Legal Forms!

- Furthermore, US Legal Forms provides users with step-by-step guidance on how to acquire and complete each template.

- US Legal Forms members simply need to Log In and access the exact form required in their My documents section.

- Individuals without a subscription must adhere to the instructions outlined below.

- Ensure the North Carolina Correction Statement and Agreement is permissible for use in your location.

- If possible, examine the description and utilize the Preview feature prior to downloading the templates.

- If you are confident the template satisfies your requirements, click on Buy Now.

- Should the template be incorrect, employ the search function to find the appropriate one.

- Then, establish your account and select a subscription plan.

- Make payment via credit card or PayPal.

Form popularity

FAQ

North Carolina LLCs have to file the completed Limited Liability Company Amendment of Articles of Organization with the Corporations Division of the Secretary of State. You can submit by mail, online, or in person.

Sign the title with the seller and make sure to have it notarized. Get a lien release from the seller. Make sure that the seller provides you with an Eligible Risk Statement for Registration and Certificate of Title, a Damage Disclosure Statement and an Odometer Disclosure Statement. Complete the Title Application.

You can file your North Carolina LLC Articles of Organization by mail or online. The filing fee is $125 for both methods. If you form your LLC by mail, it will be approved in 10-15 days (this accounts for mail time). If you form your LLC online, it will be approved in 7-10 business days.

Form NC-5 is used to file and pay withholding tax on a monthly or quarterly basis, based on your filing frequency. Form NC-5 is filed throughout the year, before you file Form NC-3.Compare the tax you paid during the year to the amount shown on your employees and contractors W-2s and 1099s.

You not need both parties to be physically present at the time of notarization, but you can only notarize for the person who is appearing before you. The other person can have their signature notarized at another time.

North Carolina titles must be notarized. Sign your name (or names) on the back of the title where it says Seller(s) Signature(s). Print your name (or names) on the back of the title where it says Seller(s) Hand Printed Name(s).

You can only transfer an LLC's ownership interests if all the other LLC owners agree, and even then, only if the state law allows for it. The first step in selling an LLC is finding the right buyer, someone who will purchase the business at the best price.

In simple situations where you own the vehicle outright and wish to transfer ownership to someone else, all you must do is complete a title certificate. Once you have filled out and signed the certificate, the buyer or recipient can take the title to a local DMV office and officially transfer ownership.

On the front of the title, near the middle, the seller must write in the current odometer reading on the vehicle. Near the bottom, the seller must fill in the following information on the appropriate lines: Date the vehicle was sold, and their printed name and signed name (which should be written on the same line).