North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company

Definition and meaning

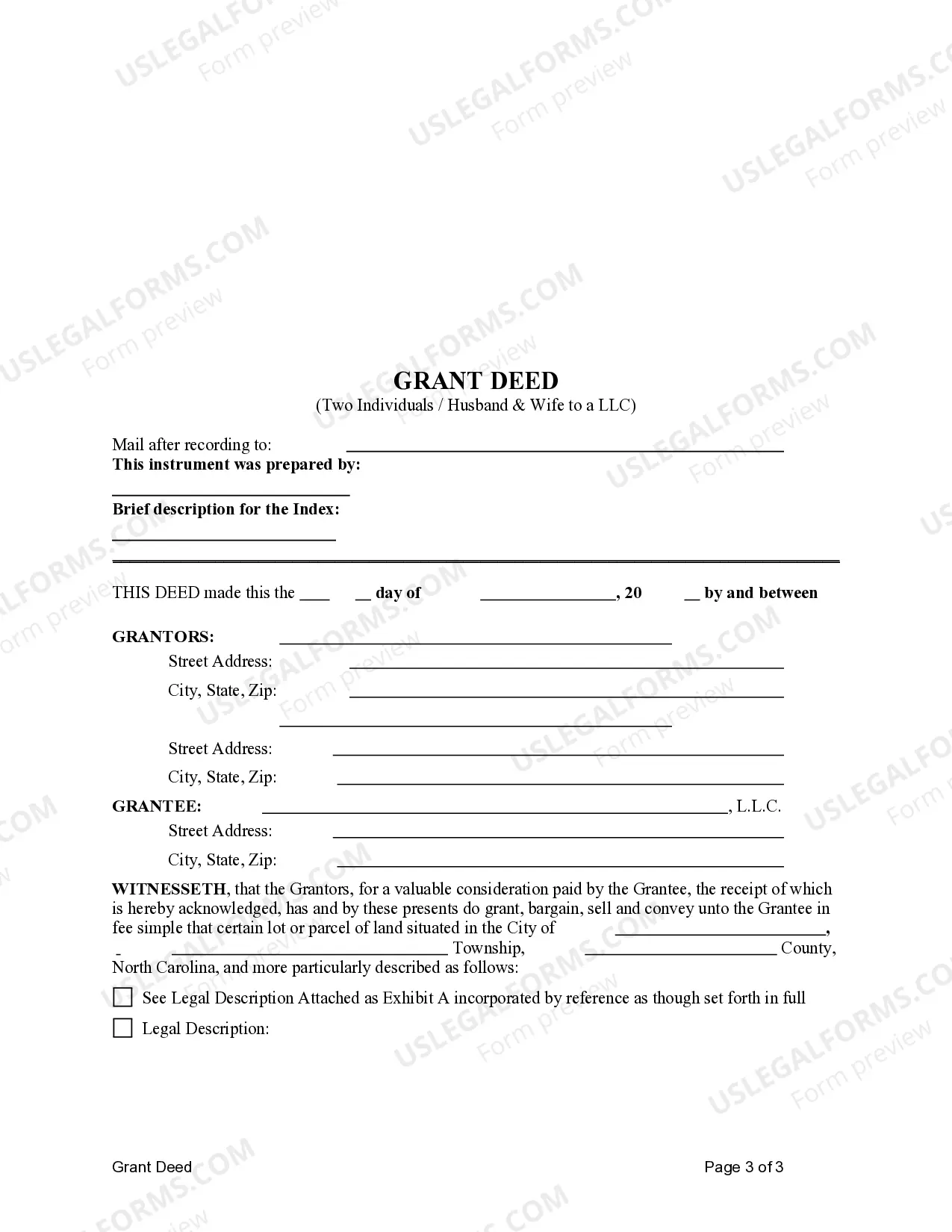

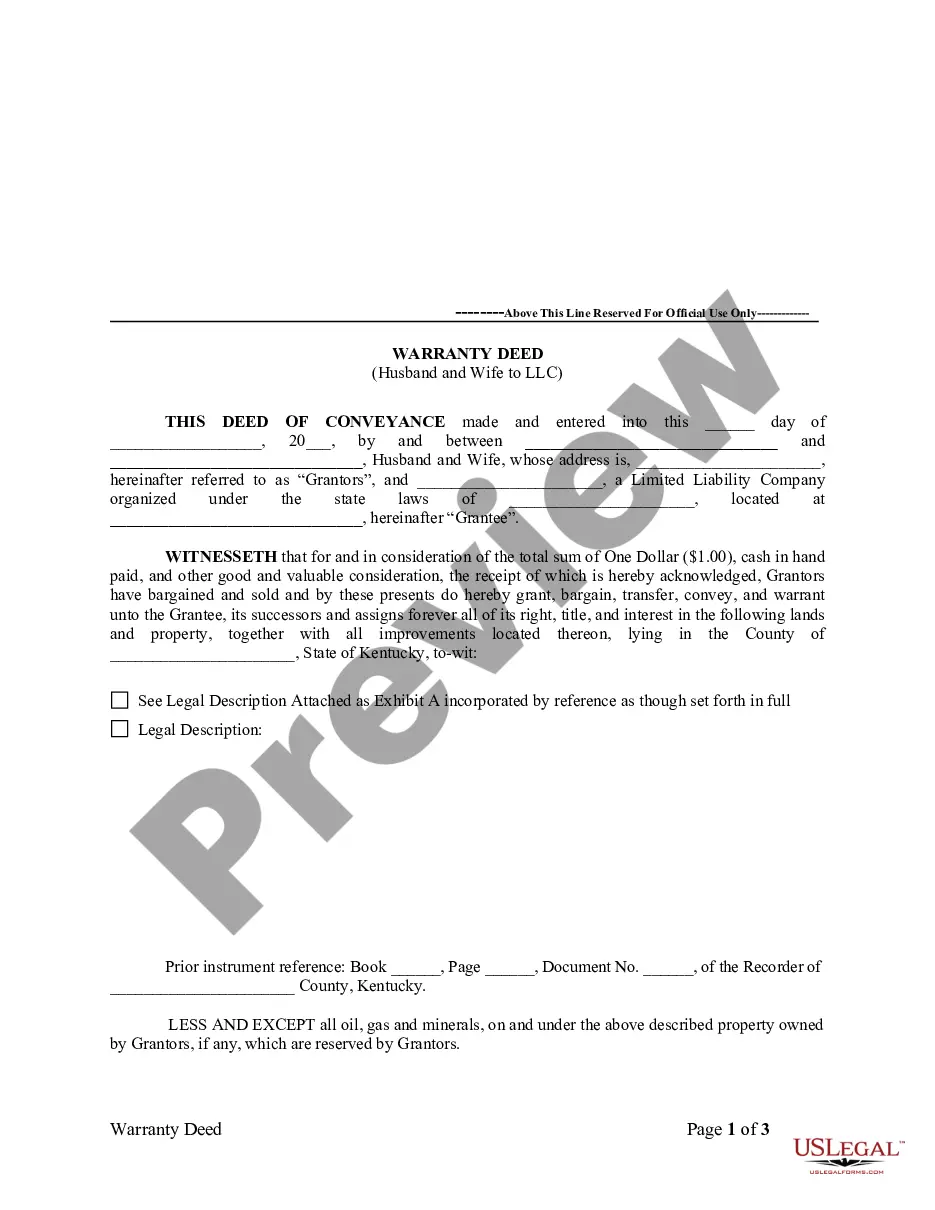

A North Carolina Grant Deed is a legal document used to transfer property ownership from two individuals, such as a married couple, to a Limited Liability Company (LLC). This form serves to officially document the conveyance of real estate rights and obligations associated with the property involved. It establishes a clear legal record of the transaction, detailing both the grantors—those conveying the property—and the grantee, the LLC receiving it.

How to complete a form

Completing the North Carolina Grant Deed involves several crucial steps:

- Identify the grantors: Clearly state the names of the individuals transferring the property.

- Specify the grantee: Indicate the name of the Limited Liability Company receiving the property.

- Provide property details: Include a detailed legal description of the property in question, ensuring accuracy.

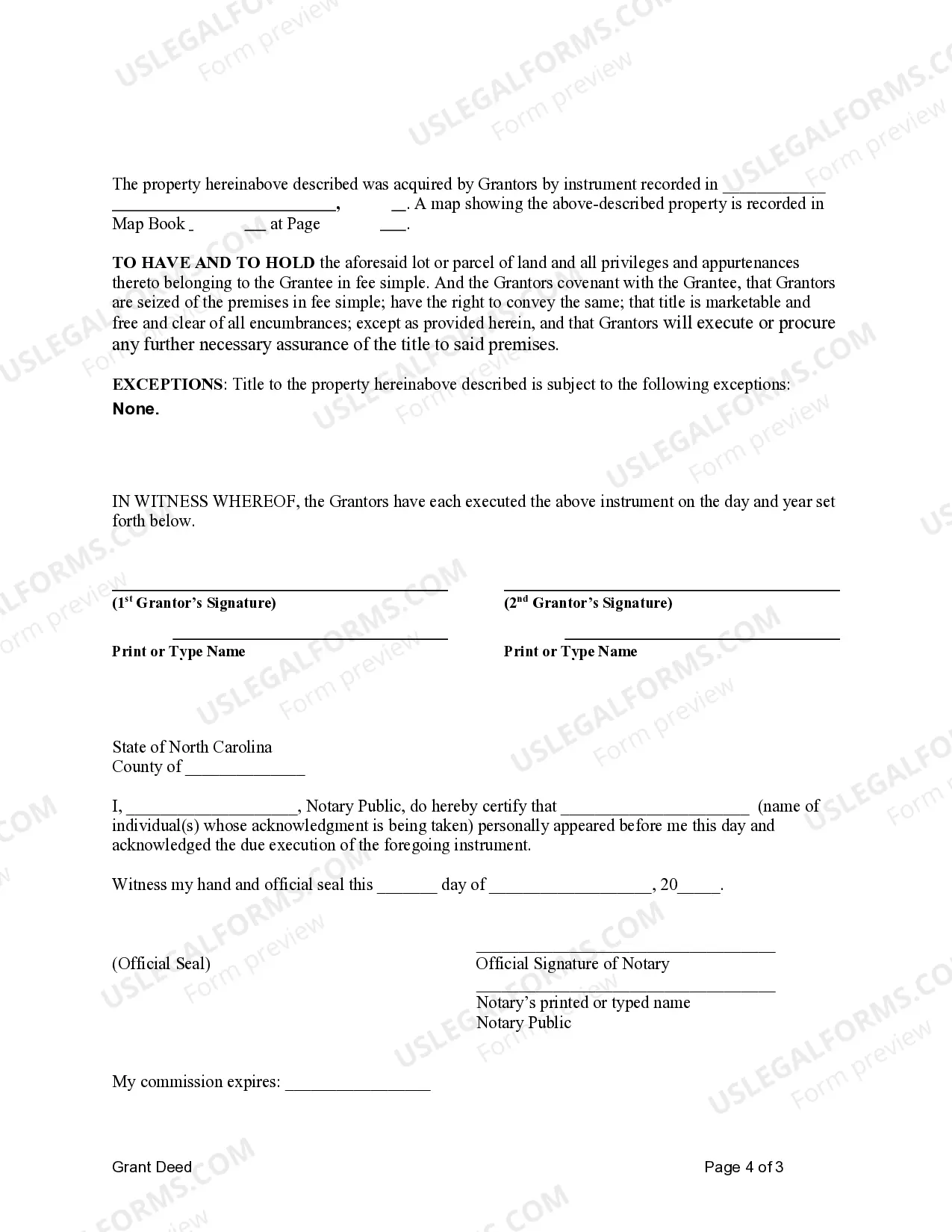

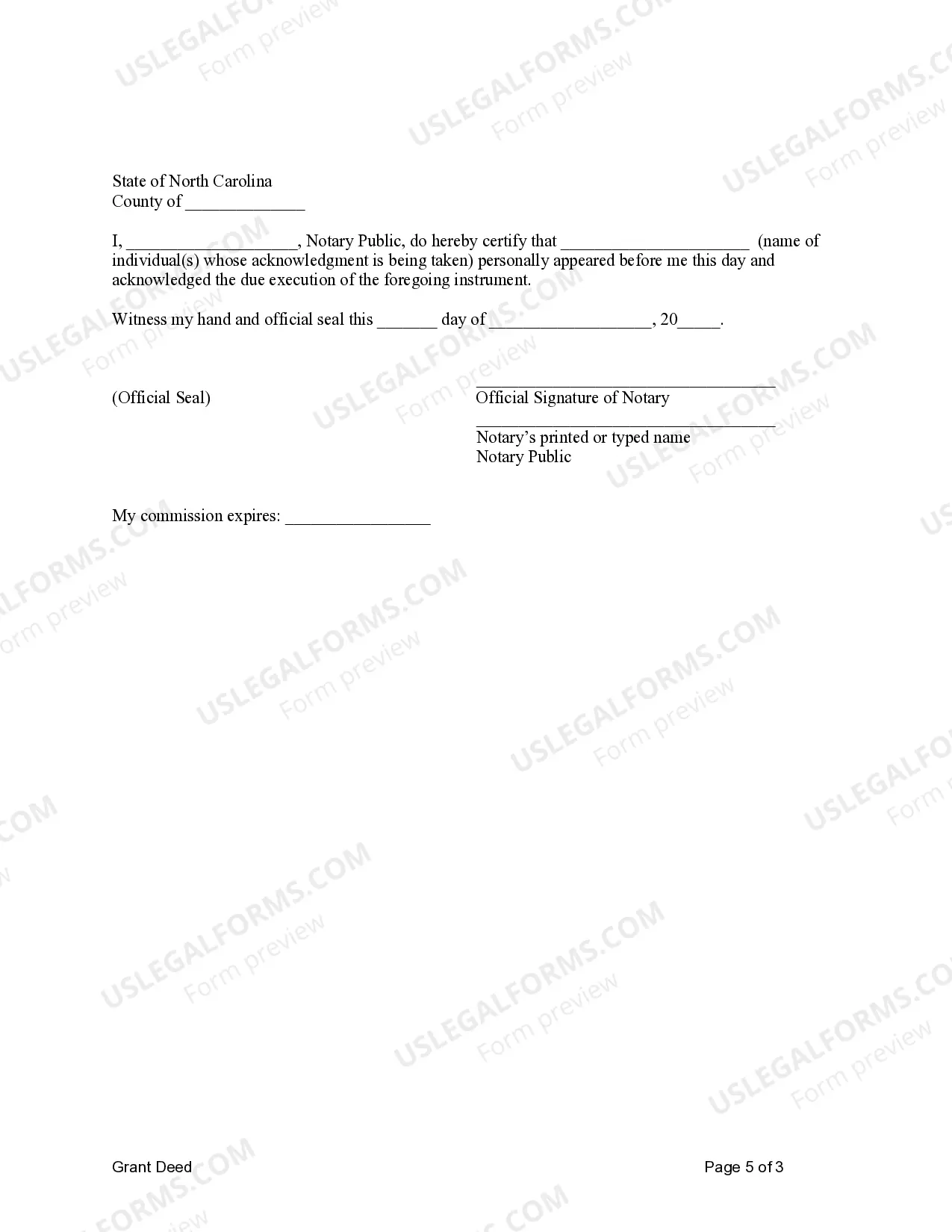

- Notarization: After signing the document, it must be notarized by a licensed notary public to validate the transaction.

Who should use this form

This form is designed for private individuals or couples who wish to transfer ownership of real estate to an LLC. It can be particularly useful for those seeking to protect personal assets or for businesses wanting to hold property under a corporate structure. Anyone involved in such transactions should consider using this form to ensure compliance with state laws and to maintain clear legal standing.

Legal use and context

The North Carolina Grant Deed is legally binding and must comply with state-specific laws regarding property transfers. It serves as evidence of ownership and helps prevent disputes regarding property rights. It is particularly relevant in real estate transactions where individuals wish to transfer property to a business entity, ensuring that all statutory requirements are met.

Common mistakes to avoid when using this form

When completing the North Carolina Grant Deed, it's important to avoid the following common errors:

- Incomplete legal description of the property.

- Failure to notarize the document after signing.

- Incorrect identification of grantors or grantee.

- Omitting essential details that could invalidate the deed.

What to expect during notarization or witnessing

During the notarization process, both grantors must be present to sign the deed in front of a notary public. The notary will verify the identities of the individuals, ensure they understand the document they are signing, and then they will affix their official seal. Proper witnessing is crucial, as it adds an additional layer of authenticity and legal validity to the Grant Deed.

Form popularity

FAQ

The General Warranty Deed. A general warranty deed provides the highest level of protection for the buyer because it includes significant covenants or warranties conveyed by the grantor to the grantee. The Special Warranty Deed. The Bargain and Sale Deed. The Quitclaim Deed.

North Carolina: Deed North Carolina is classified as a tax deed state. Tax Deeds: With a Tax Deed sale you are purchasing the property each and every time.In North Carolina, the tax collector or treasurer will sell tax deeds to the winning bidders at the delinquent property tax sale. The Land Grant Process.

Go to your Register of Deeds Office and look at the document there. Find your Register of Deeds in: Your phone book under county government. Look it up online. Many counties have their real property (land) records online. Go to the county website.

When done properly, a deed is recorded anywhere from two weeks to three months after closing.