Mississippi Partial Release from Judgment Lien

Description

Definition and meaning

The Mississippi Partial Release from Judgment Lien is a legal document that allows a judgment creditor to release a portion of a lien that has been placed on a property due to an unpaid judgment. This release signifies that while the lien on the specified property is lifted, the overall judgment against the debtor remains enforceable. This form is typically utilized when a debtor has satisfied part of their obligation, allowing them to free certain assets from the lien without fully resolving the total debt.

How to complete a form

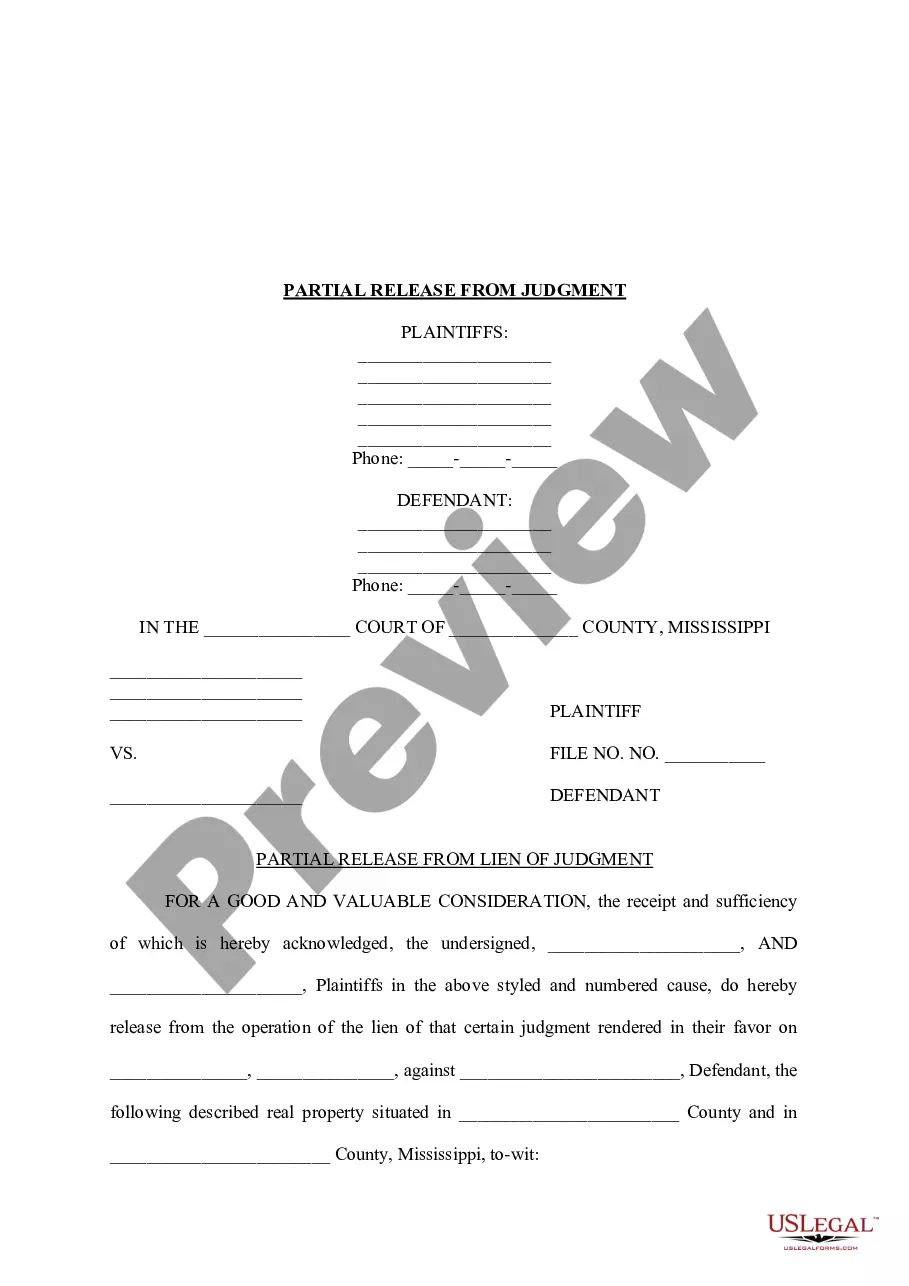

Completing the Mississippi Partial Release from Judgment Lien involves the following steps:

- Begin by identifying the plaintiffs and defendants involved in the judgment.

- Clearly state the original date of the judgment and the specific property affected by the lien.

- Include a description of the real property being released from the lien.

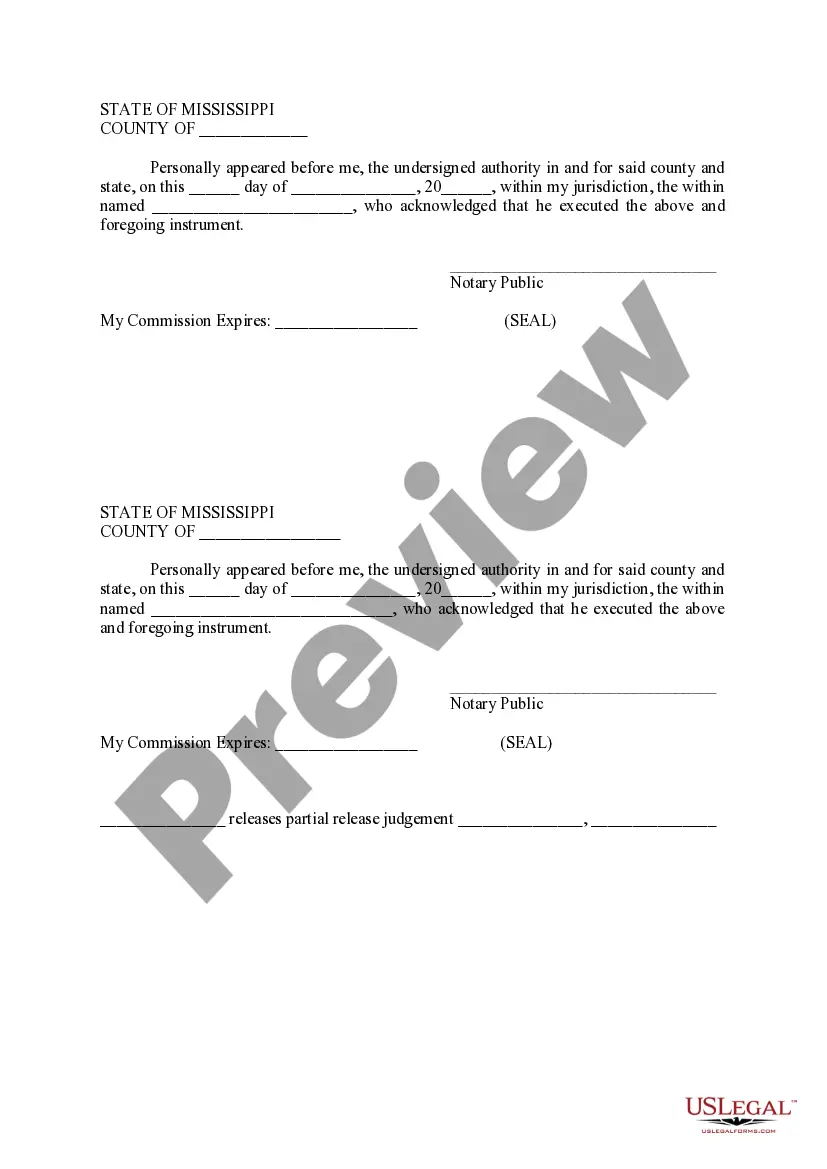

- Both plaintiffs must sign and date the document to validate the release.

- Ensure the signature is notarized, confirming the identity of the signers.

It is advisable to review the completed document for accuracy before submission.

Who should use this form

The Mississippi Partial Release from Judgment Lien should be utilized by individuals or entities involved in a legal judgment where a lien has been placed on their property. This form is particularly relevant for:

- Debtors who have made partial payments towards their judgment and wish to release specific assets.

- Creditors who are willing to release their claim on part of the property as a sign of goodwill or negotiation.

- Anyone needing to clear minor assets from a larger lien for refinancing or selling purposes.

Legal use and context

The Partial Release from Judgment Lien is often employed in the context of debt settlements and negotiations. Its legal implications involve the partial relinquishment of a creditor's claim on a debtor's property while maintaining the right to pursue the remaining judgment amount. This form can be crucial in real estate transactions or financial restructuring, facilitating smoother processes when a property is involved in legal disputes over unpaid debts.

Common mistakes to avoid when using this form

When completing the Mississippi Partial Release from Judgment Lien, users should be mindful of the following common mistakes:

- Failing to accurately identify all parties involved in the judgment.

- Neglecting to include a complete description of the property being released.

- Overlooking the notarization requirement, which can invalidate the release.

- Missing the correct dates or signatures, which could lead to legal complications.

What to expect during notarization or witnessing

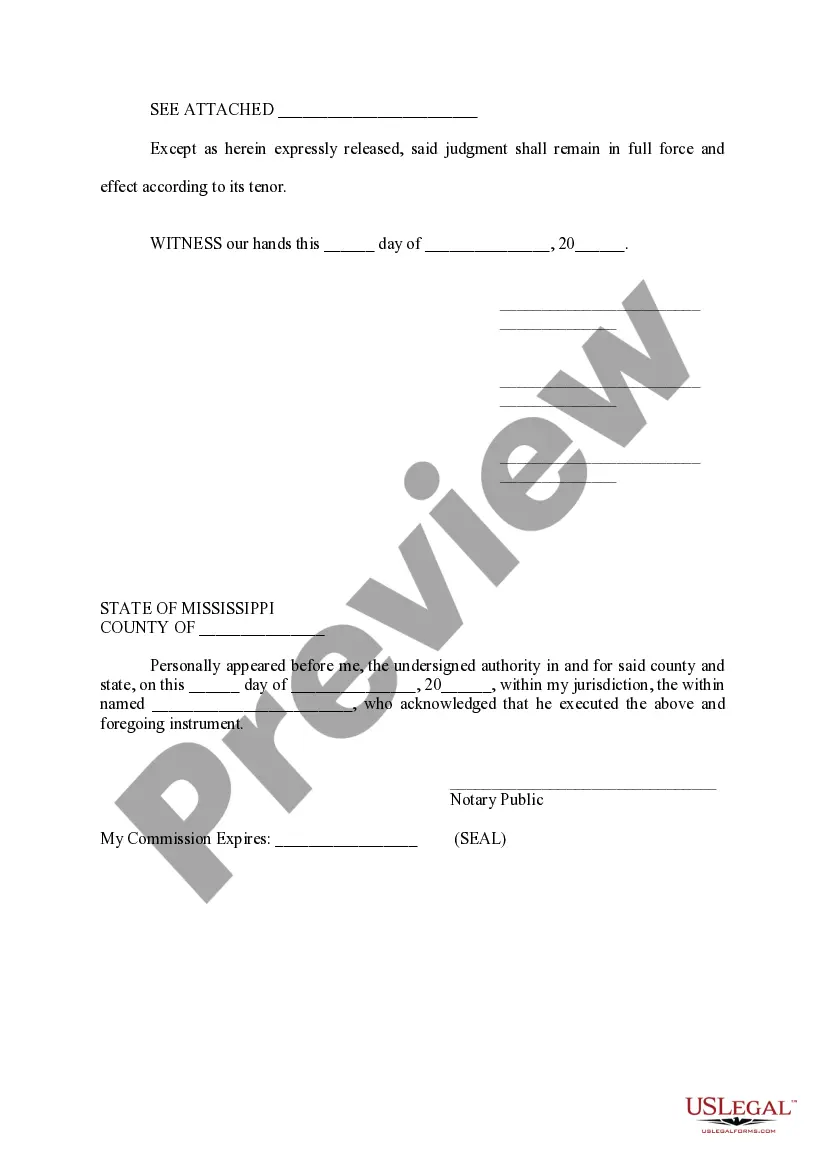

During the notarization process for the Mississippi Partial Release from Judgment Lien, the following should occur:

- The notary public will verify the identities of the signers through valid identification.

- The signers will confirm their understanding and voluntary execution of the document.

- The notary will officially stamp and sign the document, documenting the date and location.

This process ensures the legality of the document and provides further protection to all parties involved.

Benefits of using this form online

Using the Mississippi Partial Release from Judgment Lien form online offers several advantages:

- Access to professionally drafted templates prepared by licensed attorneys, ensuring reliability.

- Convenience in filling out and saving the document securely on digital devices.

- Time-saving features such as automatic calculations or reminders for completion.

- Reduced risk of errors through guided instructions available during the online process.

How to fill out Mississippi Partial Release From Judgment Lien?

Obtain a printable Mississippi Partial Release from Judgment Lien in just several clicks from the most extensive catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 supplier of reasonably priced legal and tax forms for US citizens and residents on-line since 1997.

Users who have a subscription, need to log in into their US Legal Forms account, down load the Mississippi Partial Release from Judgment Lien and find it stored in the My Forms tab. Users who never have a subscription must follow the tips listed below:

- Ensure your form meets your state’s requirements.

- If available, read the form’s description to learn more.

- If available, review the shape to discover more content.

- Once you are confident the template is right for you, just click Buy Now.

- Create a personal account.

- Select a plan.

- through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Mississippi Partial Release from Judgment Lien, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.

Aim to Pay 50% or Less of Your Unsecured Debt If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offerabout 15%and negotiate from there.

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

A Satisfaction of Judgment is basically an official receipt which says that you owed a certain amount, but that it has been paid, either partially or in full.

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

You pay less and avoid a long wage garnishment. The creditor will file a satisfaction of judgment with the court. Be sure to get a written agreement that says exactly how much you will pay and when, and that the payment settles the entire debt. An experienced consumer attorney can help ensure a successful settlement.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.