Missouri Quitclaim Deed from Individual to LLC

Understanding this form

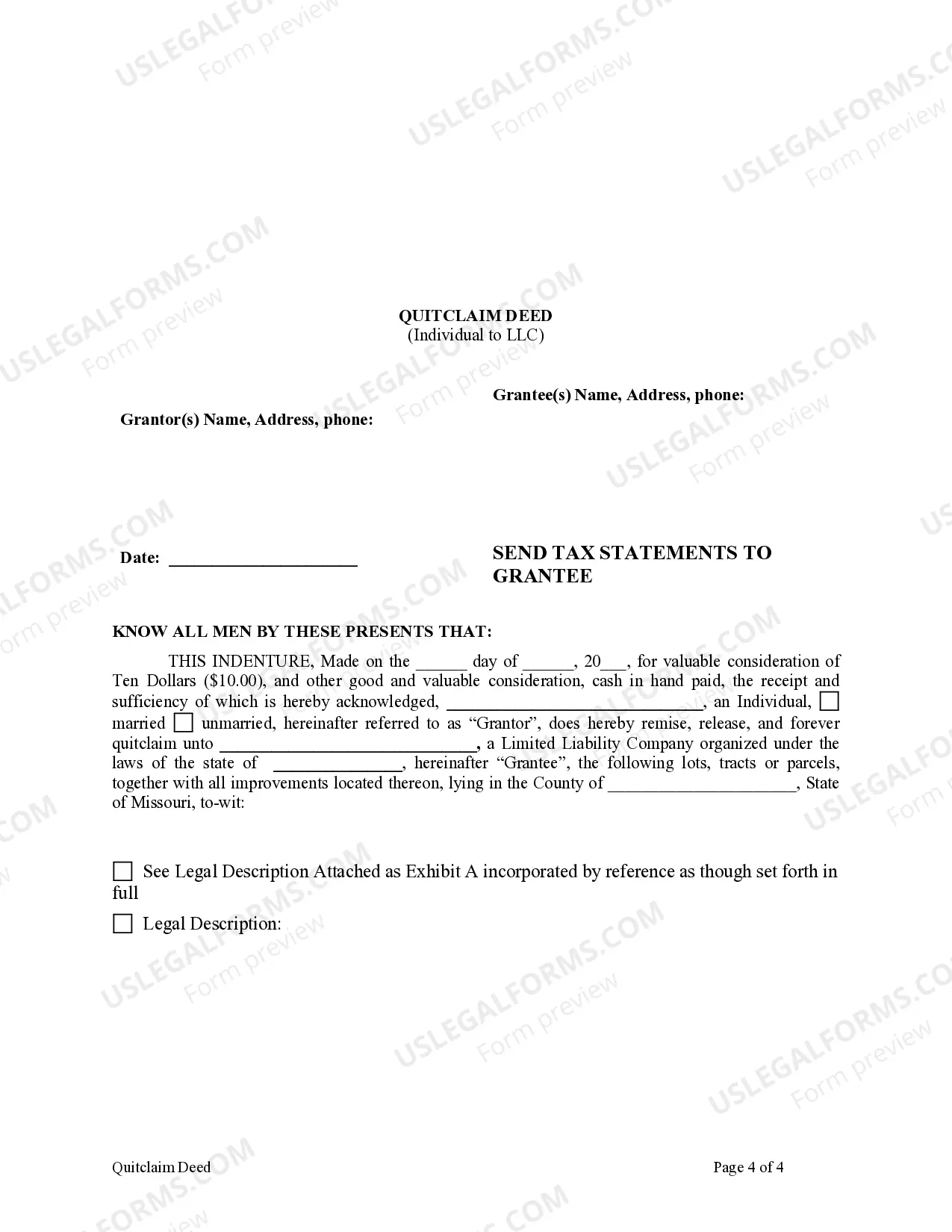

This Quitclaim Deed from Individual to LLC is a legal document that allows an individual (the grantor) to transfer property ownership to a limited liability company (the grantee). Unlike other deed types, a quitclaim deed does not guarantee the title's validity, meaning the grantor does not warrant the property's title. This form is specifically designed for situations where an individual wants to transfer property quickly and simply to an LLC, often for reasons related to asset protection or business management.

What’s included in this form

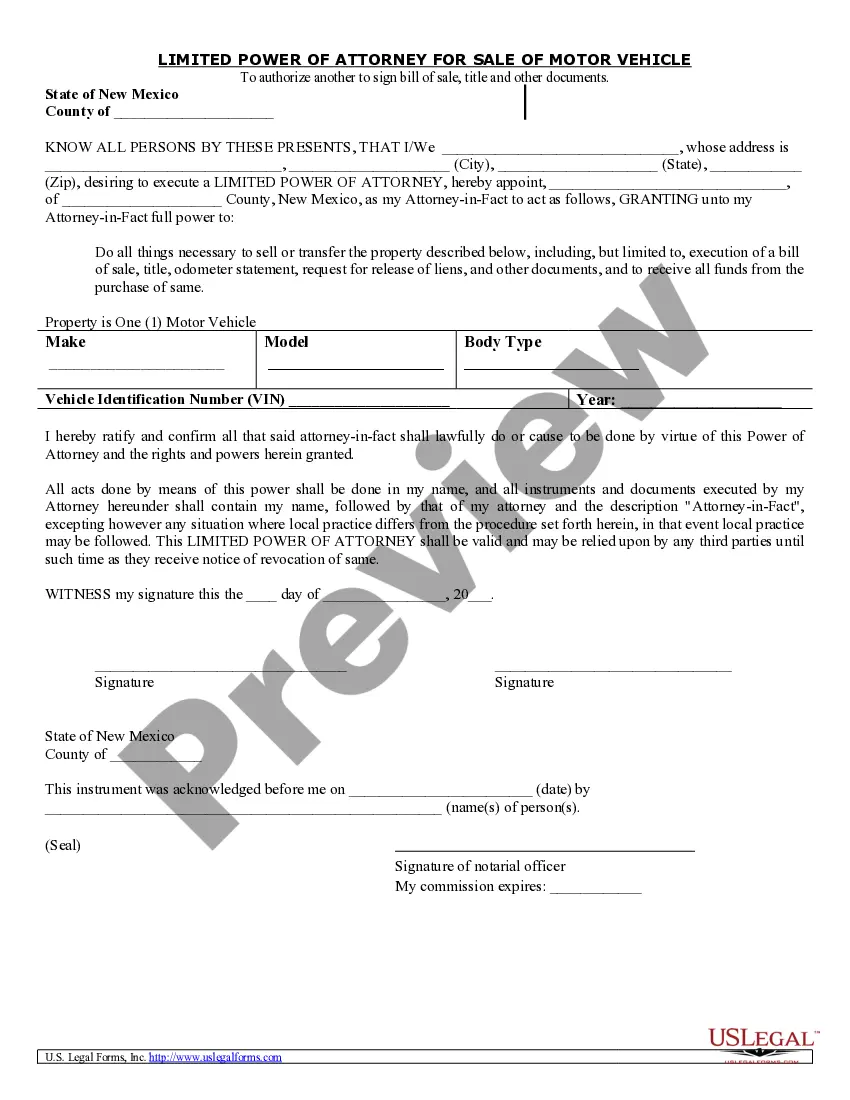

- Grantor and Grantee Information: Details on the individual transferring the property and the LLC receiving it.

- Property Description: A clear description of the property being conveyed, often accompanied by a legal description.

- Reservation of Rights: A clause stating that the grantor reserves all oil, gas, and minerals under the property, if applicable.

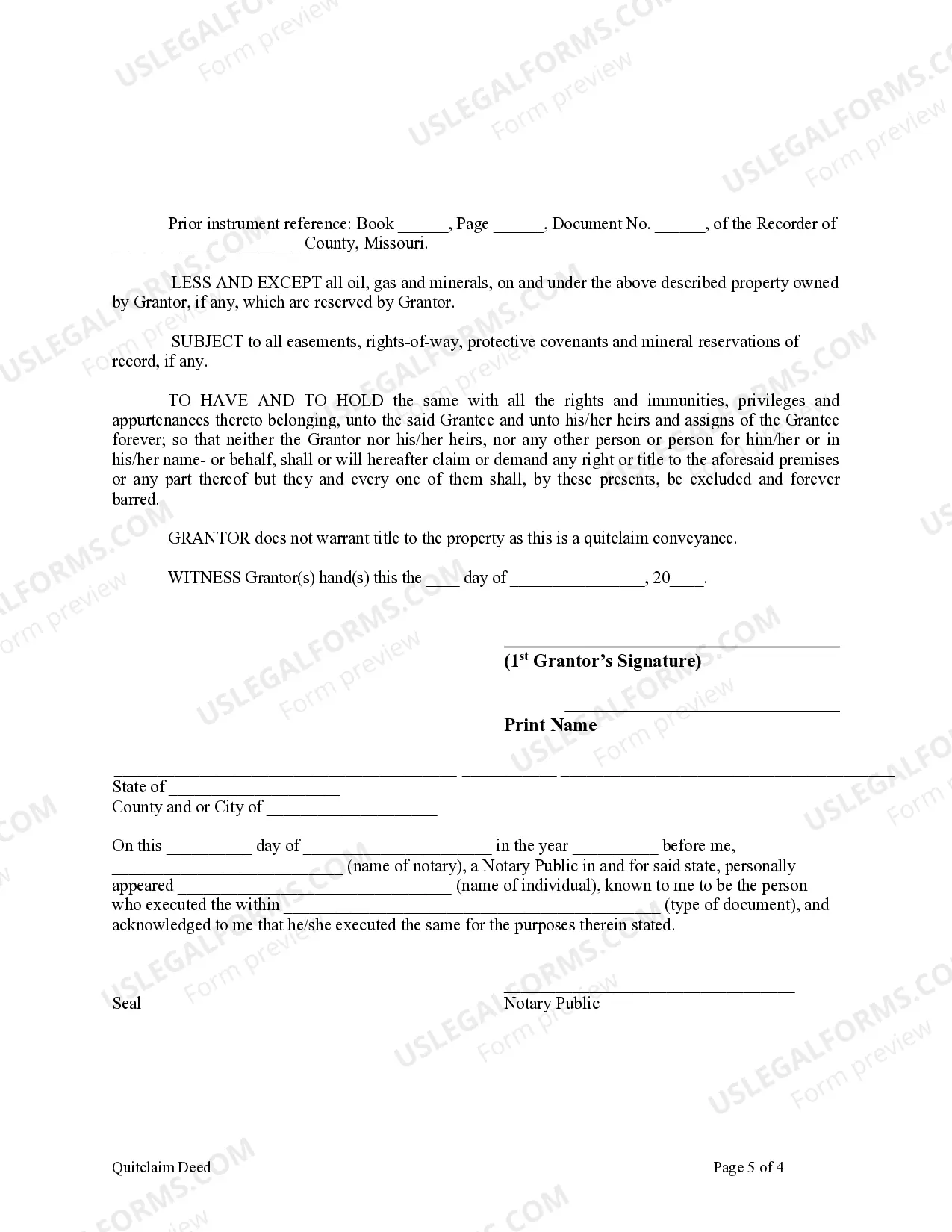

- Signature Section: Space for the grantor's signature and date to validate the deed.

- Exhibits: Reference to additional legal descriptions attached to the deed.

When to use this form

This form is useful when an individual wants to transfer property ownership to an LLC. Common scenarios include when starting a new business, consolidating assets within an LLC, or ensuring liability protection for business activities. It is important to use this form when a quick transfer is needed without the formalities required by warranty deeds.

Who can use this document

This form is intended for:

- Individuals who are the current owners of property.

- Members or managers of an LLC wishing to receive property transfers.

- Business owners looking to manage assets within a limited liability company structure.

Instructions for completing this form

- Identify the parties: Enter the full names of the grantor (individual) and the grantee (LLC).

- Specify the property: Fill in the legal description of the property being transferred.

- Address mineral rights: Note any reservations for oil, gas, and minerals under the property, if applicable.

- Sign and date: The grantor must sign and date the deed in the designated area to validate the transfer.

- Attach additional documents: Include any necessary exhibits for the legal description or additional clauses as needed.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide a complete legal description of the property.

- Not including necessary reservations for minerals or rights.

- Omitting signatures or dates, which can invalidate the deed.

- Incorrectly identifying the LLC or grantor information.

Advantages of online completion

- Convenient access: Easily download and fill out the form from anywhere.

- Editability: Fill out form fields digitally, ensuring accuracy.

- Clear instructions: Designed with user-friendly guidelines for easy completion.

- Time-saving: Reduces the time needed to prepare legal documents compared to traditional methods.

Looking for another form?

Form popularity

FAQ

To transfer a deed to an LLC, you first need to complete a Missouri Quitclaim Deed from Individual to LLC. This deed must be filled out correctly and signed by the grantor. After signing, you should file the deed with your local county recorder's office to make the transfer official. Using uslegalforms can guide you through this process with helpful templates and instructions.

People often place their property in an LLC for liability protection and potential tax benefits. By doing so, they can separate personal assets from business liabilities, which can reduce risk. Additionally, using a Missouri Quitclaim Deed from Individual to LLC can simplify the transfer process. Many find that uslegalforms provides the right tools to make this transition smooth.

Yes, you can use a Missouri Quitclaim Deed from Individual to LLC to transfer your house into your LLC. This type of deed allows you to relinquish your ownership rights in the property, making the LLC the new owner. It's a straightforward process, but ensure you follow your local regulations. Consider using uslegalforms for easy access to the necessary documents.

Yes, you can transfer a quitclaim deed in Missouri. This process allows the property owner to transfer their interest to another party, such as an LLC. To ensure the transfer is valid and meets all legal requirements, using resources like US Legal Forms can simplify the process and help you avoid potential pitfalls.

Yes, you can prepare your own Missouri Quitclaim Deed from Individual to LLC. However, it's essential to ensure that your document meets all legal requirements set by Missouri law. If you are unsure about the process, consider using platforms like US Legal Forms, which provide templates and guidance to help you create a legally sound deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Recording fees for quitclaim deeds vary among counties. In Clay County and Platte County, the fee is $24 for the first page and $3 for each additional page.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.