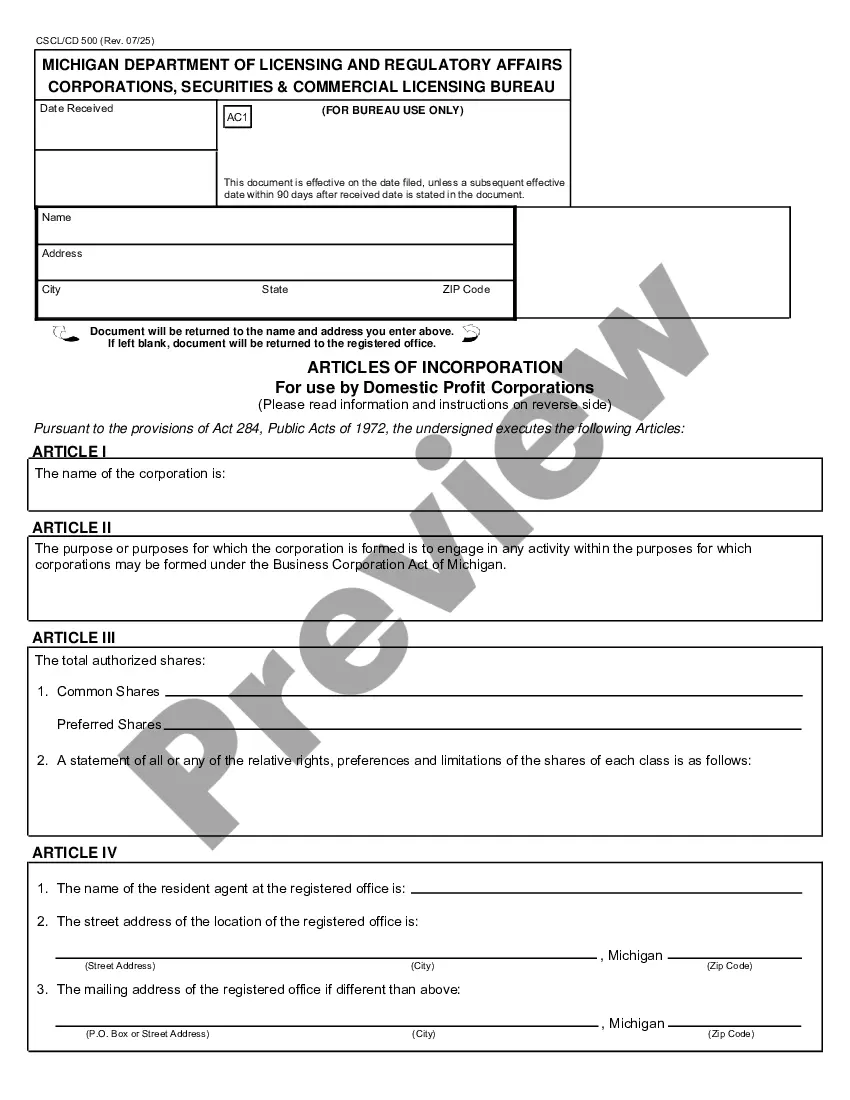

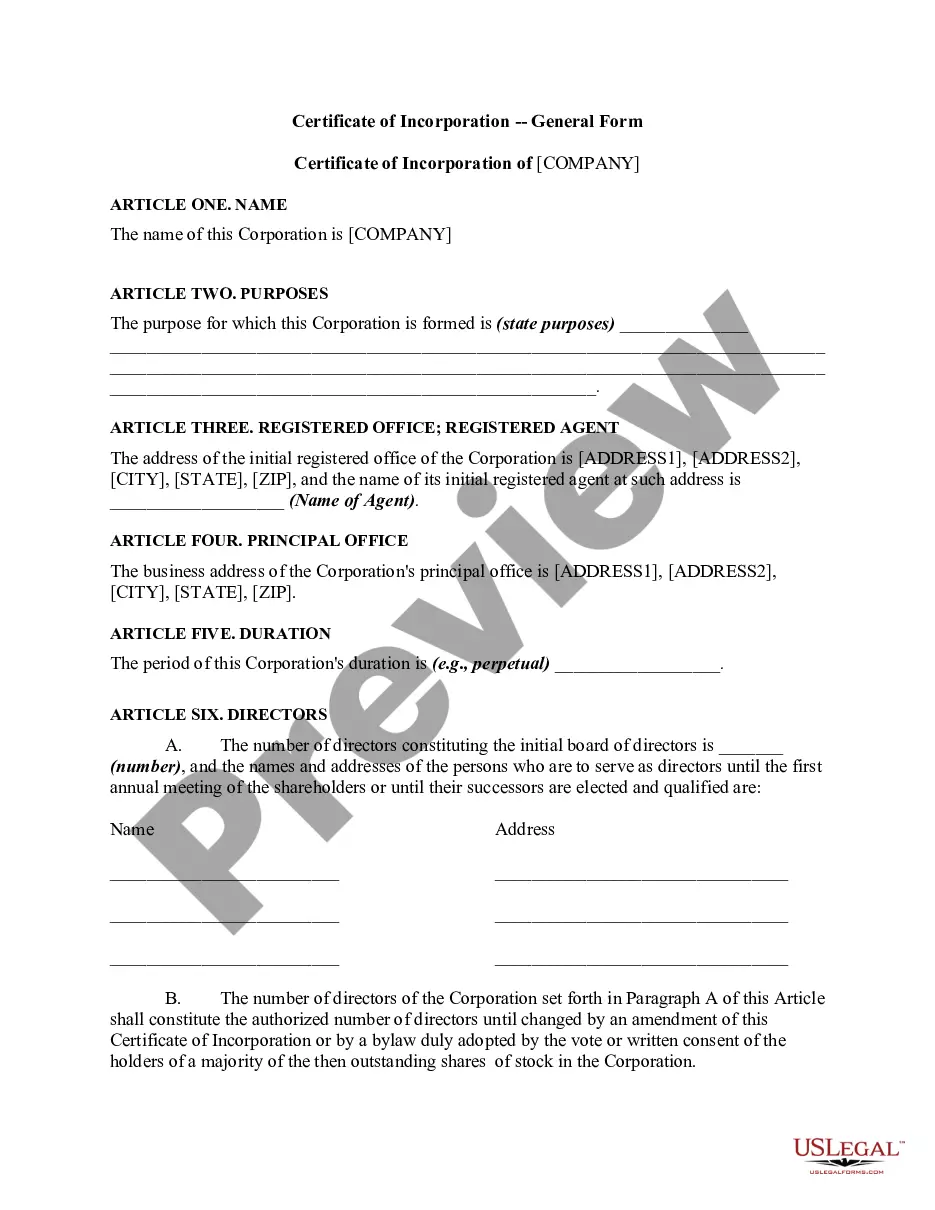

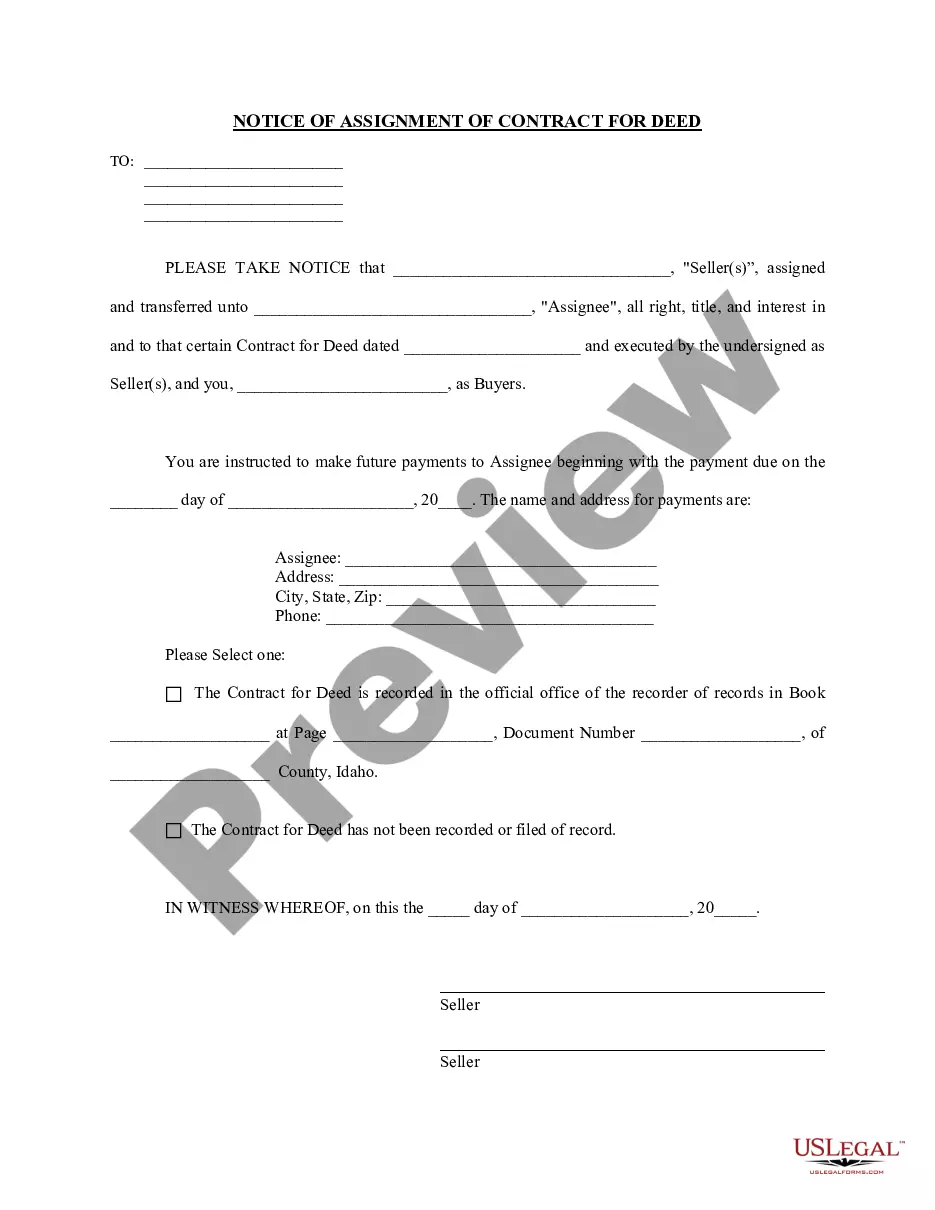

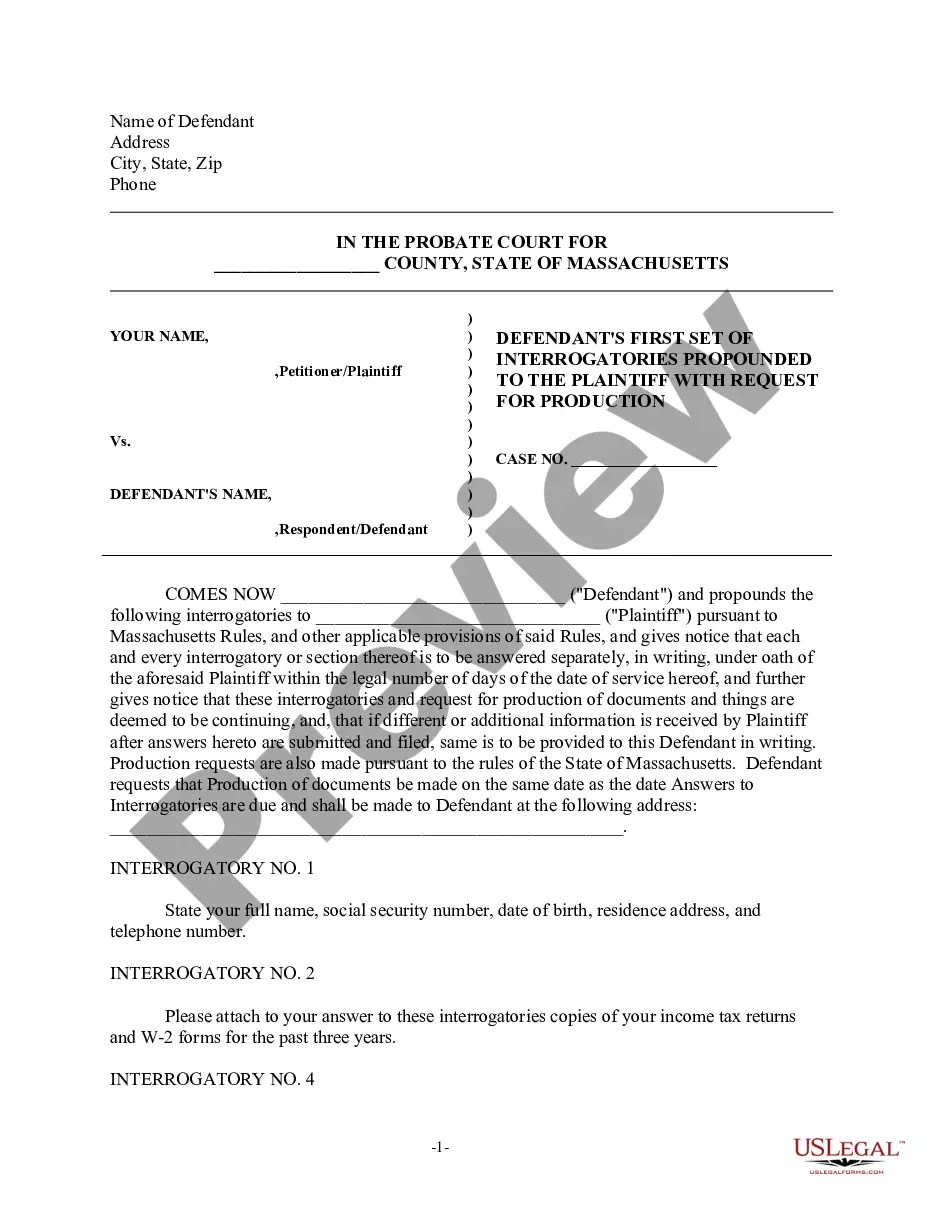

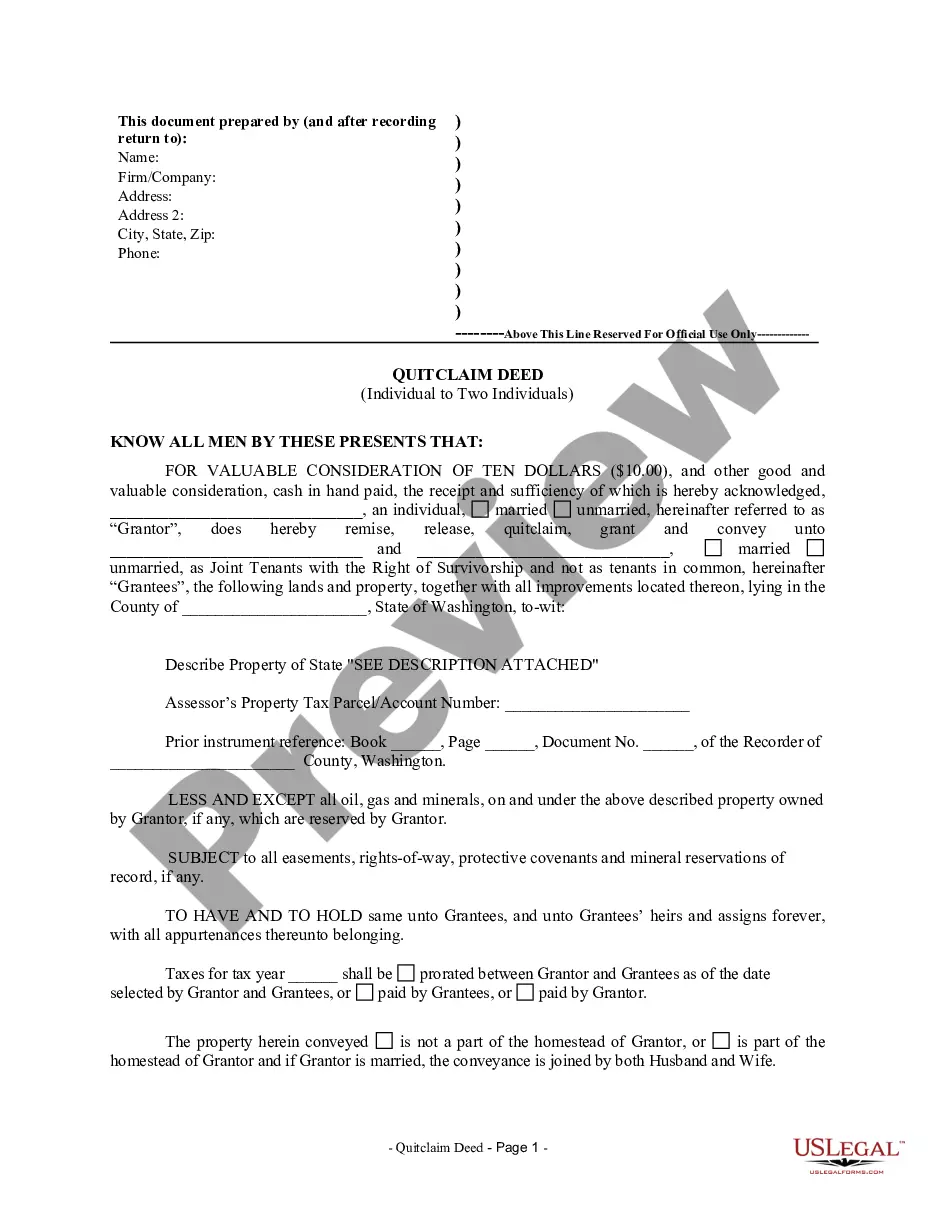

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Michigan Business Incorporation Package to Incorporate Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Business Incorporation Package To Incorporate Corporation?

Obtain any variation from 85,000 lawful papers including the Michigan Business Incorporation Package to Incorporate Corporation online with US Legal Forms.

Each template is crafted and revised by attorneys licensed by the state.

If you already have a membership, Log In. When you arrive at the form’s page, press the Download button and head to My documents to reach it.

With US Legal Forms, you will consistently have instant access to the suitable downloadable sample. The platform grants you entry to documents and organizes them into categories to simplify your search. Utilize US Legal Forms to acquire your Michigan Business Incorporation Package to Incorporate Corporation quickly and efficiently.

- Verify the state-specific criteria for the Michigan Business Incorporation Package to Incorporate Corporation you wish to utilize.

- Examine the description and look at the sample.

- Once you are confident the sample is what you require, simply click Buy Now.

- Choose a subscription plan that actually fits your budget.

- Establish a personal account.

- Complete payment in one of two suitable methods: by card or via PayPal.

- Select a format to download the document in; two alternatives are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is finished, print it out or store it on your device.

Form popularity

FAQ

If you want sole or primary control of the business and its activities, a sole proprietorship or an LLC might be the best choice for you. You can negotiate such control in a partnership agreement as well. A corporation is constructed to have a board of directors that makes the major decisions that guide the company.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

How much does it cost to form a corporation in Michigan? You can reserve your business name with the Michigan Department of Licensing and Regulatory Affairs for $10. To file your Articles of Incorporation, the Michigan Department of Licensing and Regulatory Affairs charges a $50 filing fee.

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

If you incorporate your small business, you can determine when and how you receive income from the business, which is a real tax advantage. Instead of taking a salary from the business when the business receives income, being incorporated allows you to take your income at a time when you'll pay less in tax.

Income tax rates are lower for corporations than for the personal income received by sole proprietors. Using tax planning, the tax burden can be reduced by earning income through your corporation as an incorporated contractors, due to the lower corporate tax rates.

Inc. is the abbreviation for incorporated. An incorporated company, or corporation, is a separate legal entity from the person or people forming it. Directors and officers purchase shares in the business and have responsibility for its operation. Incorporation limits an individual's liability in case of a lawsuit.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

The word "incorporated" indicates that a business entity is a corporation.A corporation or "Inc." is an entirely separate entity from its owners and shareholders. This is an important legal distinction since an incorporated business essentially becomes a separate "person" under the law.