Michigan Subcontractor's Agreement

Overview of this form

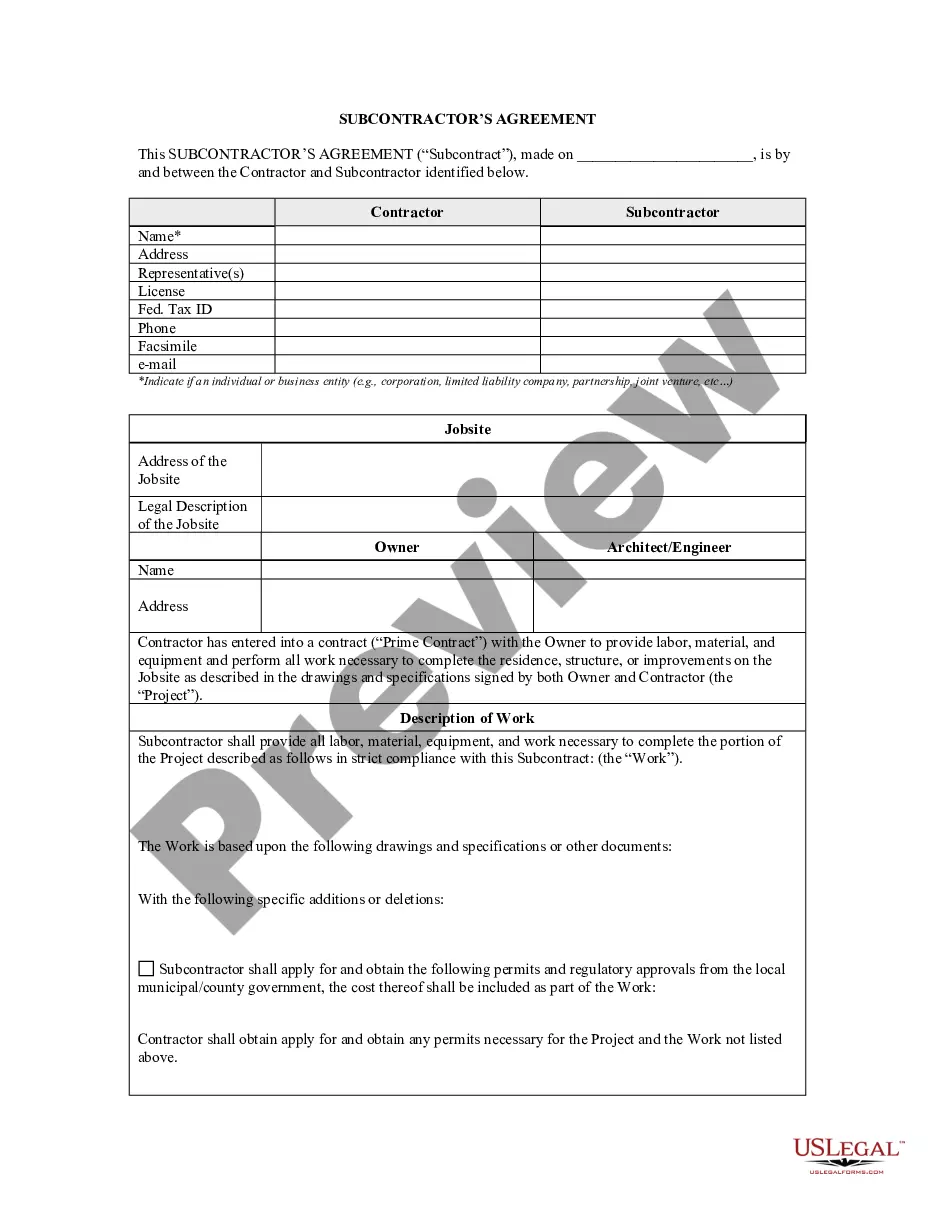

The Subcontractor's Agreement is a legal document used in construction projects to outline the terms between a contractor and a subcontractor. This form establishes the scope of work, payment details, timelines, and other critical components of the subcontracting relationship. Unlike general contracts, this agreement focuses specifically on the obligations and rights related to subcontracted work, making it essential for both parties to ensure clarity and compliance with project requirements.

What’s included in this form

- Identification of the parties involved in the agreement.

- Description of the specific work to be performed and the job site location.

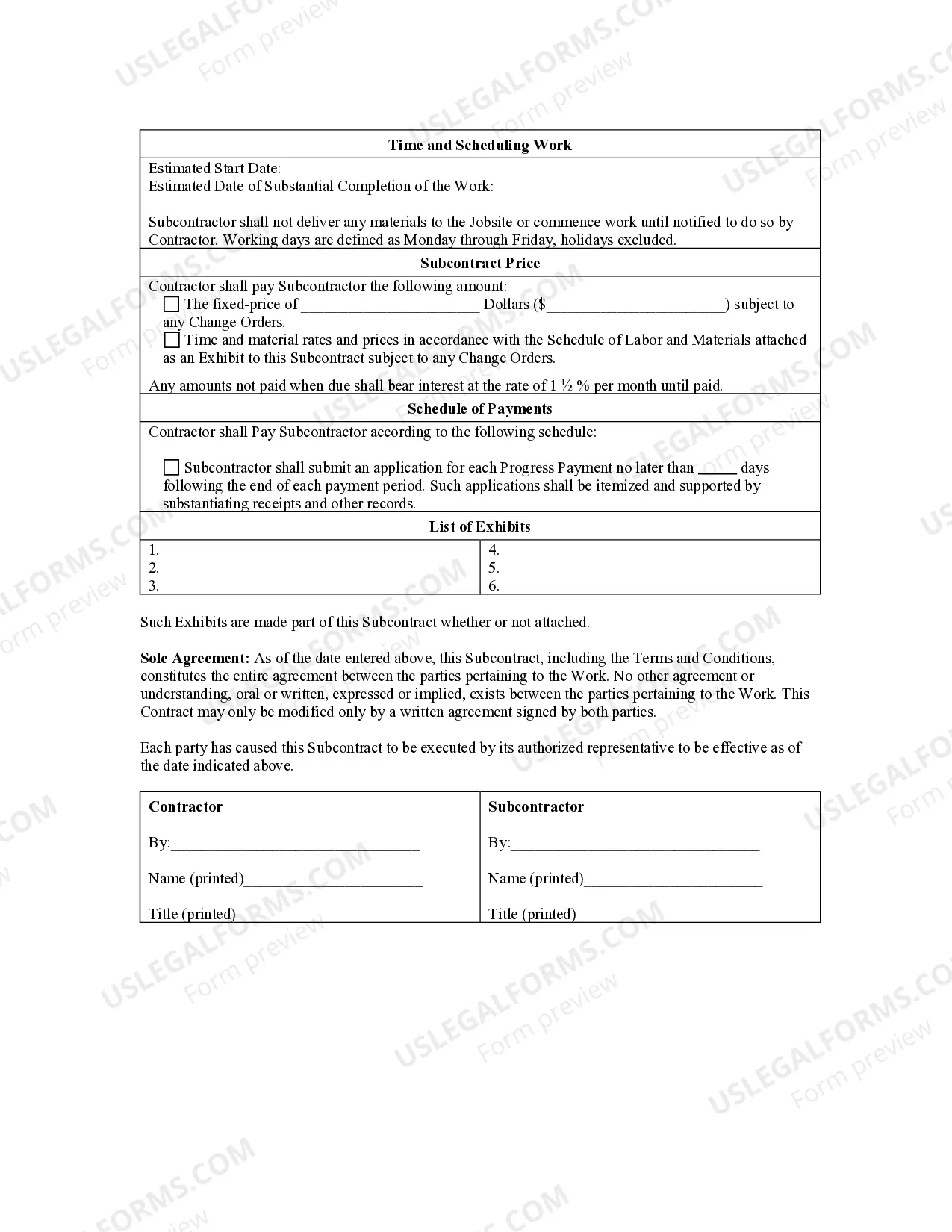

- Details on payment amounts, schedules, and terms for change orders.

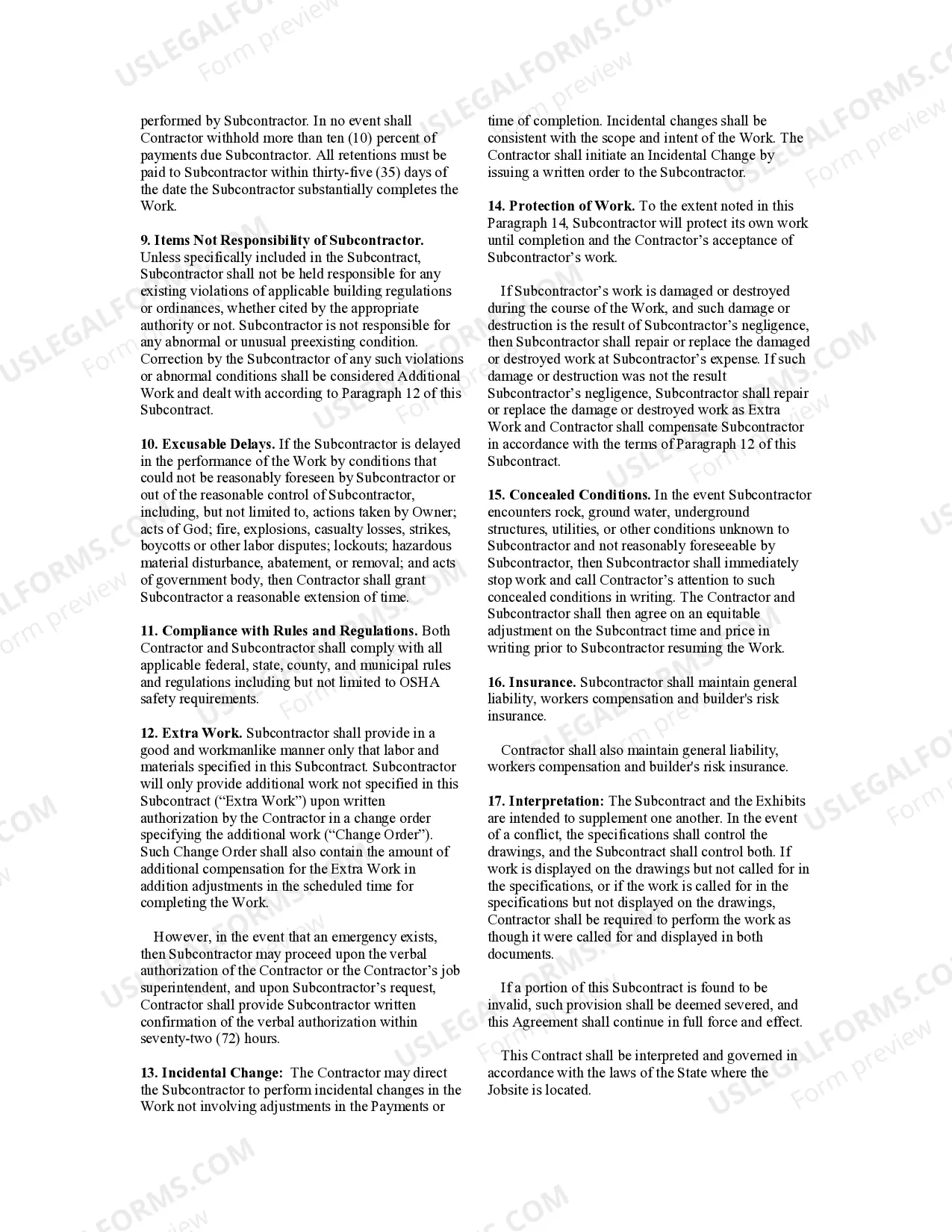

- Provisions for handling delays, disputes, and the process for resolving conflicts.

- Requirements for insurance and liability considerations.

- Obligations related to debris removal and site cleanliness upon completion of work.

Common use cases

The Subcontractor's Agreement should be used when a contractor hires a subcontractor to perform specific tasks within a construction project. It is appropriate in situations where the nature of the work requires specialized skills or additional resources, ensuring that all parties understand their rights and responsibilities. This form is essential for protecting both the contractor's and subcontractor's interests in terms of performance expectations and payment arrangements.

Who can use this document

This form is intended for:

- General contractors who want to outsource specific portions of a construction project.

- Subcontractors looking to formalize their working relationship with a contractor.

- Both parties aiming to mitigate risks and clarify obligations related to construction work.

How to complete this form

- Identify the parties by entering the names of the contractor and subcontractor.

- Specify the job site address and the detailed scope of work to be completed.

- Enter the agreed payment amount and any relevant payment schedule.

- Review and address provisions related to delays, dispute resolution, and necessary insurance coverage.

- Both parties should sign and date the agreement to confirm acceptance of the terms.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to clearly define the scope of work, leading to misunderstandings.

- Not including specific timelines for completion and payment terms.

- Omitting clauses related to dispute resolution and change orders.

- Not obtaining signatures from both parties, which may invalidate the agreement.

Benefits of completing this form online

- Convenient access to well-drafted legal templates that save time and effort.

- Ability to customize, edit, and download the form as needed, ensuring it meets specific project requirements.

- Access to legal expertise through forms created by licensed attorneys, enhancing reliability.

Looking for another form?

Form popularity

FAQ

Define the needs of the project. Finalize the provisions of the agreement, such as the due dates. Clarify the terms for payment. Write a draft of the contract and send it to the subcontractor for her review. Decide on a method to handle disputes, should one arise between you and the subcontractor.

Scope of Work. A subcontractor agreement should always specify the scope of work. Supply Chain. Defense & Indemnification. Insurance, Bonds, & Liens. Warranty. Arbitration. Conditional Payment.

A subcontractor has a contract with the contractor for the services provided - an employee of the contractor cannot also be a subcontractor.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

Subcontractor (Independent) A sales tax license may be required for this type of business. You may call the Michigan Department of Treasury at (517) 636-4660.

The employer is still legally responsible for the employee's injuries. Subcontractors are business entities independent of your company or organization; they are not your employees. Because of this, you do not need to carry workers' compensation insurance for subcontractors.

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

1Make sure you really qualify as an independent contractor.2Choose a business name (and register it, if necessary).3Get a tax registration certificate (and a vocational license, if required for your profession).4Pay estimated taxes (advance payments of your income and self-employment taxes).

Licensing.Scope of Work and Payment.Timing.Defense and Indemnification.