Kansas Articles of Incorporation for Domestic Nonprofit Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kansas Articles Of Incorporation For Domestic Nonprofit Corporation?

Searching for Kansas Articles of Incorporation for Domestic Nonprofit Corporation samples and completing them can be quite a hurdle.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your state in just a few clicks.

Our lawyers prepare every document, so you simply need to fill them out. It's truly that simple.

Select your plan on the pricing page and establish an account. Choose how you would like to pay via credit card or PayPal. Download the document in your preferred file format. You can print the Kansas Articles of Incorporation for Domestic Nonprofit Corporation template or fill it out using any online editor. Don’t stress about making mistakes since your template can be used and submitted, and printed as many times as you wish. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's webpage to save the sample.

- All your downloaded samples are stored in My documents and are available at any time for future use.

- If you haven’t registered yet, you should create an account.

- Review our detailed guidelines regarding how to obtain the Kansas Articles of Incorporation for Domestic Nonprofit Corporation form in mere minutes.

- To acquire an eligible form, verify its validity for your state.

- Examine the form using the Preview feature (if it's available).

- If there's a description, read it to understand the key details.

- Click on the Buy Now button if you found what you're looking for.

Form popularity

FAQ

Choose a Name for Your LLC. Appoint a Resident Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

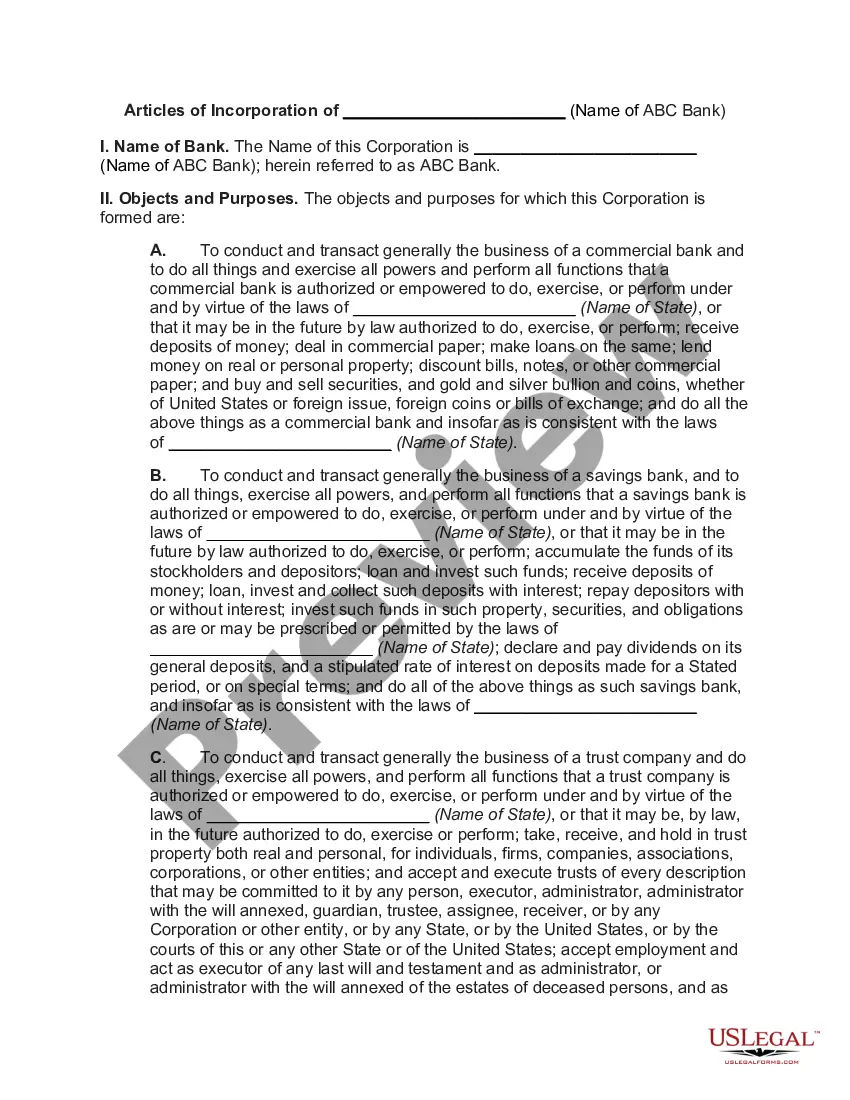

If you want to structure your business as a corporation, one of the first formal steps you'll need to take is to file a special document with a particular state office. In most states, the document is known as the articles of incorporation, and in most states it needs to be filed with the Secretary of State.

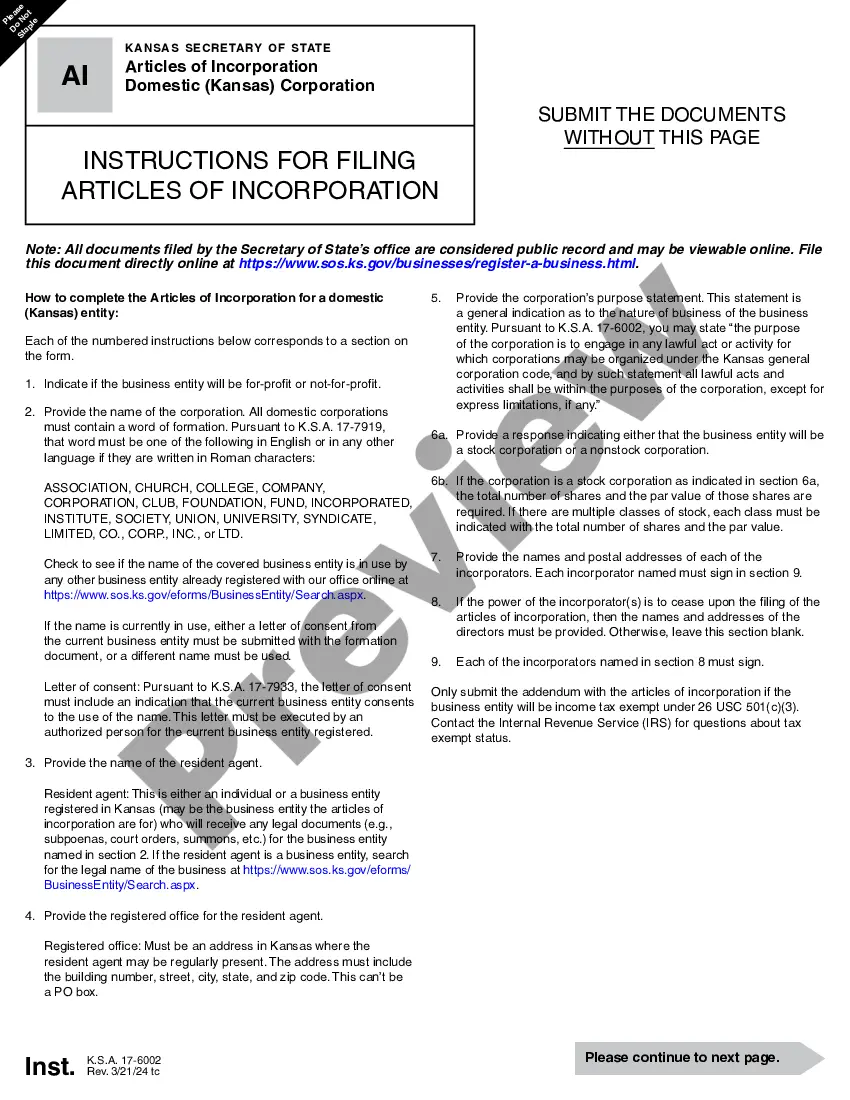

To start a corporation in Kansas, you must file Articles of Incorporation with the Secretary of State. You can file the document online or by mail. The Articles of Incorporation cost $90 ($89 online) to file.

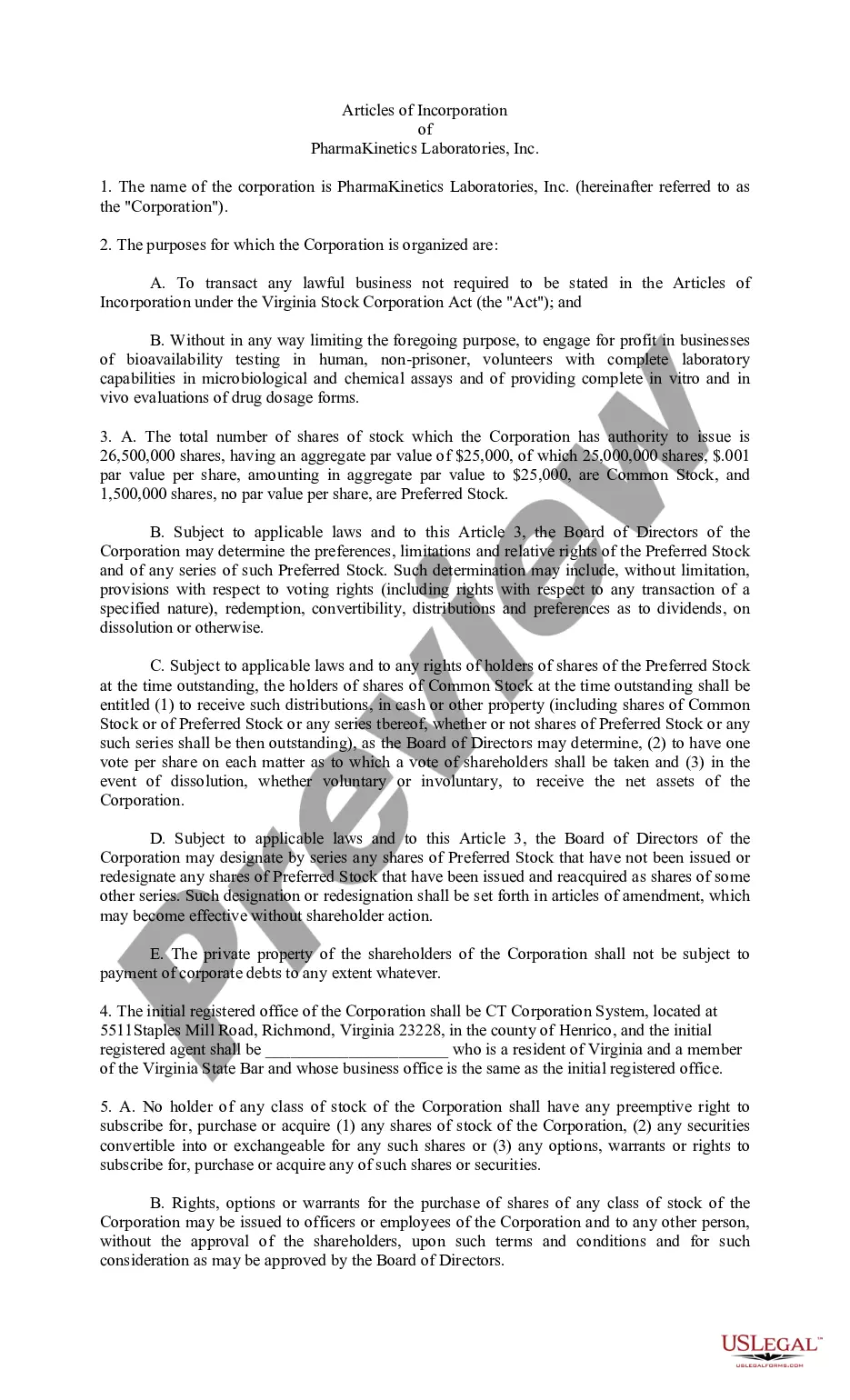

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.

Save time and money by filing your articles of incorporation online at www.sos.ks.gov. There, you can also stay up-to-date on your organization's status, annual report due date, and contact addresses. Instructions: All information must be completed or this document will not be accepted for filing.

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

The nonprofit corporation definition is an organization that is legally incorporated and also recognized by the IRS as tax-exempt based on business activity. The vast majority of nonprofits are classified as 501(c)3 organizations by the IRS. However, that is not the only designation for a nonprofit.

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.