Kansas Articles of Incorporation for Domestic Nonprofit Corporation

Description

How to fill out Kansas Articles Of Incorporation For Domestic Nonprofit Corporation?

Looking for Kansas Articles of Incorporation for Domestic Nonprofit Corporation templates and completing them can be quite a challenge. In order to save time, costs and effort, use US Legal Forms and find the correct example specifically for your state in a couple of clicks. Our attorneys draw up every document, so you just need to fill them out. It is really so easy.

Log in to your account and come back to the form's web page and save the sample. All your downloaded examples are saved in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you should sign up.

Take a look at our comprehensive recommendations concerning how to get the Kansas Articles of Incorporation for Domestic Nonprofit Corporation form in a few minutes:

- To get an eligible form, check out its validity for your state.

- Take a look at the form using the Preview function (if it’s available).

- If there's a description, read it to learn the important points.

- Click on Buy Now button if you identified what you're seeking.

- Choose your plan on the pricing page and make an account.

- Pick how you wish to pay out by way of a credit card or by PayPal.

- Download the file in the favored file format.

You can print the Kansas Articles of Incorporation for Domestic Nonprofit Corporation template or fill it out making use of any web-based editor. Don’t worry about making typos because your template can be employed and sent away, and published as often as you want. Check out US Legal Forms and access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Choose a Name for Your LLC. Appoint a Resident Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

If you want to structure your business as a corporation, one of the first formal steps you'll need to take is to file a special document with a particular state office. In most states, the document is known as the articles of incorporation, and in most states it needs to be filed with the Secretary of State.

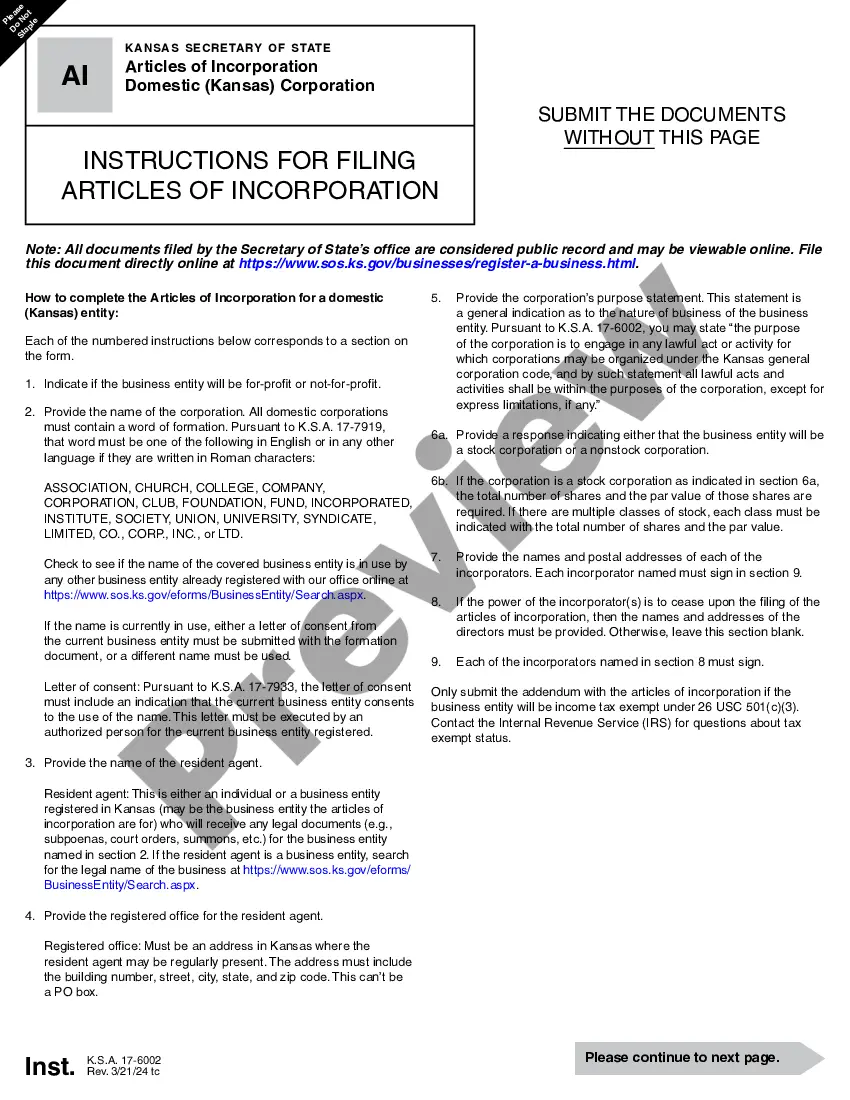

To start a corporation in Kansas, you must file Articles of Incorporation with the Secretary of State. You can file the document online or by mail. The Articles of Incorporation cost $90 ($89 online) to file.

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.

Save time and money by filing your articles of incorporation online at www.sos.ks.gov. There, you can also stay up-to-date on your organization's status, annual report due date, and contact addresses. Instructions: All information must be completed or this document will not be accepted for filing.

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

The nonprofit corporation definition is an organization that is legally incorporated and also recognized by the IRS as tax-exempt based on business activity. The vast majority of nonprofits are classified as 501(c)3 organizations by the IRS. However, that is not the only designation for a nonprofit.

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.