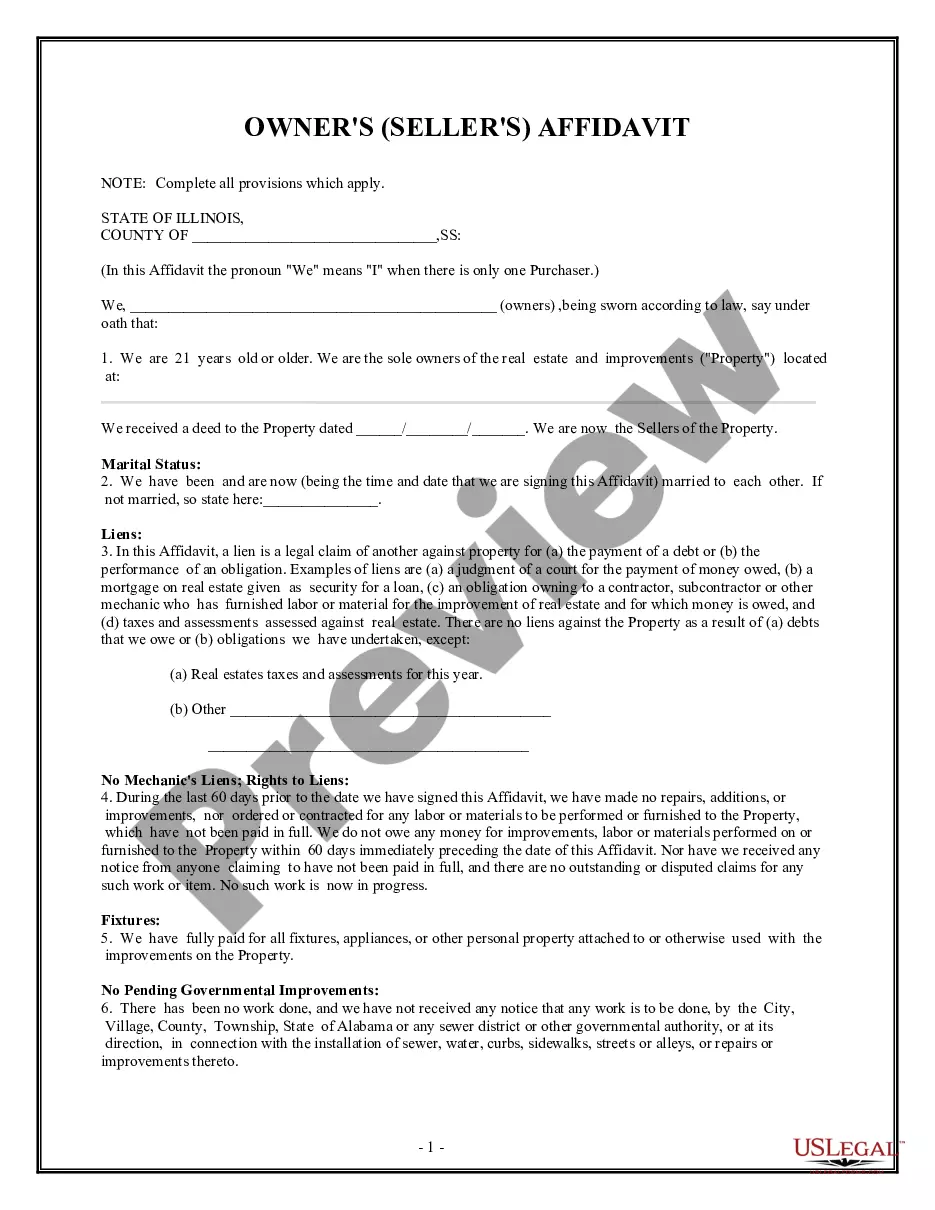

Illinois Owner's or Seller's Affidavit of No Liens

About this form

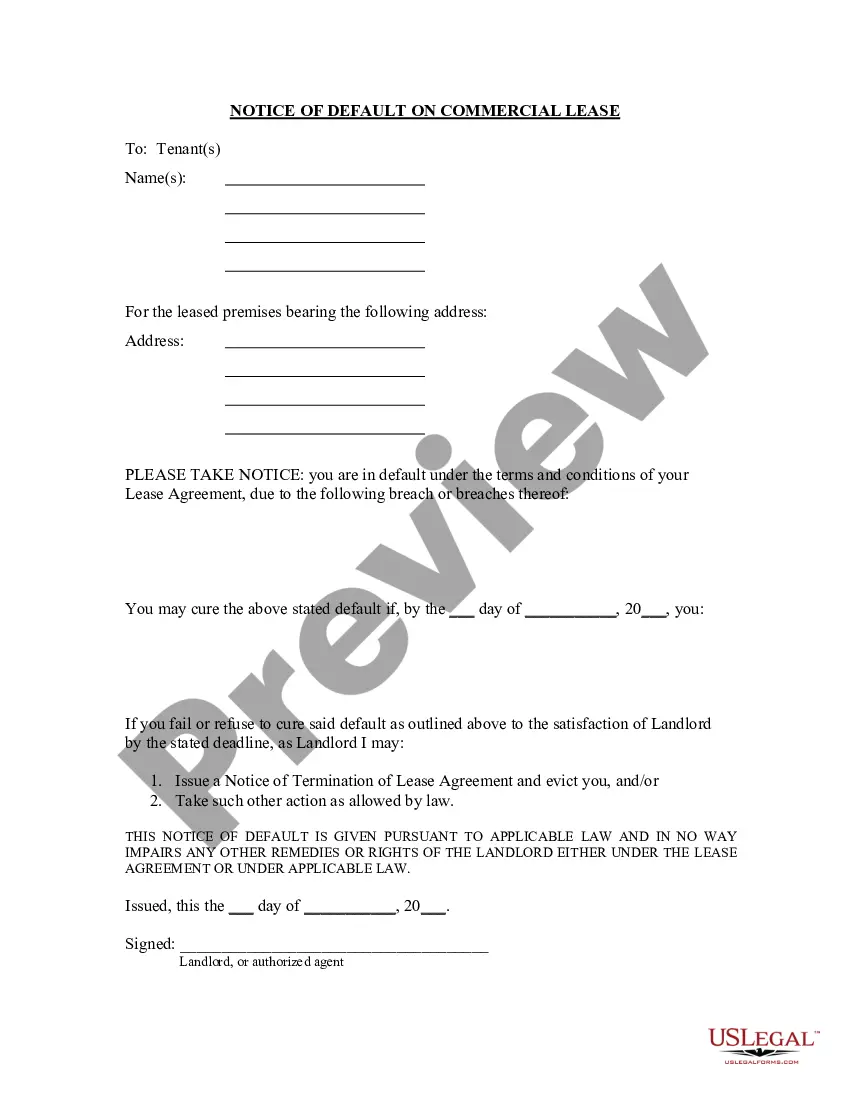

The Owner's or Seller's Affidavit of No Liens is a legal document that sellers sign at the time of closing to certify that they own the property free of any liens. This affidavit assures buyers and lenders that the property being sold is clear of legal claims, mechanic liens, and other obligations. It is a critical document in real estate transactions, ensuring the title is clean and transferable, distinguishing it from other real estate forms which may not require such certifications.

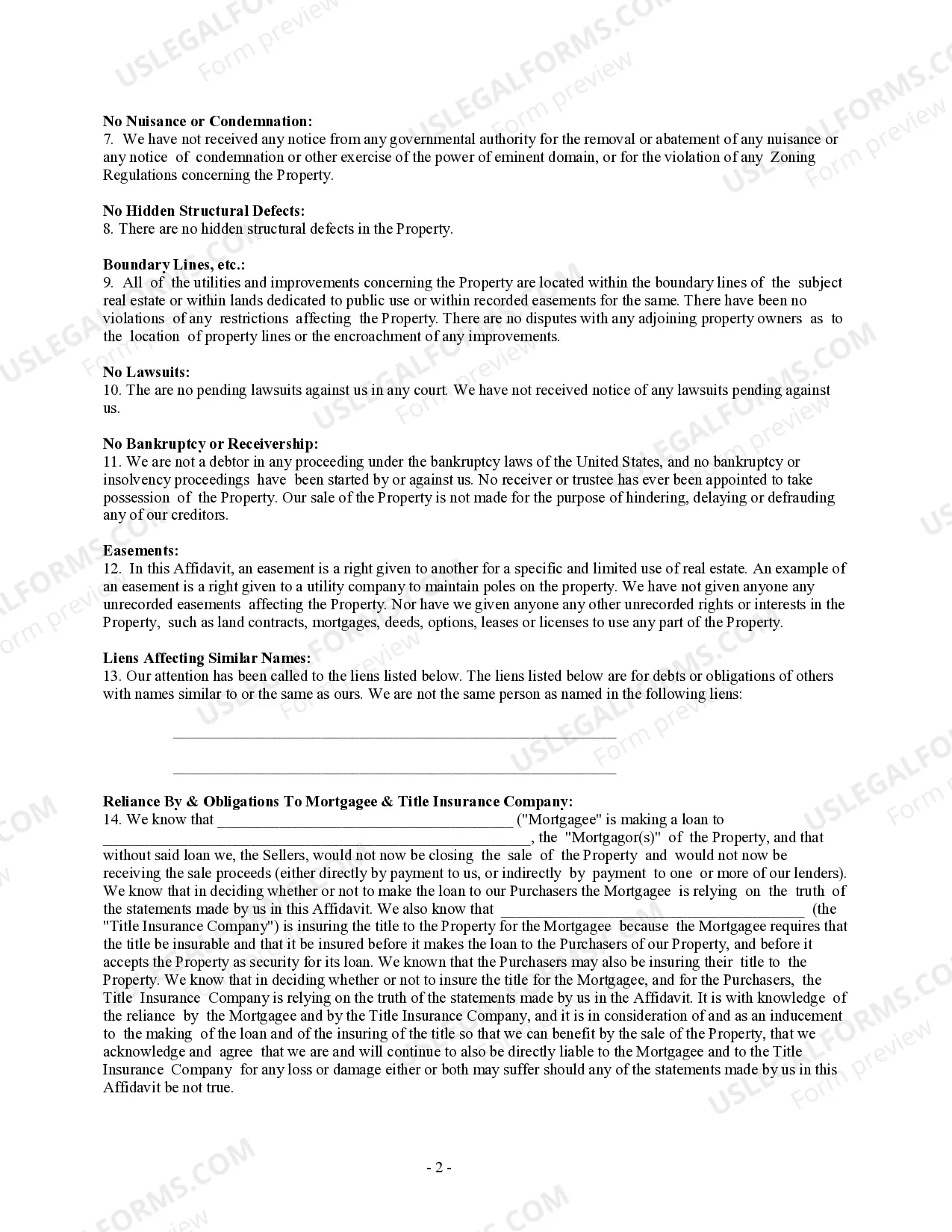

Form components explained

- Identification of the seller(s) and property details.

- Certification of ownership and marital status of the sellers.

- Declaration of the absence of liens or disputes related to the property.

- Statements regarding no pending governmental improvements or notices.

- Affirmation of having no hidden structural defects.

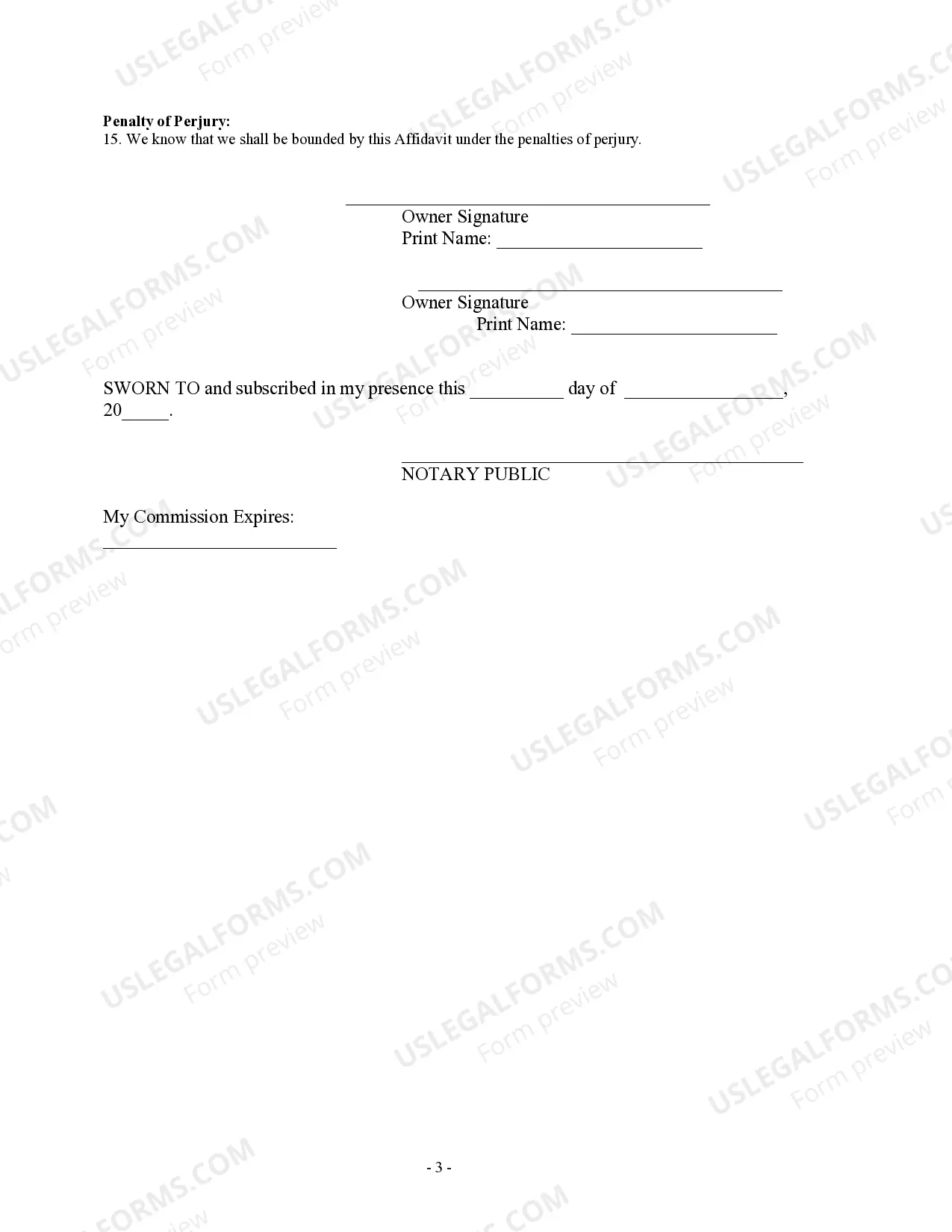

- Signing and notarization requirements.

When to use this document

This affidavit should be used during the closing process of a real estate transaction when sellers confirm they have no outstanding debts or obligations against the property. It is essential for ensuring a smooth transfer of ownership and protecting all parties involved from future disputes related to liens or other encumbrances.

Who this form is for

- Sellers of real estate properties.

- Buyers who need assurance of clear title on the property they intend to purchase.

- Real estate agents facilitating the closing process.

- Title companies reviewing documentation during closing.

How to prepare this document

- Identify and enter the names of the seller(s) and the property details.

- Certify the marital status of the sellers and whether they are the sole owners.

- Declare any known liens or obligations against the property, if applicable.

- Sign the affidavit in the presence of a notary public.

- Ensure the document is notarized to validate the affirmations made.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Common mistakes

- Failing to accurately disclose any existing liens or judgments.

- Not having the document signed by all sellers involved.

- Overlooking the notarization requirement.

- Incompletely filling out the property details section.

Summary of main points

- Use this affidavit to confirm the absence of liens on a property during real estate transactions.

- Ensure all relevant information is accurately completed to avoid issues at closing.

- Signing and notarization are essential for the validity of the affidavit.

- This document provides peace of mind for buyers and lenders regarding the property's title status.

Form popularity

FAQ

Most states now have additional tools available for free property title searches. You can find these on your state government sites under "county assessor." You will have to select your county, and you can then search through the listed properties.

Does title insurance protect against unrecorded property liens? A homeowner's title insurance policy doesn't usually cover any unrecorded debt. A Municipal Lien Search will find any unrecorded debt or issues that a traditional title search could miss.

Address of the property; Full names of the owner and the transferee, who will receive the property; Personal details of both parties; All costs the new proprietor assumes.

The title search performed in the prelim title discovers whether or not there are any liens against the title, which would typically be placed by a lender on the property. They also may have you sign a document stating that there are no liens that are not recorded. If there are not, just sign it. Bingo.

A mortgage affidavit is a written statement signed by a party in a real estate transaction under penalties of perjury that attests to certain conditions of the property.

A statement showing that your balance is paid in full. Your canceled promissory note. A certificate of satisfaction. Your canceled mortgage or deed of trust.

The general warranty deed is the standard instrument for home sales. Your notarized warranty deed is proof of ownership, and that the grantor transferred complete and clear title to you. A quitclaim deed also proves full land ownershipif the person who conveyed the interest to you had full ownership.

In most states, you can typically search by address with the county recorder, clerk, or assessor's office online. The search for liens is free, though you may have to pay a small fee for a copy of the report, which will vary by county.

An Owner Affidavit is a document used by title and closing agencies to ensure that the current owner of a property is in ownership of the property free and clear of any encumbrances.The Owner Affidavit places the seller on the hook for any claims that may arise that are not covered by the title insurance policy.