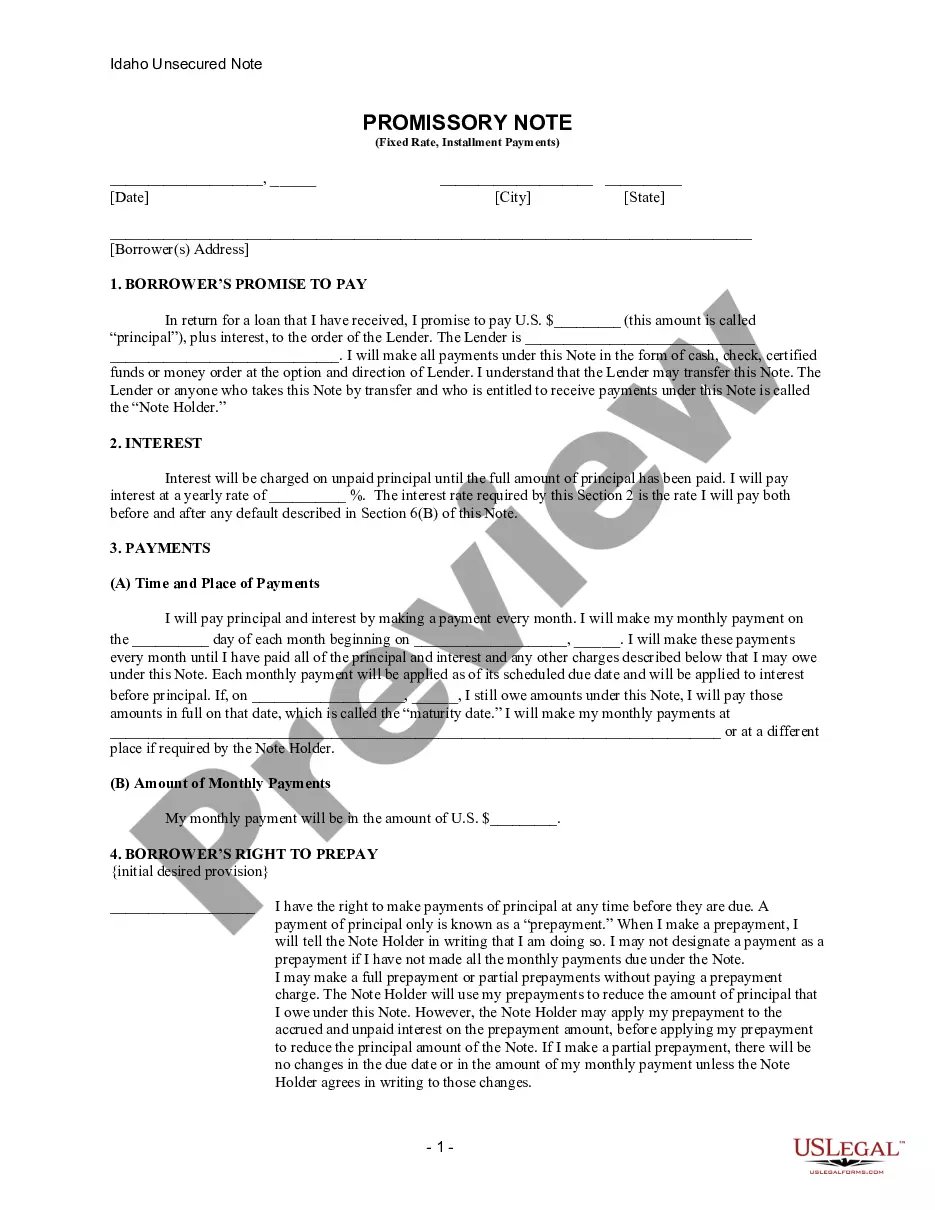

Idaho Unsecured Installment Payment Promissory Note for Fixed Rate

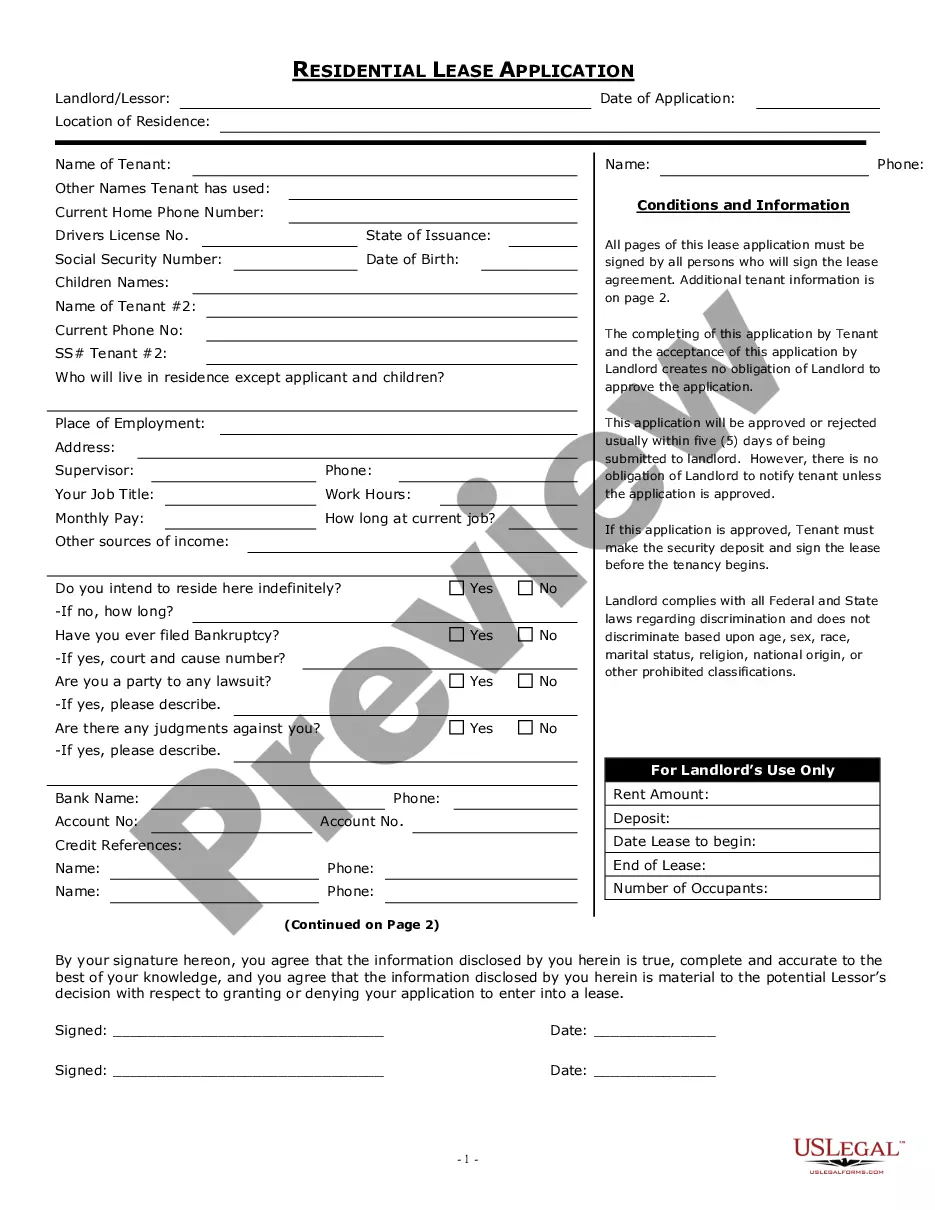

What is this form?

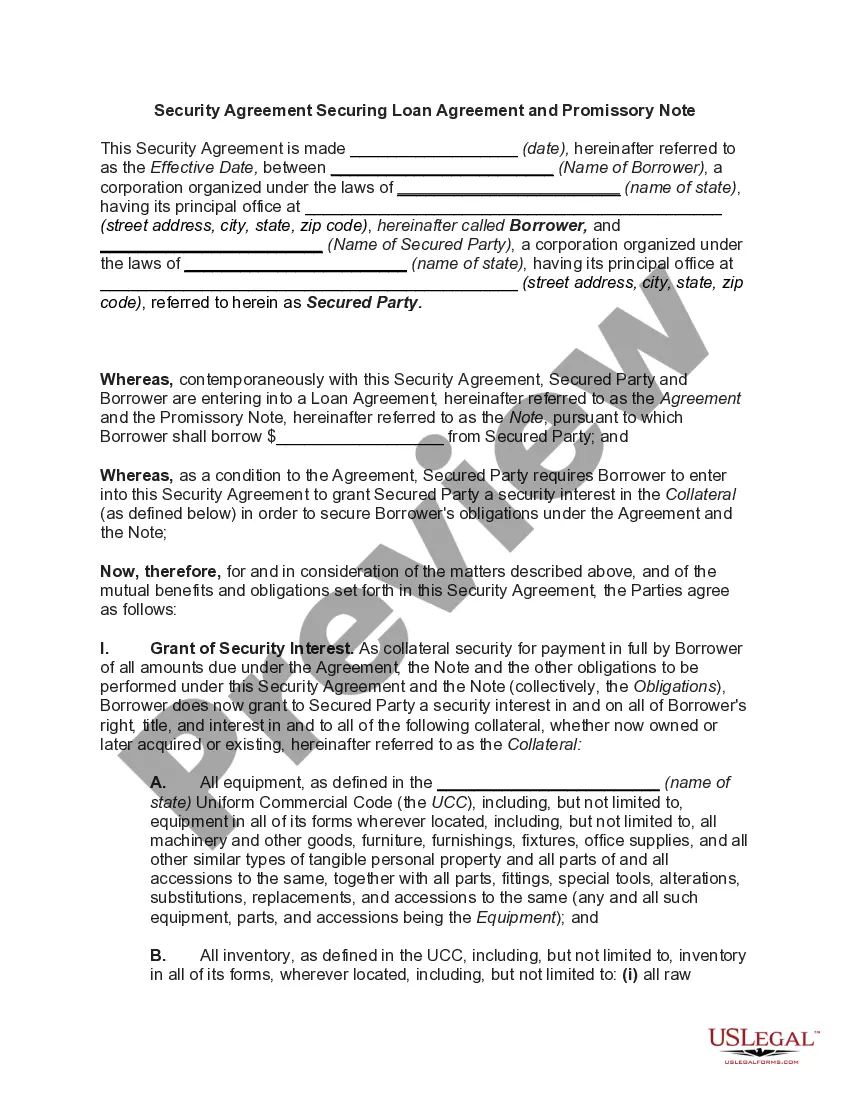

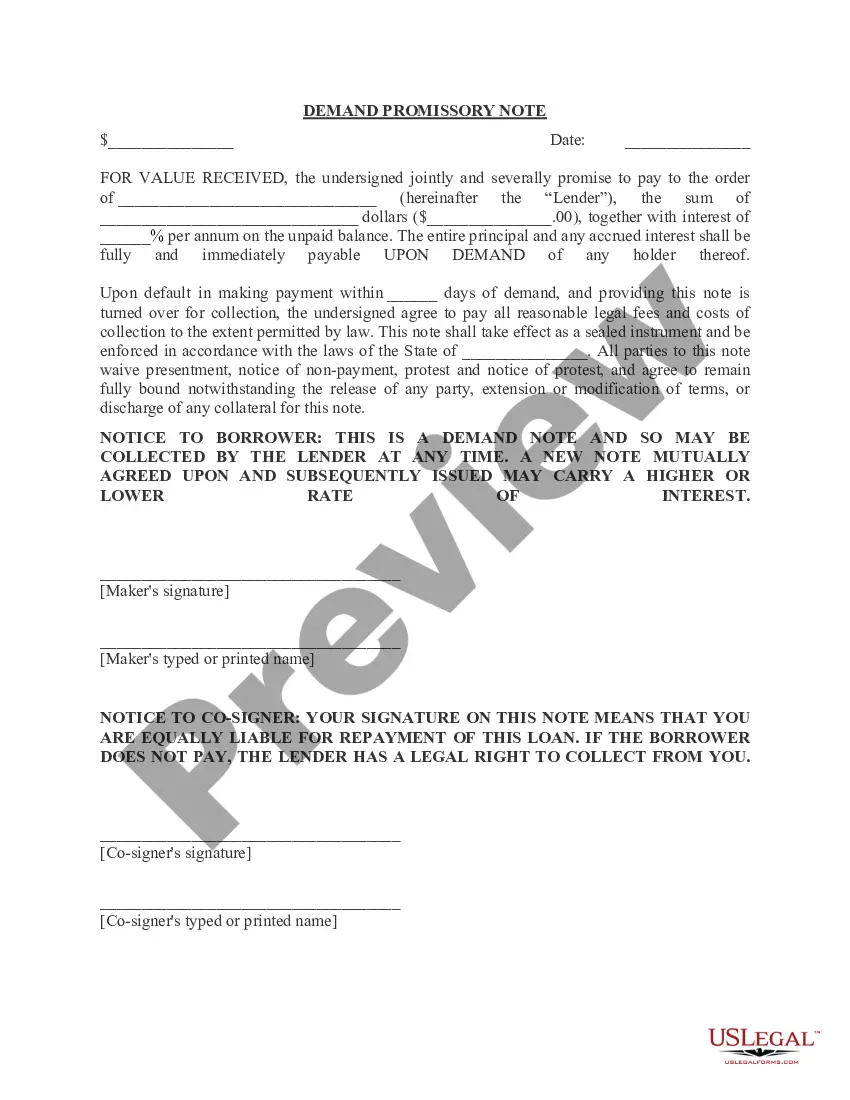

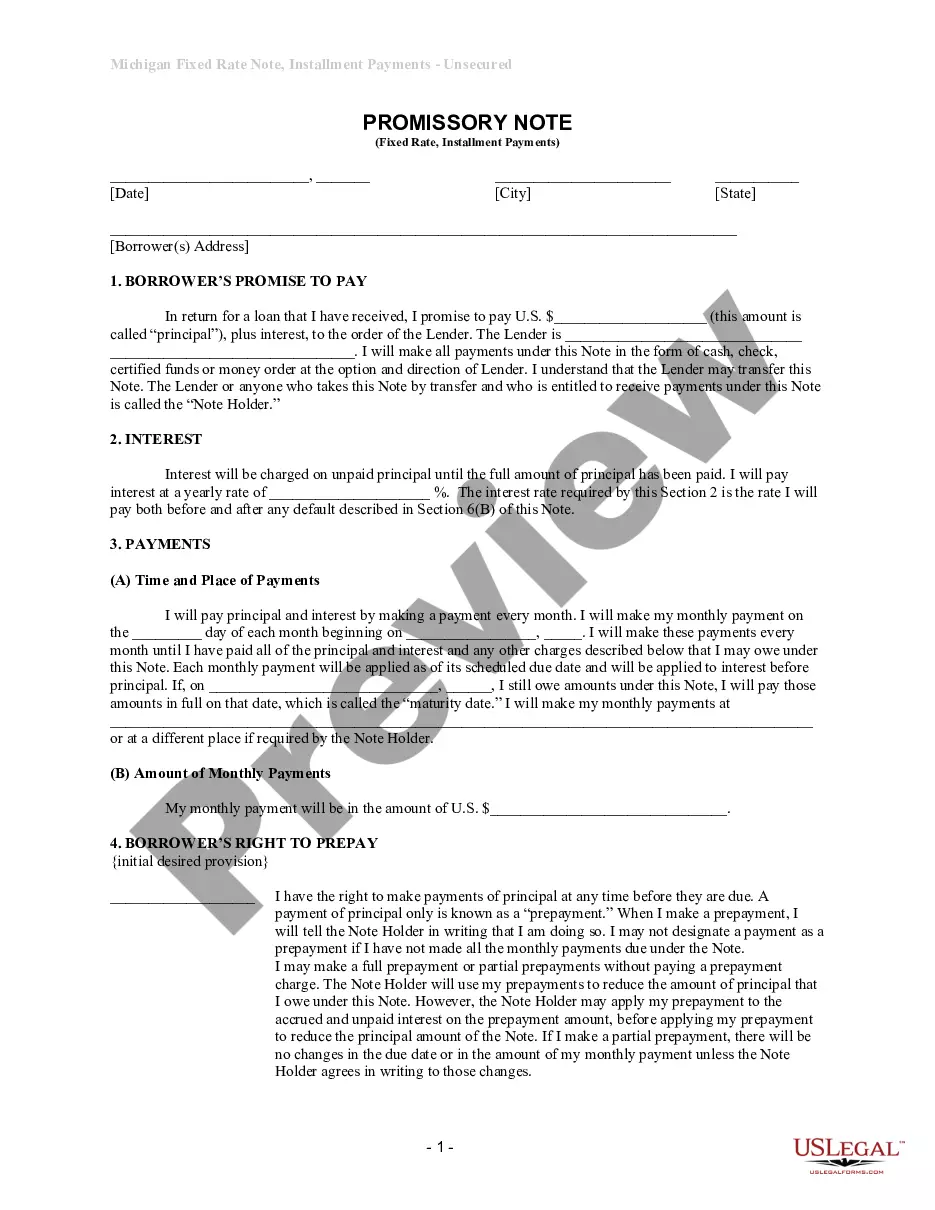

The Idaho Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document where a borrower agrees to repay a loan amount with a fixed interest rate in regular installment payments. Unlike secured notes, this promissory note does not require collateral, which means that the lender cannot claim specific assets if the borrower defaults. This form is essential for establishing clear terms regarding repayment schedules, interest rates, and borrower obligations.

Form components explained

- Borrower's promise to pay the specified principal amount plus interest.

- Clear definition of the interest rate applicable to the loan.

- Schedule for monthly payments and the maturity date for full repayment.

- Right for the borrower to prepay the loan without incurring extra charges.

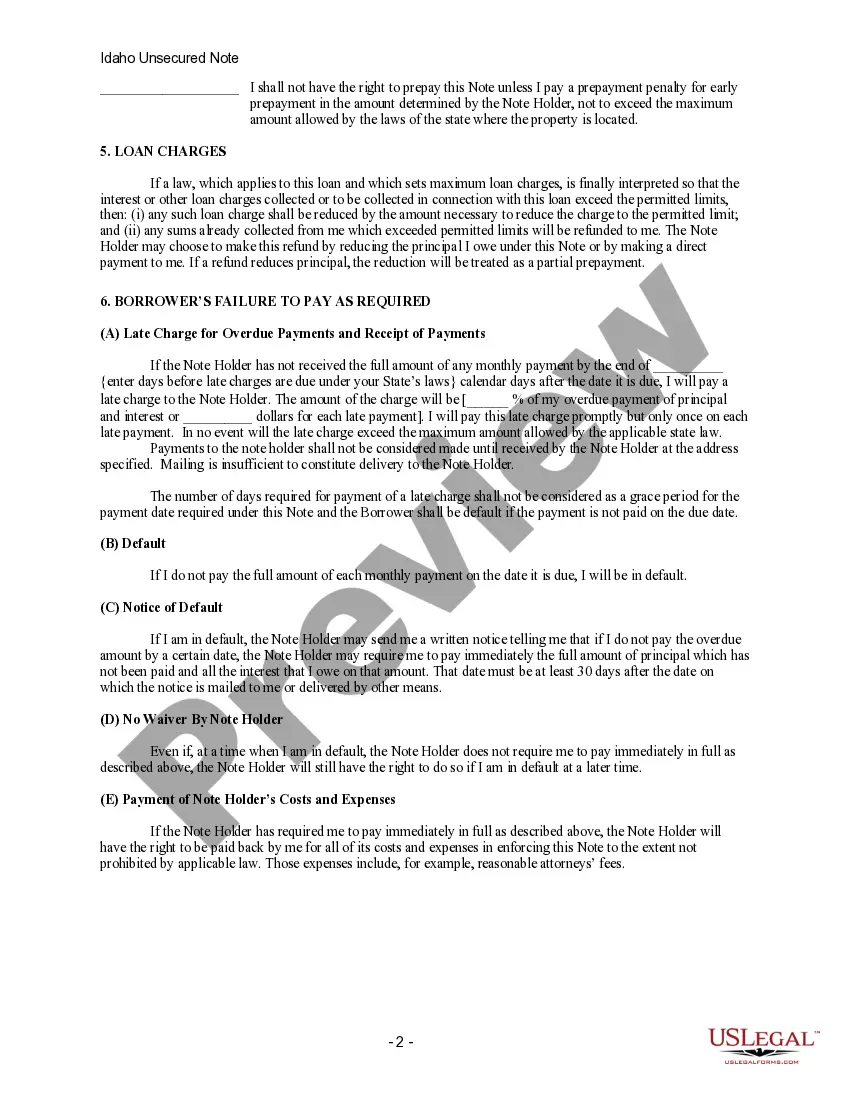

- Provisions detailing late fees for overdue payments and the consequences of defaulting.

- Notice requirements for both parties regarding any changes or defaults.

When to use this form

This form should be used when a lender provides a loan to a borrower without requiring collateral to secure the repayment. It is ideal for personal loans, informal agreements between friends or family, or small business loans where both parties agree on the terms of repayment. This promissory note helps protect the lender's rights while providing the borrower with a clear understanding of their obligations.

Who should use this form

This form is suitable for:

- Individuals who need to borrow money without collateral.

- Lenders who want a formal agreement to document a loan.

- Borrowers seeking to establish a clear repayment plan for their loan.

- Parties involved in a personal loan transaction where terms need to be clarified.

How to complete this form

- Identify the borrower by entering their full name and address at the top of the form.

- State the amount of money being borrowed, known as the principal, and the agreed-upon interest rate.

- Specify the payment schedule, including the amount of monthly payments and the maturity date for full repayment.

- Indicate if the borrower retains the right to make early payments, noting any prepayment penalties if applicable.

- Both the borrower and the lender should sign and date the form to make it legally valid.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Not clearly specifying the interest rate, which can lead to misunderstandings.

- Failing to enter the payment schedule accurately may confuse payment expectations.

- Omitting to sign the document, which renders it legally unenforceable.

- Not notifying the lender in writing when making a prepayment.

Advantages of online completion

- Convenience of downloading the form when needed, allowing for immediate use.

- Editable format to customize terms according to specific lending arrangements.

- Access to templates drafted by licensed attorneys, ensuring legal compliance.

- Easy storage and retrieval of the document for both parties involved.

Looking for another form?

Form popularity

FAQ

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied. When the loan is paid off, the trustee automatically records a deed of reconveyance at the county recorder's office for safekeeping.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

No. California promissory notes do not need to be notarized or witnessed for validity.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.