This form package provides the forms necessary to form a professional corporation for the practice of a licensed profession in the State of Georgia.

Professional Corporation Package for Georgia

Description

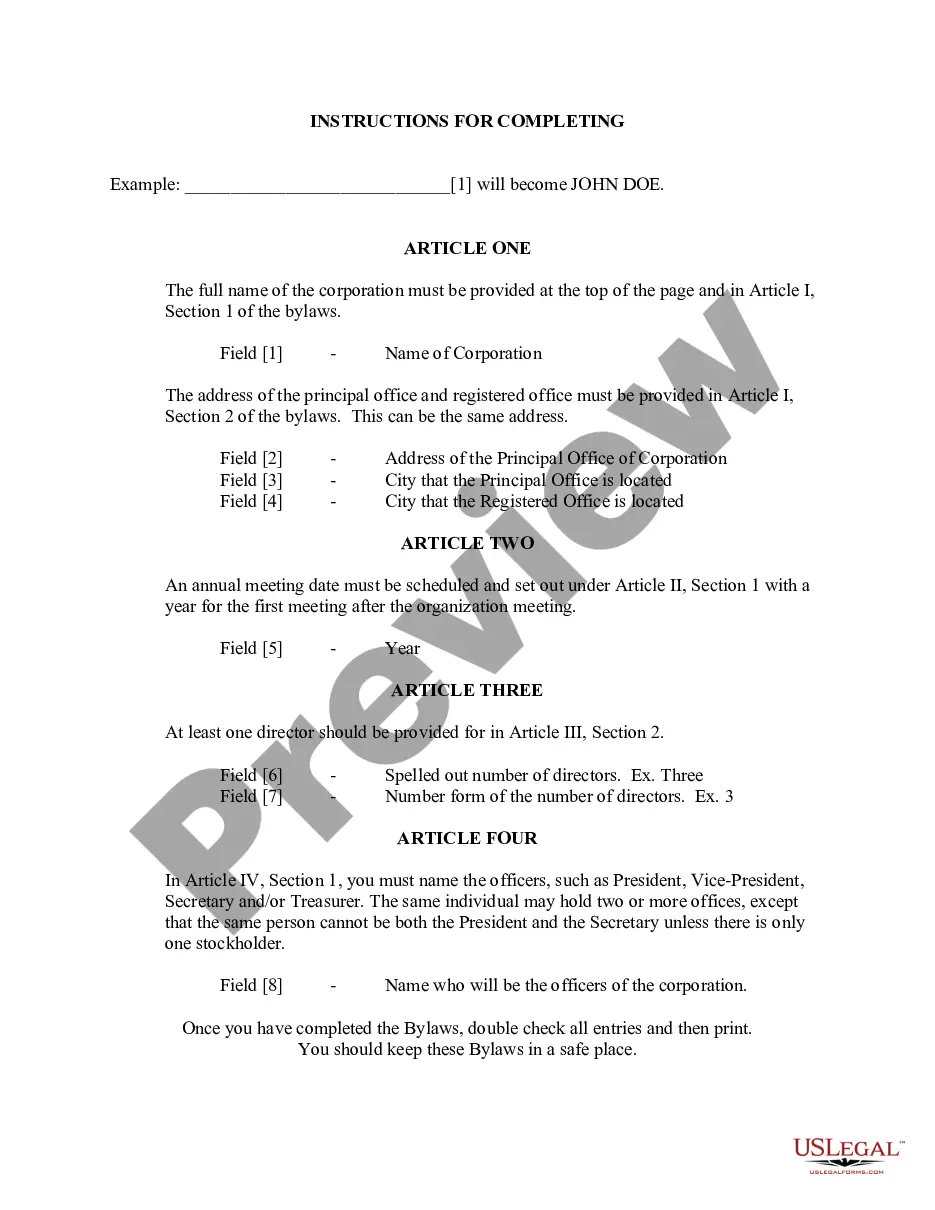

How to fill out Professional Corporation Package For Georgia?

Among countless paid and complimentary samples that you can obtain online, you cannot guarantee their precision and dependability.

For instance, who authored them or if they possess sufficient qualifications to manage what you need them for.

Stay composed and utilize US Legal Forms!

Review the document by perusing the description with the Preview function. Click Buy Now to initiate the purchasing process or discover a different template using the Search box in the header. Select a pricing plan and set up an account. Make payment for the subscription with your credit/debit card or Paypal. Download the form in the necessary file format. Once you have registered and purchased your subscription, you can use your Professional Corporation Package for Georgia as frequently as you wish or for the duration it remains valid in your region. Modify it in your preferred offline or online editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- Obtain the Professional Corporation Package for Georgia templates crafted by experienced legal professionals and evade the costly and time-consuming task of seeking an attorney.

- This way, you won’t have to compensate them to draft documents for you that you can easily locate yourself.

- If you hold a subscription, Log In to your account and locate the Download button adjacent to the file you need.

- You will also have access to all your previously downloaded files in the My documents section.

- If you are using our platform for the first time, adhere to the steps below to swiftly acquire your Professional Corporation Package for Georgia.

- Confirm that the document you find is legitimate in your jurisdiction.

Form popularity

FAQ

The primary difference between a Professional Limited Liability Company (PLLC) and an S corporation lies in their liability protections and taxation methods. A PLLC offers flexibility in management and fewer formalities, whereas an S corporation entails specific operating requirements. If you're weighing these options, consider the benefits of our Professional Corporation Package for Georgia, which guides you through making the best decision for your professional practice.

For tax purposes, a professional corporation can elect to be taxed as a C corporation or an S corporation, depending on its goals for income distribution and tax benefits. This decision affects how profits are taxed and the way income is reported. If you're exploring your options, our Professional Corporation Package for Georgia can clarify how different tax structures may impact your practice.

To form an S corporation in Georgia, you first need to register your business as a corporation with the state, then file Form 2553 with the IRS to elect S corporation status. Additionally, ensuring your business meets specific eligibility requirements is crucial. Using the Professional Corporation Package for Georgia simplifies the process and offers the necessary forms and guidance to set your S corporation up effectively.

Not necessarily; a professional corporation and an S corporation are different, even though a professional corporation can elect to be treated as an S corporation. A professional corporation is often used by licensed professionals in fields like law or medicine, while S corporations can be set up by many types of businesses. If you're unsure, the Professional Corporation Package for Georgia provides the information you need to get started.

Yes, a Professional Service Corporation (PSC) can elect to be treated as an S corporation for tax purposes. This allows the PSC to benefit from pass-through taxation while still maintaining its professional status. If you're considering the Professional Corporation Package for Georgia, you can receive guidance on this election and its advantages for your business.

A professional corporation is not exactly the same as an S corporation. While both structures offer limited liability protection for owners, a professional corporation is specifically designed for licensed professionals in Georgia. The Professional Corporation Package for Georgia can help you understand the nuances of these entities and ensure you choose the right option for your needs.

Not filing an annual report for your LLC can have serious repercussions, including penalties and possible dissolution. This can put your business at risk and affect your personal liability protections. To avoid these issues, consider our Professional Corporation Package for Georgia, which simplifies the compliance process and keeps your LLC in good standing.

Yes, Georgia mandates that LLCs file an annual report. Failure to do this could result in a lapse in your business’s legal standing. Our Professional Corporation Package for Georgia includes resources that guide you through this process, ensuring that your LLC remains compliant and active.

If you fail to renew your LLC in Georgia, it may be administratively dissolved. This dissolution can lead to loss of protections and rights associated with your business. By choosing our Professional Corporation Package for Georgia, you receive assistance with ongoing maintenance and renewals, helping you stay compliant.

In Georgia, LLCs are required to file an annual report every year. This report is essential for maintaining your good standing with the state. With our Professional Corporation Package for Georgia, you can streamline the process of annual reporting and ensure that you meet all necessary requirements without hassle.