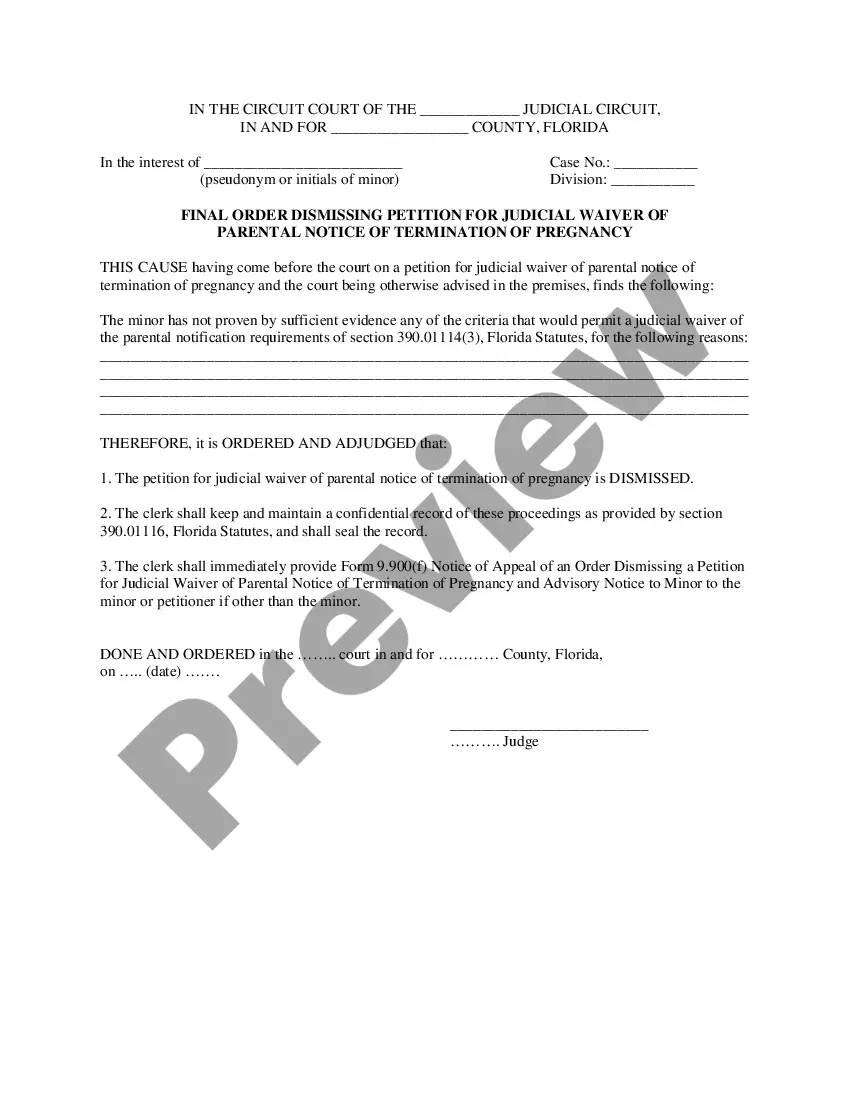

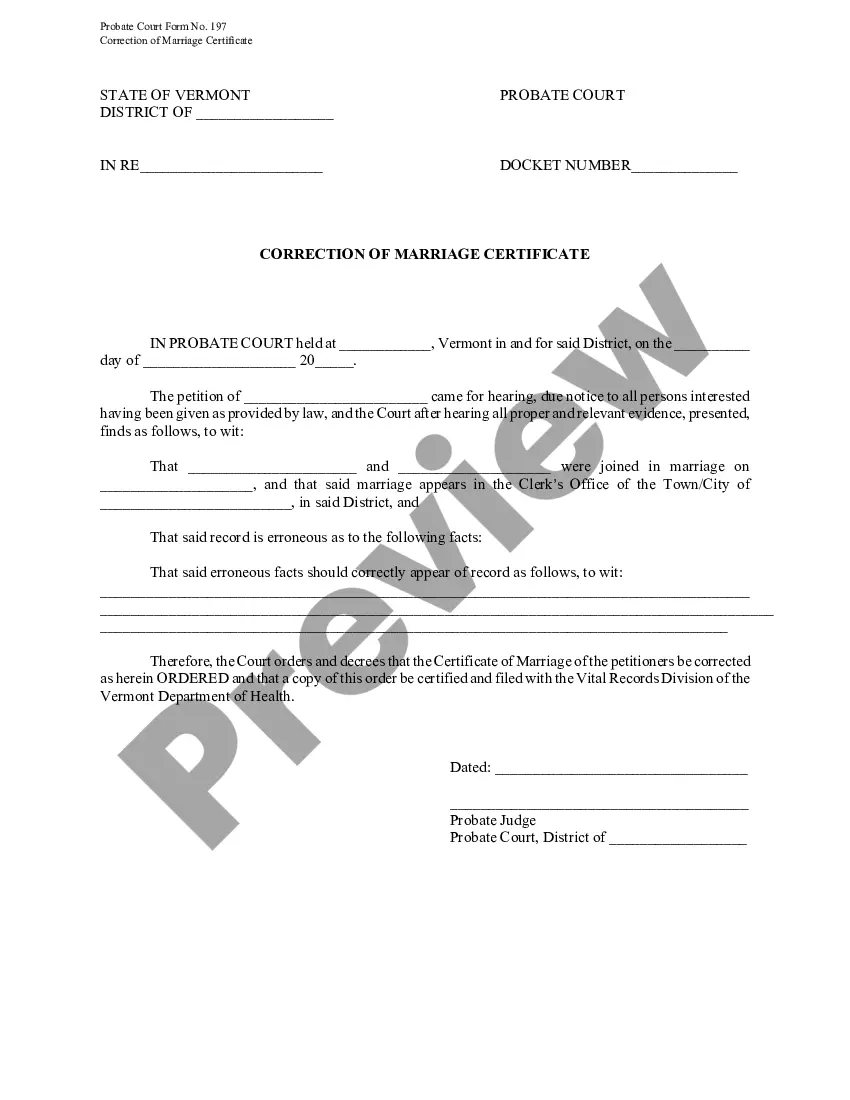

This is one of the official workers' compensation forms for the state of Georgia.

Georgia Notice Of Payment Or Suspension Of Death Benefits for Workers' Compensation

Description

How to fill out Georgia Notice Of Payment Or Suspension Of Death Benefits For Workers' Compensation?

Gain entry to the most comprehensive collection of legal documents.

US Legal Forms serves as a resource to locate any state-specific document in just a few clicks, such as the Georgia Notice Of Payment Or Suspension Of Death Benefits for Workers' Compensation templates.

No need to spend countless hours searching for an admissible form in court. Our certified professionals guarantee that you receive the most current examples each time.

Utilize the Preview feature if it’s available to examine the document's details. If everything appears correct, click Buy Now. After selecting a pricing option, create an account. Make payment via credit card or PayPal. Download the template to your device by clicking Download. That's all! You should submit the Georgia Notice Of Payment Or Suspension Of Death Benefits for Workers' Compensation form and review it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and conveniently browse over 85,000 useful forms.

- To utilize the forms library, select a subscription and register an account.

- If you have already done so, simply Log In and then click Download.

- The Georgia Notice Of Payment Or Suspension Of Death Benefits for Workers' Compensation document will automatically be saved in the My documents section (a section for all documents you download from US Legal Forms).

- To establish a new profile, follow the brief guidelines below.

- If you need to use a state-specific template, be sure to specify the correct state.

- If possible, review the description to comprehend all the details of the form.

Form popularity

FAQ

En espanol Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if he or she was living with the deceased; or, if living apart, was receiving certain Social Security benefits on the deceased's record.

Form SSA-8 Information You Need To Apply For Lump Sum Death Benefit. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office.

The Canada Pension Plan (CPP) survivor's pension is paid to the person who, at the time of death, is the legal spouse or common-law partner of the deceased contributor. If you are a separated legal spouse and the deceased had no cohabiting common-law partner, you may qualify for this benefit.

A widow or widower age 60 or older (age 50 or older if disabled). A surviving divorced spouse, under certain circumstances. A widow or widower at any age who is caring for the deceased's child who is under age 16 or disabled and receiving child's benefits.

Form SSA-8 Information You Need To Apply For Lump Sum Death Benefit. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office.

En espanol Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies.For example, a policyholder may specify that the beneficiary receives half of the benefit immediately after death and the other half a year after the date of death.

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if he or she was living with the deceased; or, if living apart, was receiving certain Social Security benefits on the deceased's record.