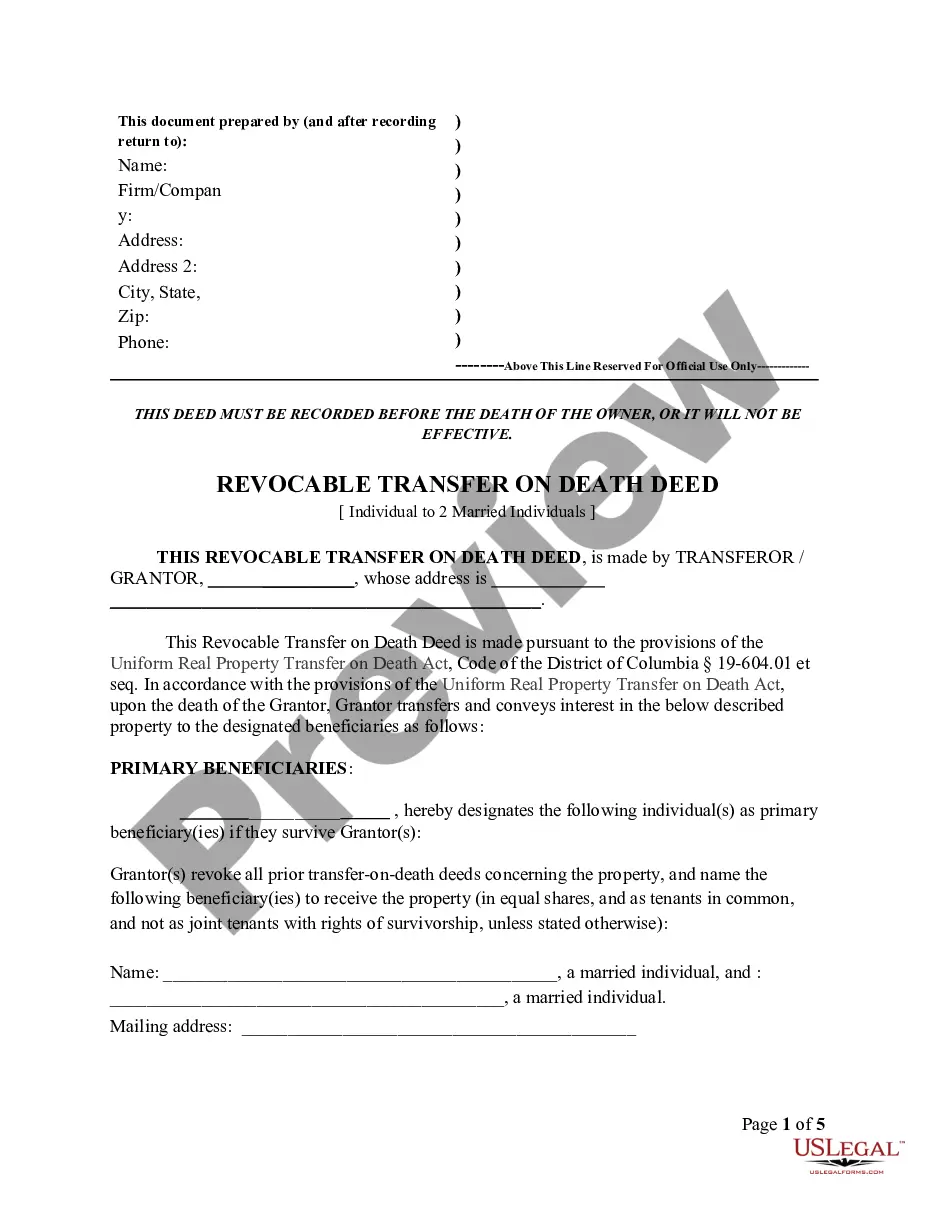

Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries - District of Columbia

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Husband And Wife Beneficiaries?

Utilize US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for an Individual to a Couple Beneficiaries.

Our court-acceptable forms are created and regularly revised by expert attorneys.

Ours is the most thorough forms library available online and offers economical and precise templates for clients, legal practitioners, and small to medium-sized businesses.

US Legal Forms provides a vast array of legal and tax documents and packages for both business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for an Individual to a Couple Beneficiaries. Over three million users have successfully used our platform. Choose your subscription plan and access high-quality documents in just a few clicks.

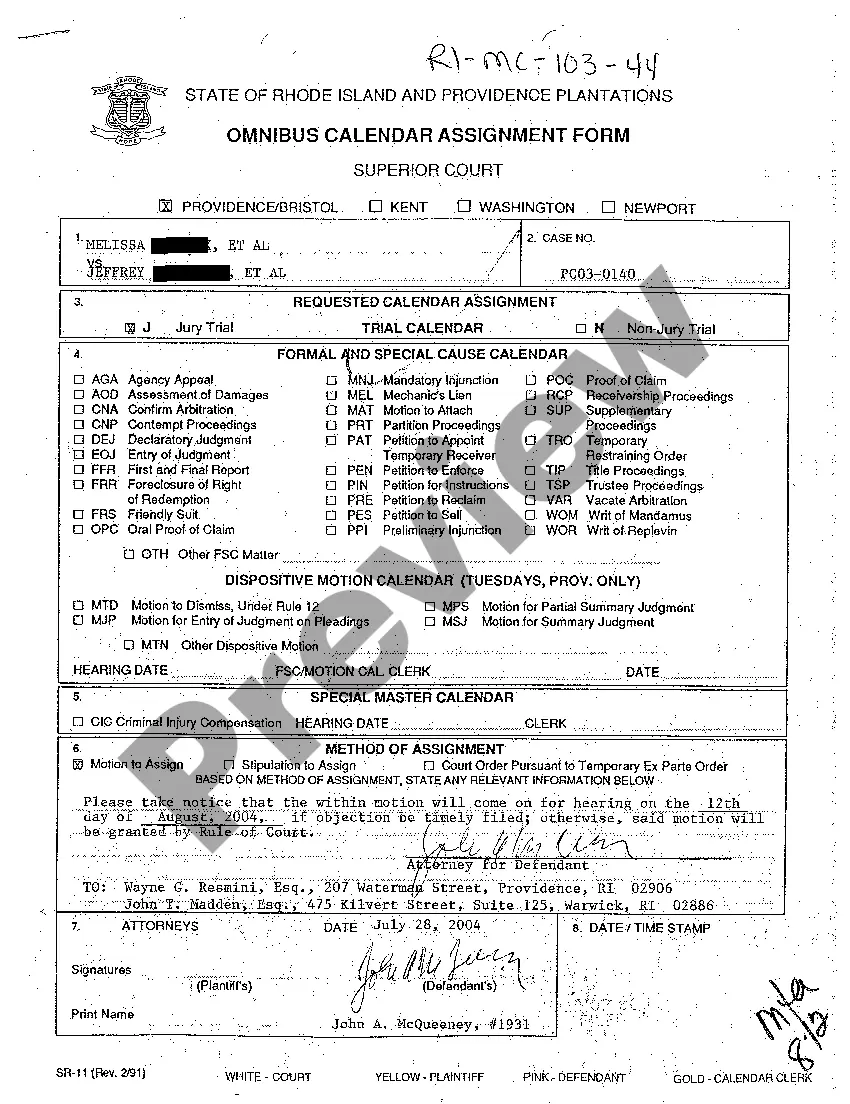

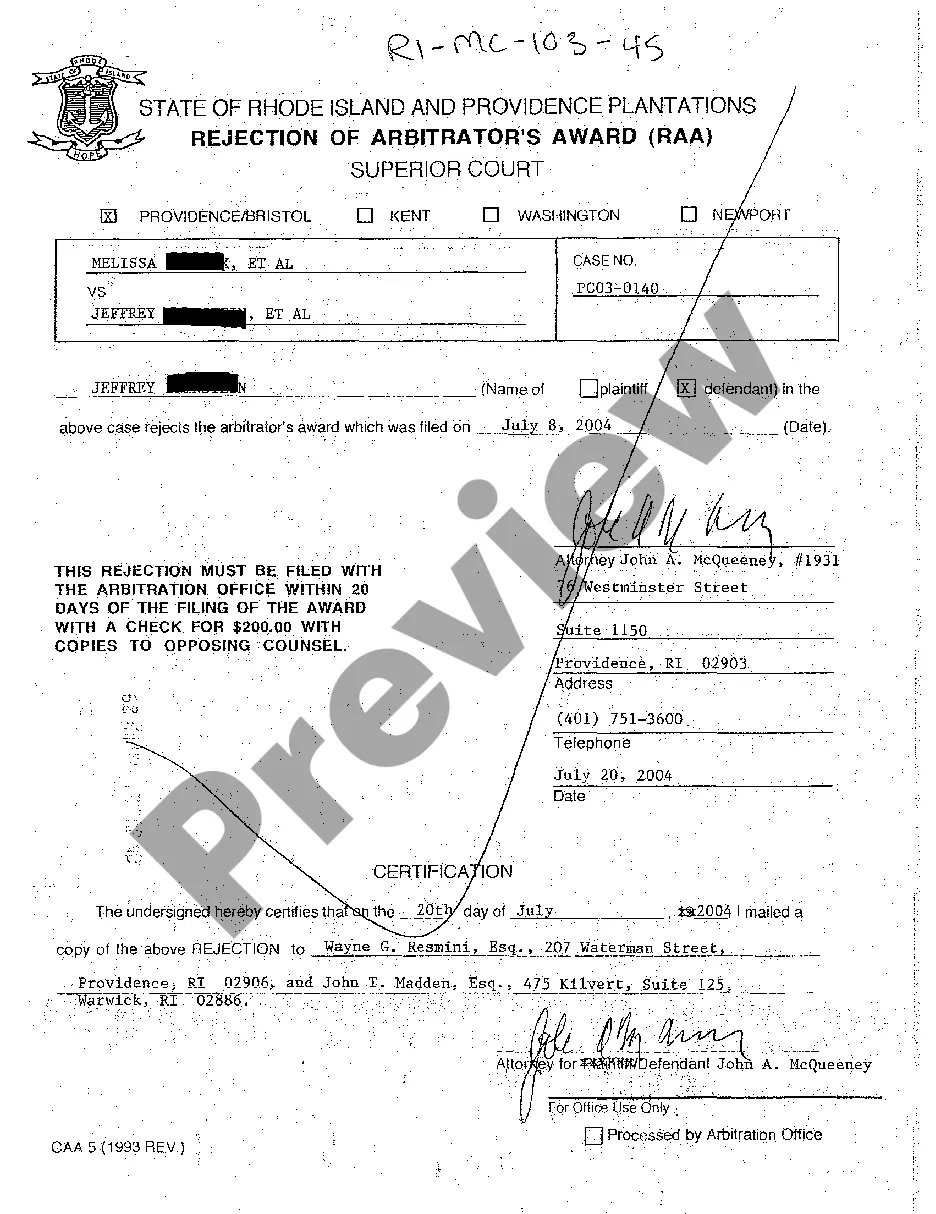

- Ensure you select the correct template corresponding to the necessary state.

- Examine the form by reading its description and using the Preview option.

- Click Buy Now if it is the document you wish to acquire.

- Create your account and make payment via PayPal or credit card.

- Download the template to your device and feel free to use it multiple times.

- Utilize the Search engine if you wish to locate another document template.

Form popularity

FAQ

Choosing between a TOD and a beneficiary designation depends on your personal circumstances and the type of asset involved. Generally, a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries is often advantageous because it simplifies the process and avoids probate. However, it's wise to consult with a legal expert to evaluate which option aligns best with your estate planning goals.

A Transfer on Death Deed (TOD) specifically refers to the legal document that facilitates the transfer of property upon the death of the owner. On the other hand, a beneficiary is the person designated to receive that property. In this case, once a valid District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries is executed, the named beneficiaries gain rights to the property after the owner's passing.

Yes, Washington, D.C. allows for the implementation of the Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries. This legal instrument enables property owners to designate beneficiaries who will automatically receive the property upon their death, thereby avoiding probate. This can simplify the transfer of property and make the process much more efficient for your loved ones.

TOD accounts can be a beneficial financial tool for transferring assets smoothly upon death. They allow account holders to maintain control while alive and bypass the lengthy probate process. However, it's crucial to evaluate your unique financial situation and perhaps consult with a financial advisor or a legal expert to determine the best approach for your needs, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries.

One disadvantage of a District of Columbia Transfer on Death Deed or TOD is that it only transfers property upon the death of the owner, leaving no benefits while the owner is alive. Additionally, if the property value increases significantly, heirs may face estate tax implications. It is also important to consider that while a TOD deed avoids probate, it does not protect against creditors' claims against the estate.

While it's not legally required to have an attorney for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries, it is often advisable. An attorney can help ensure that all legal aspects are correctly addressed, reducing the risks of errors or complications later on. Professionals can also explain the implications of the deed and guide you through the filing process, providing peace of mind.

Transfer on death deeds have several disadvantages to consider. For instance, they do not provide protection against creditors, meaning debts could impact the property after the owner passes. Moreover, if the beneficiary cannot accept the property for any reason, complications may arise. When choosing a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries, weighing these factors is essential. For more insights, consider consulting uslegalforms.

One significant disadvantage of a transfer on death deed is that it cannot be used to transfer property if the owner is unable to execute the deed due to incapacity. Additionally, any changes in the law could impact its effectiveness. Understanding these limitations is crucial when considering a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries. Engaging with uslegalforms can help clarify specifics for your situation.

While it is not a legal requirement to hire a lawyer to create a transfer on death deed, consulting with one can offer benefits. A lawyer can ensure your District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries adequately meets legal standards and reflects your wishes. Additionally, they can help navigate any specific considerations related to your situation. You can also utilize uslegalforms for helpful templates.

Several states recognize transfer on death deeds as a means of property transfer, including but not limited to states like Arizona, California, and Nevada. These designated forms provide a seamless transfer option similar to the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Husband and Wife Beneficiaries. Always check local laws, as they may vary widely. For tailored documentation, uslegalforms can guide you.