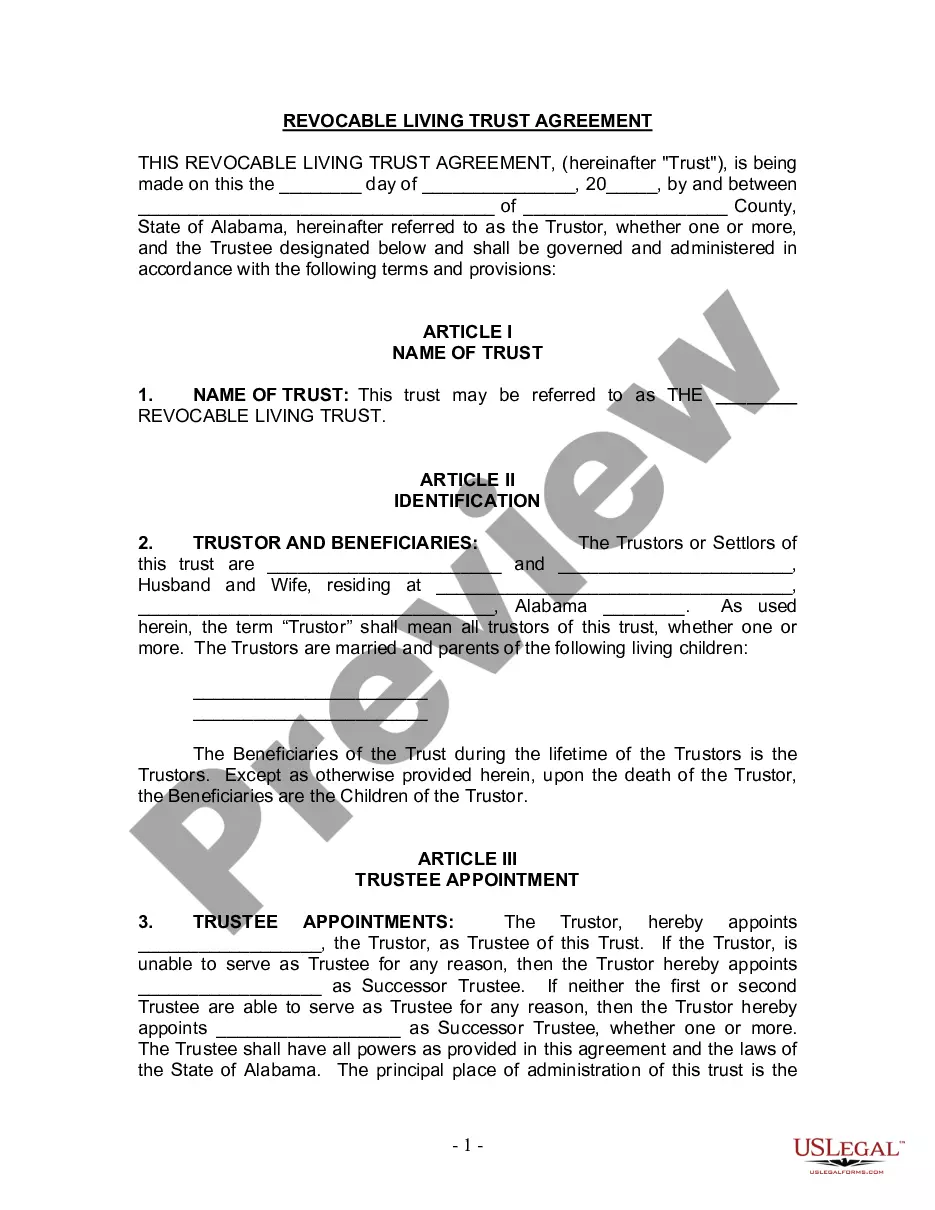

This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out District Of Columbia Living Trust For Husband And Wife With Minor And Or Adult Children?

The larger quantity of documents you must prepare - the more anxious you feel.

You can discover a vast array of District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children templates online, but you are uncertain which ones to trust.

Eliminate the trouble of identifying samples with US Legal Forms more effortlessly.

Select a convenient document format and download your template. Access every document you acquire in the My documents section. Just visit there to draft a new version of the District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children. Even when utilizing professionally created templates, it remains essential to consider consulting a local attorney to double-check the completed form to ensure your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you will locate the Download option on the webpage for the District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children.

- If you’ve not utilized our service before, complete the registration process by following these steps.

- Confirm that the District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children is applicable in your locality.

- Review your choice by reading the description or using the Preview feature if available for the selected document.

- Click on Buy Now to initiate the sign-up process and choose a pricing plan that suits your requirements.

- Enter the necessary details to create your account and complete the purchase with PayPal or a credit card.

Form popularity

FAQ

Generally, the most suitable living trust for a married couple is a revocable living trust. This trust allows both spouses to maintain control and make changes as needed throughout their lives. By utilizing a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children, couples can efficiently manage their assets, protect their legacy, and ensure that their children's future is secure.

When planning for adult children, many families prefer a revocable living trust as it provides flexibility and control over asset distribution. This type of trust allows parents to manage their assets during their lifetime and seamlessly pass them onto their adult children afterward. Utilizing a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children ensures that your wishes are clearly laid out, and any potential conflicts are minimized.

Husbands and wives might choose to have separate trusts for various reasons. One significant reason is to protect individual assets from each other’s financial issues or liabilities. Additionally, separate trusts allow each spouse to specify unique distributions for their children, whether they are minor or adult, making the management of the District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children more personalized.

One of the biggest mistakes parents make is failing to fund the trust appropriately. When establishing a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children, it is essential to ensure all intended assets are transferred into the trust. Neglecting this step can defeat the purpose of your trust and complicate future asset management.

Whether a husband and wife should have separate living trusts depends on individual circumstances. In some cases, a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children may work best when jointly managed. On the other hand, separate trusts can offer more tailored control over each person's assets and wishes.

Yes, establishing a living trust without your husband is possible. It is important to remember, however, that a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children benefits from collaboration. Jointly planning can enhance your trust strategy and ensure your family's needs are fully met.

To create a living trust in Washington, D.C., start by drafting the trust document outlining your assets and beneficiaries. Then, fund the trust by transferring your assets into it. For effective guidance, consider using platforms like uslegalforms, which can help you navigate the specifics of a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children.

Yes, you can create a trust without your spouse. However, if you are considering a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children, it is beneficial to involve your spouse. Working together allows for a more comprehensive approach to managing assets and planning for the future of your children.

Yes, a trust is indeed state dependent, which means the laws governing trusts rely on the state where the trust is created. In the context of a District of Columbia Living Trust for Husband and Wife with Minor and or Adult Children, it is crucial to understand local regulations. These regulations could affect how the trust is managed and the distribution of assets.