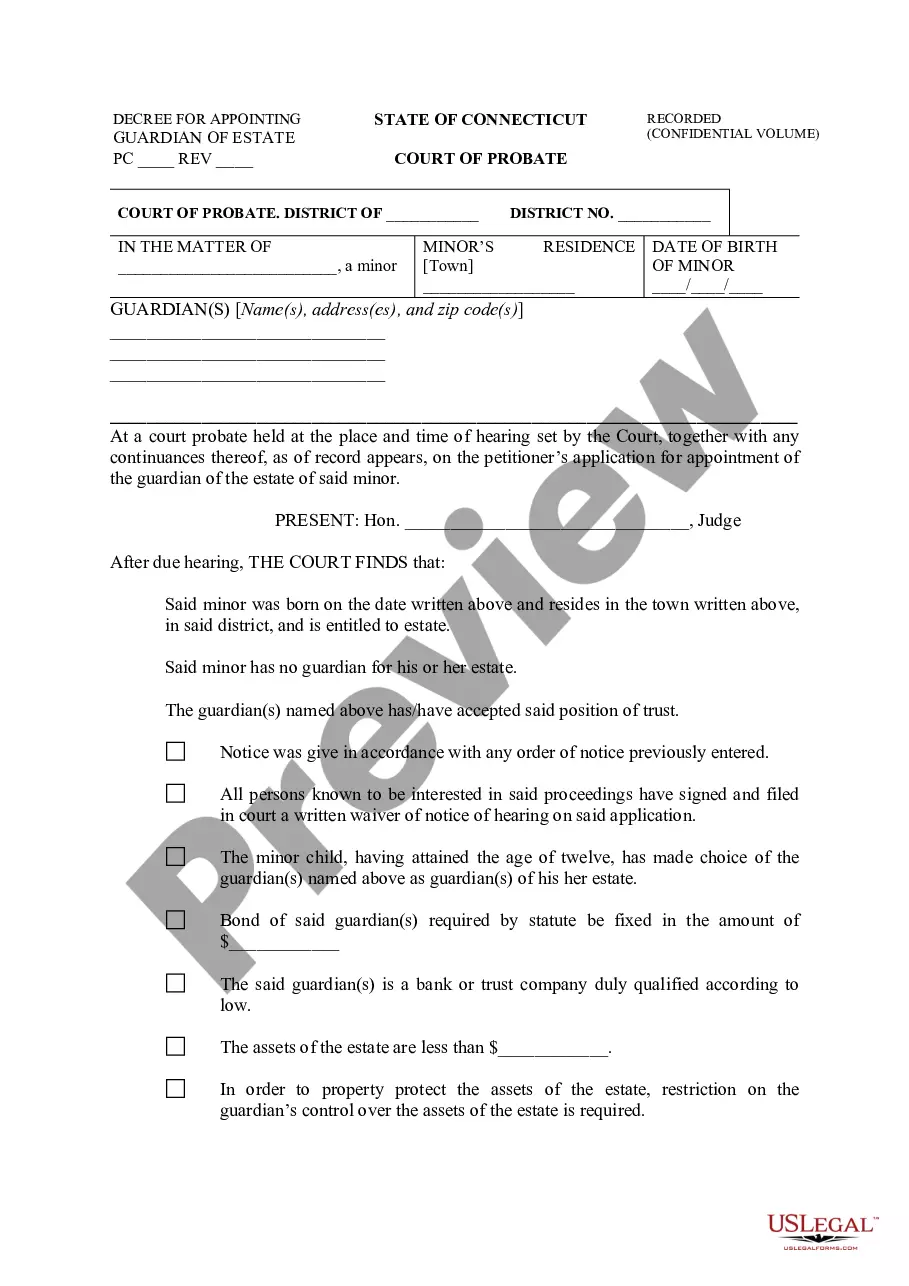

Connecticut Decree for Appointing Guardian of Estate

Form popularity

FAQ

In Connecticut, you have a reasonable timeframe to file probate after an individual's death; typically, this is within 30 days of the death date. Prompt filing ensures a smoother process in settling the estate and can simplify obtaining a Connecticut Decree for Appointing Guardian of Estate when necessary. Moreover, acting quickly can help protect the interests of all parties involved, including heirs and beneficiaries.

In Connecticut, there is no strict time limit to probate a will; however, it is advisable to start the process as soon as possible. This approach helps to settle the estate efficiently and avoid potential conflicts among heirs. Delayed probate can complicate the matters surrounding guardianship and protective decrees, such as a Connecticut Decree for Appointing Guardian of Estate.

If you do not file probate in Connecticut, the estate cannot be legally administered, which may lead to complications in asset distribution. Heirs may face delays in accessing inheritance, and creditors might pursue debts through other legal channels. Furthermore, failing to initiate probate could complicate the appointment of a guardian, such as obtaining a Connecticut Decree for Appointing Guardian of Estate.

To file for guardianship in Connecticut, you need to apply through the probate court in the district where the proposed ward resides. Gather necessary documents, including a petition form and financial disclosures. The process typically involves a hearing where evidence will be presented regarding the need for a guardian, leading to the issuance of a Connecticut Decree for Appointing Guardian of Estate if approved.

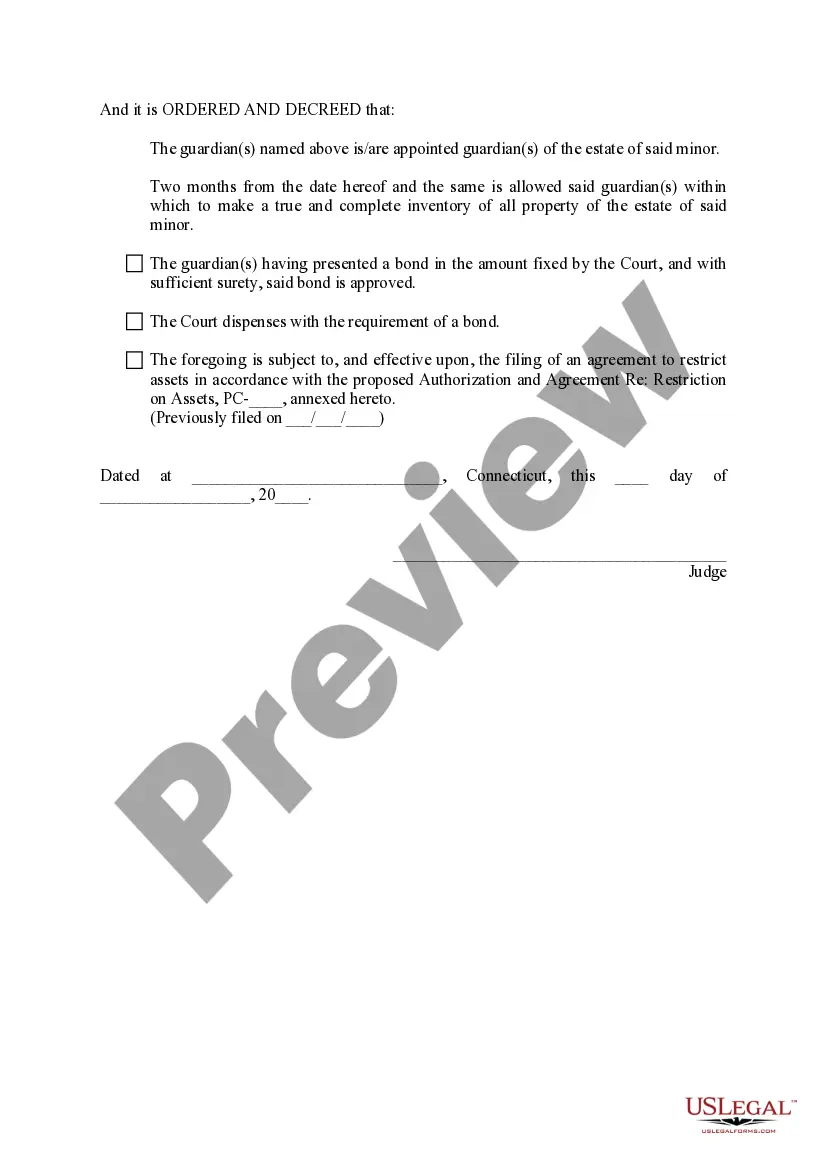

The time it takes to obtain guardianship can vary based on court schedules and the complexity of the case. Generally, once the petition for guardianship is filed, a hearing will be scheduled within a few weeks. After the review, if approved, you will receive a Connecticut decree for appointing guardian of estate shortly thereafter. Being prepared with all necessary documents can help expedite this process.

In Connecticut, guardianship lasts until the court determines it is no longer necessary or until the individual regains the capacity to manage their affairs. The court often schedules periodic reviews to assess the situation. This ensures that the guardianship remains in the best interest of the individual. Therefore, understanding the ongoing requirements is essential for maintaining a decree for appointing guardian of estate.

To obtain guardianship without court involvement, you could explore creating a power of attorney or establishing a trust. These methods let you appoint someone to manage financial matters. Keep in mind, though, that these alternatives might not offer the same level of legal protection that a Connecticut decree for appointing guardian of estate provides. It's wise to understand each option's implications before proceeding.

Giving guardianship without going to court can be challenging but is possible through legal documents like a power of attorney or a trust. These documents allow you to designate someone to manage the financial aspects on behalf of the individual. However, for many, a Connecticut decree for appointing guardian of estate might be a more secure option as it offers court oversight. Consult an expert to explore these avenues thoroughly.

Alternatives to legal guardianship include trusts, power of attorney, and advance directives. These options allow individuals to designate someone they trust to handle their affairs without the need for court involvement. While a Connecticut decree for appointing guardian of estate is a formal process, exploring alternatives can often provide the necessary protection with less complexity. Resources are available to help you decide the best alternative.

A guardian of the estate manages assets and financial affairs for someone unable to do so. In contrast, a power of attorney allows an individual to make decisions on behalf of another person but typically involves less court oversight. The decree for appointing guardian of estate is a formal court order, providing legal authority to manage someone's finances. Understanding these differences helps in choosing the right path for asset management.