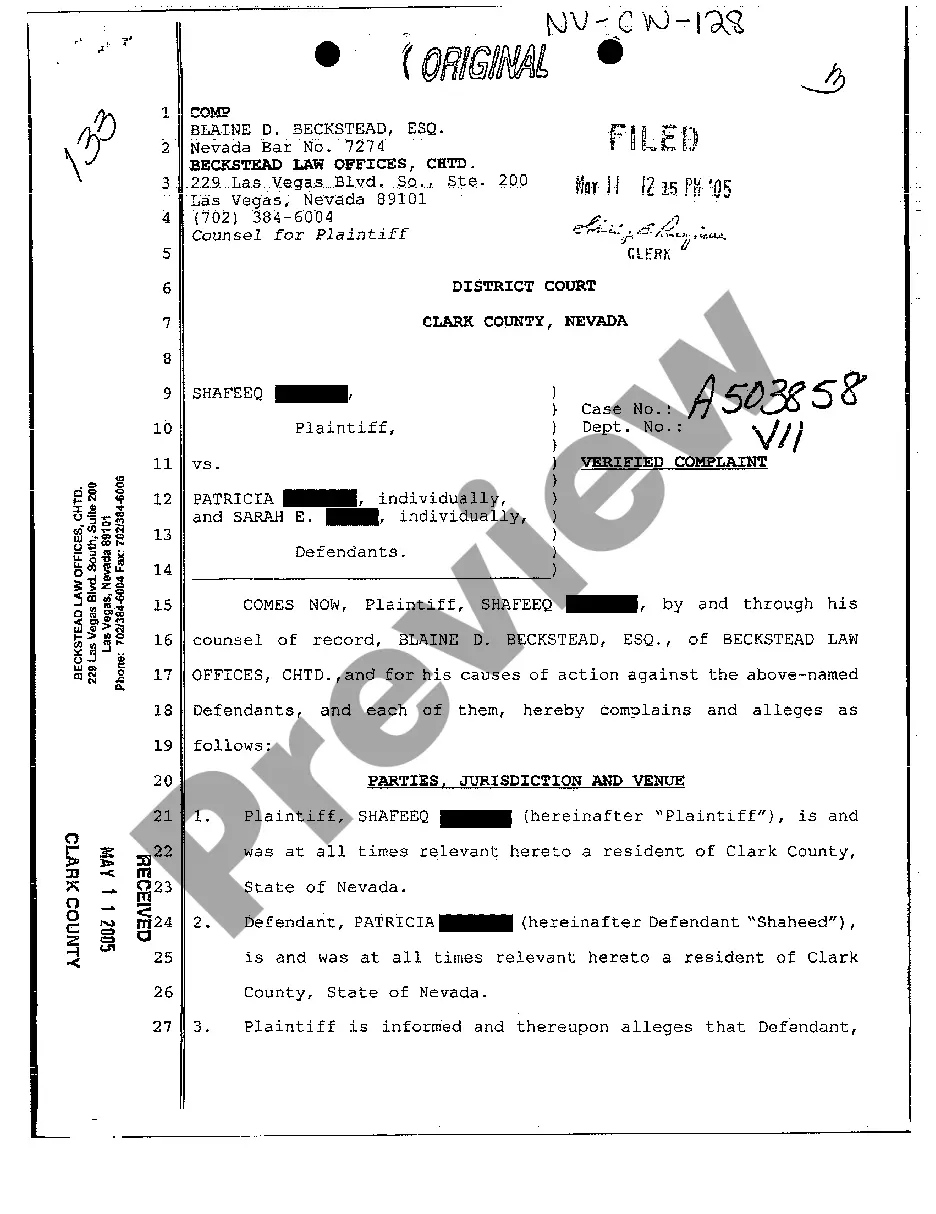

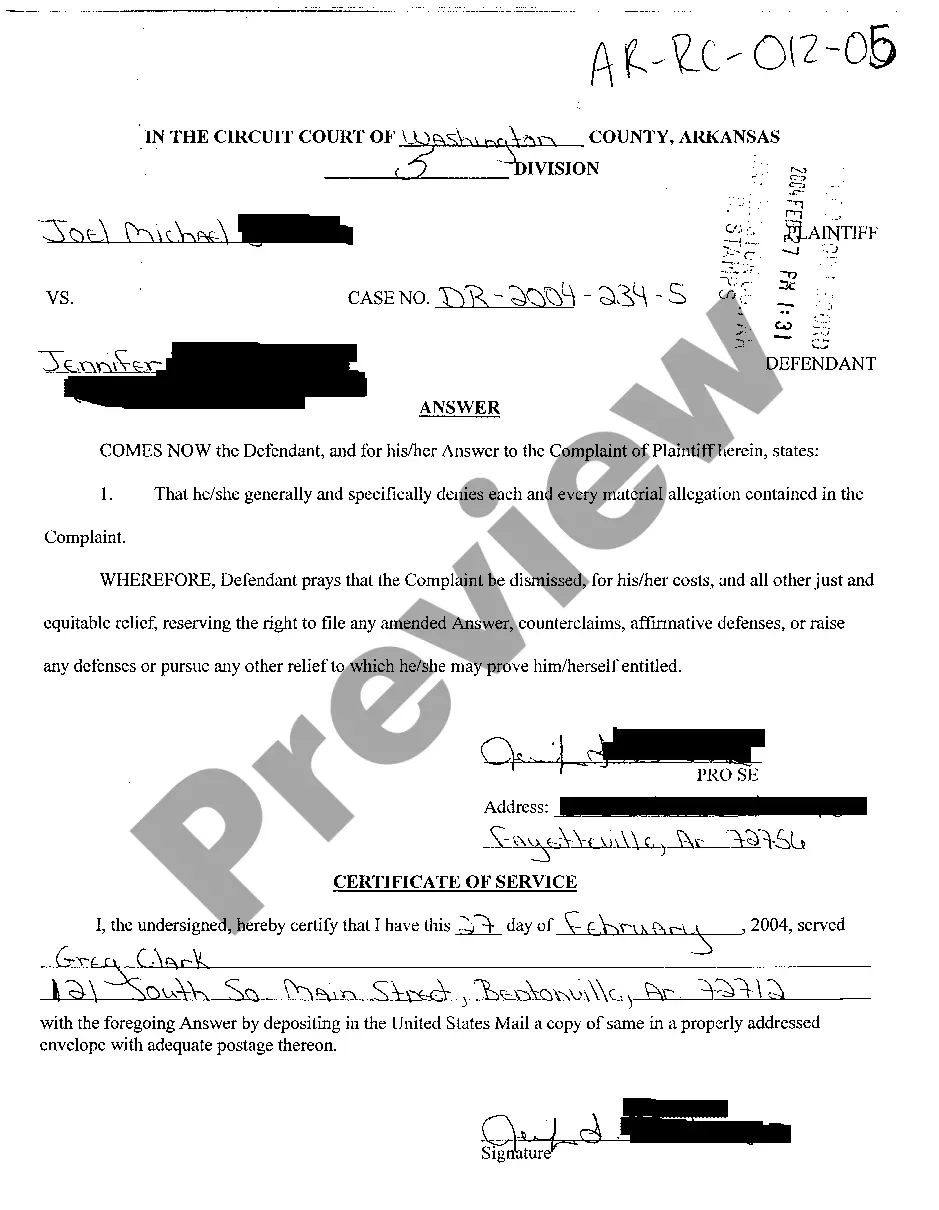

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

California Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out California Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you're looking to obtain a precise California Notice of Dishonored Check - Civil - Keywords: bad check, bounced check samples, US Legal Forms is what you require; find documents crafted and reviewed by state-certified lawyers.

Using US Legal Forms not only spares you from complications related to legal documents; moreover, you save time, effort, and funds! Downloading, printing, and submitting a professional template is considerably more economical than hiring an attorney to draft it for you.

And that’s it. With just a few simple clicks, you have an editable California Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. After you set up your account, all subsequent purchases will be processed even more smoothly. Once you have a US Legal Forms subscription, just Log In to your profile and click the Download button you can find on the form’s webpage. Then, whenever you need to use this template again, you will always be able to find it in the My documents section. Do not waste your time searching through numerous forms on various web sources. Acquire accurate copies from one reliable platform!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the instructions provided below to set up your account and locate the California Notice of Dishonored Check - Civil - Keywords: bad check, bounced check sample to meet your requirements.

- Utilize the Preview feature or review the document description (if available) to ensure that the template is the one you need.

- Verify its legitimacy in your residing state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select an appropriate file format and save the form.

Form popularity

FAQ

To write a strong demand payment letter, be clear and direct about what you want. Start with your contact information, then state the purpose of the letter and include specific details about the amount due and the original check. Emphasize your willingness to resolve the matter promptly while highlighting the possibility of legal action, such as a California Notice of Dishonored Check, if necessary. Using templates from USLegalForms can simplify this process and strengthen your letter.

Yes, you can sue someone for writing you a bad check in California. If the check was not honored and remains unpaid, you are entitled to take legal action to recover your funds. This process often involves sending a demand letter first, ensuring the recipient understands the situation before pursuing a formal lawsuit, possibly leading to a California Notice of Dishonored Check.

In California, the penalty for a bounced check can include various fees and potential legal consequences. The amount due may increase due to additional charges from the bank and the recipient’s fees. If the situation escalates, the holder of the bad check can seek damages via a California Notice of Dishonored Check. Understanding these penalties underscores the importance of managing transactions carefully.

To fight a stop payment check, gather all relevant documents, including the original check and any communications about the stop payment. Contact your bank to understand the terms of the stop payment and any potential fees involved. You may need to consider legal steps, especially if the check was issued without valid grounds, which may lead to a California Notice of Dishonored Check.

Yes, you can write a demand letter without a lawyer. It is a straightforward process that allows you to communicate your intentions clearly. Ensure you include all necessary details and maintain a professional tone throughout the letter. Using resources like USLegalForms can help you structure your demand letter properly while targeting issues related to bad checks and bounced checks.

To write a demand letter for a bad check, include your name and address, the check's details, and a clear request for payment. Be specific about the amount owed and any additional fees incurred due to the bounced check. You may want to mention the consequences of not responding, including possible legal actions, such as filing a California Notice of Dishonored Check. This letter serves as a critical first step in resolving the issue amicably.

To dispute a bounced check, first contact the issuer to address the issue directly. If necessary, gather evidence such as the check and communication records to support your claim. In cases where resolution is not achievable, the California Notice of Dishonored Check - Civil can provide a structured approach to take legal action, ensuring all parties are treated fairly under the law.

The phrase 'bounced check' describes the action of a check that is returned to the issuer without being processed. This occurs when the account does not contain sufficient funds to cover the check amount, making it unable to move forward. Being familiar with the California Notice of Dishonored Check - Civil helps in understanding the ramifications of a bounced check.

In practice, 'bounced cheque' and 'dishonored cheque' refer to the same issue—a check that cannot be processed due to insufficient funds. However, the term 'dishonored' emphasizes the legal implications involved, whereas 'bounced' highlights the physical rejection of the check by the bank. The California Notice of Dishonored Check - Civil can clarify the legal context surrounding this terminology.

Yes, writing a bad check can be considered a crime in California. If the check was issued with the intent to defraud or if the issuer knows there are not enough funds, they could face criminal charges. Under the California Notice of Dishonored Check - Civil, victims also have recourse to recover their losses, making it crucial for both parties to understand the legal standing.