Annual Minutes document any changes or other organizational activities of a Professional Corporation during a given year.

Annual Minutes for a Arizona Professional Corporation

Description

How to fill out Annual Minutes For A Arizona Professional Corporation?

If you're seeking accurate Annual Minutes for an Arizona Professional Corporation web templates, US Legal Forms is what you require; access documents created and verified by state-certified attorneys.

Utilizing US Legal Forms not only shields you from concerns regarding legal forms; furthermore, you save time, effort, and money! Downloading, printing, and completing a professional template is significantly more economical than hiring a lawyer to do it for you.

Choose a convenient format and download the document. And that's it. With a couple of simple clicks, you obtain an editable Annual Minutes for an Arizona Professional Corporation. Once you create your account, all subsequent orders will be processed even more smoothly. If you possess a US Legal Forms subscription, simply Log In to your account and then click the Download button available on the form’s page. Afterwards, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time comparing numerous forms across various websites. Purchase precise documents from a single secure platform!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions listed below to set up your account and obtain the Annual Minutes for an Arizona Professional Corporation template to address your needs.

- Utilize the Preview tool or review the document description (if available) to confirm that the template is the one you desire.

- Verify its compliance in your state.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Establish your account and pay with your credit card or PayPal.

Form popularity

FAQ

Yes, if your Professional Corporation operates in Arizona, you must file an Arizona corporate tax return. This requirement applies even if your corporation does not owe taxes. Filing on time is crucial to keep your company in good standing and to support your Annual Minutes for an Arizona Professional Corporation. You can streamline this process with the help of uslegalforms, ensuring compliance and accuracy.

To obtain an Arizona certificate of Good Standing, you need to verify that your Professional Corporation is in compliance with state regulations. You can request this certificate through the Arizona Corporation Commission's website. Make sure to provide your business name and any required details. This certificate is essential for fulfilling your obligations, including maintaining your Annual Minutes for an Arizona Professional Corporation.

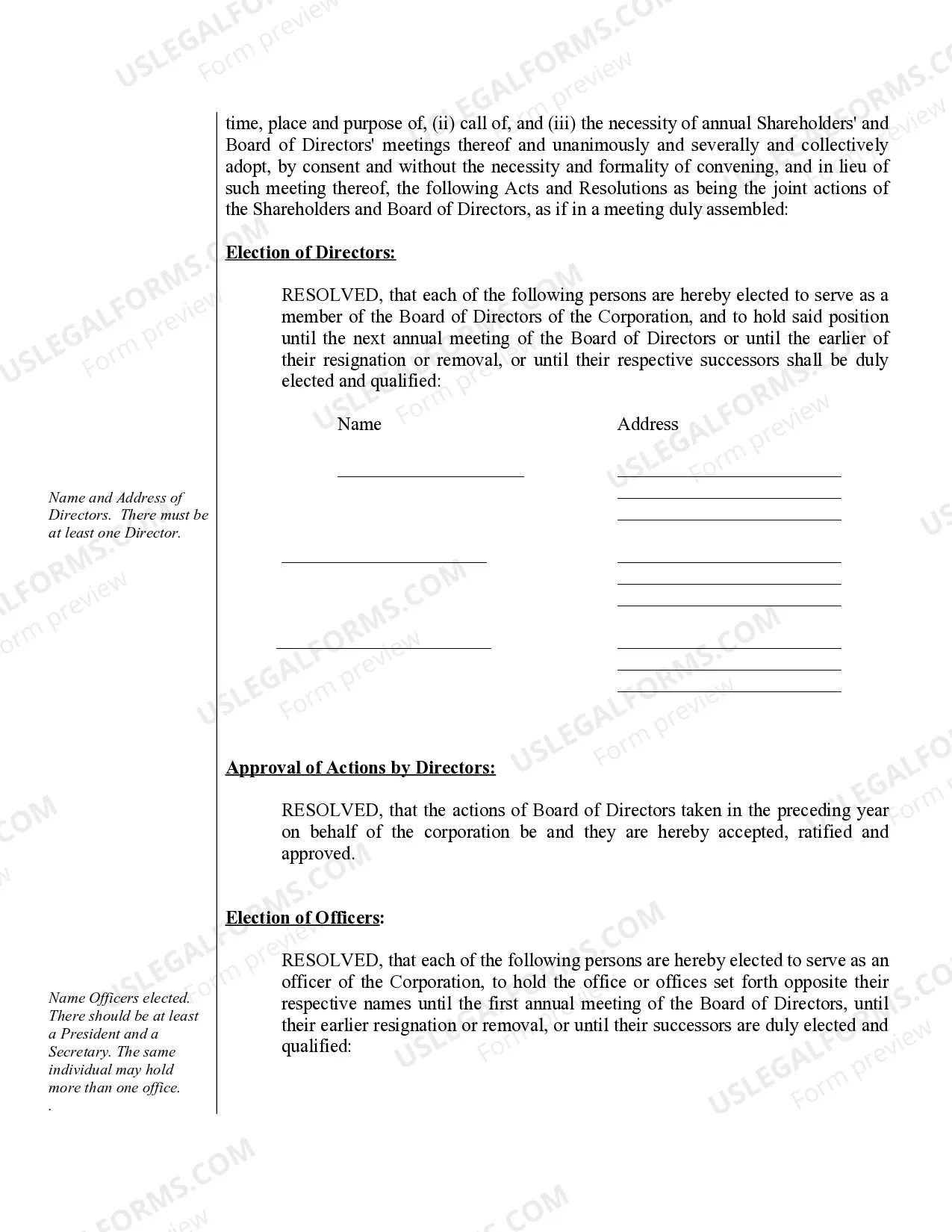

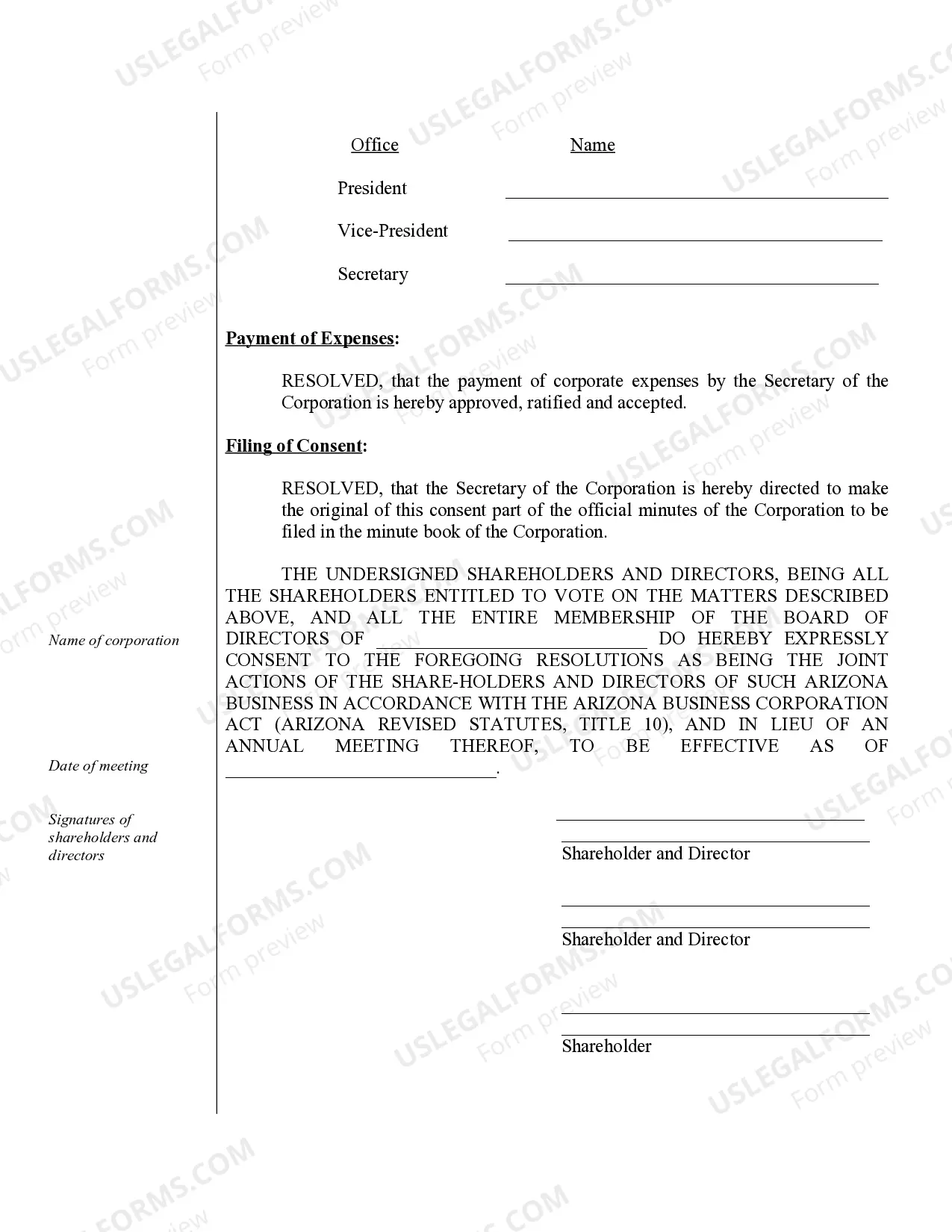

The annual meeting of a corporation is a yearly gathering where shareholders and directors discuss company performance and make key decisions. During this meeting, shareholders vote on essential matters, such as board member elections and financial approvals. For an Arizona Professional Corporation, meticulous record-keeping of annual minutes is crucial for establishing accountability and transparency.

Yes, Arizona law mandates that all corporations, including Arizona Professional Corporations, file an annual report with the state. This report typically includes details such as the corporation’s address, registered agent, and key financial information. By submitting an accurate annual report, your corporation stays in good standing and avoids penalties.

All corporations operating in Arizona must prepare an annual report, including Arizona Professional Corporations. This report provides essential information about the corporation's financial health and status, which stakeholders can review. By maintaining up-to-date annual minutes, your corporation ensures compliance with state regulations and builds trust with investors and partners.

The minutes of the annual meeting of shareholders document significant actions taken, such as the election of directors and approval of major company decisions. For an Arizona Professional Corporation, these minutes must be recorded accurately to serve as a legal record for the corporation. They will be valuable during audits or disputes, so it's essential to keep them organized and accessible.

Writing minutes for a corporation involves recording the key points of discussions and decisions made during meetings. For an Arizona Professional Corporation, include the date, time, and location of the meeting, attendees, and a brief description of each agenda item discussed. Remember, these minutes serve as an official record and may be needed for future reference.

In Arizona, all corporations are required to file a corporate tax return, including both C-corporations and S-corporations. Specifically, any Arizona Professional Corporation must file if it conducts business within the state or has income reportable to Arizona. It is important to keep in mind the deadlines and requirements to avoid penalties.

Yes, in Arizona, you are required to file annual reports for your LLC to keep your business in good standing. This includes maintaining accurate Annual Minutes for a Arizona Professional Corporation. Failing to file these documents on time can result in penalties, so it’s essential to stay updated and compliant with your filings.

To obtain a certificate of good standing in Arizona, you need to submit a request through the Arizona Corporation Commission. Ensure that your business complies with all state regulations, including filing your Annual Minutes for a Arizona Professional Corporation timely. This certificate verifies your business's legal status and is often required for various transactions.