Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife

Form popularity

FAQ

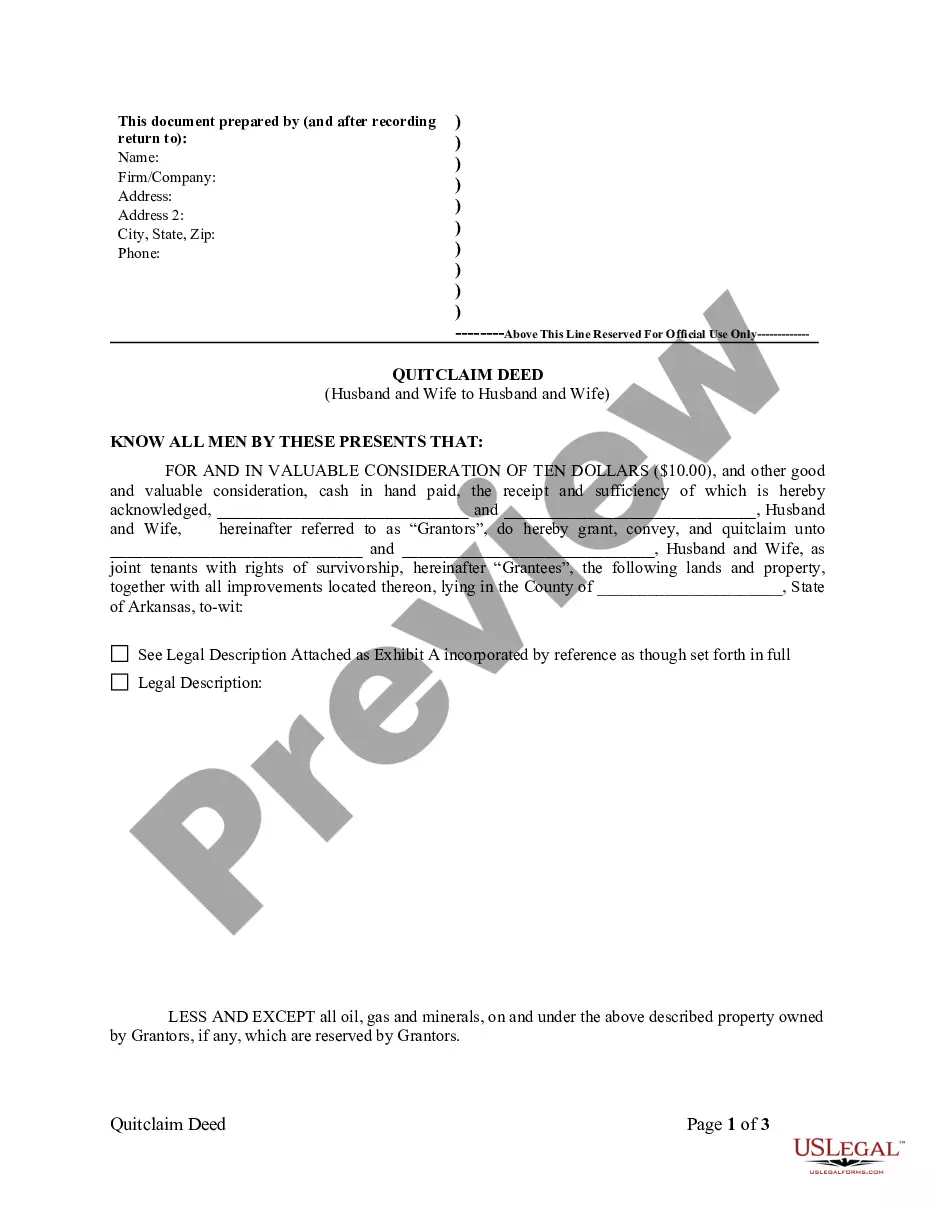

A quitclaim deed in Arkansas allows one party to transfer any interest they have in a property to another party, without guaranteeing that the title is clear. Specifically, the Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife enables spouses to easily transfer ownership rights to each other. After execution, the deed must be recorded at the local county office to formalize the transfer and make it public.

A spouse might execute a quitclaim deed to clarify ownership rights, especially in divorce situations or estate planning. Using an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife can help establish clear property ownership without implying any warranties. This document can help streamline the transfer of property between family members when needed.

The best way to transfer a property title between family members is through an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife. This deed simplifies the transfer process and is particularly effective for informal transactions among family members. Always ensure the deed is properly executed and recorded to protect everyone’s interests.

Transferring a property title to a family member in Arkansas can be efficiently done using an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife. This process involves drafting the deed, signing it in front of a notary, and then filing it with the local county clerk. This method ensures that your family member receives clear ownership of the property.

To transfer ownership of a property in Arkansas, you can use an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife. This legal document allows you to convey your interest in the property to another party without making warranties about the title. It’s essential to properly fill out the deed and record it with the county clerk’s office to complete the transfer.

To fill out an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife, start by obtaining a blank quitclaim deed form. Clearly write the names of both parties as the grantors and grantees. Include a legal description of the property and the county where it is located. Once completed, both spouses should sign the document in the presence of a notary, and then record it with the county clerk to make it official.

One key disadvantage of quitclaim deeds is that they provide no guarantee about the quality of the title being transferred. When using an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife, the grantee assumes the risk regarding any existing liens or encumbrances. This method lacks the protections found in warranty deeds, putting parties at potential legal or financial risk. Therefore, it is crucial to understand these limitations before proceeding.

To fill out an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife to add a spouse, start by obtaining the correct form from a reliable source. Ensure you have both parties’ names, property descriptions, and signatures as required. You’ll need to have the deed notarized to make it legally binding. Using platforms like USLegalForms can provide you with templates and guidance, making this process easier and accurate.

Quitclaim deeds are most commonly used for transferring property ownership among family members or resolving joint ownership issues. The Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife is especially useful during marriage, divorce, or estate planning situations. This type of deed facilitates quick and straightforward changes to property titles without legal complications. Additionally, individuals often use them to clear up title issues or promote clear ownership records.

A quitclaim deed does not override a will; instead, it functions independently. While a will dictates how a person's property is distributed after death, an Arkansas Quitclaim Deed from Husband and Wife to Husband and Wife immediately transfers ownership during the person's lifetime. Therefore, if a quitclaim deed exists, it will take precedence over the stipulations in a will concerning that property. It is advisable to consult a legal professional for clarity on how both documents interact.