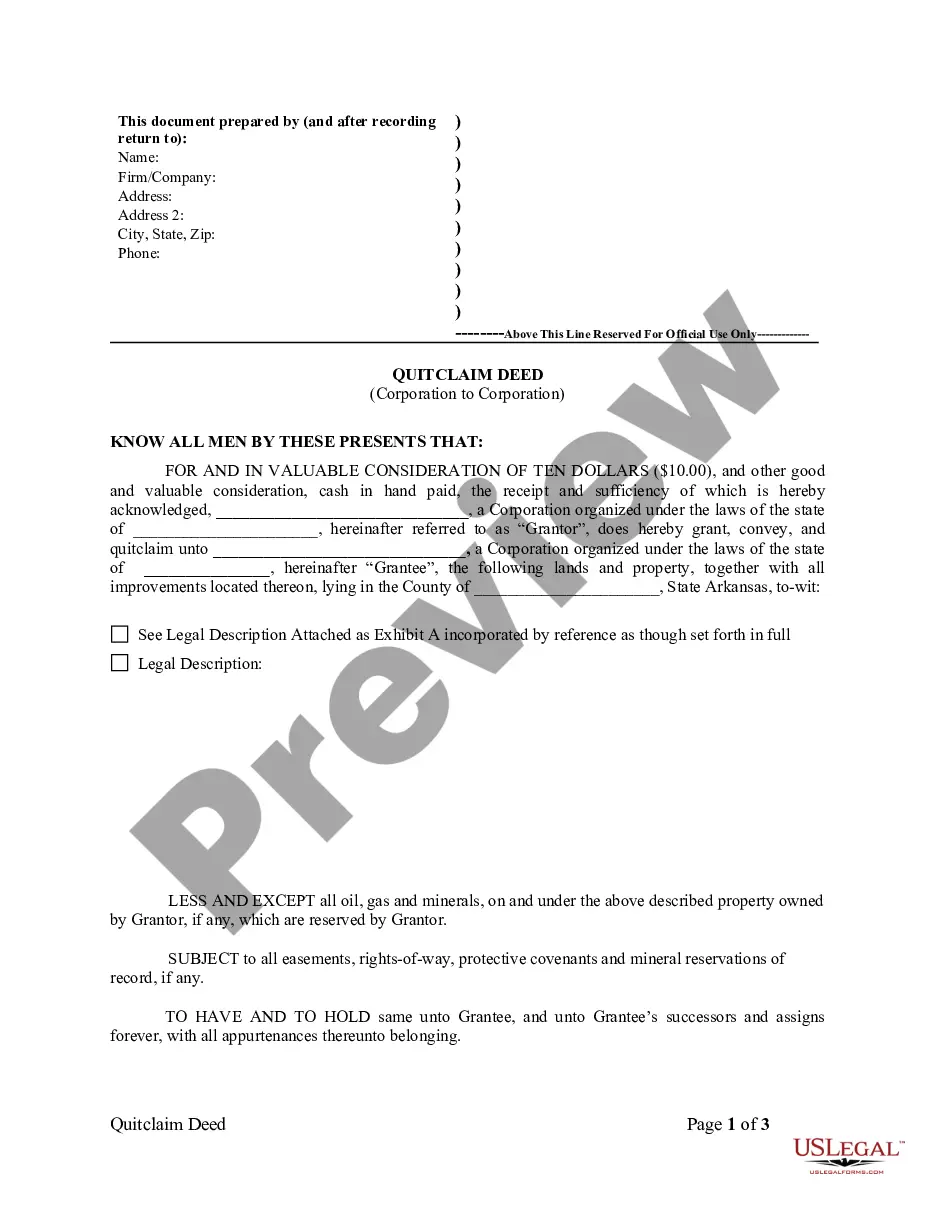

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Arkansas Quitclaim Deed from Corporation to Corporation

Description

How to fill out Arkansas Quitclaim Deed From Corporation To Corporation?

Utilizing Arkansas Quitclaim Deed from Corporation to Corporation templates designed by experienced attorneys provides you the chance to prevent complications when preparing paperwork.

Just download the template from our site, complete it, and have legal counsel review it for accuracy.

By doing so, you can conserve significantly more time and expenses compared to asking an attorney to create a document entirely from the beginning for you.

After you complete all the steps mentioned above, you’ll be able to fill out, print, and sign the Arkansas Quitclaim Deed from Corporation to Corporation template. Always remember to verify all entered information for accuracy prior to submitting or sending it out. Reduce the time devoted to completing documents with US Legal Forms!

- If you hold a US Legal Forms subscription, simply Log In to your account and navigate back to the sample page.

- Locate the Download button next to the templates you’re examining.

- Once you download a template, you can find all your saved forms in the My documents section.

- If you don’t have a subscription, there’s no need for concern.

- Just adhere to the instructions below to register for an account online, obtain, and fill out your Arkansas Quitclaim Deed from Corporation to Corporation template.

- Confirm that you are downloading the correct state-specific form.

Form popularity

FAQ

Yes, you can prepare and file a quitclaim deed yourself in Arkansas, but it is essential to understand the requirements to avoid mistakes. You will need to create a clear document that specifies the transfer from one corporation to another, including relevant details about both corporations and the property. Using a trusted platform like uslegalforms can simplify this process, as it offers templates and guidance tailored for an Arkansas Quitclaim Deed from Corporation to Corporation, ensuring your deed meets legal standards.

To file a quitclaim deed in Arkansas, you need to prepare the document correctly, ensuring it includes all necessary details like the names of the corporations involved, the property description, and the signature of the authorized representatives. Once you have the completed deed, you should file it with the circuit clerk in the county where the property is located. Remember, the Arkansas Quitclaim Deed from Corporation to Corporation needs to be recorded to be effective, ensuring that your corporate transfer is legally recognized.

To obtain an Arkansas Quitclaim Deed from Corporation to Corporation, start by gathering the necessary information, including the legal names of the corporations involved and a description of the property. You can find templates online or consider using a reliable service like US Legal Forms for efficiency and accuracy. After completing the deed, sign it in front of a notary public to validate the document. Finally, file the completed quitclaim deed with the county clerk's office in the jurisdiction where the property is located.

To effectively create an Arkansas Quitclaim Deed from Corporation to Corporation, you must include specific information like the legal description of the property and the names of the parties involved in the transaction. Additionally, the deed must be signed by the grantor and notarized to be valid. It’s important to ensure that the document meets all state requirements to prevent any legal challenges later on. USLegalForms can provide resources to help streamline this process.

A quitclaim deed may not be suitable in situations where there are disputes over property ownership or when a lender needs a full title guarantee. Essentially, if the ownership is contested or if the property is still under a mortgage, using an Arkansas Quitclaim Deed from Corporation to Corporation could lead to complications. It's always wise to consult with legal experts in these matters to avoid future issues. For accurate and proper handling, consider using USLegalForms to guide you through the process.

To fill out the quitclaim deed form, you'll need to provide specific information, like the names and addresses of the corporations involved. Make sure to include a detailed legal description of the property and the date of the transaction. After completing the form, the grantor must sign it in front of a notary public for validation. Using platforms like USLegalForms can simplify this process by providing templates and guidance.

Filling out an Arkansas Quitclaim Deed from Corporation to Corporation involves several key steps. Start by entering the names of both the grantor and grantee, along with their respective addresses. Include a legal description of the property being conveyed, as well as the date of transfer. To finalize the document, ensure it is signed by the grantor and notarized for legal acceptance.

In an Arkansas Quitclaim Deed from Corporation to Corporation, the grantor typically signs the deed. The grantor is the corporation transferring its interest in the property. While the grantee, the corporation receiving the property, does not need to sign the deed, it is common for both parties to be involved in the transaction process. Ensure the grantor's representative signs to validate the deed.

Yes, when a corporation transfers ownership of property, the deed must be signed to be valid. It is essential that the Arkansas Quitclaim Deed from Corporation to Corporation includes the necessary signatures for both parties involved. Generally, an authorized representative of the corporation must sign the deed to ensure legal compliance. This signature confirms the corporation's intention to transfer the property rights.