Wyoming Close Corporation Withholding Tax

Description

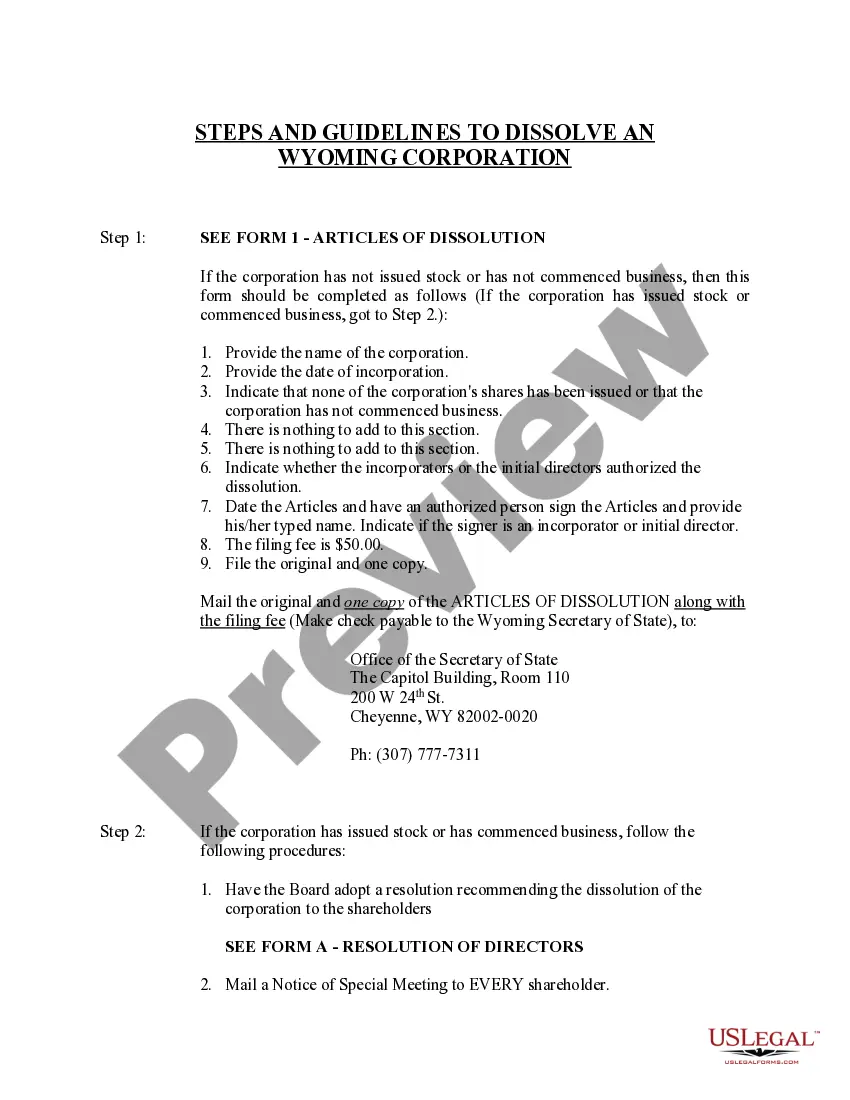

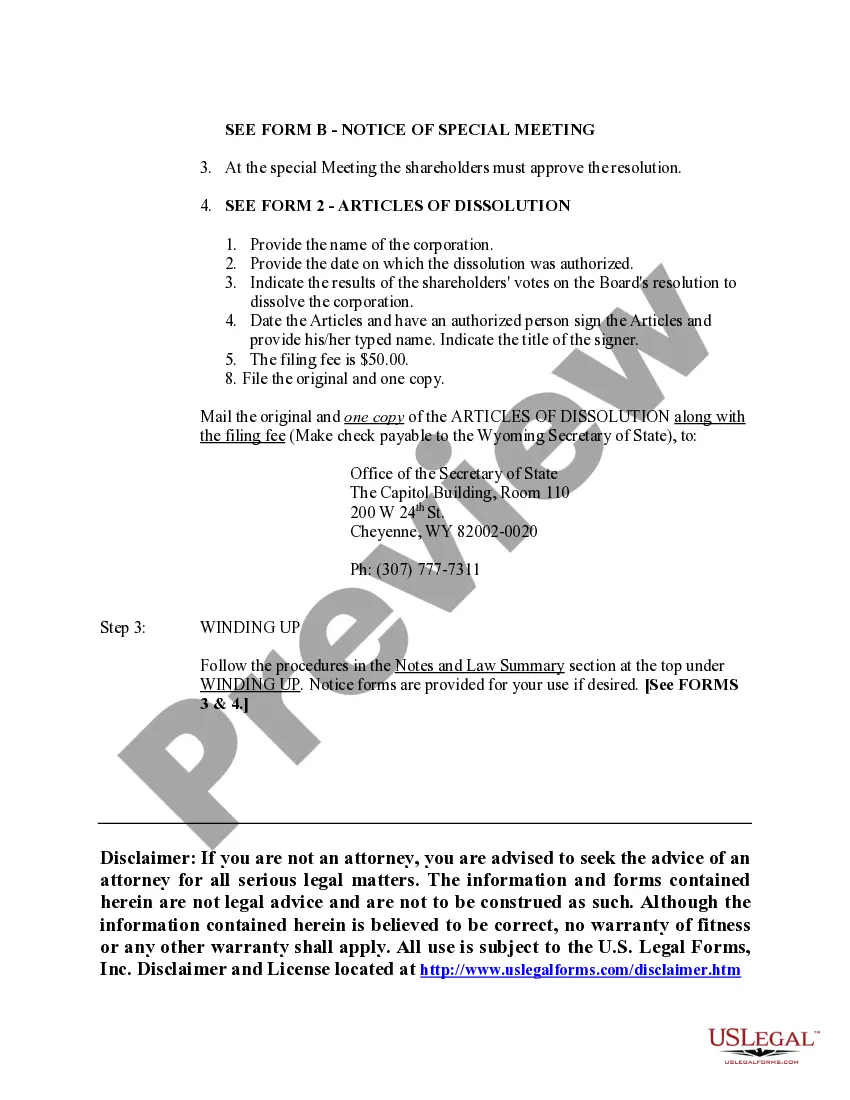

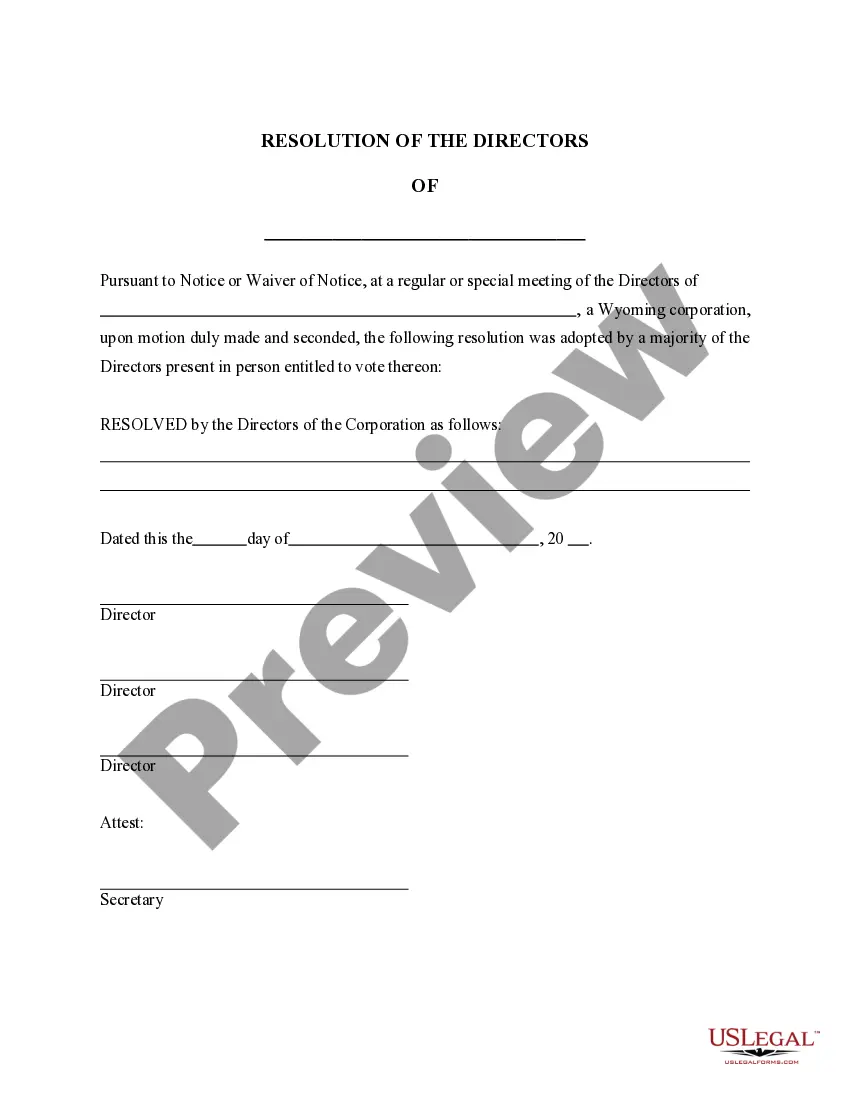

How to fill out Wyoming Dissolution Package To Dissolve Corporation?

The Wyoming Close Corporation Withholding Tax presented on this page is a reusable official template crafted by expert attorneys in accordance with national and local statutes and guidelines.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal need. It’s the quickest, simplest, and most reliable method to acquire the forms you require, as the service ensures bank-level data security and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for every situation in life at your fingertips.

- Search for the necessary document and verify it.

- Browse through the sample you’ve found and preview it or read the form description to confirm it meets your requirements. If not, use the search function to find the correct one. Click Buy Now when you locate the template you need.

- Subscribe and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Acquire the editable template.

- Choose the format you prefer for your Wyoming Close Corporation Withholding Tax (PDF, DOCX, RTF) and store the template on your device.

- Fill out and sign the documents.

- Print the template to complete it by hand. Alternatively, utilize an online versatile PDF editor to quickly and accurately fill in and sign your form with a legally-binding electronic signature.

- Re-download your documents as needed.

- Make use of the same document again whenever required. Access the My documents tab in your profile to redownload any previously downloaded forms.

Form popularity

FAQ

Closing an AC corporation can lead to several tax consequences. Shareholders may face capital gains taxes if the corporation's assets have appreciated in value. Moreover, the implications of Wyoming close corporation withholding tax become relevant during the liquidation process. Consulting with experts can ensure smooth handling of these financial obligations.

Filing and Similar Fees (1) Supreme Judicial Court:Entry of a Small Claims Action$ 50.00Entry of a Small Claims Disclosure per defendant$ 15.00Service of a Small Claims Action or Disclosure, per party (optional)$ 15.00Entry of a Money Judgment Disclosure$ 60.0066 more rows

District Court Fee Schedule DISTRICT COURT FEE SCHEDULE Effective December 1, 2020FILING FEESFiling fee for civil actions (includes $52 administrative fee)$402Filing fee for appeal$50520 more rows

The fee to file a Small Claim is $40 which includes the cost of postage and a mediation fee. Checks or money orders for the $40 filing fee should be made payable to ?Maine District Court?. An essential part of a Small Claims case is notifying the defendant about the case.

What is small claims court? Small claims court provides a speedy and inexpensive way to resolve disputes when the plaintiff's claim is $6,000 or less. Cases are heard and decided in Maine District Court by a judge without a jury.

Costs orders for a losing party to pay the winning party's legal costs are therefore very unusual. On the Small Claims Track, parties are expected to bear their own costs, even if they pursue a successful claim.

Here's how it works: Claim amountFeeUp to £300£35£300.01 - £500£50£500.01 - £1,000£70£1,000.01 - £1,500£803 more rows ?

If you are not represented by a lawyer, you can go to Maine Courts Guide & File ?Start a New Filing and choose ?Small Claims? as the type of filing. Go through the Guide & File interview to complete the forms online and eFile them with the Bangor District Court.

This is the Maine form for keeping your address confidential when filing for a Protection from Abuse order. Use this form if you don't want the abuser to know your address.