Wyoming Close Corporation Forms

Description

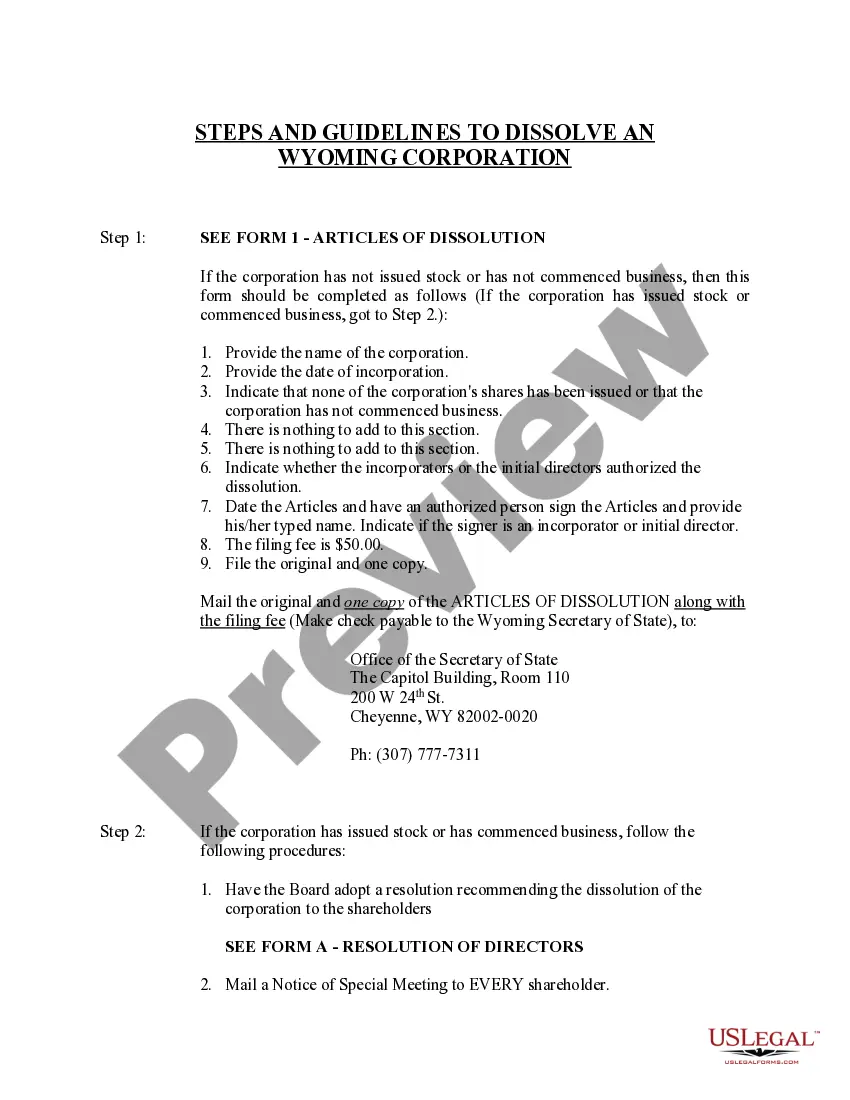

How to fill out Wyoming Dissolution Package To Dissolve Corporation?

When you are required to file Wyoming Close Corporation Forms in line with your local state's statutes, there may be numerous alternatives available.

There's no necessity to scrutinize each form to confirm it meets all the legal requirements if you are a subscriber to US Legal Forms.

It is a reliable service that can assist you in acquiring a reusable and current template on any subject.

Browse the designated page and verify it meets your necessities.

- US Legal Forms is the most comprehensive online repository featuring an archive of over 85,000 ready-to-use documents for both business and personal legal matters.

- All templates are verified to comply with the laws of each state.

- Consequently, when you download Wyoming Close Corporation Forms from our site, you can be assured that you possess a legitimate and current document.

- Acquiring the necessary sample from our platform is exceptionally straightforward.

- If you already have an account, just Log In to the system, confirm your subscription is active, and save the selected file.

- Later, you can navigate to the My documents tab in your profile and access the Wyoming Close Corporation Forms whenever needed.

- If this is your first interaction with our library, please follow the instructions below.

Form popularity

FAQ

One notable disadvantage of an LLC in Wyoming is the limited ability to raise capital due to restrictions on the number of owners. Furthermore, LLCs may face challenges securing financing, as banks often prefer corporations for loans. While LLCs offer liability protection, potential investors may view them as less stable. To navigate these challenges smoothly, our Wyoming close corporation forms can assist in establishing a more conventional business structure.

A close corporation in Wyoming adopts a unique structure that minimizes complexity while offering ownership control. This type of corporation caters to businesses with a small number of shareholders who prefer to manage operations actively. Close corporations also enjoy less regulatory scrutiny compared to larger corporations. To ensure you follow all legal requirements, it's wise to use our Wyoming close corporation forms.

The processing time for the Secretary of State (SOS) in Wyoming generally varies based on the type of filing. Typically, online filings take 2 to 3 business days, while mail filings may take longer, roughly 5 to 10 business days. It's important to prepare your documents accurately to avoid delays. Using our Wyoming close corporation forms can help streamline your submission.

A Wyoming LLC allows for a flexible management structure and is often used for various business purposes. In contrast, a close LLC is designed for smaller, closely-held companies where members have a more active role in management. This type of entity limits the number of owners and frequently comes with more privacy. If you're considering forming a close LLC, explore our Wyoming close corporation forms for a seamless process.

A Wyoming statutory close corporation is a specific type of business entity that combines the benefits of both a corporation and a closely-held company. This arrangement allows for fewer formalities, which can make operations easier for small businesses. It limits the number of shareholders and provides certain protections to keep control within a small group. Using specialized Wyoming close corporation forms can help streamline the setup and compliance for this type of entity.

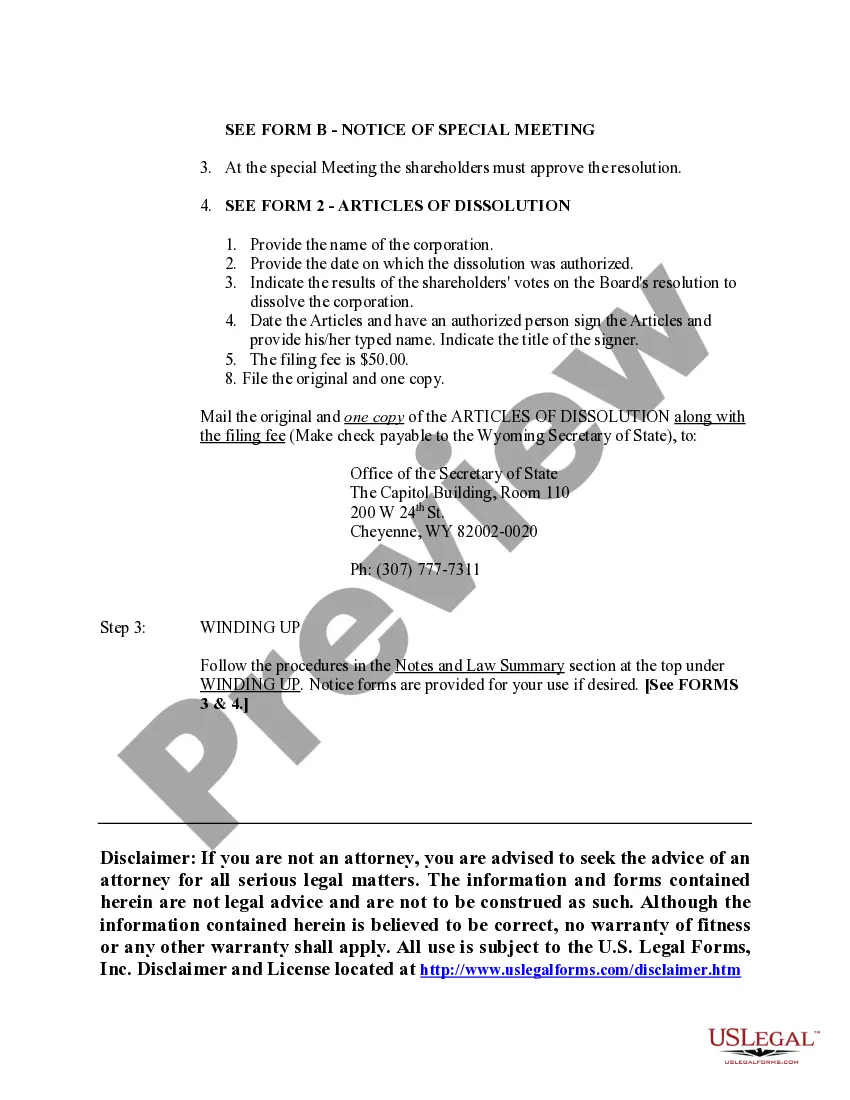

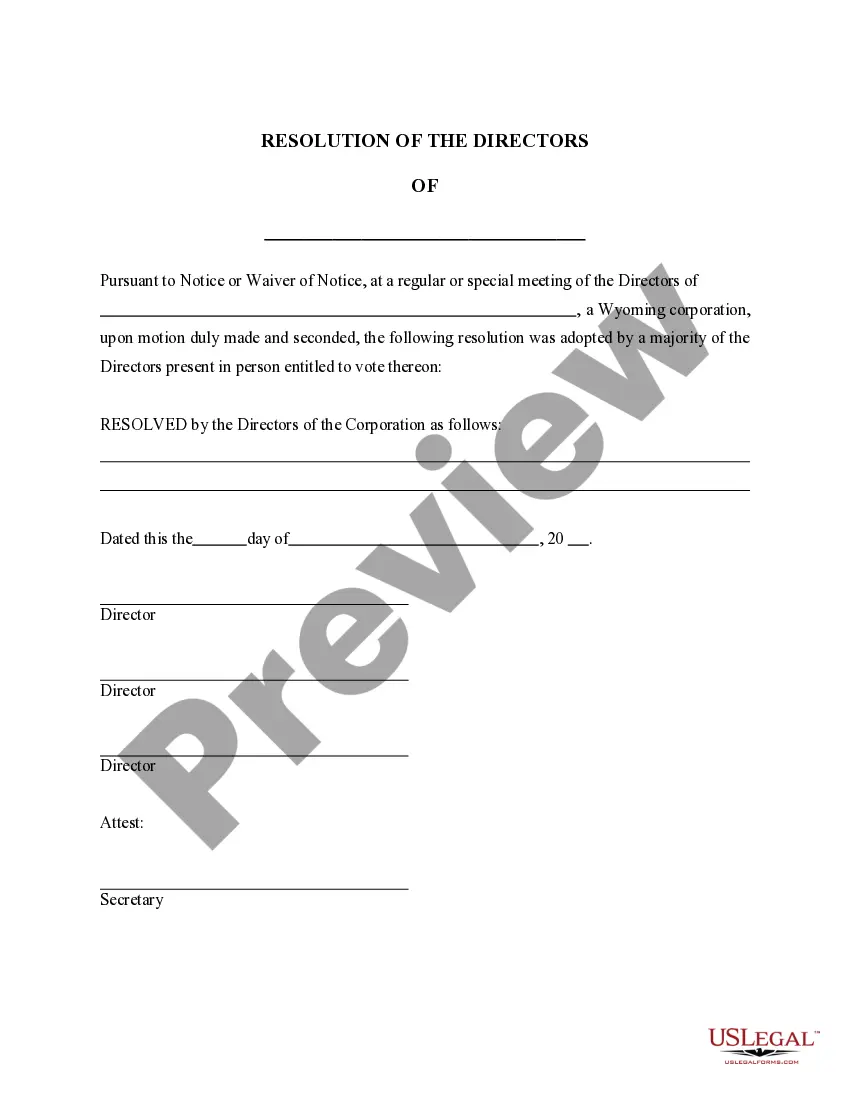

Closing a corporation involves several crucial steps. First, the corporation must settle all debts and obligations. Next, you must formally file the appropriate Wyoming close corporation forms to dissolve the entity legally. Finally, notifying stakeholders and managing the distribution of remaining assets are essential parts of the closure process.

The primary difference between a Wyoming LLC and a Wyoming close LLC lies in their structure and management. A Wyoming LLC can have an unlimited number of members, while a close LLC is limited to a defined group, usually a fewer number of members. Additionally, close LLCs often face fewer regulations and can enjoy a more laid-back management style, making them attractive for small businesses. Choosing the right option depends on your business goals and needs.

A statutory close corporation in Wyoming is a type of corporation that offers more flexibility in management and fewer formalities compared to traditional corporations. This structure allows for limited ownership, typically with a maximum of 30 shareholders, who can participate more directly in daily operations. For those interested in this format, utilizing Wyoming close corporation forms can simplify the establishment and operation of your business.

To close a corporation in Wyoming, you need to prepare and file the necessary Wyoming close corporation forms with the Secretary of State. This process includes settling all debts, distributing assets, and submitting the Articles of Dissolution. You may also need to notify creditors and comply with any regulatory requirements specific to your business. Make sure to follow these steps carefully to ensure a smooth closure.

To close your Wyoming corporation, you must follow specific steps that include filing dissolution documents with the state. This process typically involves settling debts, distributing assets, and submitting the appropriate Wyoming close corporation forms. Engaging with a platform like uslegalforms can simplify this experience and ensure you contact all necessary procedures.