File Lien On Business

Description

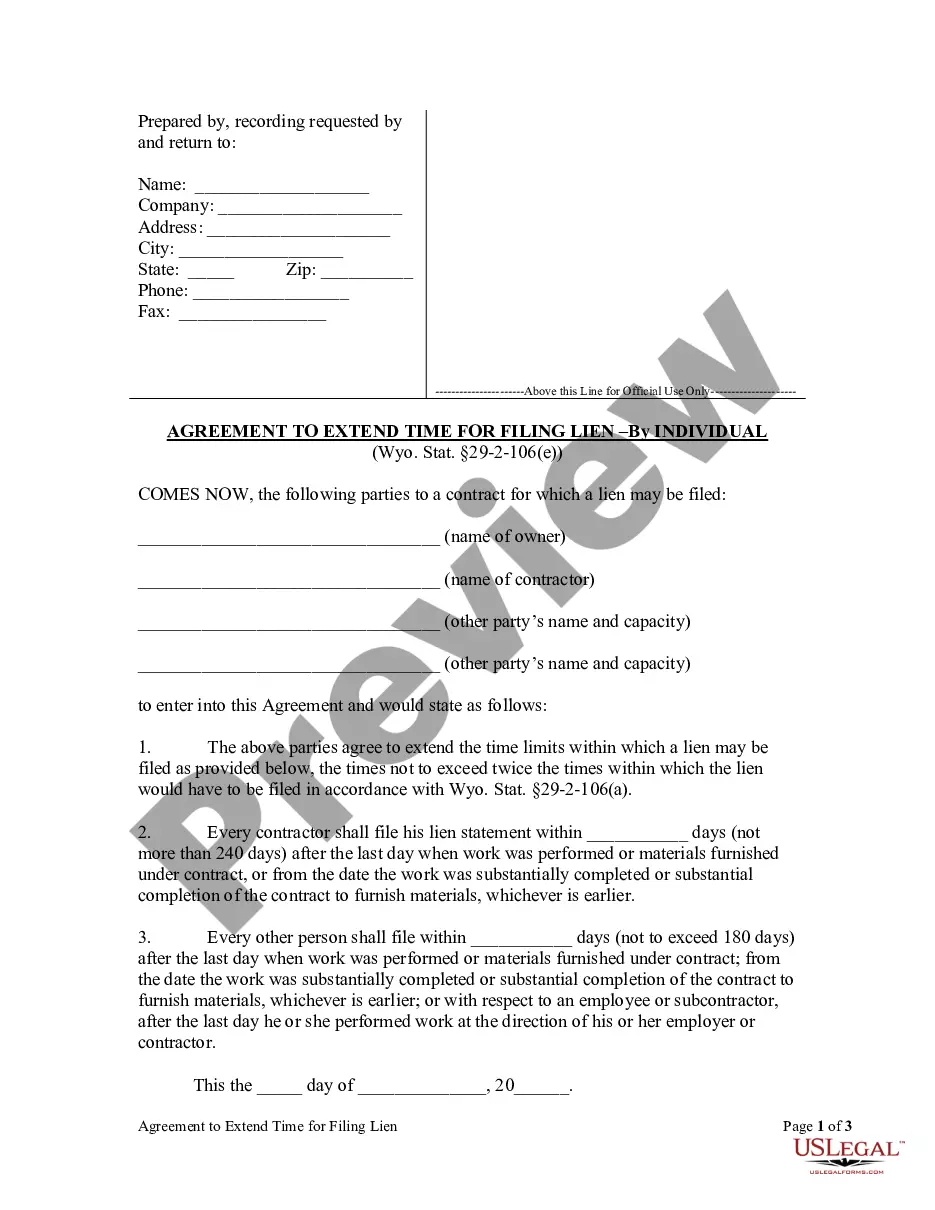

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- Log into your US Legal Forms account, ensuring your subscription is active, then proceed to download the required lien template.

- Review the form description and preview mode carefully to confirm that you have selected the correct form tailored to meet your local jurisdiction's regulations.

- If you notice any discrepancies, utilize the search function to find an alternative template that better fits your needs.

- Select your preferred subscription plan by clicking on the Buy Now button and create an account for full access to the vast library of forms.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the lien form to your device, and you can also find it later in the My Forms section of your profile menu.

Once you have completed these steps, you can confidently submit your lien, knowing you utilized a trusted resource with an extensive library of legal forms.

Start your journey with US Legal Forms today and protect your business interests effectively!

Form popularity

FAQ

Yes, you can file a lien on personal property that you own, provided you have a legitimate claim. This process often applies to property used as collateral for loans or unpaid debts. Filing a lien serves as a warning to other potential creditors about your financial commitments. US Legal Forms offers user-friendly resources for those looking to file a lien on business or personal property, guiding you through the legal requirements.

To conduct a lien search on a company, you can start by visiting your state’s Secretary of State website or local land registry. Many jurisdictions offer online databases where you can input the business name and review any recorded liens. Alternatively, using resources like US Legal Forms can simplify the lien search process by providing accessible tools and guidance to ensure you find relevant information quickly.

The minimum amount required to file lien on business property can vary significantly depending on state laws and the nature of the claim. In most cases, there is no specific minimum amount; however, the costs associated with filing, such as court fees or legal fees, may influence the decision. It is always best to consult local legal resources or platforms like US Legal Forms to determine the specific requirements in your area.

The principle of a lien establishes a legal right that a creditor has to seize and sell a debtor's property to satisfy an obligation. When someone files lien on business assets, it creates a claim against those assets, thereby ensuring that creditors can recover owed amounts in case of default. This principle supports financial accountability and encourages responsible business practices.

The primary reason for a lien is to secure a creditor’s interest in the property owned by a debtor. By filing lien on business assets, creditors can ensure they have a legal right to enforce payment if debts remain unpaid. This legal claim helps protect the creditor’s investment and encourages timely repayment from the business.

Not everyone can file lien on business property; specific criteria and legal provisions govern the process. Generally, creditors can place a lien if they have a valid legal claim against the business, such as unpaid debts. However, the process requires documentation and must adhere to local laws to ensure the lien remains enforceable.

The limitation on a lien refers to the time frame in which a creditor can enforce their claim on a debtor's property. Typically, liens have a statute of limitations that varies by state, which can limit the duration a creditor has to file lien on business assets. After the expiration of this period, the lien may become invalid, allowing the debtor to regain clear ownership without the burden of the claim.

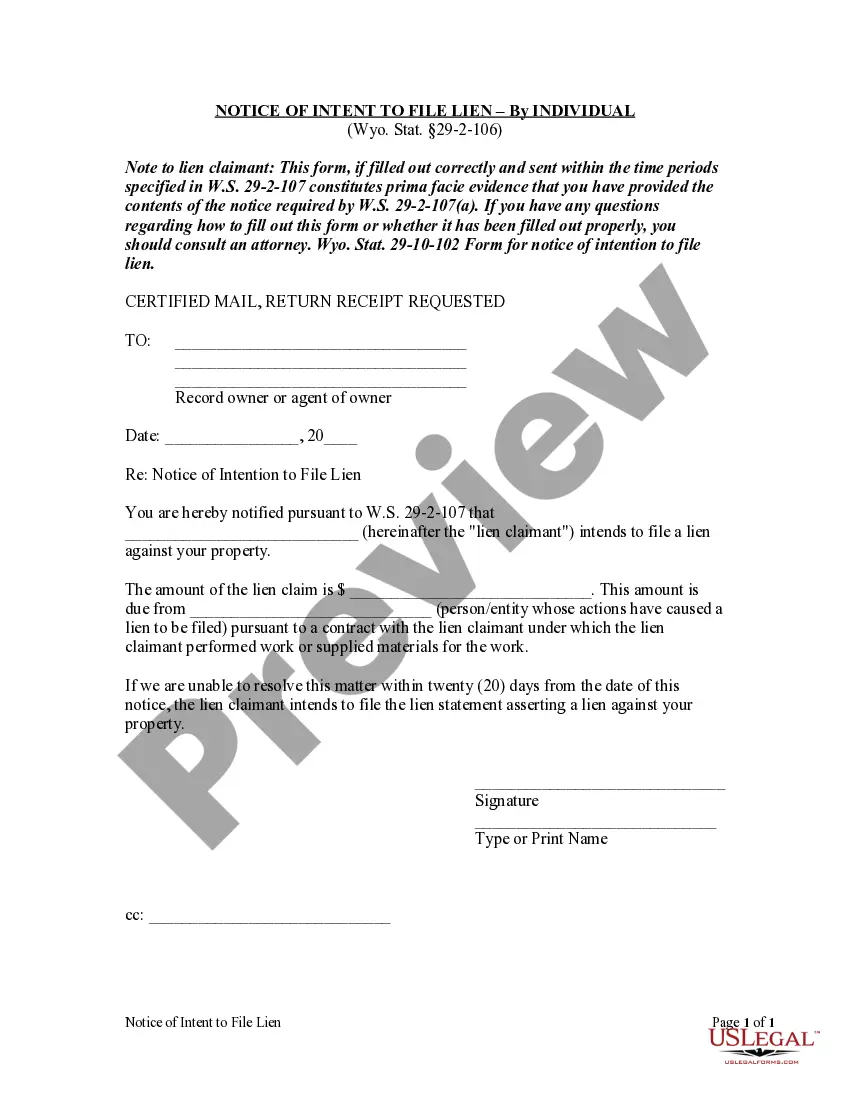

The conditions for filing a lien typically include having a valid debt or obligation, having made attempts to resolve the issue, and adhering to local laws regarding the filing process. Each jurisdiction may have specific requirements you must meet. Additionally, understanding the nuance of each condition can help you avoid pitfalls. Using platforms like US Legal Forms can simplify the process of learning how to file a lien on a business accurately.

Yes, you can file a lien against a business if you have a legitimate claim or contract dispute. This process provides you with a legal recourse to recover your dues. However, it’s important to follow proper procedures and legal requirements when filing. Resources like US Legal Forms can guide you through how to file a lien on a business smoothly.

Having a lien on your business signifies that there is a claim against your property due to unpaid debts. This situation can limit your ability to secure loans or engage in new transactions. It acts as a red flag for lenders and suppliers, indicating that you have outstanding obligations. To protect your interests, it's wise to seek ways to understand and manage how to file a lien on a business appropriately.