Wv Employment File Withdrawal

Description

How to fill out West Virginia Employment Employee Personnel File Package?

Handling legal paperwork and procedures could be a time-consuming addition to the day. Wv Employment File Withdrawal and forms like it usually need you to look for them and understand the best way to complete them correctly. For that reason, regardless if you are taking care of economic, legal, or personal matters, using a comprehensive and hassle-free web library of forms when you need it will significantly help.

US Legal Forms is the best web platform of legal templates, featuring over 85,000 state-specific forms and numerous tools to help you complete your paperwork quickly. Check out the library of relevant papers available to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any moment for downloading. Shield your papers management operations having a top-notch support that lets you prepare any form within a few minutes without having extra or hidden fees. Simply log in to your profile, locate Wv Employment File Withdrawal and download it right away in the My Forms tab. You can also access formerly downloaded forms.

Would it be the first time utilizing US Legal Forms? Sign up and set up an account in a few minutes and you will gain access to the form library and Wv Employment File Withdrawal. Then, follow the steps below to complete your form:

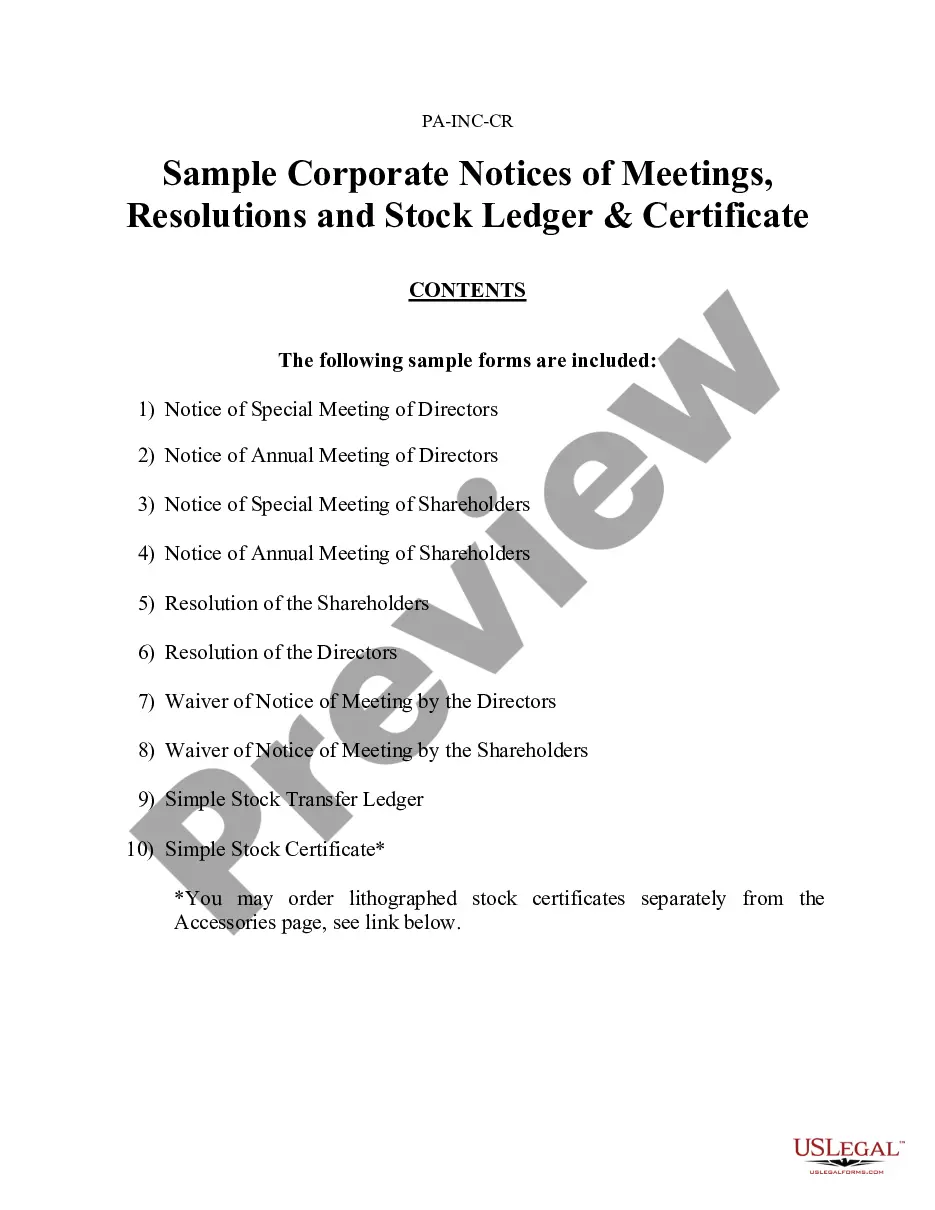

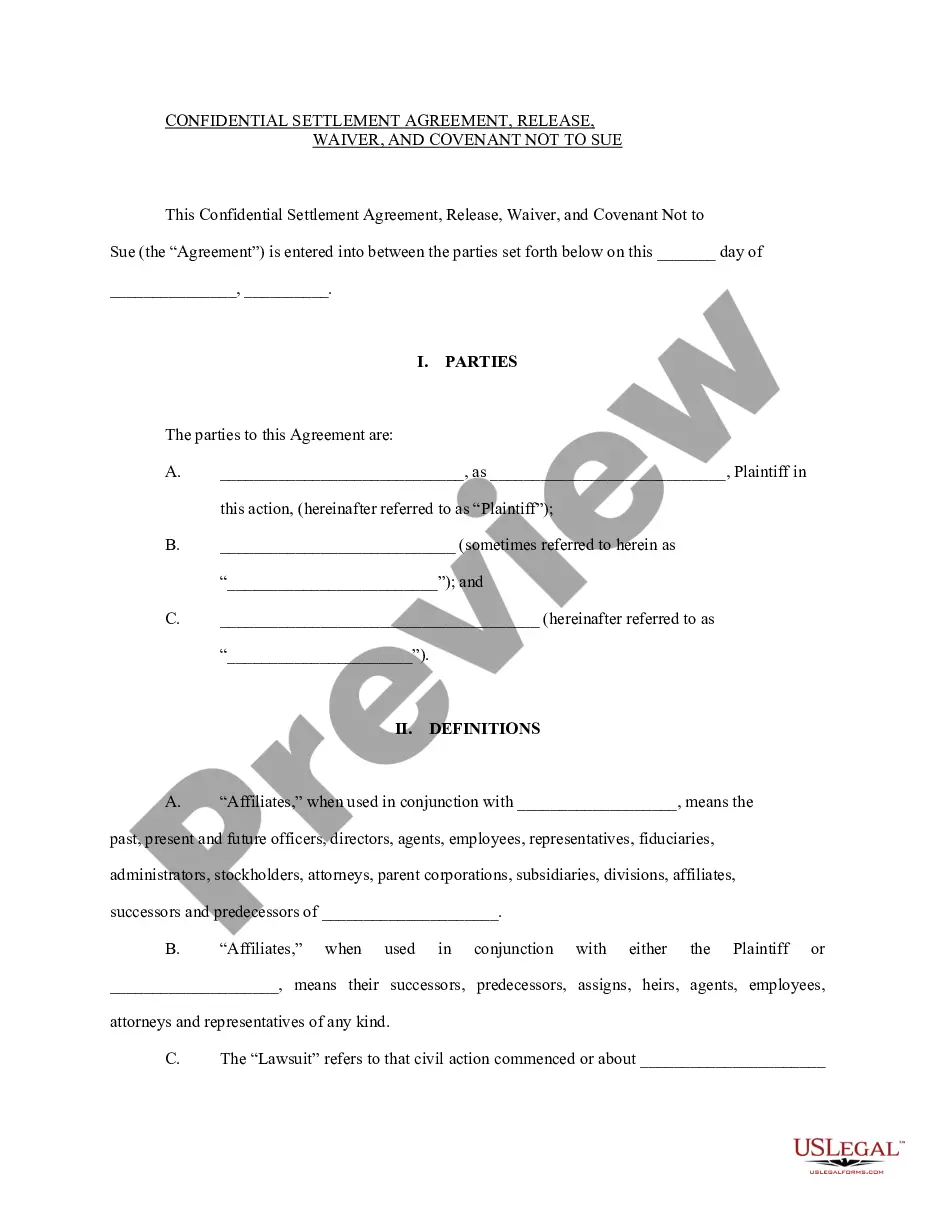

- Ensure you have found the correct form by using the Preview option and looking at the form information.

- Select Buy Now once all set, and choose the subscription plan that meets your needs.

- Press Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of expertise helping consumers control their legal paperwork. Obtain the form you need right now and enhance any process without having to break a sweat.

Form popularity

FAQ

Upon receipt of this form, properly completed, your employer is authorized to discontinue the withholding of West Virginia Income Tax from your wages or salaries earned in West Virginia.

Every employer making payment of any wage or salary subject to the West Virginia personal income tax is required to deduct and withhold the tax from such wages or salaries and remit the tax withheld to the Tax Division.

WEST VIRGINIA CERTIFICATE OF NONRESIDENCE Upon receipt of this form, properly completed, your employer is authorized to discontinue the withholding of West Virginia Income Tax from your wages or salaries earned in West Virginia.

File a dissolution, termination, withdrawal, or cancellation online quickly and conveniently through the One Stop Business Portal. The Secretary of State's Office also provides forms that meet minimum state law requirements available online through the Secretary of State Form Search.

To register with the West Virginia State Tax Department, you must complete the Application for Registration Certificate (Form WV/ BUS-APP) in this booklet and return to: West Virginia State Tax Department PO Box 2666 Charleston, West Virginia 25330-2666 You may register with all agencies online at .business4wv.com.