Wv Employee File Withholding Form 2022

Description

How to fill out West Virginia Employment Employee Personnel File Package?

Getting a go-to place to access the most recent and appropriate legal samples is half the struggle of dealing with bureaucracy. Discovering the right legal files demands accuracy and attention to detail, which is why it is very important to take samples of Wv Employee File Withholding Form 2022 only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the information about the document’s use and relevance for your circumstances and in your state or region.

Consider the listed steps to finish your Wv Employee File Withholding Form 2022:

- Use the library navigation or search field to find your sample.

- View the form’s description to ascertain if it matches the requirements of your state and county.

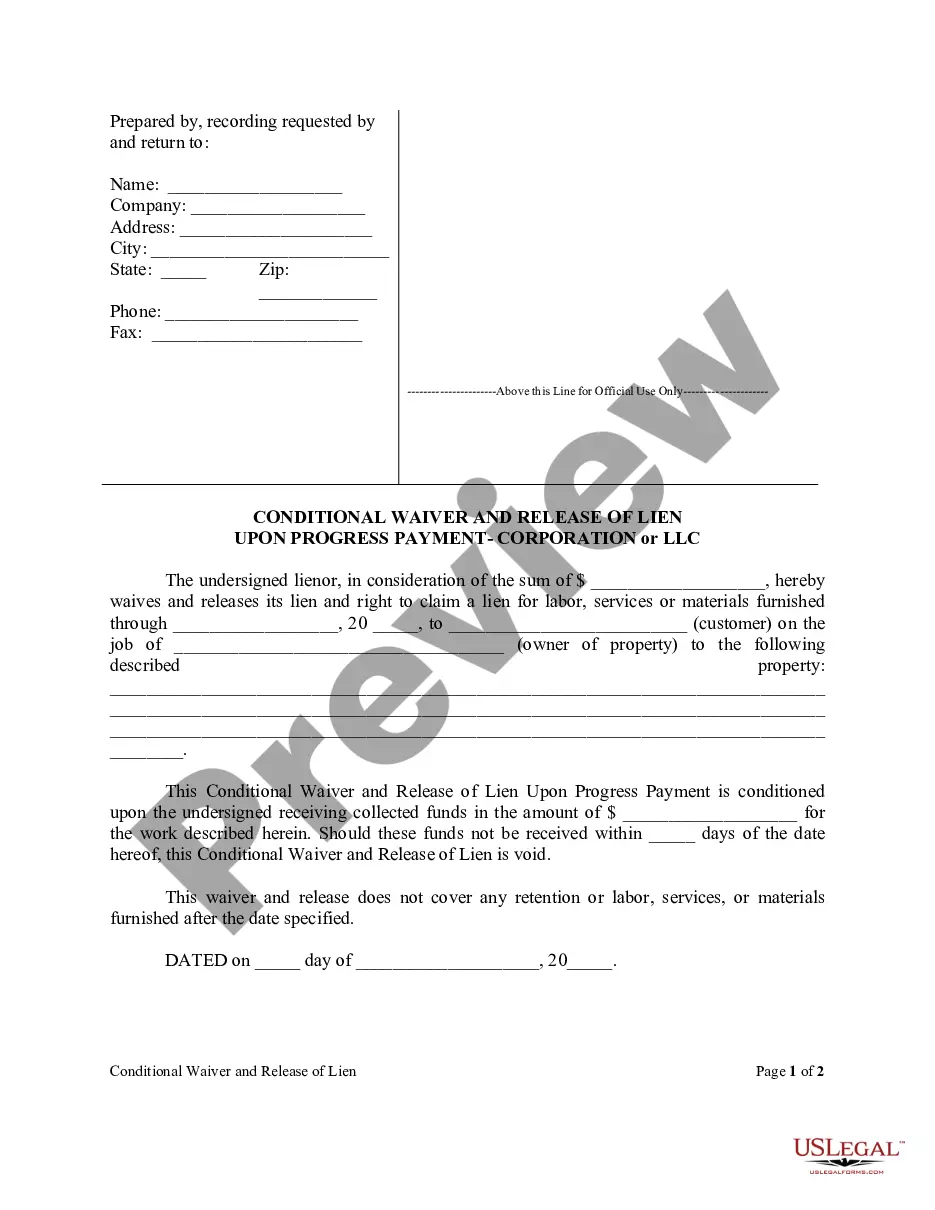

- View the form preview, if there is one, to make sure the form is definitely the one you are looking for.

- Go back to the search and look for the correct template if the Wv Employee File Withholding Form 2022 does not match your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Choose the file format for downloading Wv Employee File Withholding Form 2022.

- When you have the form on your gadget, you may change it using the editor or print it and finish it manually.

Get rid of the hassle that accompanies your legal documentation. Check out the comprehensive US Legal Forms collection to find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

You may be subject to a penalty on tax owed the state. Individuals are permitted a maximum of one exemption for themselves, plus an additional exemption for their spouse and any dependent other than their spouse that they expect to claim on their tax return.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.