Tod Form For Real Estate

Description

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Filling out legal papers requires careful attention, starting with picking the appropriate form template. For example, if you pick a wrong edition of a Tod Form For Real Estate, it will be rejected when you send it. It is therefore essential to get a reliable source of legal documents like US Legal Forms.

If you need to get a Tod Form For Real Estate template, stick to these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Check out the form’s information to make sure it suits your case, state, and region.

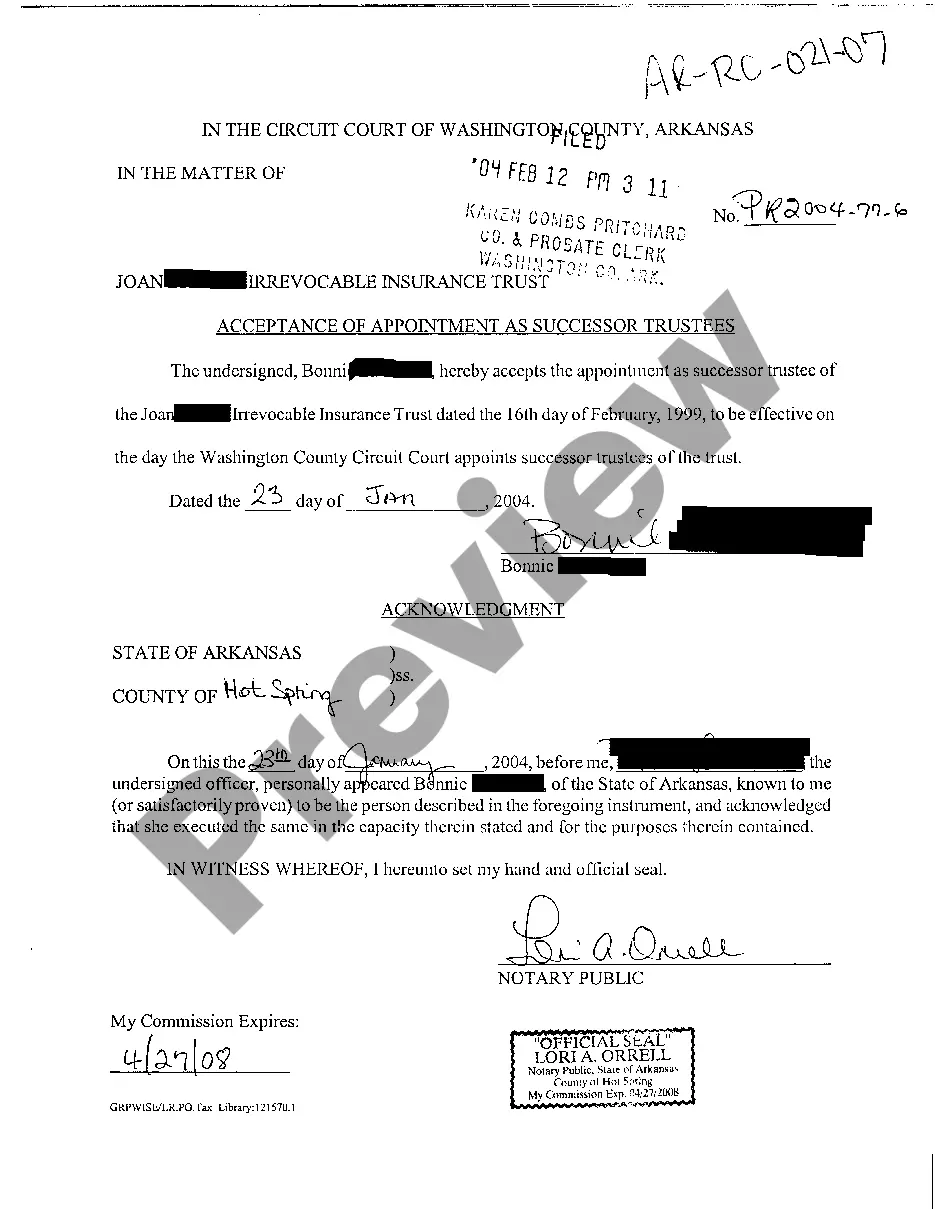

- Click on the form’s preview to see it.

- If it is the incorrect form, get back to the search function to find the Tod Form For Real Estate sample you require.

- Get the template when it meets your requirements.

- If you have a US Legal Forms profile, click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your transaction method: use a credit card or PayPal account.

- Choose the document format you want and download the Tod Form For Real Estate.

- Once it is saved, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time looking for the appropriate template across the internet. Take advantage of the library’s easy navigation to get the proper form for any situation.

Form popularity

FAQ

If you suddenly become incapacitated and unable to manage your own affairs, a transfer-on-death clause will do nothing to help you. Your beneficiary will not be able to access the money to pay your bills because they only get the money once you have died.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

And while the process may vary slightly from state to state, there are some general, basic steps to follow. Get Your State-Specific Deed Form. Look up the requirements for the state the property is in. ... Decide on Your Beneficiary. ... Include a Description of the Property. ... Sign the New Deed. ... Record the Deed.