Revoke Power Attorney Sample With Irs

Description

How to fill out Wisconsin Revocation Of Power Of Attorney For Care Of Child Or Children?

There's no longer a need to invest hours searching for legal documents to meet your local state stipulations.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our platform offers over 85k templates for any business and individual legal situations organized by state and area of use.

Utilize the Search field above to find another sample if the previous one was not suitable.

- All forms are professionally created and verified for accuracy, ensuring you receive an up-to-date Revoke Power Attorney Sample With Irs.

- If you are acquainted with our service and possess an account, confirm your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents anytime needed by accessing the My documents tab in your profile.

- If you are a first-time user, the process will require a few additional steps to complete.

- Here is how new users can acquire the Revoke Power Attorney Sample With Irs from our catalog.

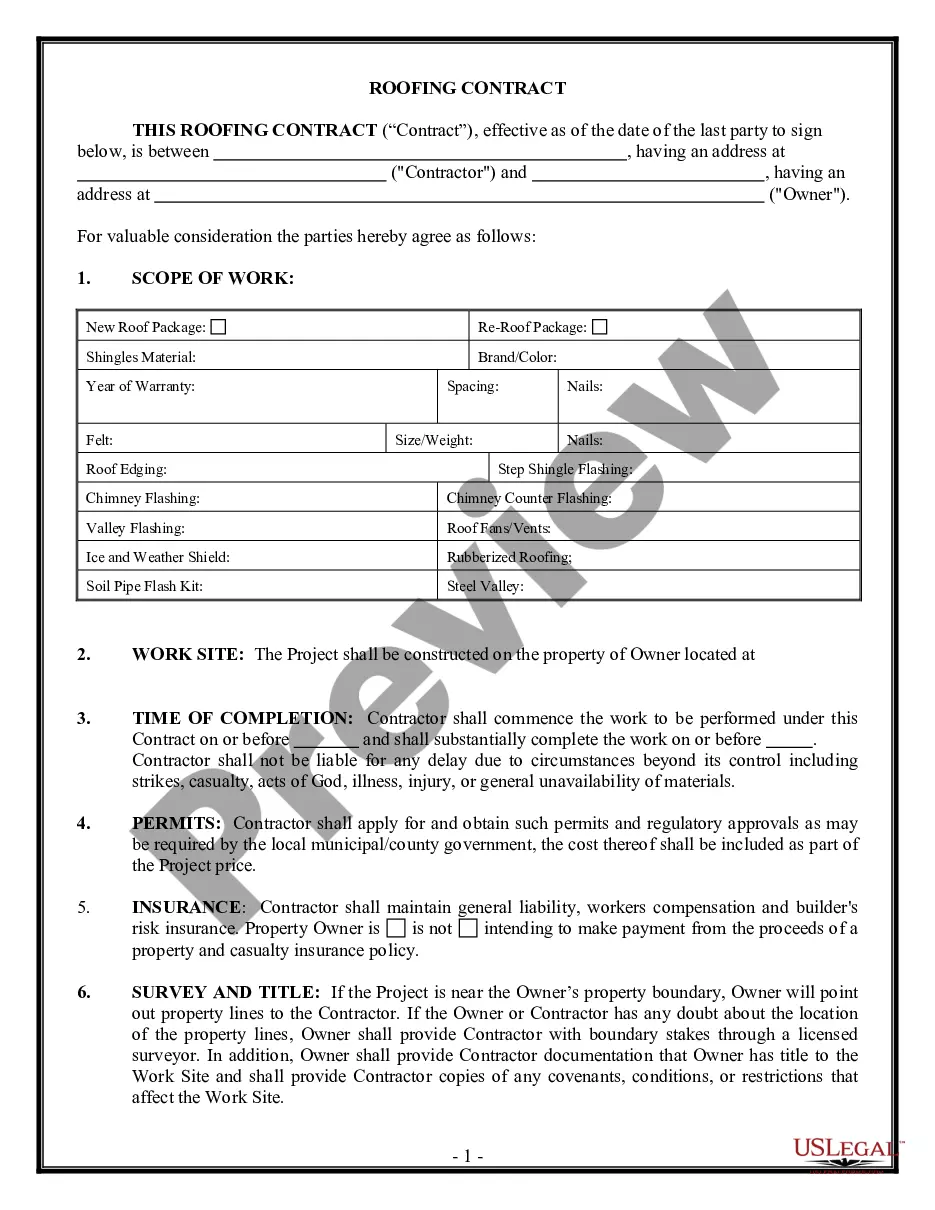

- Carefully review the page content to ensure it contains the sample you need.

- To do so, utilize the form description and preview options, if available.

Form popularity

FAQ

This option is good for taxpayers who want to resolve disputes at the earliest stage of the audit, don't have many disputed issues, and have provided information to the IRS agent to support the taxpayer's position. With a target resolution of within 120 days, Fast Track is faster than a traditional appeal.

If you disagree you must first notify the IRS supervisor, within 30 days, by completing Form 12009, Request for an Informal Conference and Appeals Review. If you are unable to resolve the issue with the supervisor, you may request that your case be forwarded to the Appeals Office.

The power of attorney (POA) is the written authorization for an individual to receive confidential information from the IRS and to perform certain actions on behalf of a taxpayer.

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person

Circular 230 contains rules of conduct in preparing tax returns. Persons preparing tax returns must not: Take a position on a tax return unless there is a realistic possibility of the position being sustained on its merits. Frivolous tax return positions are prohibited.