Default Letter For Real Estate

Description

Form popularity

FAQ

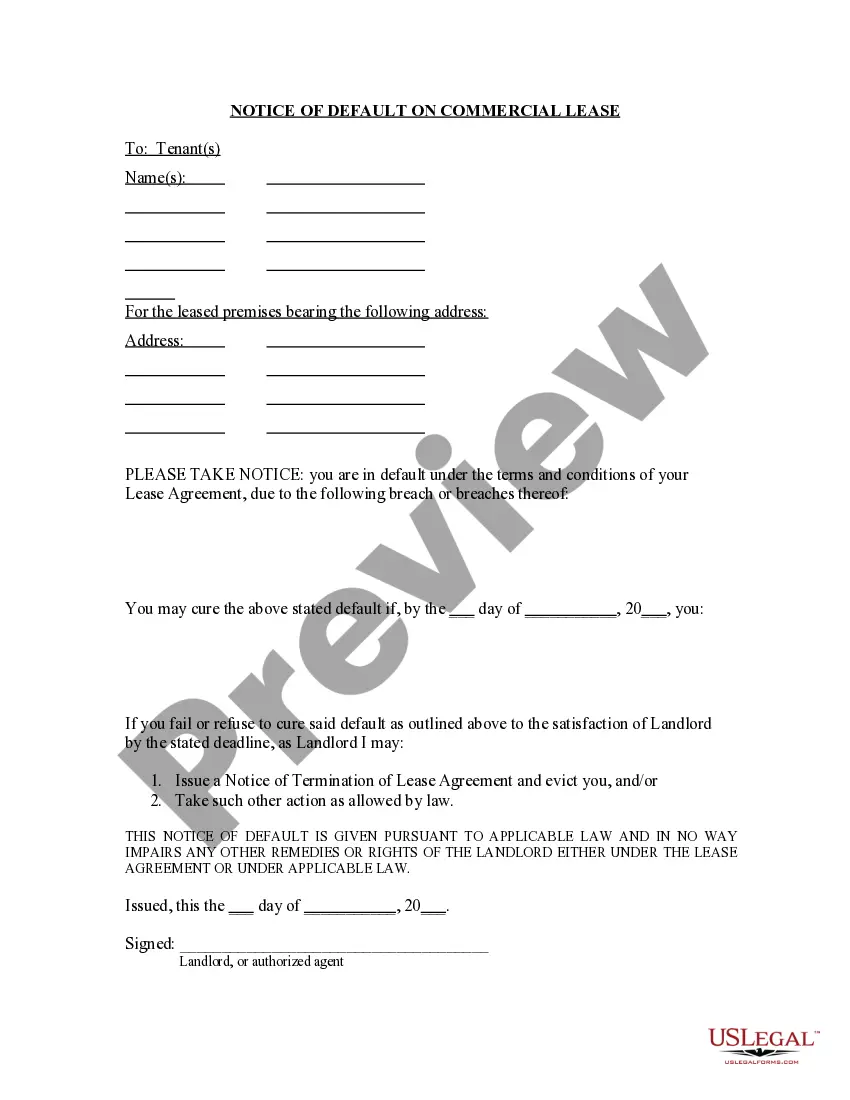

A notice of default typically includes important details such as the address of the property, the reason for the default, and the amount owed. This document serves as an official alert to the borrower that they are behind on payments and must take action. A notice may also specify a time frame to rectify the situation before further legal actions are taken. To craft a response, a professionally designed default letter for real estate can be very helpful.

Default notices are communications sent by lenders when a borrower fails to meet their mortgage obligations. These notices inform the borrower of their default status and the potential consequences of not resolving the situation. Understanding default notices is crucial for homeowners, as they are the first step in the foreclosure process. For those needing to respond, using a default letter for real estate can provide a structured and formal way to address the issue.

To issue a notice of default, start by preparing the default letter for real estate with accurate details. You should state the borrower's information, the reasons for the default, and any applicable deadlines. It’s essential to send this notice via certified mail to ensure it is received and documented properly. US Legal Forms provides user-friendly templates to streamline this process.

A default notice for real estate must include specific information to be valid. Typically, it should detail the nature of the default, including the amount owed and the actions required to remedy the situation. Additionally, it should mention the time frame in which the borrower must address the default to avoid further legal action. Using a template from US Legal Forms can help ensure that you meet all necessary requirements.

A notice of default serves as an initial warning that you are behind on your mortgage, while foreclosure is the legal process that follows if the debt remains unpaid. Simply put, a notice of default is the first step toward foreclosure. Understanding the implications of a default letter for real estate can empower you to take action and potentially avoid losing your property.

In real estate, a notice of default means that a borrower has missed mortgage payments and is at risk of losing their property. This notice is an early warning that the lender may begin foreclosure proceedings if the delinquency is not resolved. It's important to respond to a default letter for real estate swiftly, as this can help prevent further negative consequences.

Getting a default letter typically prompts a crucial decision-making process for you as a homeowner. This letter serves to inform you of your current financial standing with your lender and outlines your options. By utilizing resources like a default letter for real estate, you can better understand your rights and responsibilities, allowing you to make informed decisions moving forward.

When you receive a notice of default, the lender typically initiates the process to recover the owed amount. They will outline the specific actions you need to take to remedy the default, including paying the overdue amount. If not addressed, this notice can lead to further legal actions, including foreclosure, making it essential to respond promptly to a default letter for real estate.

A default notice is a serious matter that should not be ignored. It signals that you may lose your property if you do not take immediate action to address the overdue payments. Engaging with resources like a default letter for real estate can help you navigate this situation and work towards a resolution.

To write a letter to a defaulter, provide a polite yet firm opening that identifies the reason for the letter. Clearly state the nature of the default and what actions are required for resolution. Including a friendly reminder of the consequences of non-payment can encourage the defaulter to take action quickly.