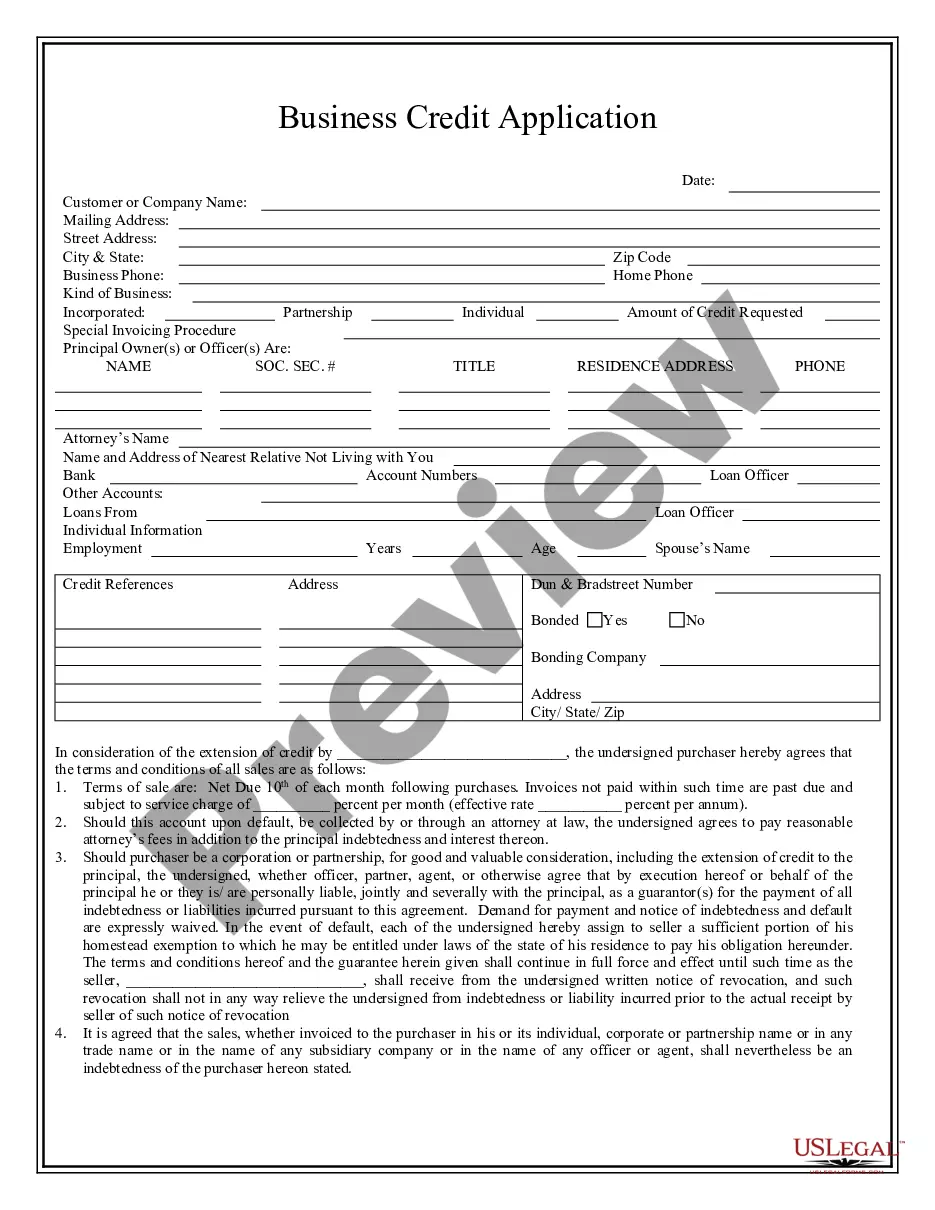

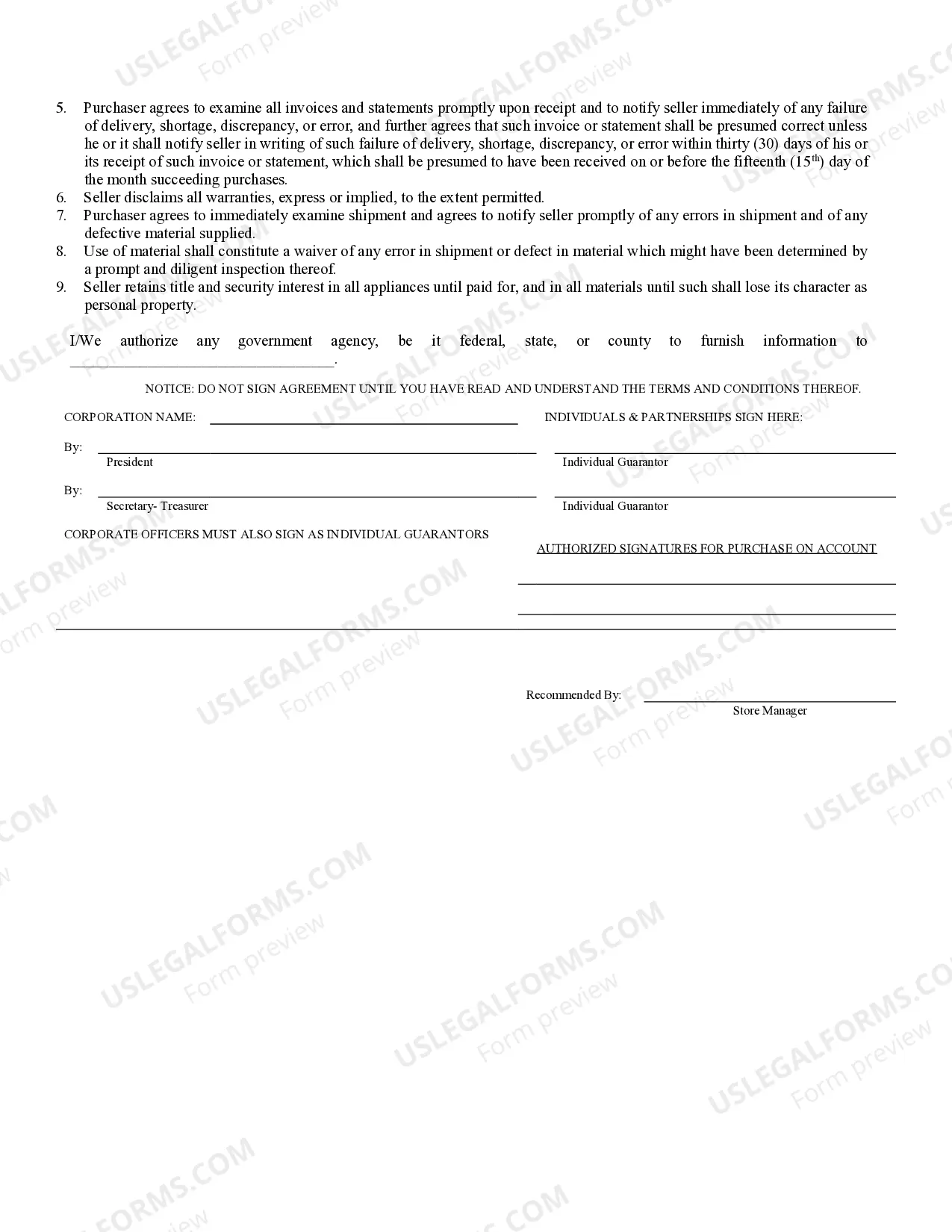

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Wisconsin Loans And Lending Credit Applications Within Australia

Description

How to fill out Wisconsin Loans And Lending Credit Applications Within Australia?

How to locate professional legal templates that adhere to your state regulations and prepare the Wisconsin Loans And Lending Credit Applications While in Australia without consulting a lawyer.

Numerous online services provide templates to address various legal circumstances and requirements. Nevertheless, it might require time to determine which of the offered examples fulfill both your needs and legal standards.

US Legal Forms is a trusted service that assists you in locating formal documents crafted in alignment with the latest state law modifications while saving on legal costs.

If you do not have an account with US Legal Forms, follow the instructions below: Review the opened webpage to verify if the form meets your requirements. To accomplish this, use the form description and preview options if they exist. Search for another template in the header suggesting your state if needed. Click the Buy Now button when you identify the correct document. Choose the most suitable pricing plan, then sign in or register for an account. Select your preferred payment method (via credit card or PayPal). Choose the file format for your Wisconsin Loans And Lending Credit Applications While in Australia and click Download. The acquired templates remain yours: you can always return to them in the My documents section of your profile. Subscribe to our library and create legal documents independently like a seasoned legal expert!

- US Legal Forms is more than just a conventional online directory.

- It comprises over 85,000 verified templates for different business and personal situations.

- All documents are categorized by area and state to enhance your search efficiency and convenience.

- It also features robust tools for PDF modification and electronic signature, enabling users with a Premium subscription to swiftly complete their forms online.

- Acquiring the needed documents requires minimal effort and time.

- If you currently possess an account, sign in and confirm your subscription is active.

- Download the Wisconsin Loans And Lending Credit Applications While in Australia using the relevant button alongside the file name.

Form popularity

FAQ

When purchasing a house, most lenders prefer you to have a minimum of three tradelines on your credit report. Having these tradelines shows your creditworthiness and helps build a strong financial profile. This becomes particularly crucial in the context of Wisconsin loans and lending credit applications within Australia. If you lack sufficient tradelines, consider using platforms like uslegalforms to guide you in establishing and optimizing your credit profile.

In Australia, the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) oversee lending activities. These regulatory bodies establish guidelines and monitor compliance to ensure consumer protection. Individuals interested in Wisconsin loans and lending credit applications within Australia should consider lenders who follow these regulations, ensuring a safer borrowing experience. Utilizing resources from USLegalForms can help streamline the application process while adhering to these requirements.

Yes, lending is regulated in Australia to protect consumers and uphold fairness in the financial market. Various laws govern how loans are offered, ensuring transparency and accountability among lenders. When exploring Wisconsin loans and lending credit applications within Australia, it is essential to choose a lender that adheres to these regulations. Platforms like USLegalForms aid consumers by documenting their agreements within this regulated framework.

Yes, private lending is legal in Australia. It offers a flexible alternative to traditional bank loans, especially beneficial for those seeking Wisconsin loans and lending credit applications within Australia. Borrowers should understand their obligations, and lenders must comply with relevant laws to ensure a smooth process. Platforms like USLegalForms can assist in navigating these legal requirements effectively.

Several Australian banks specifically offer lending options for expats, allowing you to secure favorable terms and rates. Notable banks include Commonwealth Bank, ANZ, and Westpac, which are known for their expat-friendly policies. If you’re exploring Wisconsin loans and lending credit applications within Australia, it’s valuable to research each bank’s requirements and offerings. Understanding your options will help you make informed decisions about your finances.

Yes, you can obtain loans in Australia if you meet certain criteria. Many financial institutions provide options for both residents and non-residents, including loans for various purposes. If you're considering Wisconsin loans and lending credit applications within Australia, it’s essential to gather the required documentation and assess your eligibility. Moreover, platforms like USLegalForms can help streamline the application process.

To register as a foreign entity in Wisconsin, you must first complete the application process for a Certificate of Authority. You will need to furnish necessary documentation, such as a Certificate of Good Standing from your home state. After submitting your application with the required fees, ensure compliance with Wisconsin’s ongoing business regulations. Utilizing information about Wisconsin loans and lending credit applications within Australia may enhance your funding options during this registration process.

Yes, you can set up your own LLC in Wisconsin by following the state's established procedures. Start by choosing a unique name for your LLC and filing the Articles of Organization with the Wisconsin Department of Financial Institutions. Additionally, consider creating an operating agreement to outline your LLC's management structure. Exploring Wisconsin loans and lending credit applications within Australia can provide you with financial avenues as you launch your business.

A foreign entity refers to a business that is established in one state or country but operates in another. An LLC, or Limited Liability Company, is a specific type of business structure that can be either domestic or foreign. While all LLCs can be considered foreign entities when operating outside their home state, not all foreign entities are LLCs. When considering business operations, understanding Wisconsin loans and lending credit applications within Australia may offer financial options that suit your foreign entity's needs.

To register a foreign entity in Wisconsin, you need to start by completing the application for a Certificate of Authority. This requires you to provide basic information about your entity, such as its name, state of origin, and nature of business. After submitting the application along with the required fees, your entity will need to comply with Wisconsin laws. Understanding Wisconsin loans and lending credit applications within Australia can help you finance this process effectively.