Wisconsin Transfer Valued Within

Description

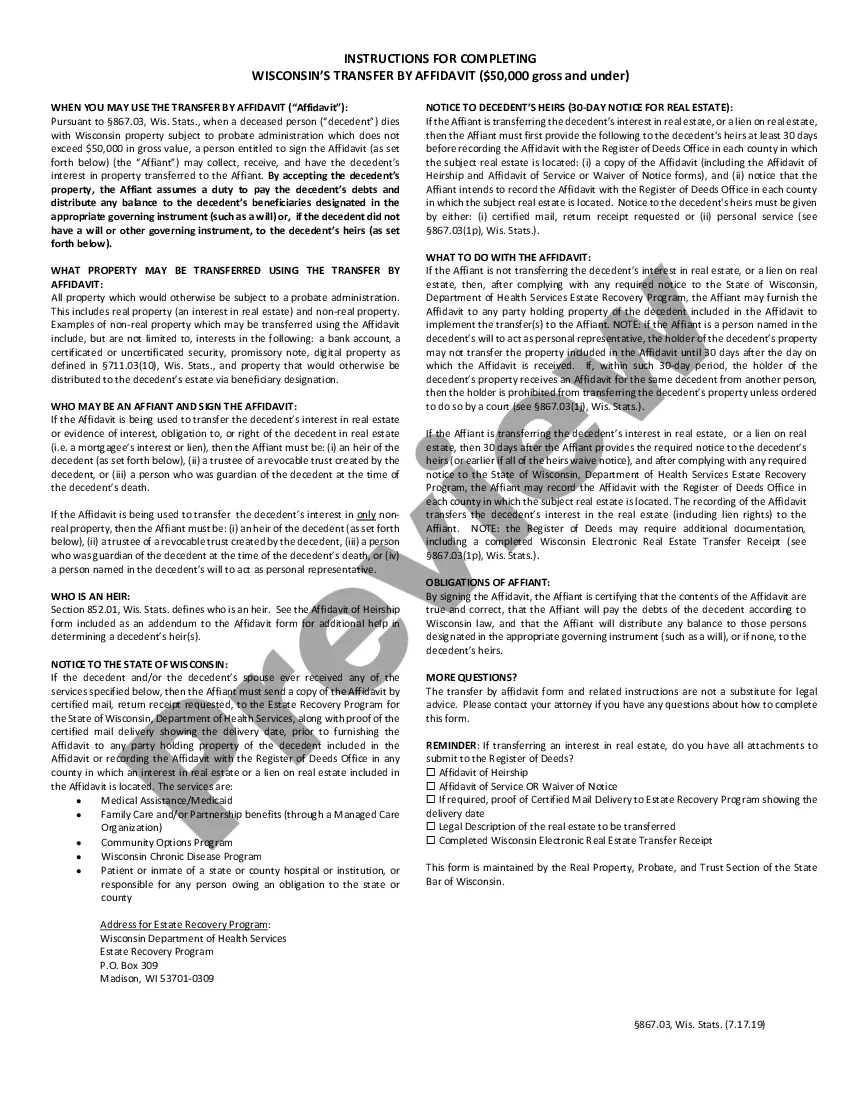

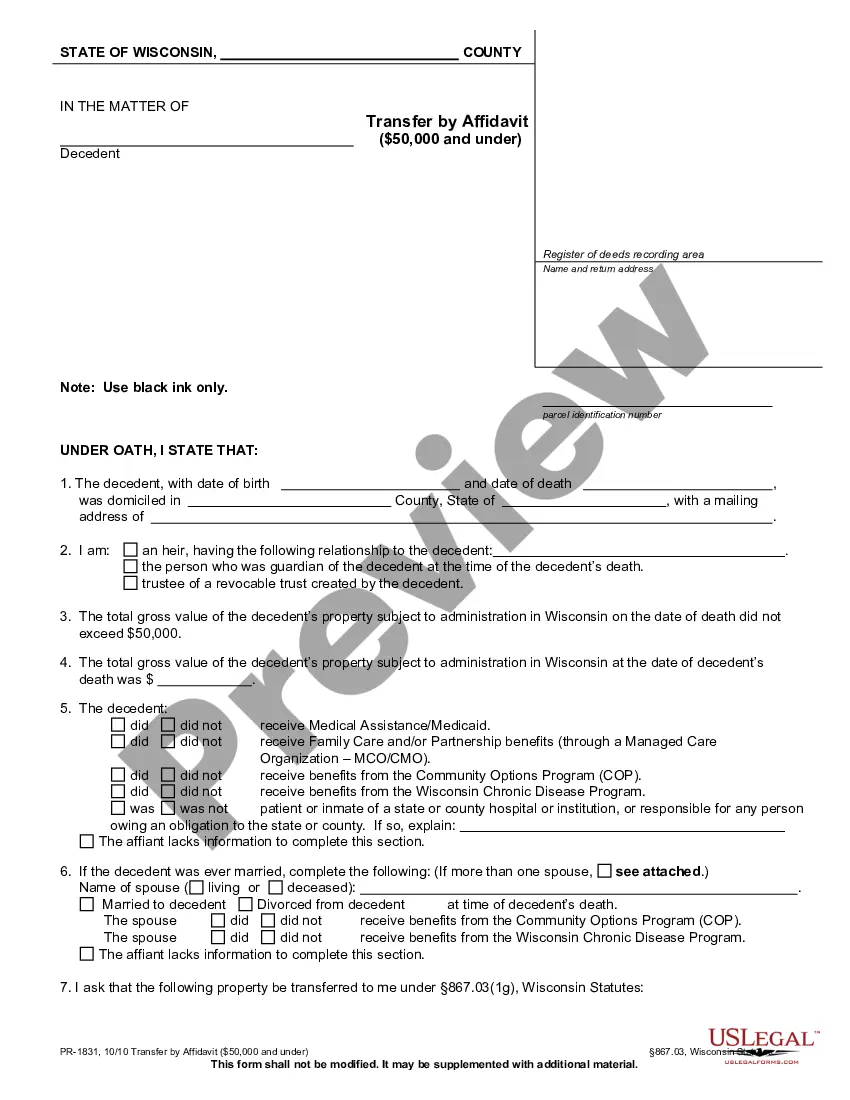

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Whether for commercial objectives or personal matters, everyone must confront legal circumstances at some point in their lives.

Completing legal paperwork requires meticulous attention, starting with selecting the right form template.

With an extensive US Legal Forms catalog available, you never have to waste time searching for the right template online. Utilize the library’s user-friendly navigation to find the suitable form for any scenario.

- For example, if you choose an incorrect version of a Wisconsin Transfer Valued Within, it will be rejected when you submit it.

- Therefore, it is essential to find a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Wisconsin Transfer Valued Within template, follow these straightforward steps.

- Obtain the template you require by using the search bar or catalog navigation.

- Review the form’s details to confirm it fits your circumstances, state, and locality.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to find the Wisconsin Transfer Valued Within template you need.

- Obtain the template if it aligns with your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Wisconsin Transfer Valued Within.

- Once downloaded, you can fill out the form using editing software or print it out and complete it manually.

Form popularity

FAQ

The deed transfer tax is $3.00 per $1000.00 or major fraction thereof of consideration. The seller customarily pays the deed transfer tax. Wisconsin does not have a mortgage, recordation or excise tax. Title insurance premium includes the search and examination fee.

Complete the deed form on your computer or print it and complete it in all black ink. The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR).

Transfer fee due The grantor of real estate must pay a real estate transfer fee at the rate of 30 cents for each $100 of value or fraction thereof on every conveyance not exempted or excluded under state law (sec. 77.22(1), Wis.

A deed and an Electronic Wisconsin Real Estate Transfer Return (eRETR) must be completed to convey title to real estate. If you need additional information in regards to your inquiry you will have to consult with a title company or an attorney. You can also contact the Register of Deeds at (608) 266-4141.

A Wisconsin transfer on death deed allows an owner of real property to designate one or more beneficiaries to receive their interest upon their death. Also known as ?pay on death? (?POD?) or ?TOD? for short, this document allows the transferor and beneficiary to skip the lengthy probate process.