Wisconsin Transfer Valued For Their

Description

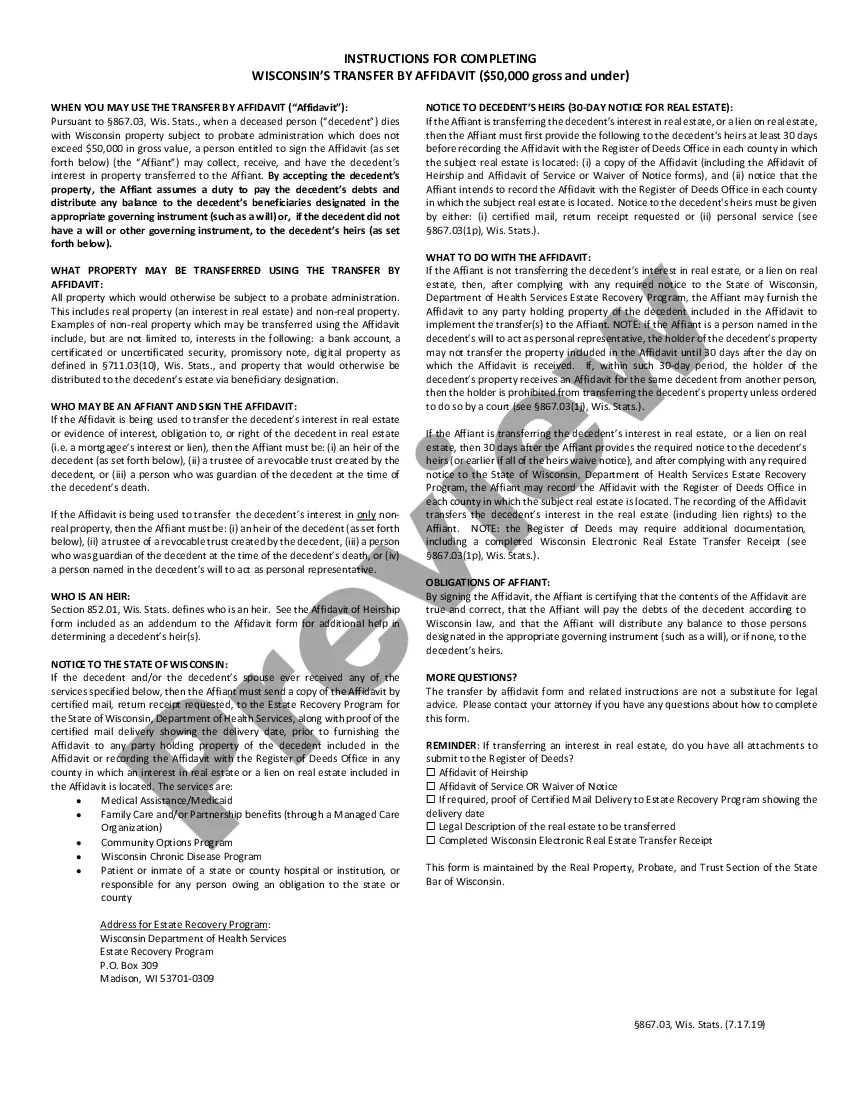

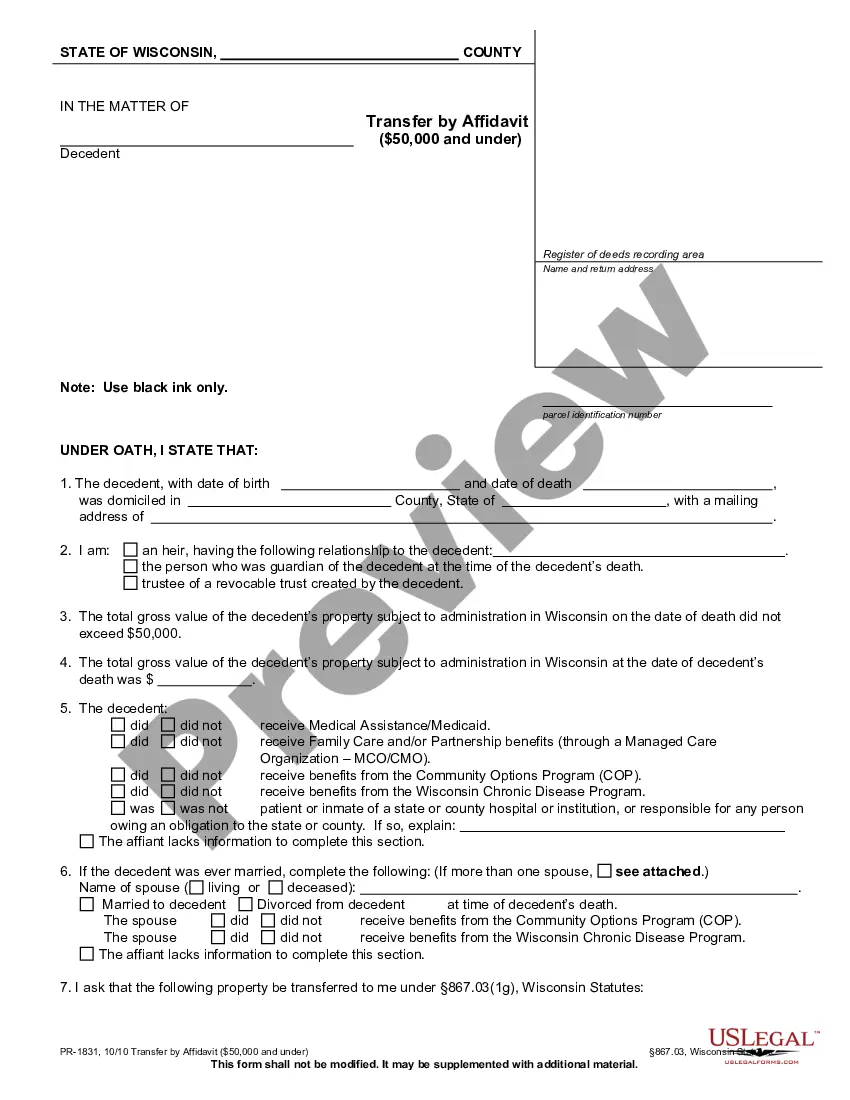

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Dealing with legal documents and procedures can be a lengthy addition to your entire day.

Wisconsin Transfer Valued For Their and similar forms typically necessitate you to locate them and figure out how to fill them out correctly.

For this reason, whether you’re managing financial, legal, or personal issues, having a comprehensive and user-friendly online directory of forms readily available will greatly assist.

US Legal Forms is the premier online service for legal templates, boasting over 85,000 state-specific documents and a range of resources to help you complete your paperwork effortlessly.

Is it your first time using US Legal Forms? Register and create an account in a few minutes, and you’ll gain entry to the form directory and Wisconsin Transfer Valued For Their. Then, follow the steps below to fill out your form: Ensure you have identified the correct form by using the Review feature and examining the form details. Click Buy Now when ready, and choose the subscription plan that fits your needs. Select Download then fill out, sign, and print the document. US Legal Forms has 25 years of expertise assisting users with their legal documents. Obtain the form you need today and simplify any process without breaking a sweat.

- Explore the collection of relevant documents accessible to you with just a single click.

- US Legal Forms offers you state- and county-specific documents available at any time for download.

- Protect your document management processes with a top-tier service that allows you to prepare any form in minutes without additional or concealed fees.

- Just Log In to your account, locate Wisconsin Transfer Valued For Their, and download it instantly from the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

A Wisconsin transfer on death deed allows an owner of real property to designate one or more beneficiaries to receive their interest upon their death. Also known as ?pay on death? (?POD?) or ?TOD? for short, this document allows the transferor and beneficiary to skip the lengthy probate process.

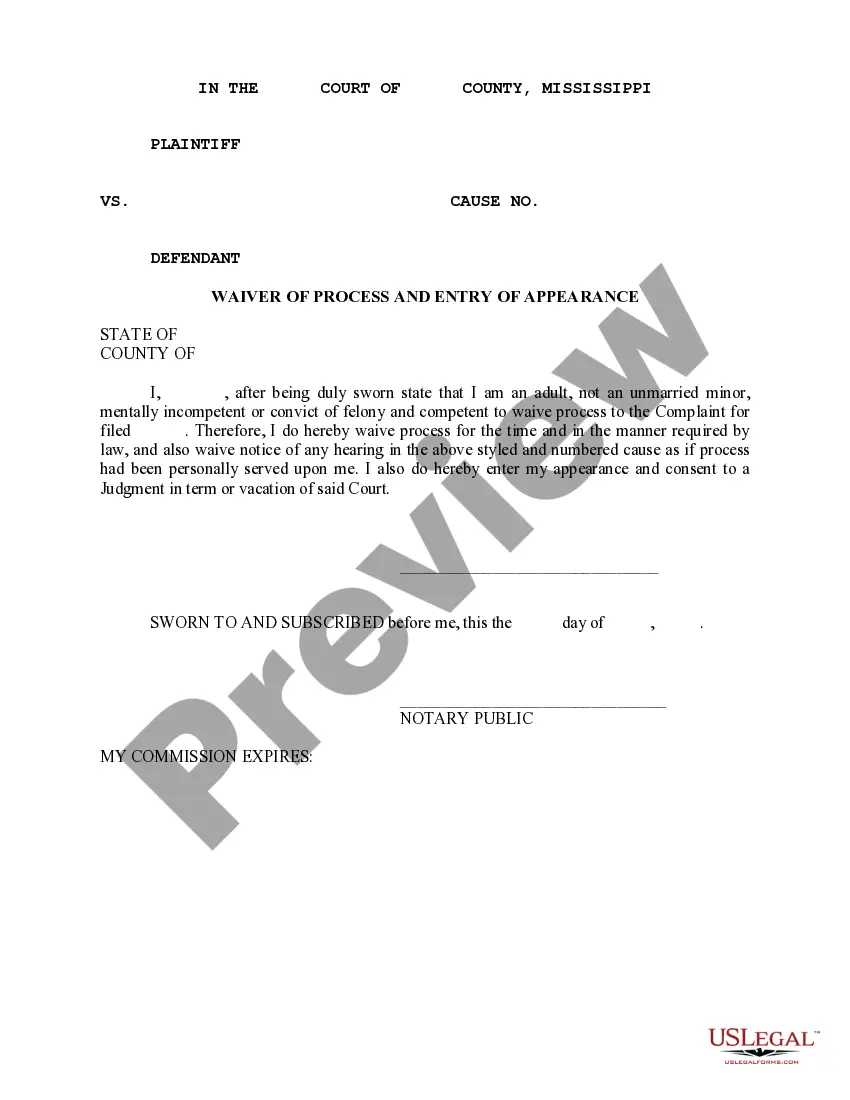

Complete the deed form on your computer or print it and complete it in all black ink. The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR).

A deed filed for a partnership filing or canceling a statement of qualification is exempt from transfer fee under state law (sec. 77.25(6d), Wis. Stats.).

You must sign the TOD designation and get your signature notarized, and then record (file) the designation with the county register of deeds before your death. Otherwise, it won't be valid. You can make a Wisconsin designation of transfer on death beneficiary with WillMaker.

In order for a gift deed to be valid they must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift.