Wisconsin Transfer Valued For Acquisition

Description

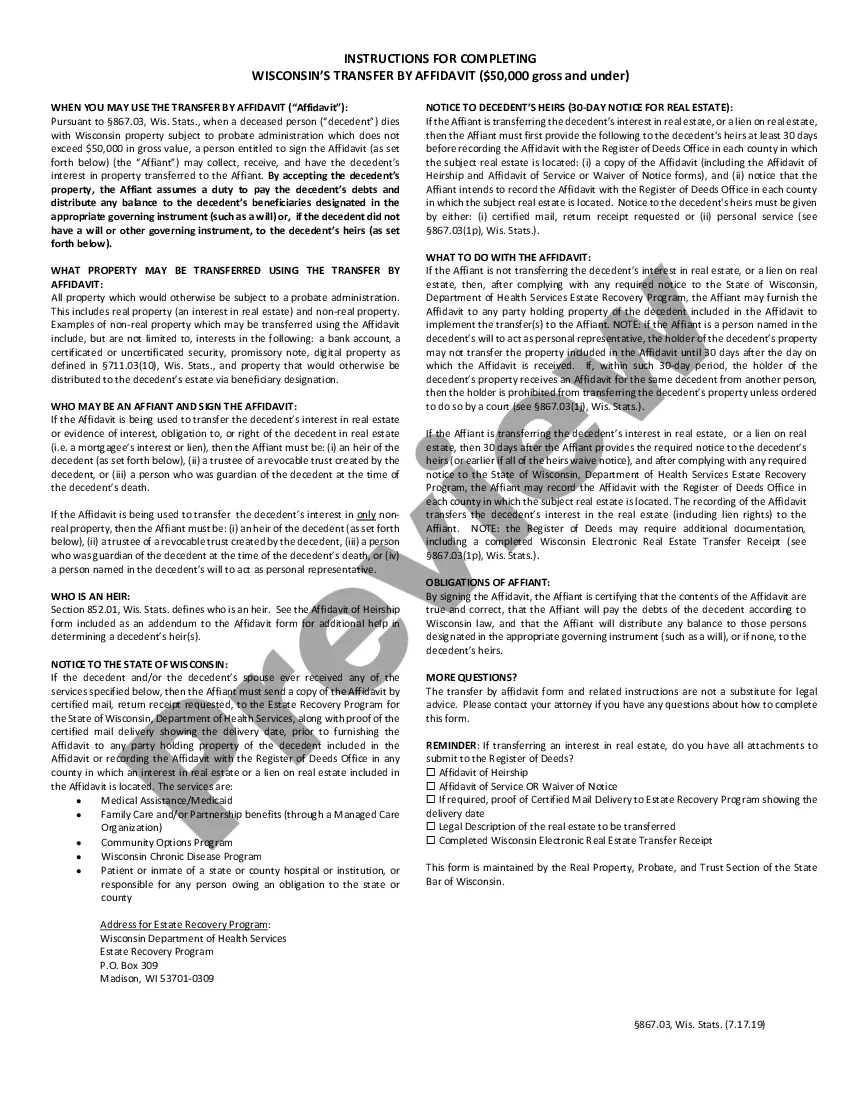

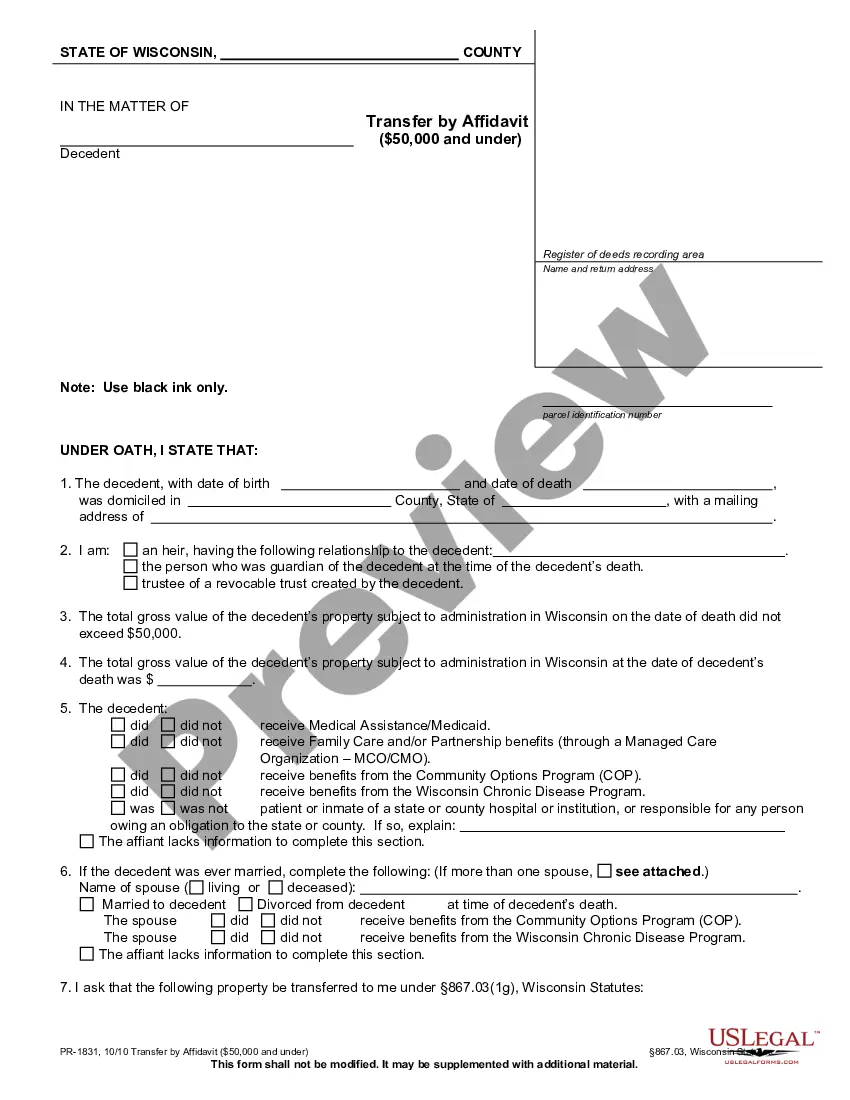

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Managing legal documents can be daunting, even for the most experienced experts.

When searching for a Wisconsin Transfer Valued For Acquisition and lacking the time to find the correct and current version, the procedures can be overwhelming.

Obtain state- or county-specific legal and organizational documents. US Legal Forms addresses all needs, ranging from personal to business paperwork, in a single platform.

Utilize cutting-edge tools to complete and manage your Wisconsin Transfer Valued For Acquisition.

Here are the steps to follow after downloading the form you need: Validate that it is the correct form by previewing it and reviewing its details. Ensure that the template is authorized in your state or county. Click Buy Now when you are ready. Choose a monthly subscription plan. Locate the format you desire, and Download, complete, eSign, print, and submit your documents. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Transform your daily document management into a straightforward and user-friendly process today.

- Access a valuable resource library of articles, guides, handbooks, and tools related to your situation and requirements.

- Conserve time and effort in searching for the documents you need, and utilize US Legal Forms’ advanced search and Review feature to find Wisconsin Transfer Valued For Acquisition and acquire it.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to view the documents you have previously downloaded and to manage your files as desired.

- If this is your initial experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library.

- A comprehensive online form repository could be transformative for anyone looking to navigate these circumstances effectively.

- US Legal Forms stands out as a leader in the realm of online legal documents, boasting over 85,000 state-specific legal forms accessible whenever required.

- With US Legal Forms, you can.

Form popularity

FAQ

Transfer fee due The grantor of real estate must pay a real estate transfer fee at the rate of 30 cents for each $100 of value or fraction thereof on every conveyance not exempted or excluded under state law (sec. 77.22(1), Wis.

You must sign the TOD designation and get your signature notarized, and then record (file) the designation with the county register of deeds before your death. Otherwise, it won't be valid. You can make a Wisconsin designation of transfer on death beneficiary with WillMaker.

The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value.

A deed and an Electronic Wisconsin Real Estate Transfer Return (eRETR) must be completed to convey title to real estate. If you need additional information in regards to your inquiry you will have to consult with a title company or an attorney. You can also contact the Register of Deeds at (608) 266-4141.

Complete the deed form on your computer or print it and complete it in all black ink. The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR).